Key points:

- The leading tech hubs increased their dominant share of job postings, with San Jose and Austin growing most. But the eight leading tech hubs show significant differences in their job mixes.

- Job seekers have good reason to look at tech centers outside the big hubs. Costs are lower and these centers offer a different variety of jobs, sometimes in fields hard to find in the tech hubs.

- In many of these smaller markets, such as Huntsville, AL, and Colorado Springs, job seekers are in the driver’s seat since they’re competing with fewer others for tech jobs.

- In more diversified tech markets, such as Austin and Raleigh, employers have an advantage because more job seekers are competing for each slot.

Where is tech growing? Look at housing construction in Seattle, traffic in Austin, or job growth in the Bay Area. These leading tech hubs are thriving. Or consider Amazon’s choices last year for its additional headquarters: metro Washington, DC, and New York—two expensive places with large, established tech sectors. These are signs that tech is expanding where it already has deep roots. Yet, at the same time, other places outside the leading tech hubs are attracting attention and investors, sparking the Comeback Cities tours and the Rise of the Rest venture fund.

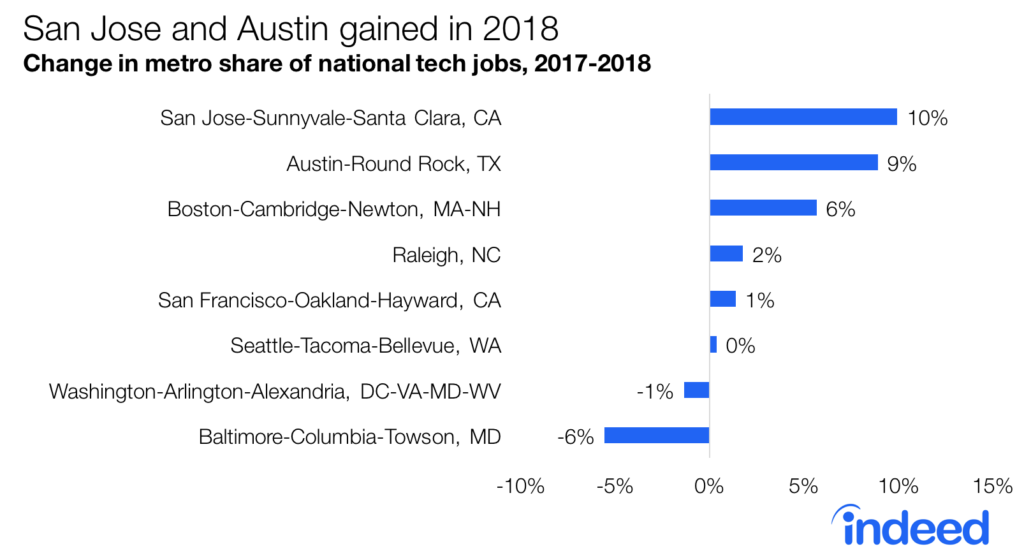

So which is it? Are established tech hubs consolidating their lead or are other metros catching up? The numbers from 2018 show that the leading tech hubs increased their outsized share of job postings, with San Jose and Austin growing most. The Bay Area had the biggest concentration of high-paying, rapidly growing tech jobs—ahead of other tech clusters like Seattle, Boston, and Washington. The top tech hubs are pulling ahead despite their high and escalating housing costs. They continue to dominate the US tech scene, defying attempts to share the wealth more broadly.

Nevertheless, job seekers often have good reason to look outside the big tech hubs. Smaller tech centers like Huntsville, AL, Boulder, CO, and Trenton, NJ—often anchored around military facilities or universities—offer a different mix of jobs, sometimes in specialties hard to find in the big hubs. What’s more, costs are lower and these second-tier tech centers are scattered widely across the country. In many of these smaller markets, job seekers are in the driver’s seat since they’re competing with fewer rivals for tech jobs.

