Key Points:

- Look past the unexpected 690,000 spike in job openings; it’s unlikely to represent the underlying trend in demand for new hires.

- The latest data on quitting and layoffs continue to show an open path toward a soft landing.

- The US labor is cooling down but retaining heat—a positive trend for workers, employers, and policymakers.

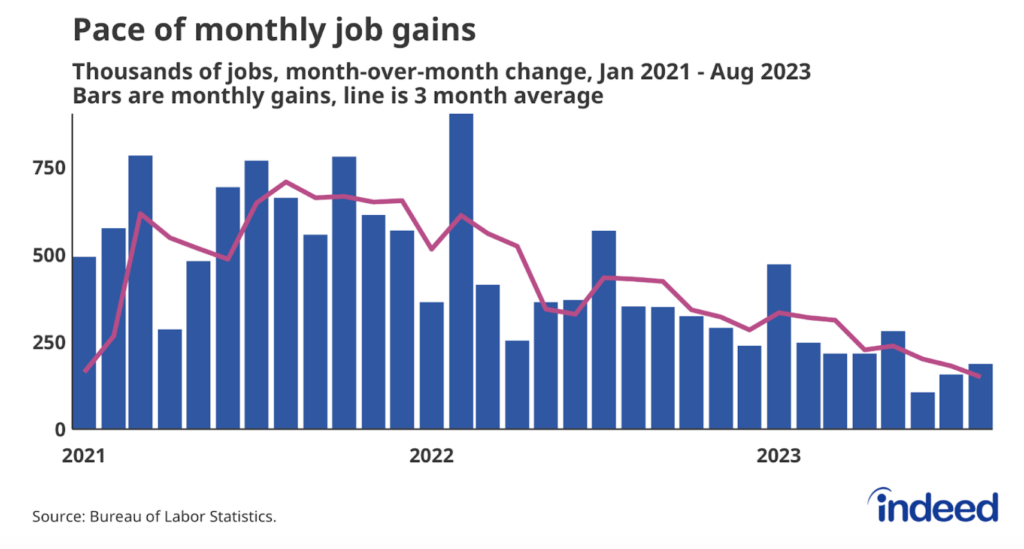

Don’t be fooled into thinking the longstanding cooldown in the labor market has suddenly reversed itself after an unexpectedly strong August. While the headline jump in openings was surprising, the large majority of the almost 700,000 increase in job openings came from just one industry—professional and business services—and is likely noisy. Yes, the job market is still retaining a lot of heat, but it hasn’t gone back on the boil. Job openings are down 20% from their peak this cycle, and the quits rate has fallen back to its pre-pandemic baseline. Layoffs are still so low that the layoff rate in August would have been a record low prior to 2020. Remember: the trend is your friend. The US labor market is cooling down.

