The US labor market forged ahead in 2017. Job growth was strong and steady after accounting for hurricanes and extreme weather. Unemployment kept falling and wage growth picked up a bit. Best of all—the labor market recovery reached many of the least well-off, including those who were hurt most in the recession.

Still, the good news hasn’t touched everyone. The biggest short-term challenge is not growth, but distribution—some sectors of the economy and a few regions of the country lagged. Furthermore, the welcome narrowing of some labor market gaps in 2017 might turn out to be temporary. The labor market also faces longer-term challenges from technological disruption and polarization. In short, behind the successes of 2017, we found plenty to watch, wonder and even worry about in the year ahead.

A look back at 2017: leaps and momentum, with room to grow

The labor market made impressive gains this past year. October 2017 was the 85th consecutive month of job growth. So far in 2017, monthly job growth has averaged 169,000—down modestly from previous years, but more than we’d expect after so many years of recovery and expansion. Job growth is also still far ahead of what’s needed to keep up with low working-age population growth.

The result is more people are working. Two key measures improved notably: The U-6 rate, a broad measure of unemployment that includes discouraged workers and those involuntarily working part time, fell from 9.2% in December 2016 to 7.9% in October 2017. And, over the same period, the share of 25–54 year-olds at work rose to 78.8% from 78.2%. Not only are these measures improving, but they’re improving at the same rate or better than they were a year ago. Even after years of gains, the labor market recovery still has momentum.

What’s more, the labor market probably still has room to grow. Granted, the market looks very tight by some measures. The headline unemployment rate (U-3) is 4.1%, its lowest point since the end of 2000. There are nearly as many job openings as unemployed workers. Employers are laying off fewer workers today than in the early 2000s.

But other measures suggest there’s still slack. Several key measures of the labor market haven’t returned to their 2000 levels, including the broad U-6 unemployment rate, the share of people unemployed for more than six months, and the employment-to-population ratio among people of prime working age. These indicators stand in contrast to the measure that gets the most attention—the narrower headline unemployment rate, which doesn’t count people who are willing and able to work but aren’t looking. Thus, the headline rate probably overstates labor market tightness.

Wage trends also point to some remaining slack. Wage growth has averaged 2.6% year-over-year throughout 2017, similar to 2016 and ahead of the pace from 2010 to 2015, according to the Bureau of Labor Statistics (BLS) monthly jobs report.

Why haven’t wages risen even faster in 2017 as the unemployment rate has dropped? It’s partly a measurement issue. The measure of wage growth in the jobs report probably understates 2017 wage gains. The BLS releases an alternative measure of wages and benefits that accounts for changes in the job mix—and that indicator has accelerated in 2017. Furthermore, this alternative measure has historically tracked the employment-to-population ratio among prime-age workers closely. Today, this measure of wage growth is what we’d expect for the improving, but not gangbusters, prime-age employment-to-population ratio.

Thus, the headline unemployment rate probably overstates labor market tightness, while wage growth in the jobs report probably understates 2017 wage gains. That means, first, there may be more room for employment to expand. And, second, wage growth is neither quite as slow nor as puzzling as it initially appears.

Even better news: labor market gaps narrowed in 2017

By themselves, solid job expansion, falling unemployment and strengthening wage growth would be reason enough to cheer 2017. But there’s more—the greatest gains have gone to the people who needed them most. The least well-off and those hurt most by the recession typically saw larger employment and wage increases than others. Thus, labor market inequalities narrowed in 2017.

