Key points:

- Job openings declined to 8.8 million at the end of July as demand for new hires continued to moderate.

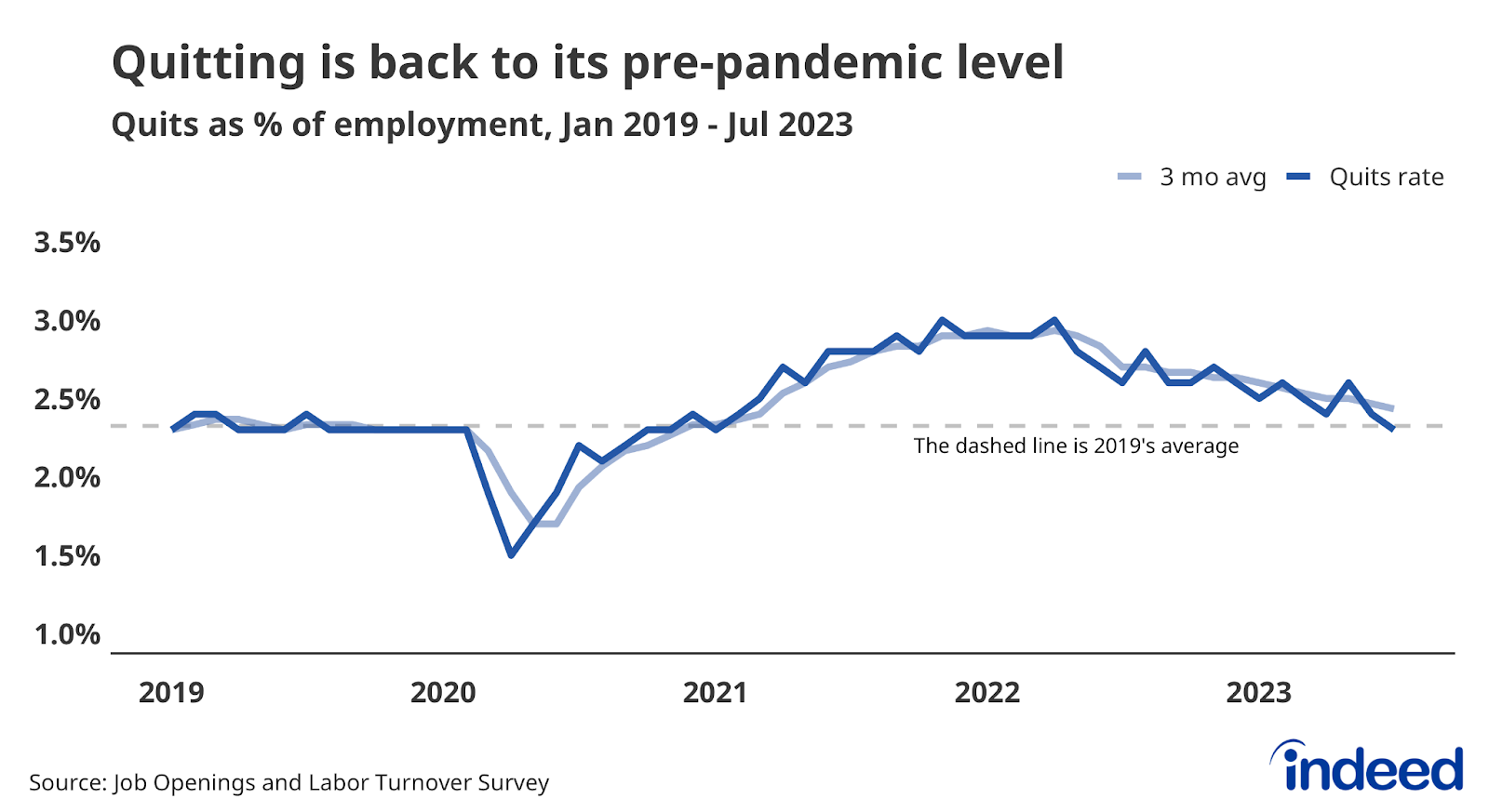

- The return of the quits rate to its average rate during 2019 of 2.3% signals the end of the Great Resignation.

