Key Points:

- The labor market remains strong as employment grew by 261,000 jobs in October and the unemployment rate rose to a still-low 3.7%.

- While the labor market is far from backsliding, some of the new data should raise our concern level a bit.

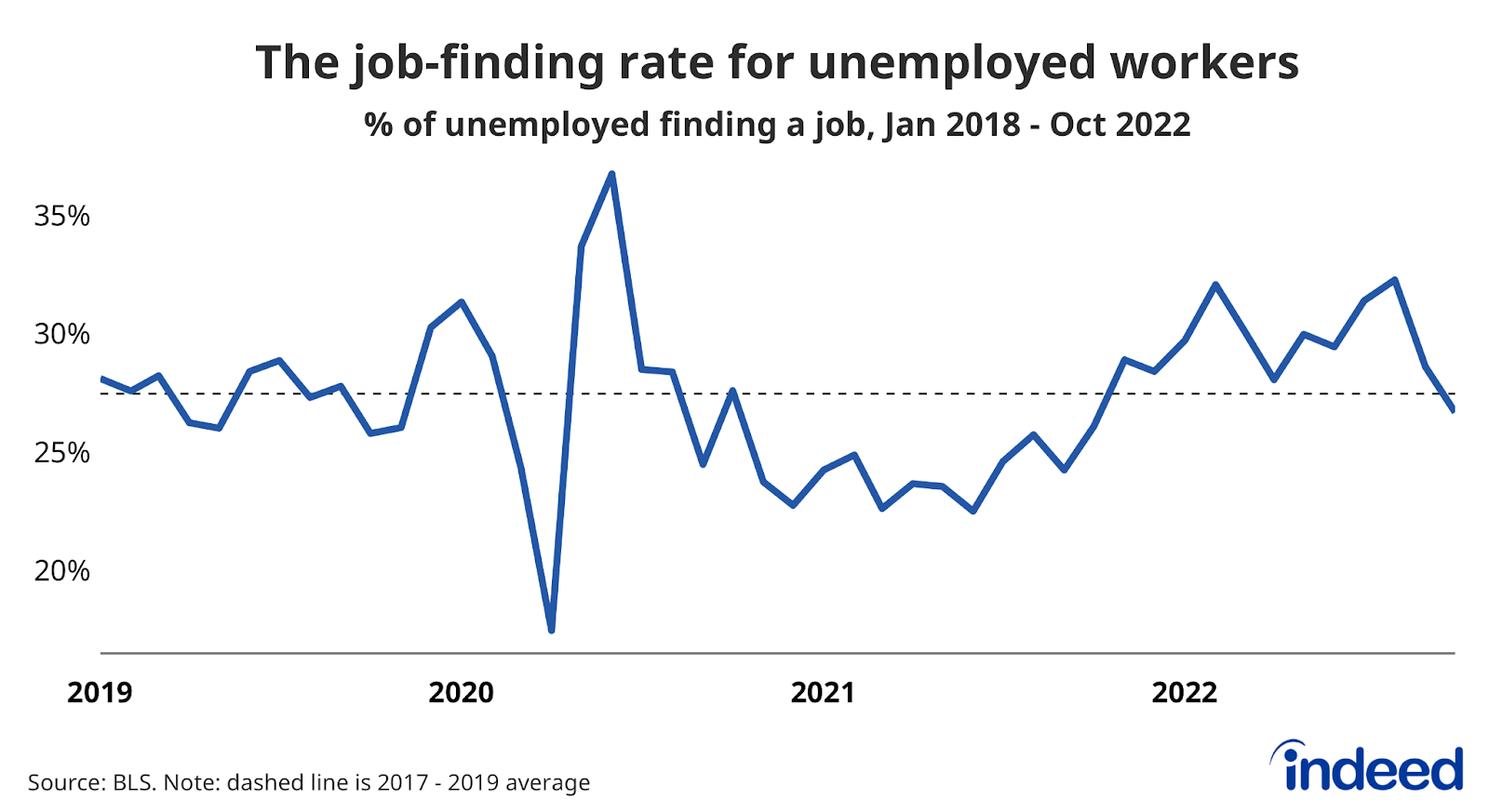

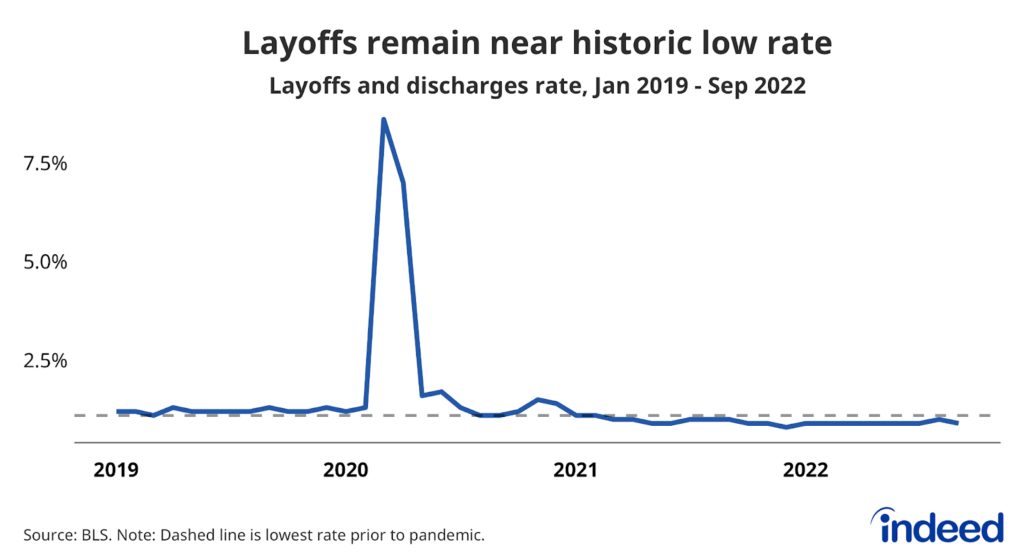

- The rate at which unemployed workers are finding jobs is declining and some pandemic-era sources of strength are weakening.

Everything might seem calm on the surface of today’s jobs report, but a look below the surface reveals some troubling currents. Payroll growth is still strong, but some previous leading sectors are pulling back. Unemployment is still low but rates of job finding are declining and the prime-age employment to population ratio dropped dramatically. The labor market remains strong, but that won’t always be the case.

Payroll growth continues to slow, but it’s still robust. The average growth of 289,000 jobs a month over the past three months is much slower than last year, but it stacks up well by most standards. However, some of the trends in industry employment growth are concerning. Warehousing and storage industries, a pandemic-era winner, lost 20,000 jobs over the month, likely a result of the pivot away from goods consumption. Rental and leasing services, a sector exposed to the now retreating goods market, also lost jobs in October, down 8,000.

The household survey was the more concerning of the two data sources this month. Clearly the rise in the unemployment rate was concerning, but the stark dropoff in the prime-age employment-to-population ratio should raise our concern level. The rate at which unemployed workers found jobs also declined, even if it is still roughly in line with pre-pandemic norms.

No one should be concerned that the US labor market is about to start sinking. Joblessness is still low and job growth is strong, but today’s report shows it may be springing some leaks. The hope is that the labor market is merely returning to a more normal pace, rather than sitting dead in the water. The labor market is still cruising for now, but the seas may get rougher ahead.