The modest quarterly acceleration in today’s Employment Cost Index data is likely a reflection of continued strength in the labor market, proof that the market still has gas in the tank for continued expansion, and less a signal of a more worrisome, broad-based re-acceleration. While overall job postings have declined over the last year as the market has cooled, employer demand and wage growth remain well above pre-pandemic norms in many sectors. Wage growth for union workers, in particular, was notably stronger than for non-union workers, potentially a reflection of new work agreements reached late in 2023 that may have taken effect this year.

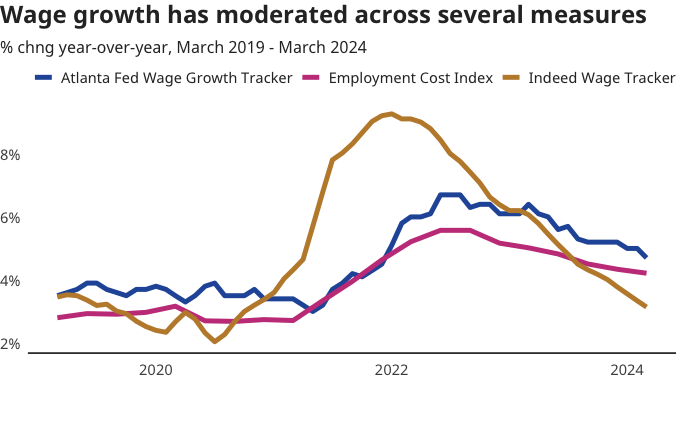

When workers with more volatile compensation are removed (those paid on commission, for example) it’s more clear that year-over-year growth in wages and salaries costs continues to move in the right direction, even if the pace is modest. For now, these data look like a quarterly outlier more than a reversal of long-term trends, and trends in the Indeed Wage Tracker and other government data have shown signs of slowing pay growth in recent quarters. Policymakers at the Federal Reserve will be glad to see those longer-term cooling trends still in place, even if they are also likely frustrated by the slow pace of moderation.