The Bay Area maintains its lead in tech

We define tech hubs as metros with at least 1 million people where technology occupations account for a high share of overall jobs based on 2018 job postings on Indeed.com. Metro San Jose was at the top of the list, with 23% of 2018 job postings in tech—far ahead of any other large metro. Washington, DC, was second at 15%, followed by Seattle and San Francisco. Rounding out the top eight were Baltimore, Raleigh, Austin, and Boston.

Of course, other metros have more total tech jobs than some of these hubs do. For example, New York, Los Angeles, and Chicago each has more tech job openings than Raleigh or Austin. But that’s because these big metros are large. Tech accounts for a smaller share of their labor markets than in the eight tech hubs.

Most of the eight tech hubs gained share over the past year. Between 2017 and 2018, the fraction of national tech jobs rose 10% in San Jose, 9% in Austin, and 6% in Boston. Only Baltimore and Washington lost share.

As a result, the concentration of tech jobs in these eight hubs increased despite high labor and housing costs. In 2018, 31.7% of national tech jobs were in these hubs, up from 31.1% in 2017. And the leading tech hub, San Jose, had the largest increase in tech jobs share. This represents a reversal of previous years when tech jobs dispersed nationally.

How the big tech hubs differ from each other

Among the eight hubs, the tech scene differs a lot. We identified specific tech job titles that pay well and are growing rapidly—today’s hot tech titles. These roles—like data scientist and cloud engineer—are often cutting-edge and highly desirable in contrast with established tech jobs that pay more moderately, like technical support and quality assurance analyst. Hot tech titles accounted for 19% of tech jobs in San Francisco and 18% in San Jose. Like the Bay Area, Austin, Seattle, and Boston had high concentrations of these hot tech jobs, while Raleigh, Washington, and Baltimore were at or below the national average of 11%.

In addition, in San Francisco, San Jose, Austin, and Seattle, more than half of local tech jobs were at technology businesses rather than at workplaces like banks, manufacturing companies, or government agencies, according to the US Census Bureau. The Washington and Baltimore metros stood out for high shares of government tech jobs.