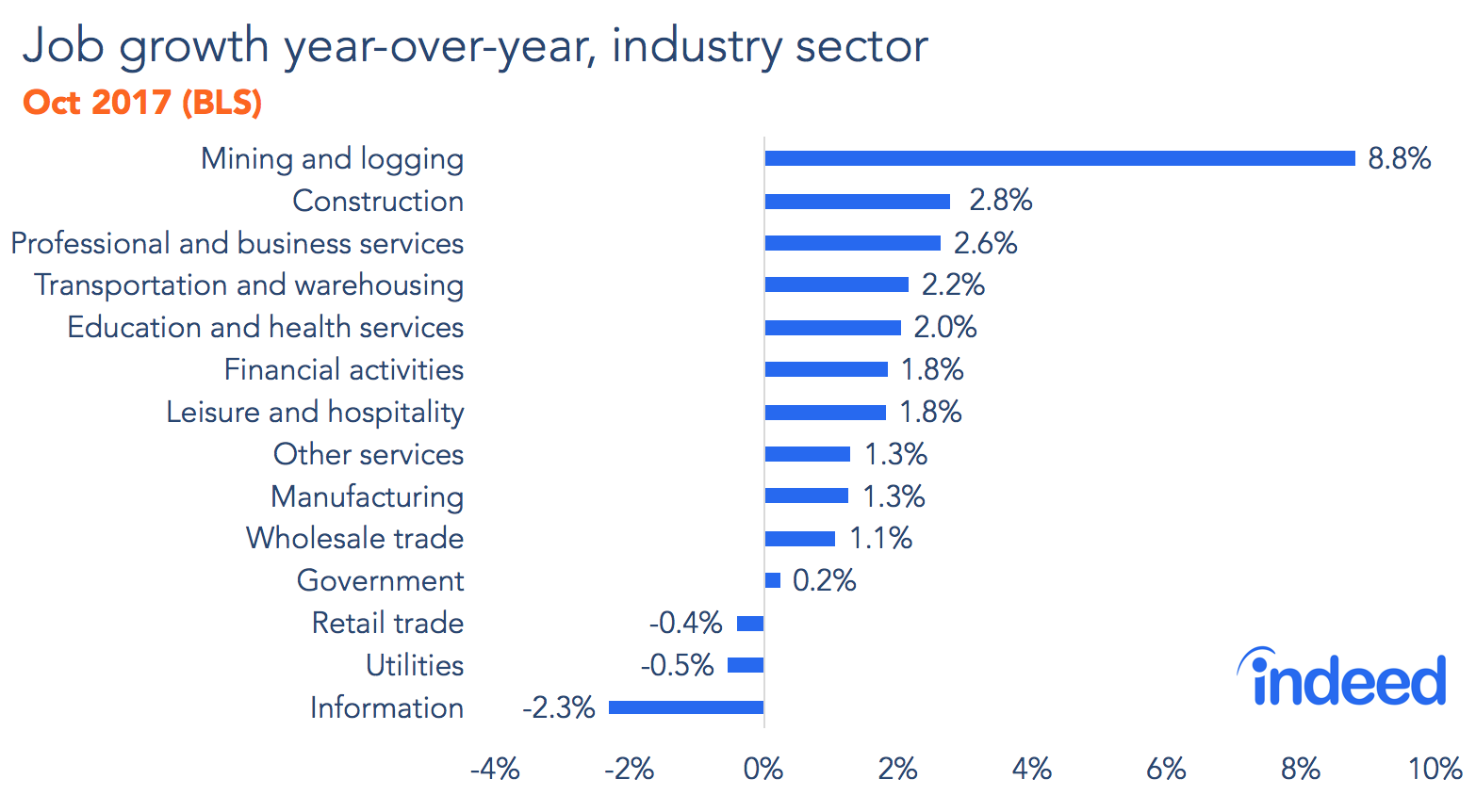

Let’s look first at industries. Over the past year, employment increased most in middle-wage industries, such as couriers and messengers, non-store retailers and homebuilding contractors. Middle-wage industries fared worst during the recession, losing more jobs than both higher- and lower-wage industries. Their newfound strength is a welcome rebound.

