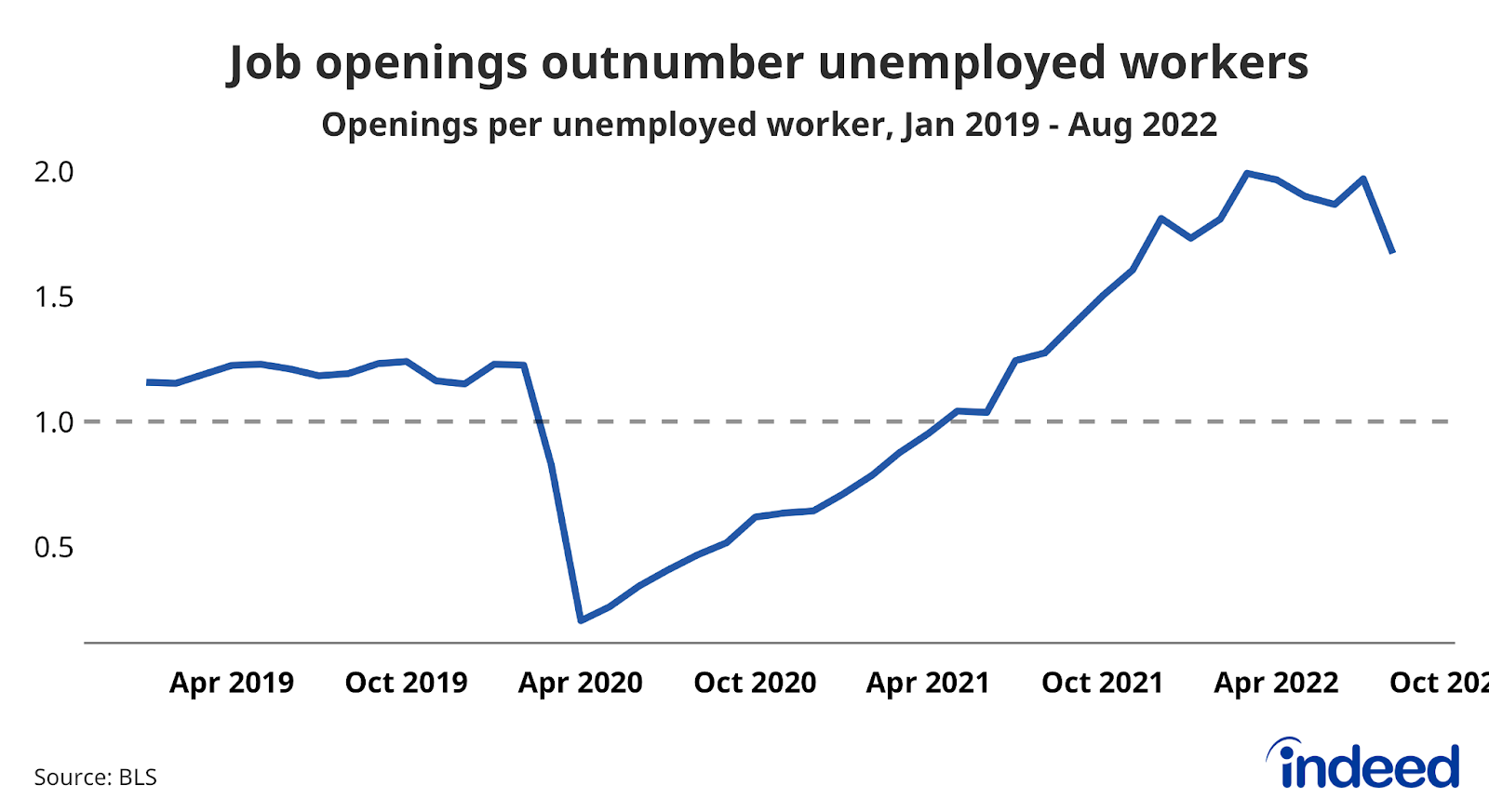

The long-awaited pullback in job openings has arrived. Over the course of August, the number of private sector job openings fell by an astonishing number — nearly 10%, according to the latest federal Job Openings and Labor Turnover Survey (JOLTS) data. The labor market metric that Federal Reserve Chair Jay Powell pays close attention to, the ratio of job openings to unemployed workers, fell to 1.7 from two a month prior. There were likely a few cheers in the Eccles Building, the Federal Reserve’s main office, when these numbers were released. A sustained decline in job openings like this one without a spike in unemployment is vital for a soft landing in the labor market.

The labor turnover data continues to point in the same direction it has since earlier this year. Quitting is still elevated, but below the highs we saw in the late fall of 2021. However, one trend has shifted: a large increase in Leisure and Hospitality quits indicates that the sector hasn’t totally moved beyond its high turnover moment. Employers also continue to hold onto workers they do have as layoffs are still very low. This is the 18th straight month the layoff rate is below its pre-pandemic nadir.

The dramatic decline in job openings shouldn’t be overlooked, but this one-month drop brings that measure of demand in line with the standard narrative of the current labor market. The heat of the labor market is slowly coming down to a slow boil as demand for hiring new workers fades. This is still very much a job seekers’ labor market, just one with fewer advantages for workers than a few months ago. Workers’ voices are quieter than earlier this year, but their voices are still being heard.