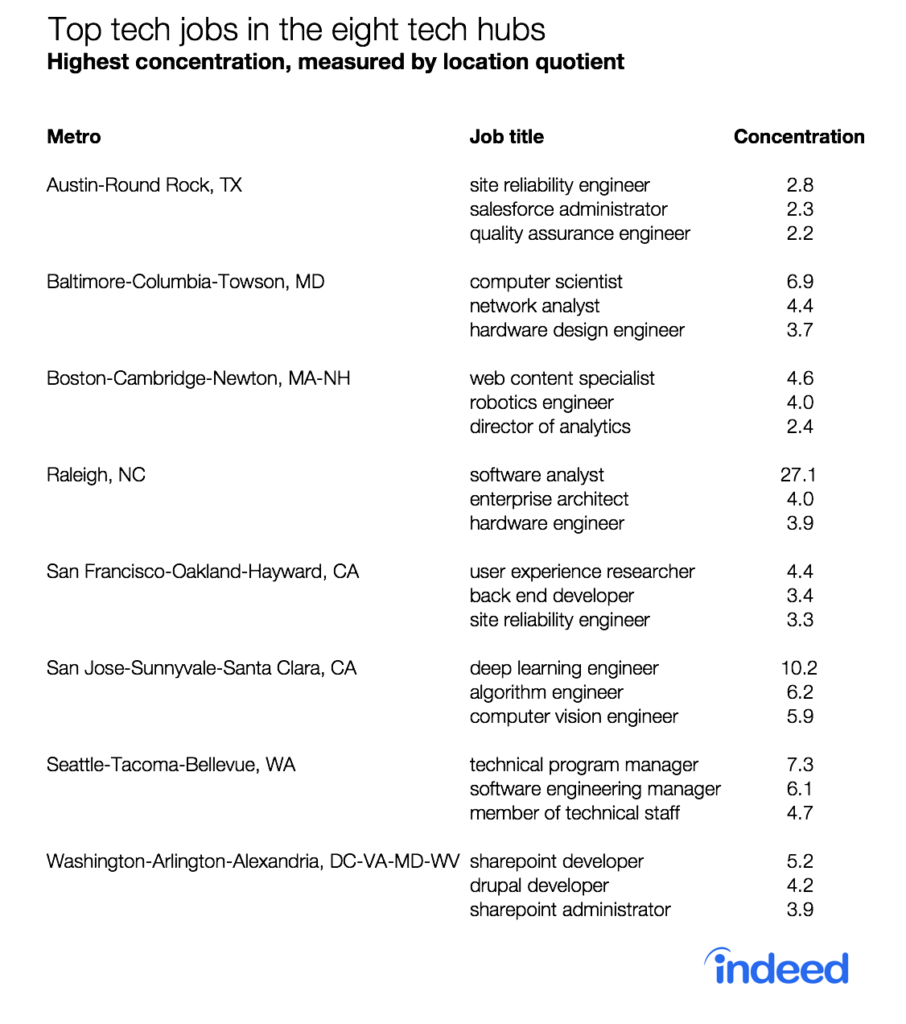

The job titles that cluster in specific metros offer a more granular view on how tech hubs specialize. San Jose, in the heart of Silicon Valley, is a center for artificial intelligence. Job postings for deep learning engineers were 10 times more prevalent there than nationally in 2018. Algorithm developers and computer vision engineers were six times more prevalent. The San Francisco area stood out for user experience researchers, back-end developers, and site reliability engineers.

In contrast, Baltimore and Raleigh had more hardware engineering roles. Metro Washington had lots of jobs for SharePoint developers, who manage intranet, collaboration, document management, and other online tools, along with postings for IT and network security specialists.

Some hot tech jobs were concentrated outside the tech hubs. For instance, robotics engineers were more prevalent not just in Boston, but also in Pittsburgh and Detroit, where autonomous vehicle technology is being developed.

While each tech hub is different, some are close cousins. Among the eight hubs, the most similar pair based on the types of jobs posted in 2018 was Austin and Boston. San Francisco’s mix was similar to Boston’s and Austin’s. San Francisco also overlapped significantly with San Jose. Washington and Baltimore were similar to each other since both have large shares of government tech jobs, but were at the opposite pole from San Jose and Seattle. In fact, Seattle and Washington were the most dissimilar pair of tech hubs. If Amazon had wanted a metro like Seattle for its major expansion, the Bay Area would have come closest. And several metros outside the eight hubs, like Portland, OR, and San Diego, looked more like Seattle in tech mix than Washington did.

Perhaps though, these differences are less than meets the eye. The eight tech hubs actually have plenty in common. Six of them are on the East or West coast. All except Raleigh have a cost of living at least as high as the national average. And all lean left politically, having voted for Clinton over Trump by at least a 10-point margin in 2016. They’re also large, since we defined them by looking only at metros with at least a million people. For really different tech markets, we need to look beyond the big eight hubs.