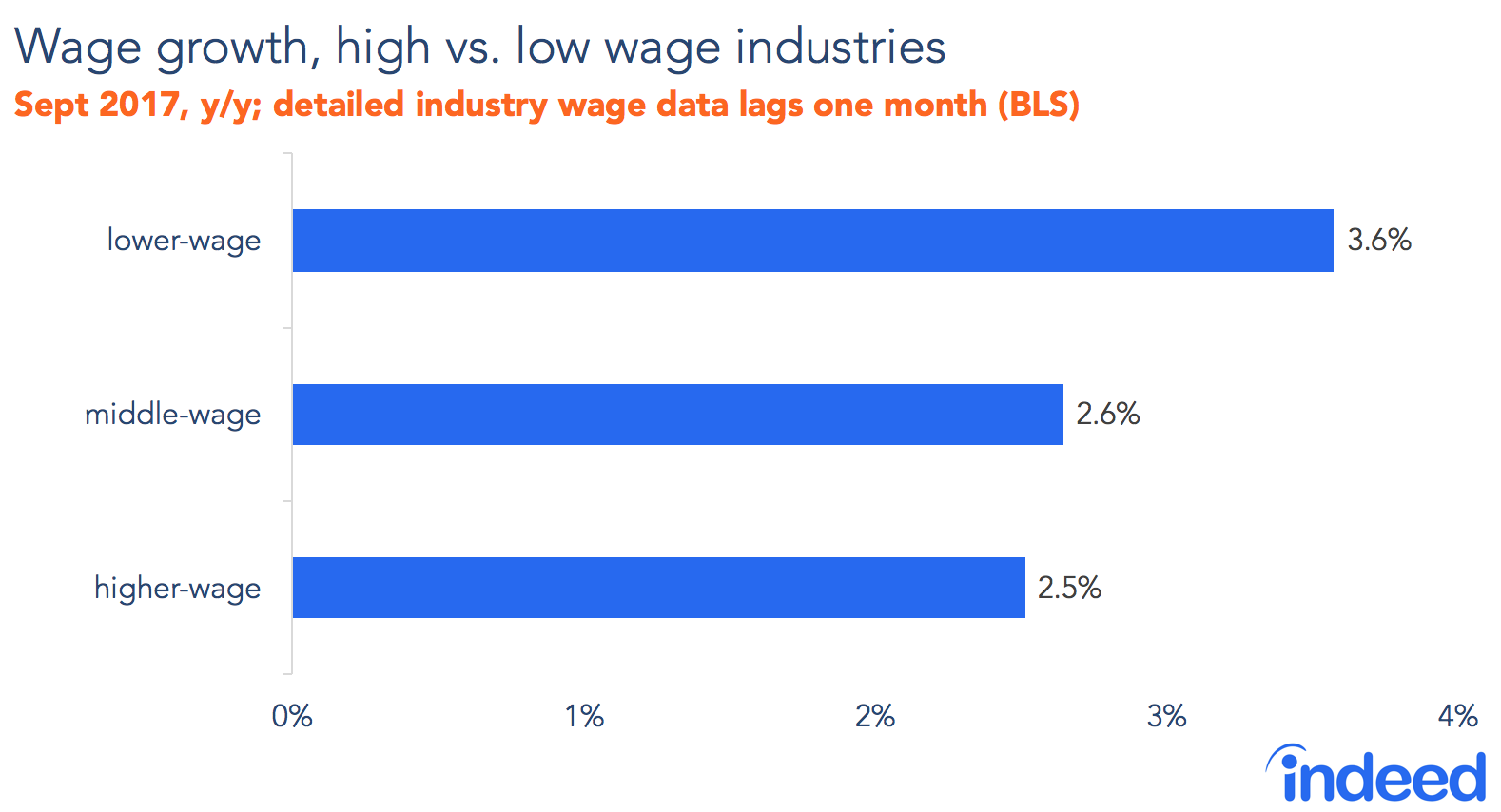

Strikingly, after losing jobs in 2016, manufacturing grew 1.3% in the past year, nearly the same pace as employment overall. In addition, wages rose most in lower-wage industries, as they have for several years. Wages in lower-wage industries were up 3.6% in September 2017 year-over-year versus 2.6% in middle-wage and 2.5% in higher-wage industries.

