Key points:

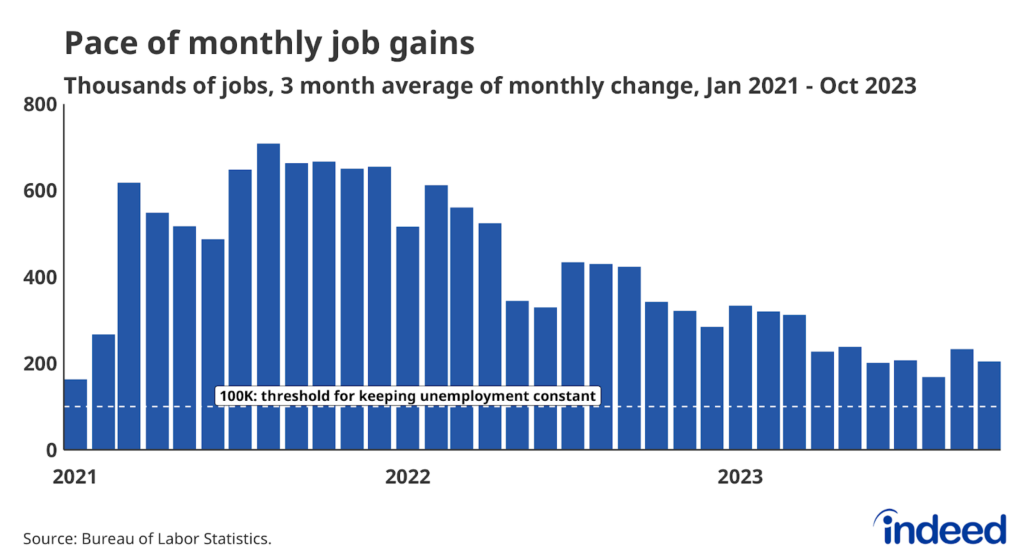

- Job gains remained robust, with employers adding 216,000 jobs in December.

- The unemployment rate was steady at 3.7% but labor force participation dropped sharply, hinting at potential labor supply problems in the year ahead.

