Key points:

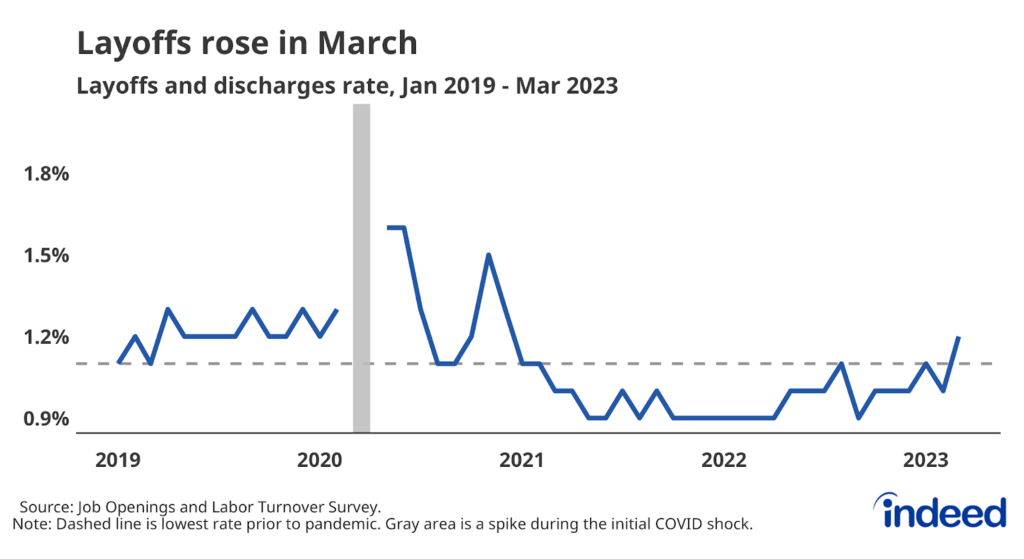

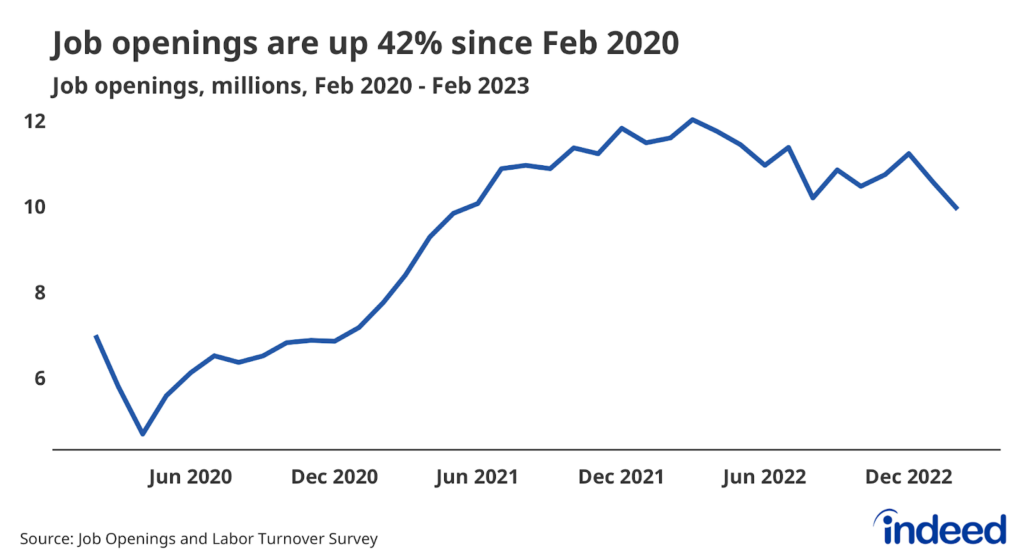

- There’s no argument that the labor market continues cooling down, as job openings and the rate of quitting declined and layoffs rose in March.

- The often-cited ratio of job openings to unemployed workers continued to fall, hitting 1.6 in March, its lowest rate since October 2021.

- The layoff rate picked up to 1.2%, its highest level since December 2020. The Construction sector saw a particularly large jump, which could be a sign that fallout from high mortgage interest rates is beginning to hit the labor market.

- The quits rate ticked down to 2.5% as workers are less willing to voluntarily leave their old jobs.

The cooldown in the US labor market is now unambiguous — it’s happening. Job openings are no longer resisting gravity and clearly trending downward as the quits rate continues to moderate. This month’s JOLTS data also shows a clear rise in layoffs, to their highest level since December 2020, led by an eye-popping spike in construction layoffs. But while the labor market is loosening relative to recent norms, hiring remains historically tight. Job openings still outnumber unemployed workers and the quits rate is still above its pre-pandemic pace. But it’s unreasonable to expect these conditions to last too much longer.

As they continue to take historic steps to cool the broader economy and rein in inflation, Federal Reserve Chairman Jay Powell and other Fed policymakers will be pleased to see the labor market picture painted by this data. The often-cited ratio of job openings to unemployed workers continued to fall, hitting 1.6 in March, its lowest rate since October 2021. Monetary policymakers should keep an eye on the construction labor market. The dramatic 1.4 percentage point jump in the construction layoff rate — admittedly volatile data that may just be noise — might be a sign that fallout from high mortgage interest rates is beginning to hit the labor market.

Another sector worth keeping an eye on is Leisure and Hospitality, where the quits rate fell by 1.1 percentage points in March and continues to slide closer to pre-pandemic norms. Bars, restaurants, and hotels were epicenters of the great surge in job-switching. But less churn in these sectors, along with Retail Trade and Other Services, point toward less competition in lower-wage industries, which will ultimately lead to slower wage gains.

Don’t mistake the clear cooldown as a sign that the labor market is in imminent danger. Demand for new hires is still strong and layoffs are still low by historical standards. Job seekers and workers can take some comfort in the current state of affairs, though the pullback may pick up as the year goes on and the advantages gained by job seekers in recent years may fade away. The latest data does not entirely scrap hopes for a soft landing, but they may be starting to fade.