Key points:

- Job openings picked up in May, but do not confuse a one-month move for a trend: Demand for new hires is not trending upward.

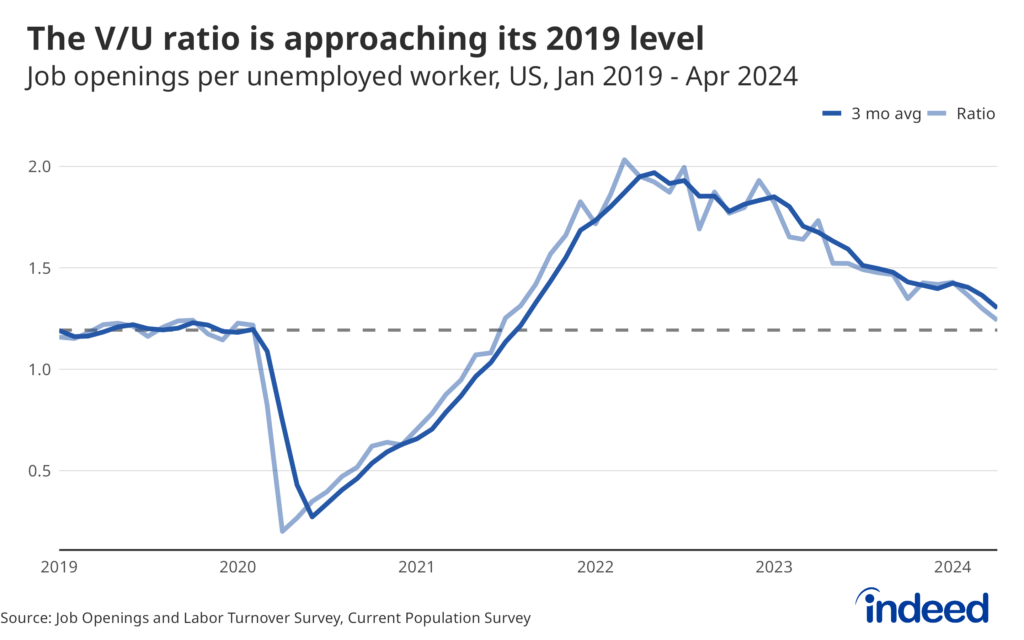

- The current level of openings is consistent with a healthy, sustainable, and balanced labor market as hiring and quitting stabilize and layoffs remain low.

- However, any continued declines in job openings below current levels will quickly become more worrisome and risk a sharp rise in unemployment.

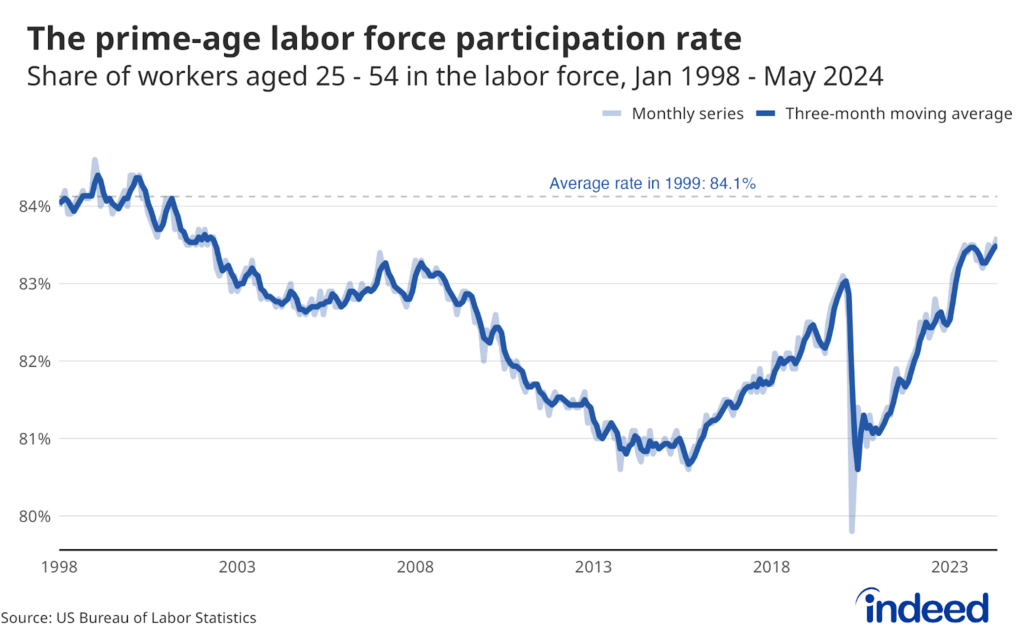

After more than two years of steady declines in job openings, the labor market may be well on the way to leveling off at a sustainable plateau. The words “little changed” were repeated no fewer than a half dozen times in the May JOLTS release, and virtually every key indicator tracked showed limited notable movement, either up or down. This short-run stability is a good thing, but the question remains if this period of calm can continue or if more unsteady times are on the horizon.