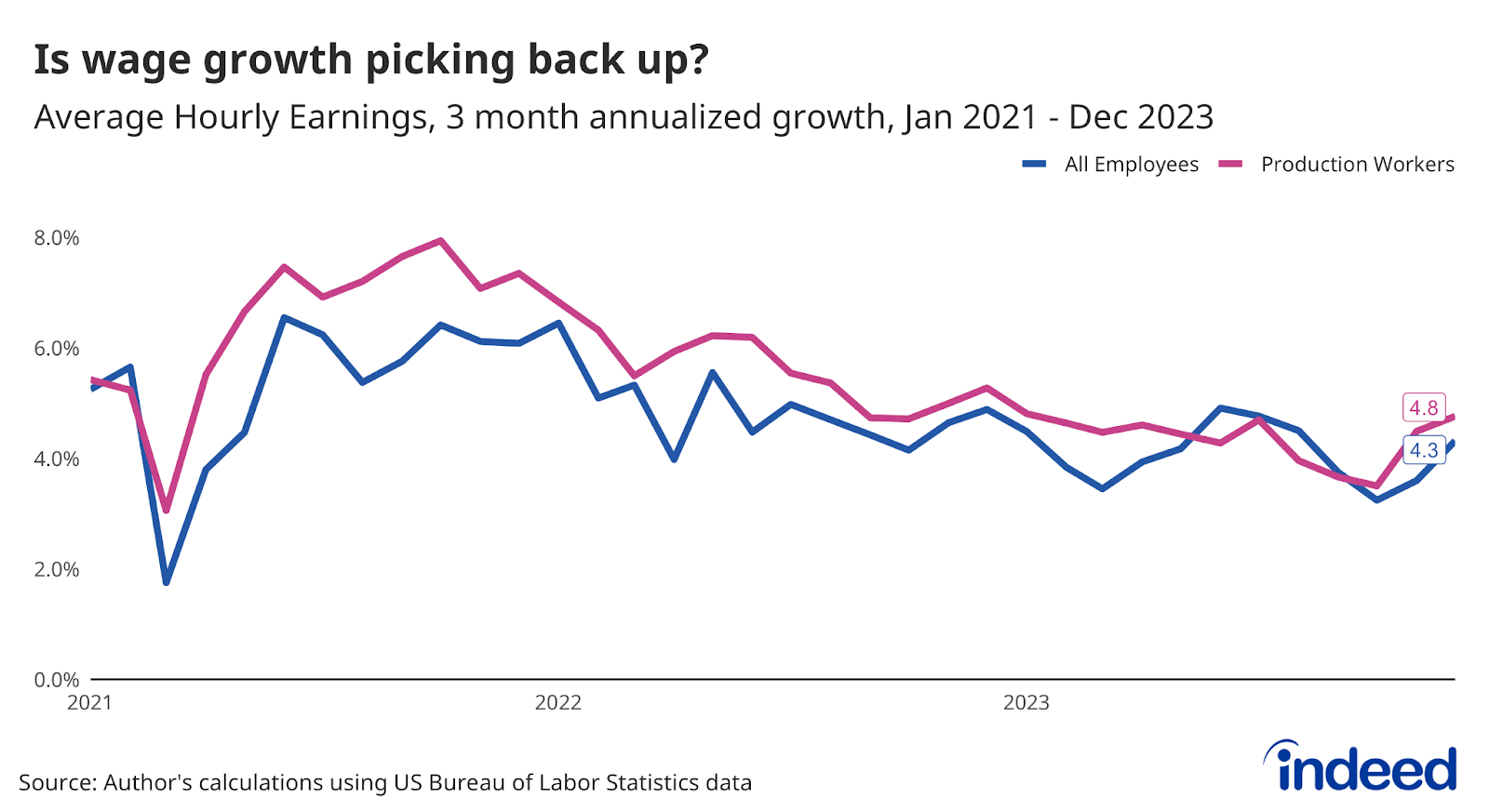

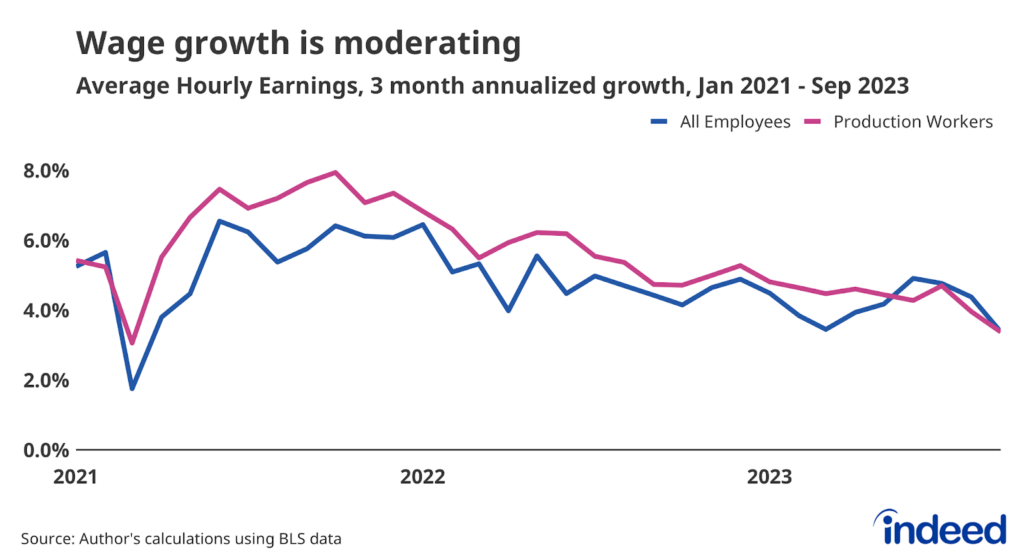

- Wage growth picked up in December, a sign that the labor market might not be rebalancing as quickly as previously thought.