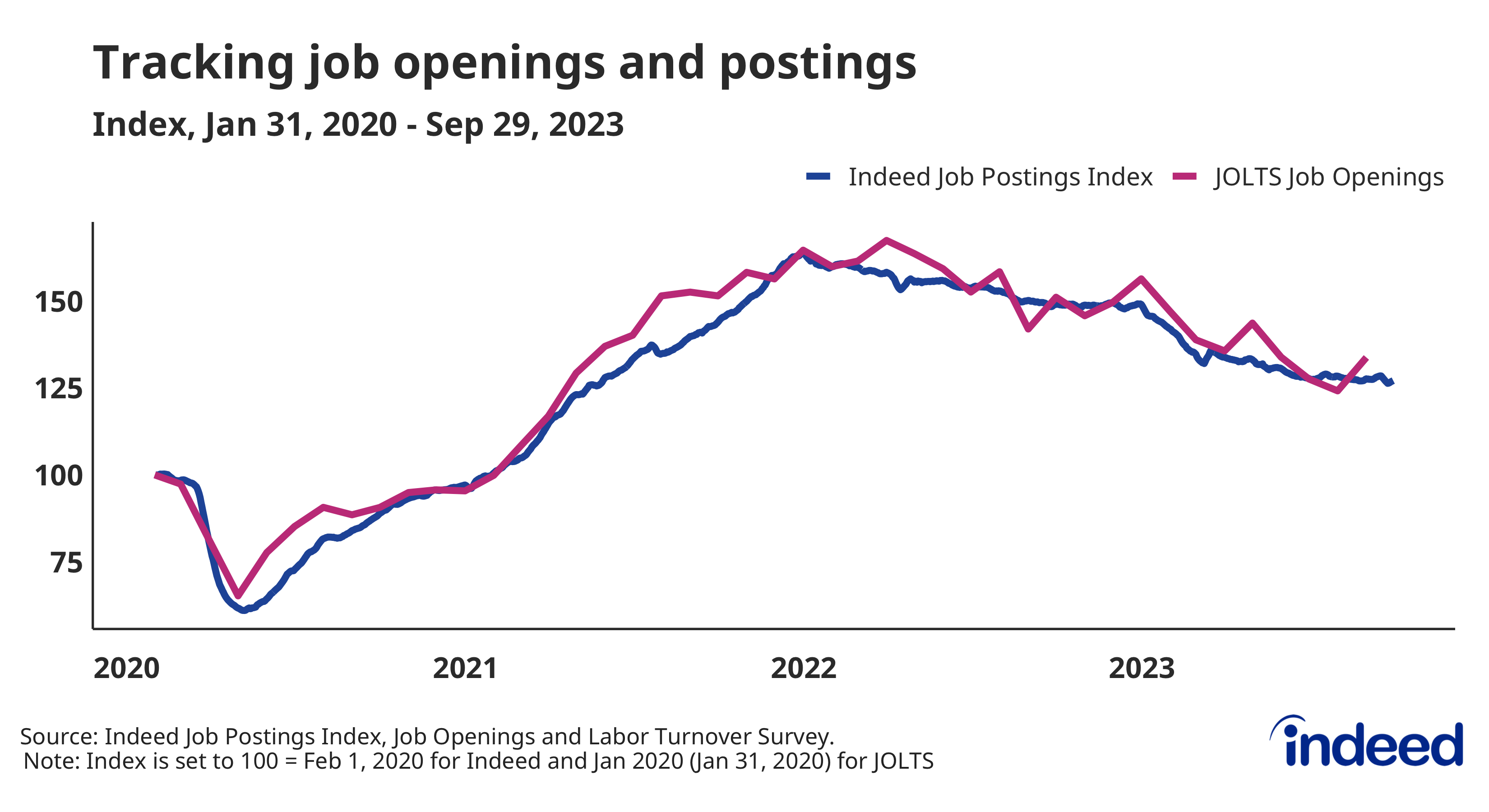

Job openings spiked in August, but the underlying reality is more likely one of resilience rather than resurgence. Other measures of demand for new hires, including Indeed’s Job Postings Index which held steady from August through September, are more muted. The weakness in Retail Trade is also showing up in Indeed data, as seasonal job postings are lagging the trend of the past few years. Demand for new hires has come down from its peak, but there’s little sign it’s falling off a cliff.

Much of the rest of the report suggests the path to a soft landing remains open. Quitting held steady at its pre-pandemic average of 2.3%. If this key indicator can continue to stay resilient, wage growth will continue to slow while settling in at a still-rapid pace. And workers continue to have solid job security as layoffs remain low across the board. Even the layoff rate in the Information sector, the home of many tech and media companies, is below its pre-pandemic level.

The next couple of months of data will go a long way toward helping the Federal Reserve determine how high interest rates will go, and how long they will stay there. But so far, so good. We’d need to see several months of data like today’s, and signs from other data, before feeling like the trend has changed. Friday’s jobs report will also provide more clarity, showing whether last month’s spike in unemployment was an aberration. The labor market is in a sweet spot right now. Hopefully, things don’t turn sour any time soon.