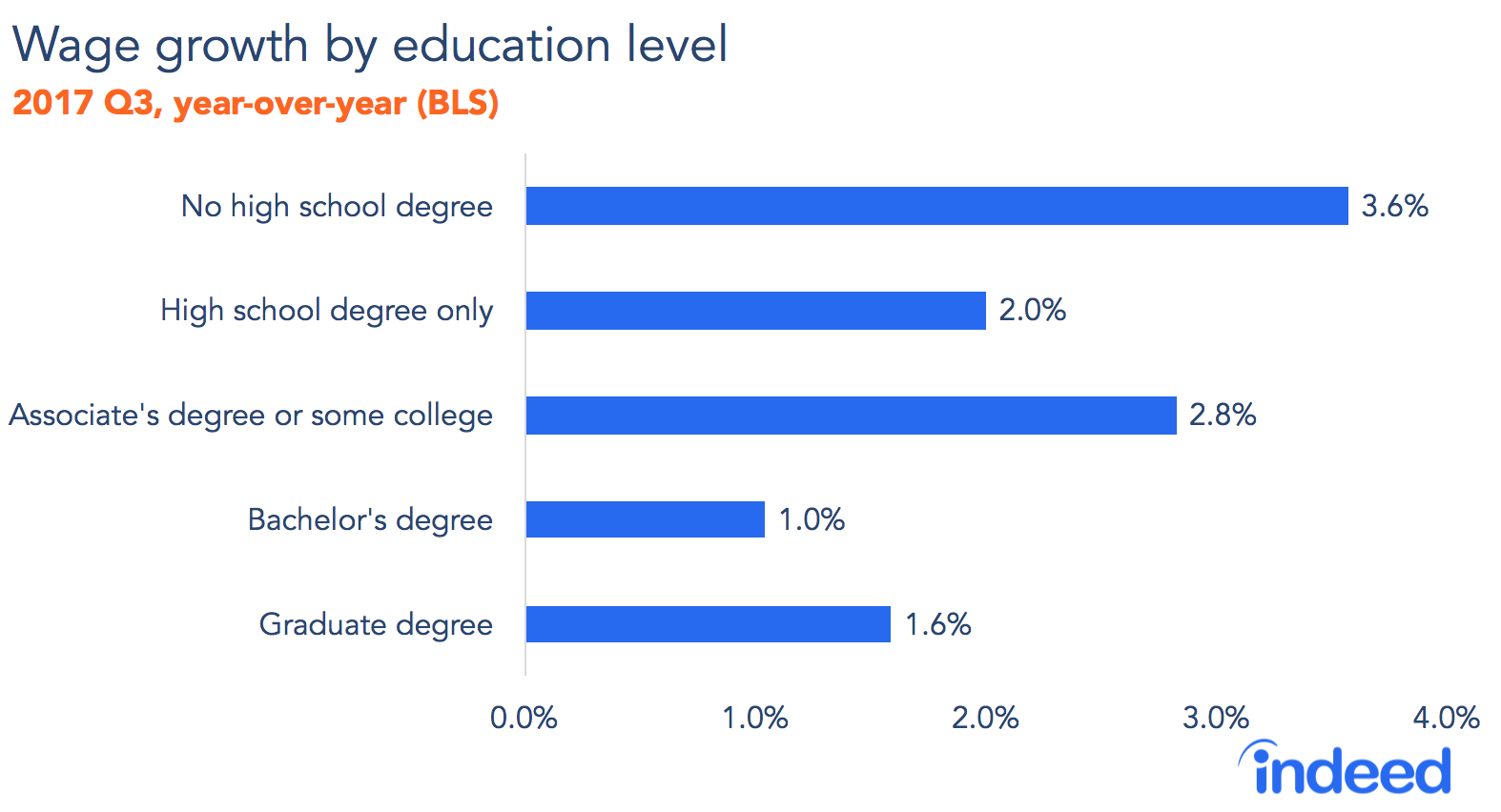

These trends translate to better conditions for people with fewer advantages in the labor market—including those with less education. Whatever the measure—unemployment, earnings or risk from automation—people with more education typically fare better in the labor market. But, over the past year, people with a high school degree or less have notched the biggest employment gains, whether measured by the unemployment rate or the employment-to-population ratio. This group has also had proportionally bigger wage gains than people with a bachelor’s or graduate degree.