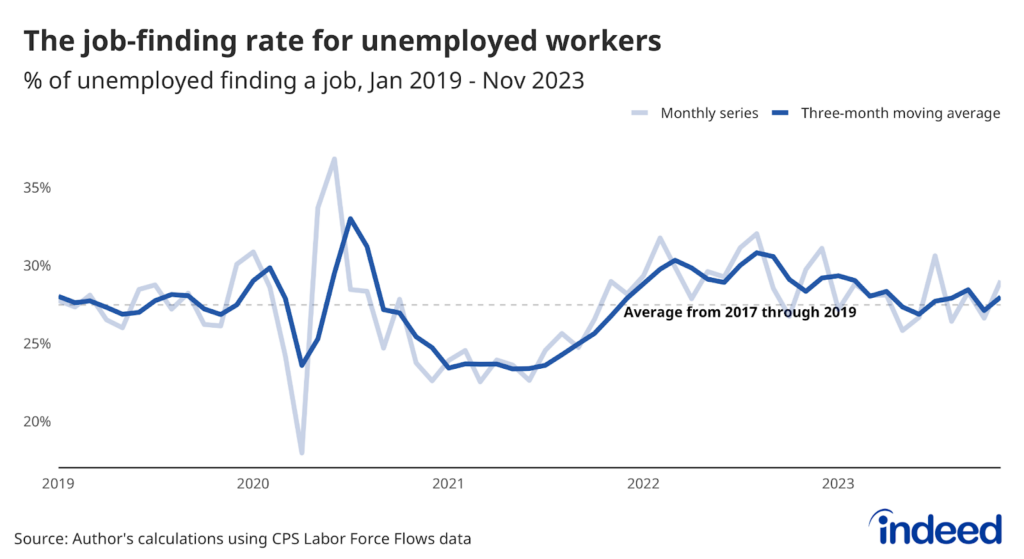

After entering 2023 with a sonic boom, the US job market is headed into 2024 at a comfortable cruising speed. The pace of job creation is strong but not overwhelming, unemployment is low and stable and job openings are plentiful. But turbulence lurks on the edges of the radar. Labor force participation fell off towards the end of the year, and wage growth re-accelerated — both signs that while labor demand may still be high, labor supply may be struggling to keep pace. Much of the success in the labor market over the past few years has relied on the ability of a strong labor market to pull people back into the workforce. If that engine is starting to sputter, it could spell trouble.

Job gains are clearly slower than this time last year, with the three-month average gain falling to 165,000 last month, from an average of 284,000 in December 2022. However, the current gains are still strong enough to keep the unemployment rate low given the slowing population growth. A few sectors still account for the lion’s share of recent job gains, with more than 75% of December’s growth coming from Education & Health Services, Government, and Leisure & Hospitality. But that’s not particularly concerning, at least for now. The diffusion index, a measure of the breadth of job gains across industries, rose to its highest level since August, a sign that most industries are still adding jobs.

Employers are still looking to hire, but they might be finding that the supply of easy workers isn’t as deep as it was recently. The overall labor force participation rate dropped in December, as did the rate for so-called prime-age workers aged 25 to 54. After rising in the early part of the year, the prime-age participation rate stalled out this summer and has steadily declined since September. Average hourly earnings as measured by the Bureau of Labor Statistics picked up last month, growing at a 4.3% three-month annualized rate. While wage growth can be measured in many ways, and this trend will need to be confirmed with additional data, a sustained re-acceleration in wage growth would mean the labor market isn’t rebalancing as quickly as previously thought.

This time last year, most people were bracing for a recession. But since last December, employers have added just shy of 2.7 million jobs, well above the roughly 2 million jobs added from December 2018 to December 2019. Demand for workers remains strong. Today’s report is another one that should alleviate most short-term recession fears. If there’s any surprise emerging in this report, it’s that the labor market might have more momentum than previously thought.