Key points:

- Despite the rise in the unemployment rate, the US labor market is still gliding toward a soft landing.

- Employers added 272,000 jobs in May, bringing the three-month average to a level similar to last year.

- The weak data from the household survey is less concerning than it initially appears, as the vast majority of the weakness is concentrated among young workers, and trends for other workers are more benign.

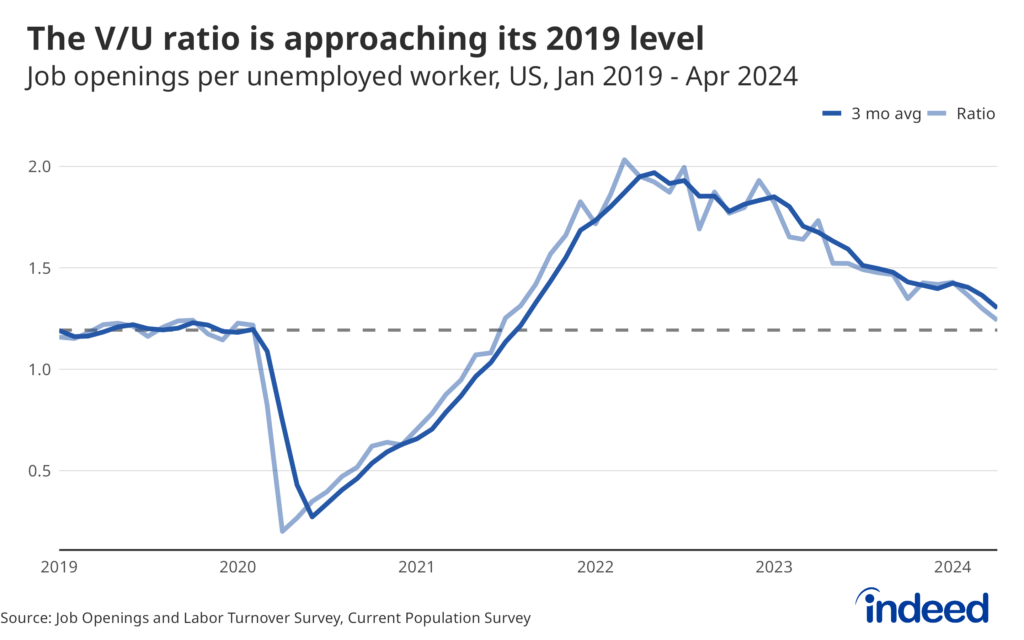

Don’t get overly spooked by the rise in the unemployment rate. The labor market is still gliding toward a soft landing. The rise in unemployment can almost entirely be chalked up to workers 24 and under, while prime-age employment rose. Payroll gains were not only large but also widespread. But while there is still a lot of strength in the labor market, its ability to continue to deliver robust gains at these levels will likely be challenged going forward as job openings continue to fall and the economy continues to cool.

Payroll gains were once again strong, but continue to be particularly robust in a few sectors. Private education and health services, government, and leisure and hospitality once again contributed the lion’s share of gains, responsible for more than 60 percent of May’s gains. But just because these sectors are powering ahead doesn’t mean other sectors are weak. Interest rate-sensitive sectors, including construction and manufacturing, are still adding jobs. The gains are still broad-based, with the diffusion index increasing from last month and remaining well above a reading of 50, which indicates growth in most sectors.

