The delta variant is still visible in the September Job Openings and Labor Turnover Survey (JOLTS) report, though we do know from the October jobs report that the labor market did get on more stable ground.

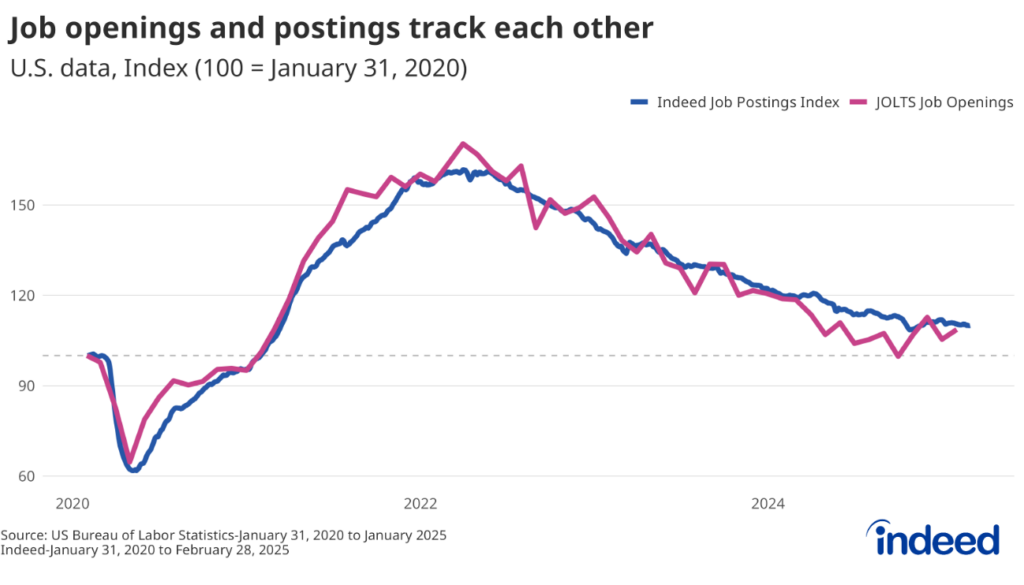

Job openings declined for the second straight month, fueled again by a pullback in demand in the leisure and hospitality sector. About 50% of the decline in total job openings was in the sector that contains restaurants, bars, hotels and concert venues. The recent wave of the pandemic is the likeliest culprit behind this demand slowdown. The stronger employment growth in October suggests this ebb in demand was temporary.

While demand might have slowed down, workers continue to quit at historic levels, with the quits rate hitting an all-time high of 3%. The rise of quitting across the labor market is remarkable, but the concentration among a few sectors is eye-popping. Quits are up the most in sectors where most work is in-person or relatively low paying. Manufacturing quits are up 78% since February 2020 while leisure and hospitality is up 43% and ‘other services’ is up 41%. Meanwhile, the number of quits in the financial activities sector is only up 5% over that same time period. The ‘Great Resignation’ is more a story about strong demand for workers, rather than a rethink of work among higher-income workers.

If the recent swoon in job openings is temporary, then the outlook for the pace of the recovery continues to be strong. Demand for workers is still elevated and if some of the factors holding back job seekers continue to fade, the speed of the recovery will remain robust.