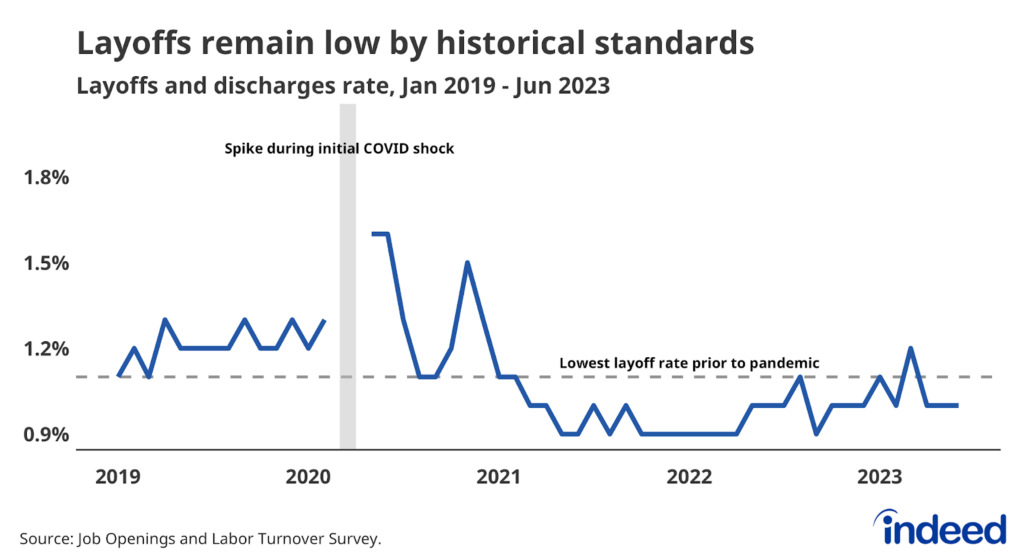

- The layoff rate remained low at 1% and is unchanged from its level last July.

Today’s JOLTS data show that the Great Resignation has come to an end and the path toward a soft landing remains open. After two-plus years spent quitting and finding new and better opportunities at elevated rates, US workers are now voluntarily leaving their jobs at the same rate they were prior to the pandemic. This reduction in job-hopping signals that wage growth will continue to cool as employers face less pressure to attract new hires and retain current employees. This trend, plus the decline in job openings and dormant layoffs, is likely to please Fed policymakers.

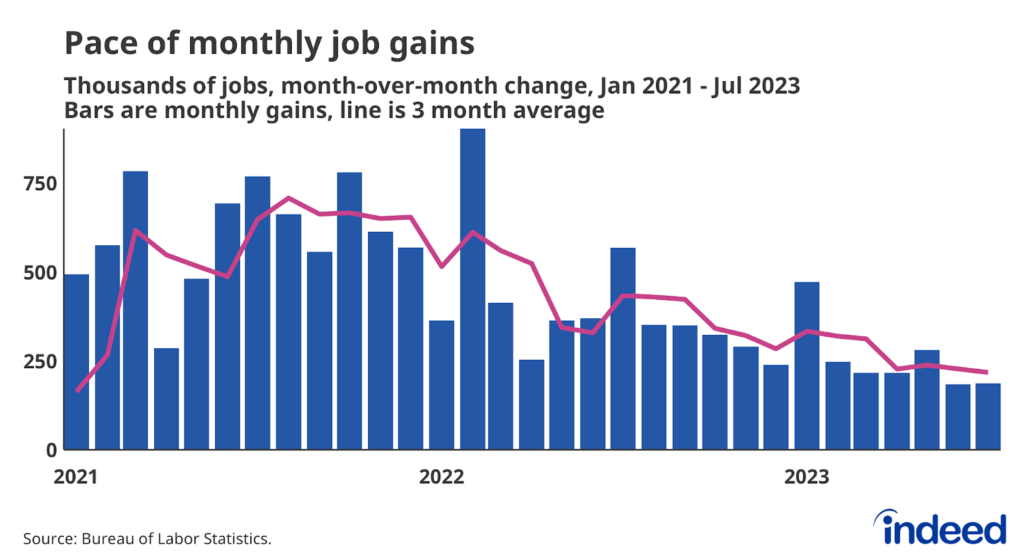

Quitting is coming down because job seekers are finding fewer opportunities—job openings have declined by 1.5 million over the past three months. There were still 23% more job openings at the end of July than there were on the last business day of January 2020, down from the peak of 67% at the end of March 2022. And while job openings continue to outnumber unemployed workers, the ratio of job openings to unemployed workers declined to 1.5 in July, the lowest ratio since September 2021. The labor market is still tight, but continues to loosen.

The pullback in quitting is broad-based, with many sectors currently boasting quits rates equal to or below their immediate pre-pandemic levels. Most notably, quitting in two sectors that led the way during the Great Resignation has returned to early 2020 rates. Quitting in the Retail sector in July was equal to the sector’s February 2020 rate, and Leisure and Hospitality’s rate is slightly below that baseline. If quitting has moderated in these industries that experienced so much churn in recent years, then the Great Resignation is definitely behind us.

The reduction in quitting and job openings is happening at the same time as layoffs remain low. The layoff rate remains unchanged over the past year and at a level that would have been an all-time low prior to the pandemic. All three of these trends are necessary ingredients for a soft landing in the US labor market, but that soft landing is still not guaranteed. The US labor market remains on solid footing, but demand for labor needs to continue declining as supply rises to meet it, all as inflation continues to cool.