Tech outside the eight big hubs

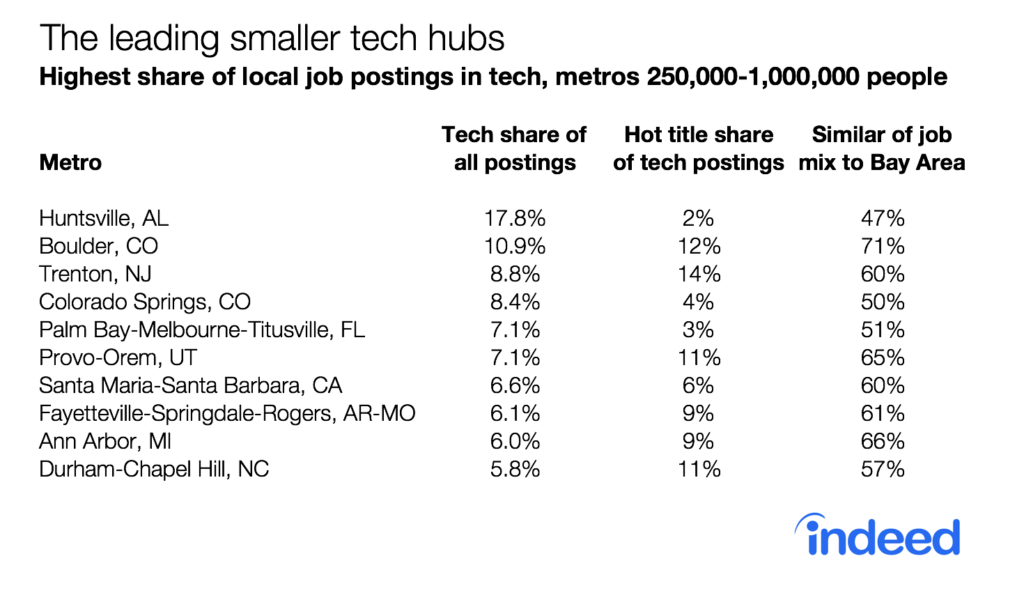

Outside large metros, tech jobs are rarer. Tech accounted for 6.6% of job postings in the million-plus metros, versus just 3.3% in metros with at least a quarter million people but less than a million. Plus, in large metros, 12% of tech postings were the fast-growing, high-paying hot tech jobs versus 6% in smaller metros.

The smaller tech centers tend to be more affordable and more politically and geographically diverse than the big hubs. Smaller centers include several college towns, like Boulder, CO; Trenton, NJ, which includes Princeton; Ann Arbor, MI; and Durham-Chapel Hill, NC. Huntsville, AL, and Fayetteville, AR, are affordable, with living costs more than 10% below the national average. Five of these ten leading smaller tech hubs voted for Trump over Clinton in 2016. Some of these markets, like Boulder, Provo-Orem, UT, and Ann Arbor, have job mixes that would be familiar to a Bay Area transplant—including lots of hot tech jobs. And several—like Huntsville, Colorado Springs, and Palm Bay-Melbourne-Titusville, FL—are military or aerospace centers.

These smaller tech centers lack the wealth of jobs, venture capital funding, and deep technical workforces of the big hubs. Still, for tech job seekers who want to avoid the high costs and urban ills of the Bay Area, Seattle, or Austin, smaller markets offer opportunities.