Inevitably though, not every corner of the labor market is thriving. Job growth has been slower in the Northeast and Midwest than in the South and West. In fact, ten of the 103 largest metros lost jobs in the past year, including several in the Great Lakes region.

We find laggards not only by geography, but also by sector. Three sectors lost jobs in the past year. Employment in the information sector was dragged down by losses in motion pictures, broadcast outlets and telecoms. The retail sector overall lost jobs, particularly brick-and-mortar stores that directly face online competitors. At the same time, non-store retailers and related industries like couriers and warehouses gained.

The places and industries left behind are not our only labor market concerns. We’ve also got our eye on several big questions for next year.

What to watch, wonder and worry about in 2018

Let’s start with the too-much-of-a-good-thing worry. If the labor market tightens further—or if, as some argue, the market is already so tight that it has little room to grow—what challenges will we contend with? That leads to our first big question:

ONE: How will employers respond to a tightening labor market? Falling unemployment and rising wages for people with less education are drawing in job seekers and raising their expectations. On the Indeed site, searches for full-time work have increased, but not for part-time work. But good news for workers brings challenges for employers. Companies may have to raise wages, relax hiring requirements or invest more in on-the-job training, and they might struggle to fill part-time jobs. Tellingly, more job-seekers are searching using terms like “no background check” and “felony-friendly” jobs. And employers looking for technical workers might also face the additional challenge of future restrictions on immigration to the US and the rising interest of US tech workers in Canadian jobs.

Then there are longer-term concerns. We have big questions about why people remain out of work, whether labor market polarization will increase again and how people whose jobs disappear will manage.

TWO: Will fewer workers be sidelined by illness and disability? The share of prime-age adults who aren’t working because of illness or disability has risen from 2% in 1970 to over 5% today, and the percentages are much higher for adults with a high school degree or less. This long-term trend has worsened with the opioid crisis. Some in this category may never work again. But there is a glimmer of good news: Illness and disability is keeping fewer people out of work today than in 2015. The tightening labor market—especially for less-educated adults—may be lifting wages enough to lure some of these adults back to work.