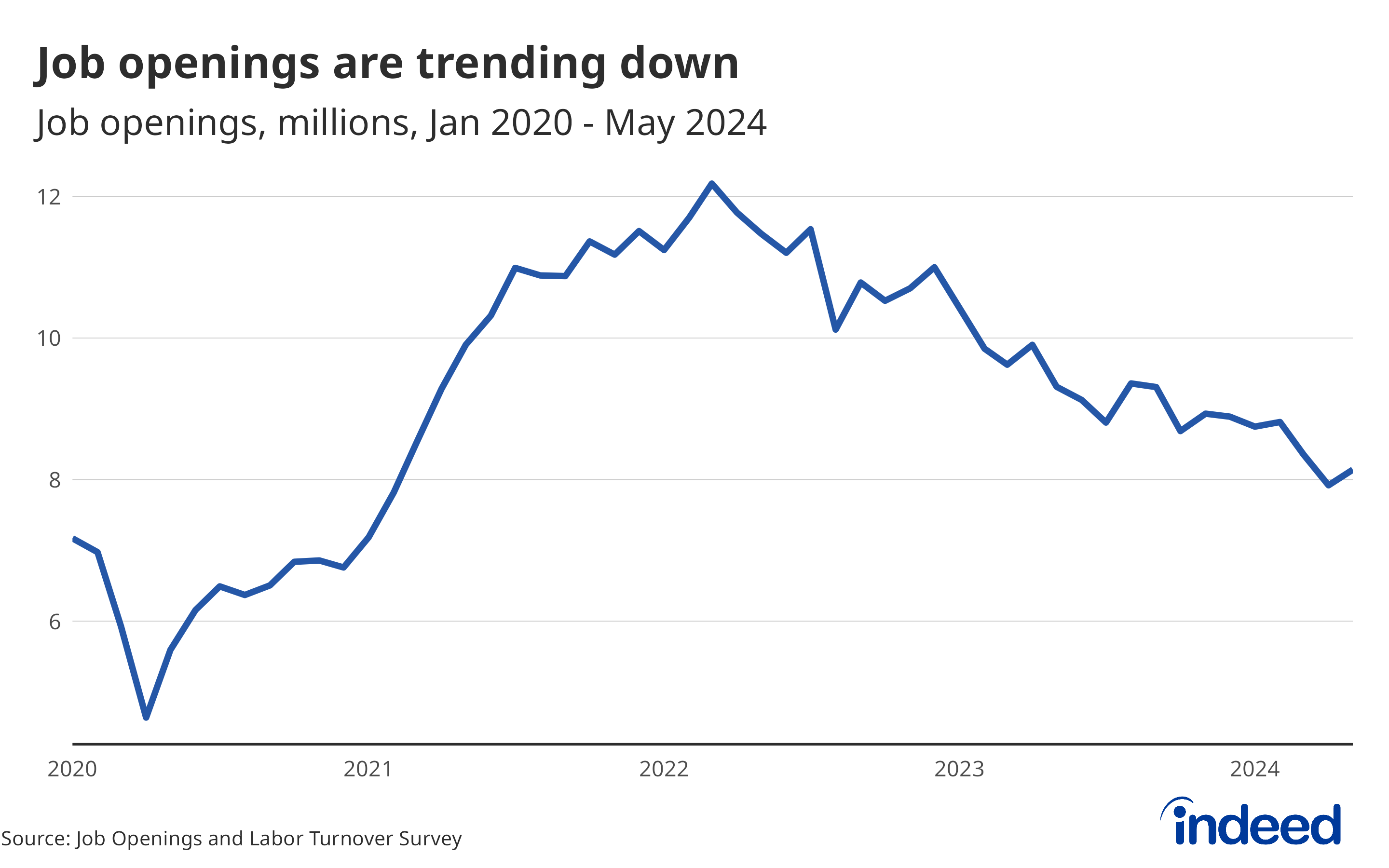

Job openings rose over the month to 8.1 million from a revised 7.9 million at the end of April. Openings data can be quite volatile, but it’s clear that job openings almost certainly are not trending up. The labor market is not heating back up. But after several years of declines, job openings might be, and — perhaps more importantly — need to be leveling off to preserve the current health of the labor market. Job postings on Indeed declined just 0.7% from the end of May through June 28. A similar trend in official job openings would suggest next month’s June reading should come in right around 8 million. Diving below that 8 million is a sign that any further declines in openings would start to push the unemployment rate up even more.

Looking ahead, the labor market stands at a crossroads. This current level of job openings is consistent with a healthy, sustainable, and balanced market, but any continued declines below these current levels will quickly become more worrisome. Yet many people have also underestimated the enduring strength of the US labor market, at their own peril. An interest rate cut this year might be necessary to keep demand for workers from falling too far, but may also provide an unnecessary boost to a market that may not need it.