Key points:

- Job openings fell to 8.1 million in April, their lowest level since February 2021.

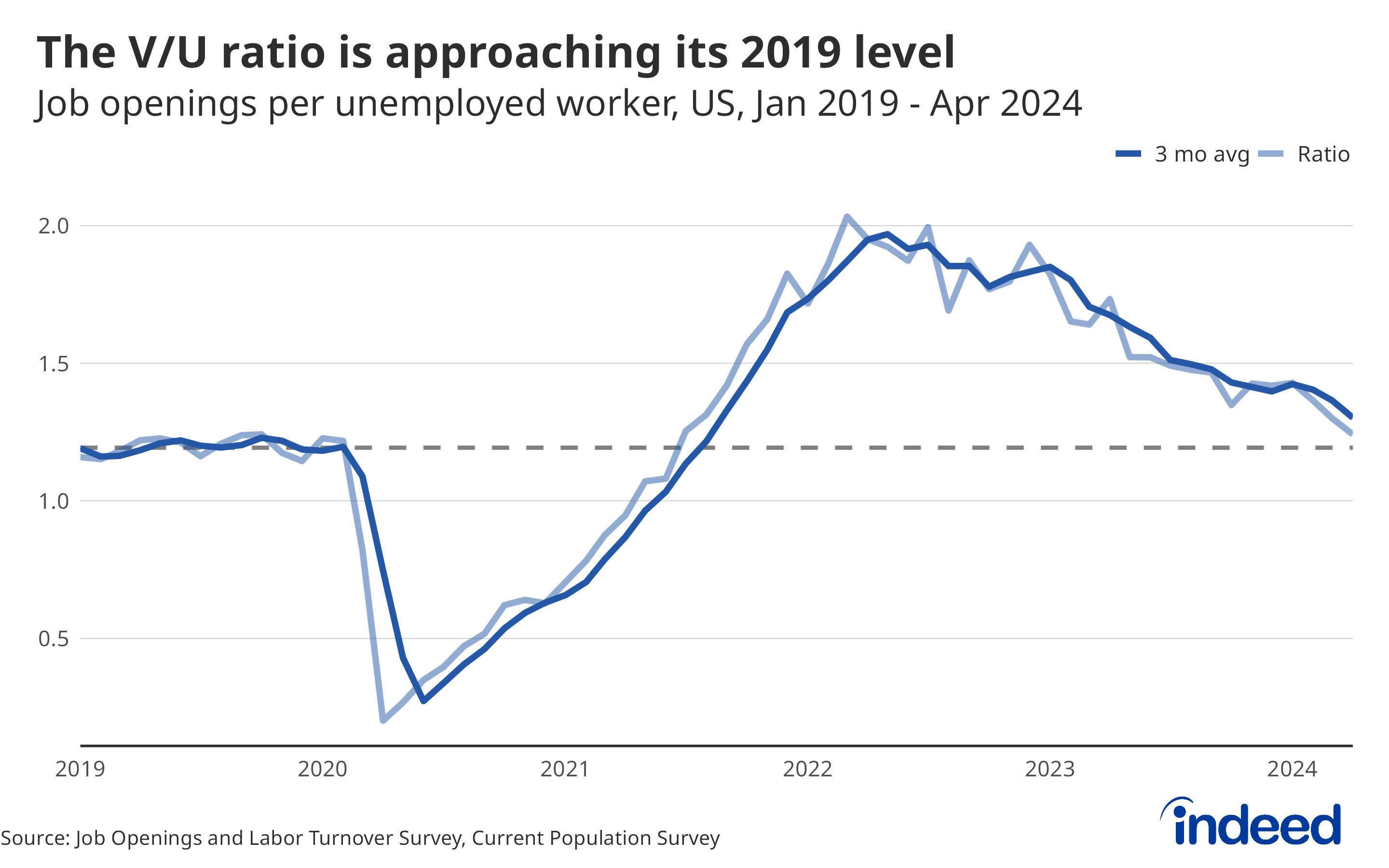

- The ratio of job openings to unemployed workers is now just above its average level in 2019, a sign the US labor market is rebalanced.