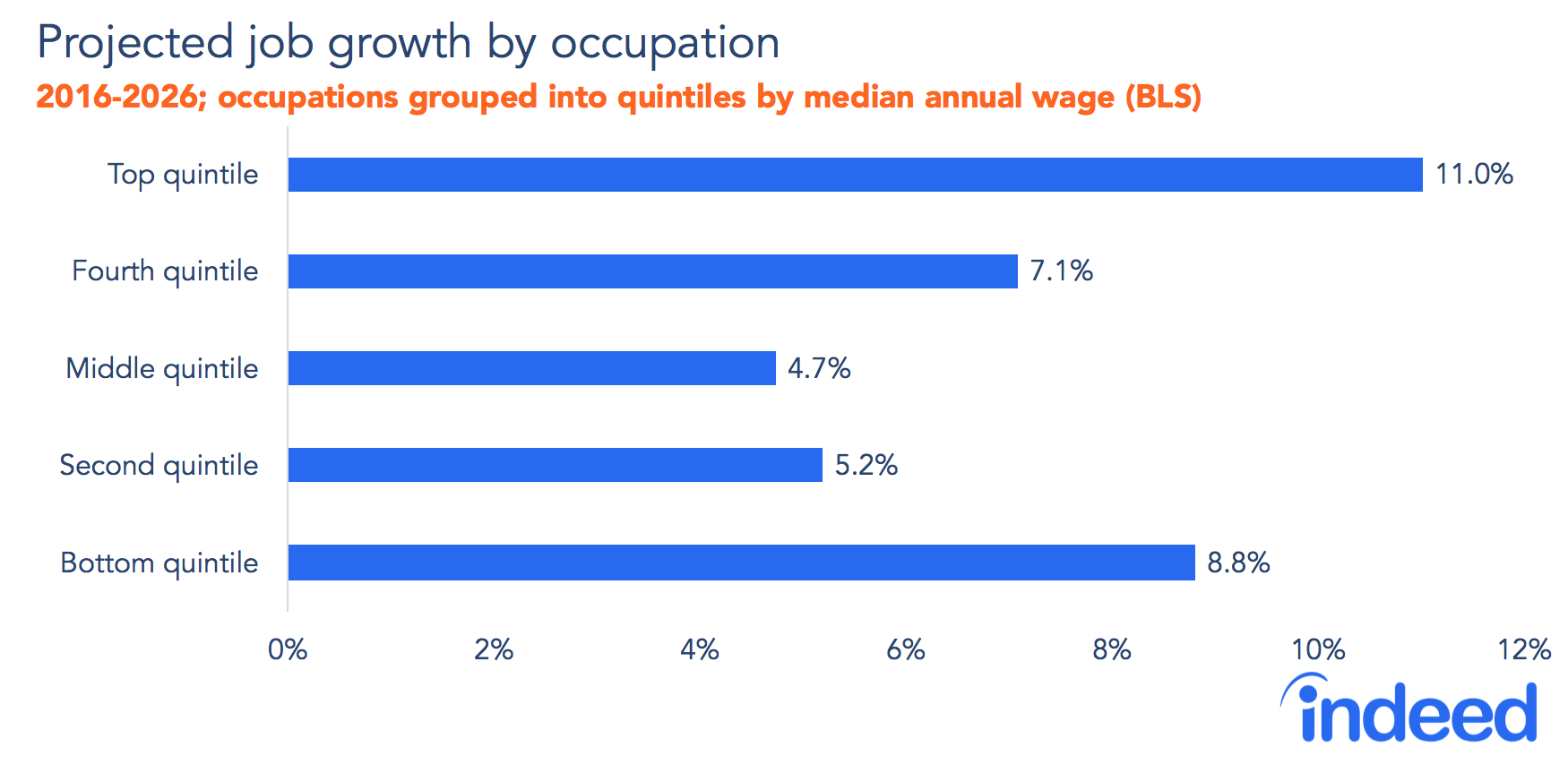

THREE: Will labor market gaps start widening again? The narrowing of employment and wage gaps in 2017 might not last. Although middle-wage jobs grew fastest in the past year, polarization of the labor force could return. The latest BLS projections point to faster job growth in high-wage and low-wage jobs, with slower growth of middle-wage jobs and for people with a high school degree or less.

Plus, geographic gaps are likely to worsen. Job growth today is faster in larger metros than in smaller metros or rural areas. Future job growth will probably continue to lag in rural areas, where slower-growing occupations are concentrated. In contrast, the fastest-growing occupations are clustered in places like the San Francisco Bay Area, Boston, Washington DC, and other expensive coastal markets. In particular, higher-paying, cutting-edge tech jobs increasingly are concentrated in top tech hubs.

FOUR: How will workers manage painful disruptions? Hard as it may be to believe, there is less disruption and churn in the labor market today than in the early 2000s and much less than in the 1940s and 1950s. In fact, economists worry that there’s too little job-switching, business turnover and mobility, not too much. Still, for people whose jobs are being disrupted by automation or globalization, the pain is real. And it’s not just factory workers and farmers. Most of the jobs in shrinking occupations are now in service positions like secretaries and data-entry work. People in threatened occupations are looking at opportunities in new fields. On Indeed’s site, we see truckers checking out mining and heavy-equipment-operation jobs, while retail workers are clicking on customer service and sales-rep roles.

Those are some of the questions we’ll be looking at next year. Both the best news from 2017 and some of our top concerns for 2018 are about the distribution of labor market gains, not the overall growth rate. The labor market is entering 2018 with strength and momentum, and these longer-term challenges are moving—as they should be—into the foreground.