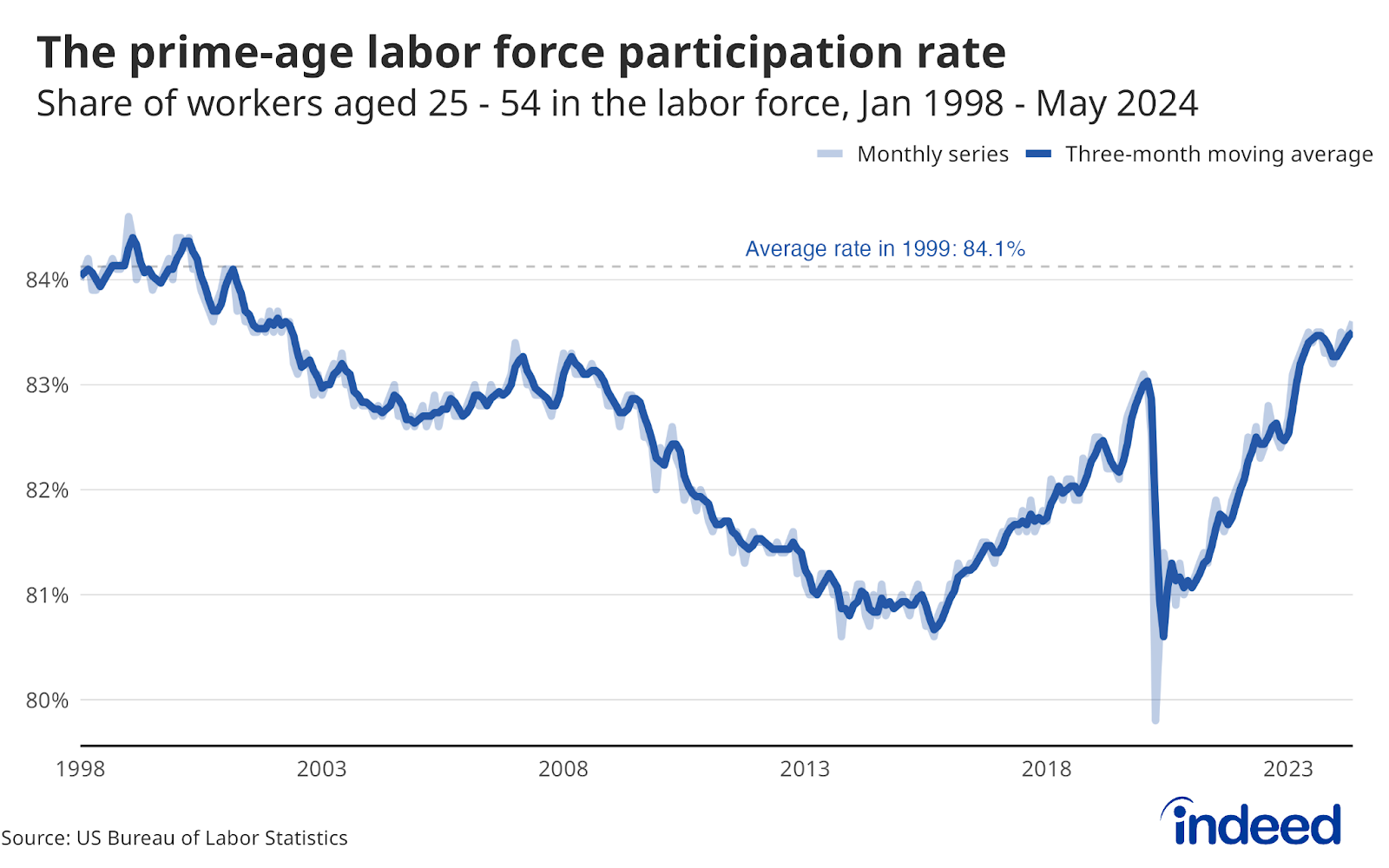

The rise in the unemployment rate and the drop in employment shown in the household survey are less concerning after a deeper look at the data. The headline number shows employment dropping by 408,000, but all of that drop came from workers aged 16-to-24. Similarly, the unemployment rate for this age group jumped by a full percentage point, while the unemployment rate for workers aged 25-to-54 only barely edged up to 3.3%, where it was two months ago.

Wage growth did accelerate from last month’s weak reading, with growth overall continuing to slow only very gradually. On the one hand, relatively firm wage growth will continue to boost household balance sheets and consumer spending. On the other, central bankers at the Fed might be concerned about the upside risk to inflation from stronger wage growth. But given strong productivity growth and the likely continued slowdown to come, they shouldn’t be too upset.

The labor market has defied expectations for so long that it might seem invincible. But nothing ever is. The current trajectory is positive, but with declining demand for workers, it can’t hold up forever. We should celebrate the current situation but be alert to the fact that moderation can turn into something more painful.