Where tech job seekers are in the driver’s seat

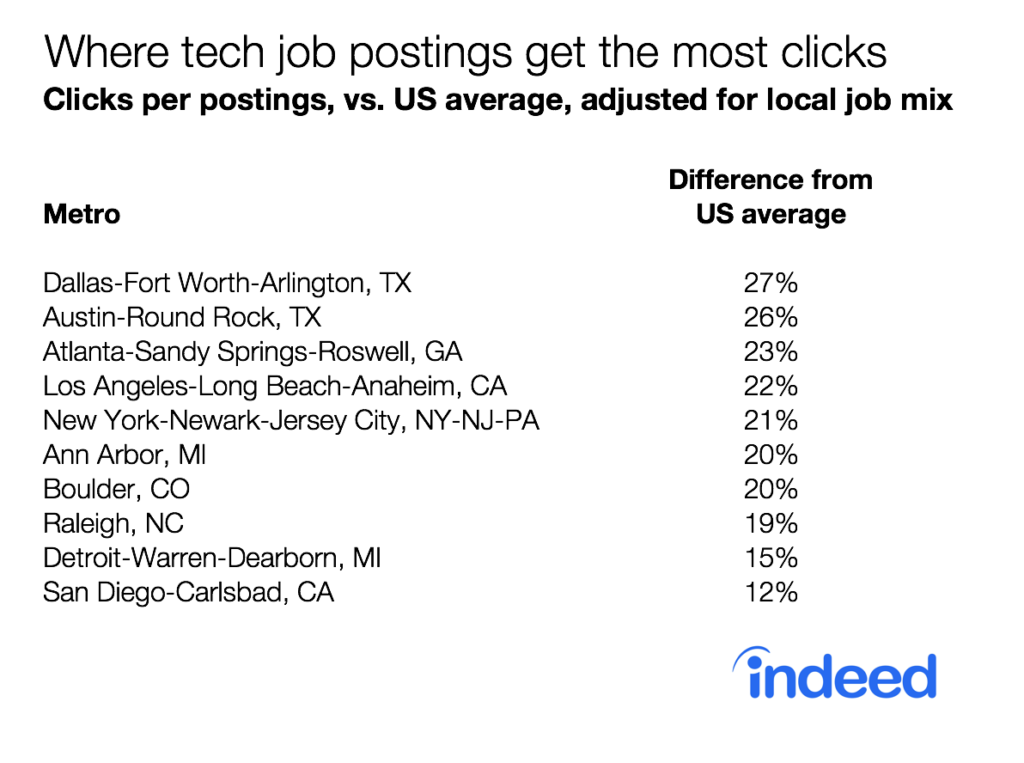

Tech markets differ in another important way—the level of competition for tech jobs. We measure this by looking at the number of times an Indeed job posting has been clicked on. The more clicks per posting, the more competition there probably is for those jobs. When there are fewer clicks per postings, job seekers are in the driver’s seat.

Generally, occupations get fewer clicks per posting in places where that occupation is more concentrated. For instance, in Seattle and San Jose, where data science jobs are more common, those jobs get fewer clicks per posting than in Denver or Houston, where data science jobs are rarer. But, on the flip side, if you’re an employer trying to hire data scientists, you’ll probably see more interest in your posting in Denver or Houston than in Seattle or San Jose.

That means some tech markets are better for job seekers than others. In places where specific tech jobs are highly clustered, job seekers tend to be in the driver’s seat. The fewest clicks per posting were in Baltimore, Huntsville, and Colorado Springs. Among the big tech hubs, Baltimore, Washington, Seattle, and San Jose had relatively few clicks per posting.

Dallas and Austin get the most clicks per tech-job posting—a quarter more clicks than the national average. The metros with more clicks per posting tend to be more populous and have more broadly diversified economies. Fewer of their tech postings are in highly specialized, clustered tech occupations.Their tech job mixes look a lot like the US overall. That’s true even in Austin and Raleigh, two of the big eight tech hubs. In these more diversified tech markets, more job seekers are competing for each job—so employers are more in the driver’s seat.

Tech jobs can be found in markets large and small across the US. Tech job postings—especially in high-paying, high-growth titles—remain concentrated in the eight big tech hubs. Still, each of the big tech hubs has its own unique set of jobs, with big differences between places dominated by tech companies, like San Jose and Seattle, and centers of government tech like Washington and Baltimore.

Beyond these hubs, smaller tech markets offer affordability and geographic diversity. What’s more, in many of these smaller markets, job seekers are in the driver’s seat. For some in tech, the Bay Area remains the only place to be—but there are plenty of tech centers elsewhere for those who want someplace different.

Methodology

Throughout the post, the Bay Area refers to both the San Francisco-Oakland-Hayward and San Jose-Sunnyvale-Santa Clara metro areas.

Nearly all data in this post are based on Indeed.com job postings and job-seeker clicks in 2018. The shares of local tech jobs in tech-industry companies and government are from the US Census Bureau’s American Community Survey microdata from 2015-2017 downloaded from IPUMS. Hot tech job titles are those for which national average posted salaries were above $100,000 in 2018 and the number of Indeed postings doubled from 2015 to 2018.

The similarity index measures how alike a pair of metros are in their tech-job postings mixes. Two metros with identical tech-job postings mixes would have a score of 100. Two metros with tech-job postings in entirely different job titles (all of Nerdville’s postings are for data scientists; all of Geektown’s postings are for IT security specialists) would have a score of 0. The measure is equal to the sum across job titles of the absolute value of the difference in each job title’s share of local postings, divided by two, subtracted from one, and multiplied by 100.

The clicks-to-posting ratio for metros adjusts for differences in the local tech jobs mix.