- Quitting and hiring held steady at rates below where they stood just before the pandemic, indicating that churn in the labor market is subdued but hasn’t been snuffed out.

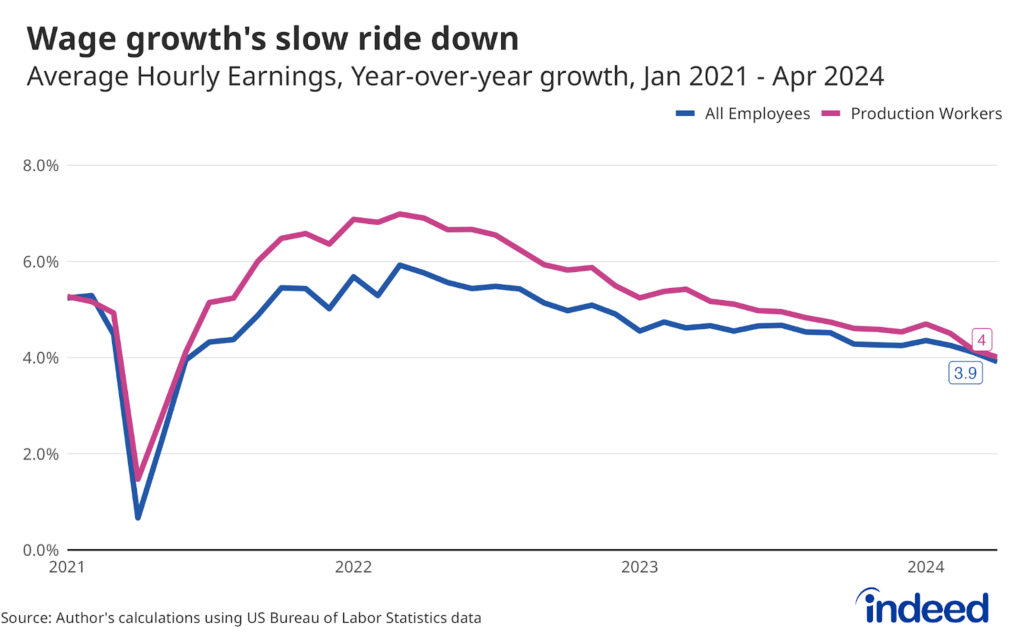

The labor market’s descent continues to be smooth, but don’t take that as a guarantee the ride will stay so serene. The substantial decline in job openings in April, to the lowest level since February 2021, paints a clear picture of a job market that has essentially returned to its pre-pandemic balance and is on the cusp of a soft landing. The decline in openings combined with the slight recent uptick in unemployment has brought the ratio of open jobs to unemployed workers to 1.2, just above pre-pandemic levels. At the same time, hires and quitting have stabilized while layoffs remain low. The question going forward is if policymakers can make this landing stick. Further declines in openings in coming months will make it difficult for hires to hold as steady as they have, and would be a prelude to a more sustained increase in unemployment. It’s important not to get overly confident in the future path of the market; past performance is no guarantee of future results.

More than two-thirds of April’s decline in job openings came from a drop in the healthcare and social assistance industries, a potential sign that the overall drop might be overstated. But large drops in other sectors that lately had been rapidly hiring — including leisure and hospitality and state and local government — show that openings are clearly trending down and have already reached levels consistent with a rebalanced labor market.

The good news is that the recent decline in openings hasn’t led to further deterioration in hiring. The hires rate has been at least 3.6% since November of last year, below its pre-pandemic level and no longer trending down. The same can be said for the quits rate, which has been at 2.2% for four straight months. These subdued but sustained rates are a sign the labor market has cooled but not crashed.

Similarly, layoffs remain historically low. A 1% layoff rate would have been an all-time low before the pandemic, but is now regarded as something normal. The low layoff rate has been a linchpin in the relatively painless labor market slowdown. If hiring can hold up and layoffs stay steady, this rebalancing can end without a bang. But that’s not guaranteed. The Fed should contemplate that at next week’s scheduled meeting of the Federal Open Markets Committee.