Editor’s Note: This article is part of a series about benefits in job postings, including a deep dive into each benefit type. Find more about overall benefits here, retirement benefits here, family benefits here, and leave-related benefits here.

Key points:

- Medical and insurance benefits are the most commonly advertised benefits, appearing in 45% of job postings on Indeed in May.

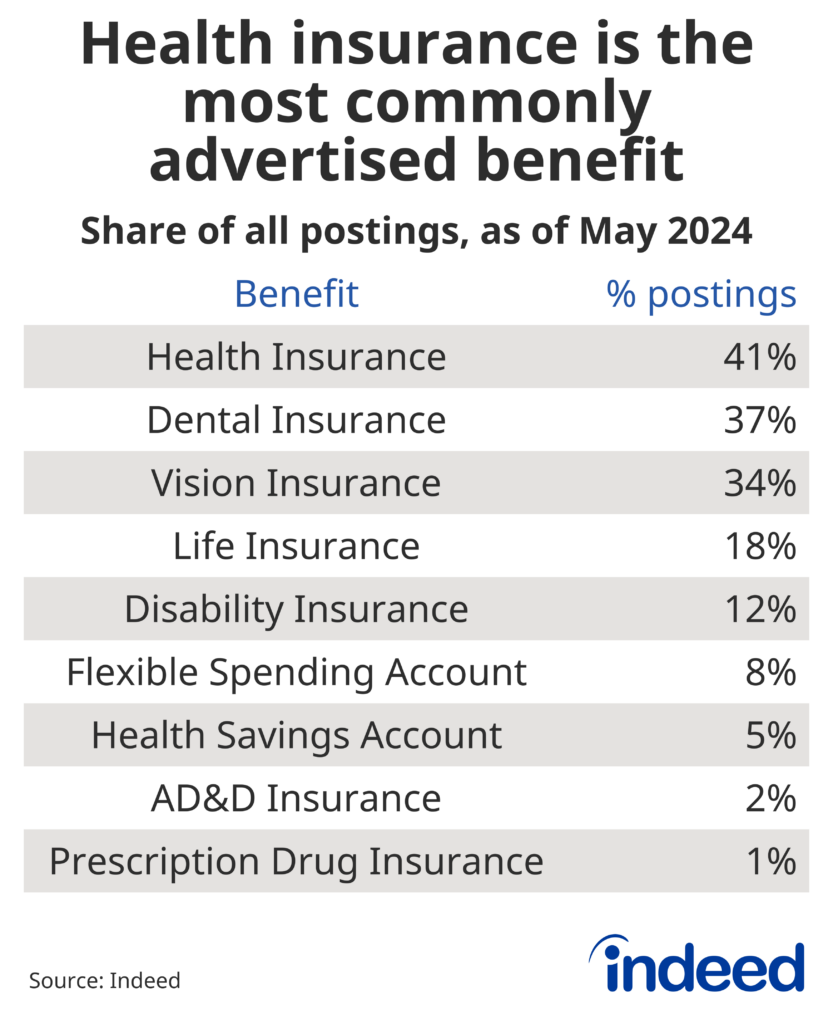

- Health insurance — a benefit required for most full-time employees — is the most common medical and insurance benefit.

- Sectors with the lowest share of medical and insurance benefits in job posting advertisements are also the most likely to offer benefits in general.

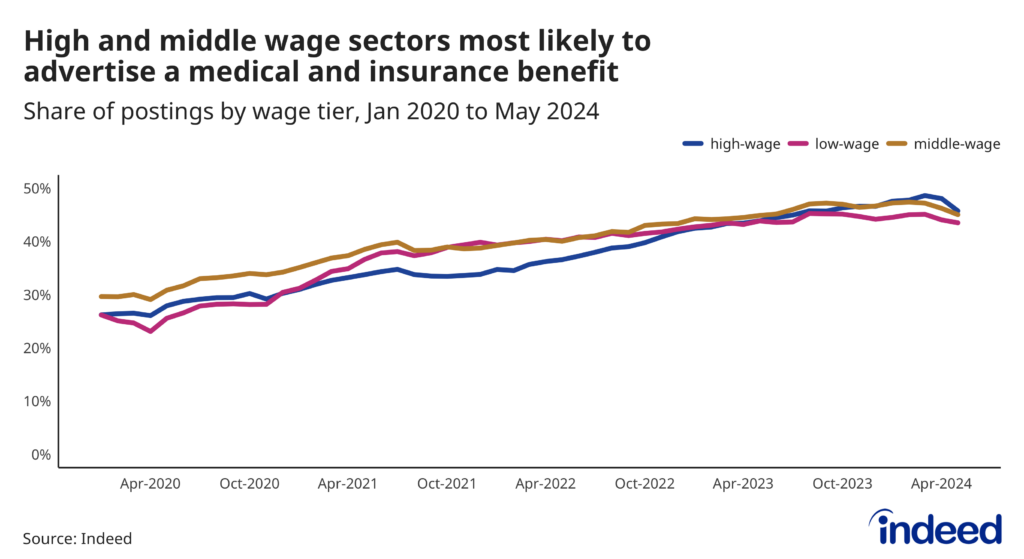

A tight labor market in the wake of the pandemic has likely prompted more employers to begin advertising medical and insurance benefits in their job postings. The share of postings advertising an employer-paid medical or insurance benefit rose from 27% in January 2020 to 45% in May 2024. However, given that the Affordable Care Act has required many companies to provide medical insurance to full-time employees since its passage in 2010, the data signals that while medical and insurance benefits are being more widely advertised, those benefits are not necessarily being more widely given.

Medical and Insurance are the most frequently advertised benefits

According to the Bureau of Labor Statistics (BLS), health insurance is available to 89% of all private-industry, non-unionized workers. So it makes sense that health insurance is the most commonly offered medical/insurance benefit in job postings, appearing in 41% of all job postings in May, up from 25% in January 2020. This is also maybe doubly unsurprising given that companies with at least 50 full-time employees are required to provide it. But mentions of dental and vision insurance are also rising, appearing in 37% and 34% of all job postings — despite the fact that employers are not legally required to offer these benefits. The data suggest these benefits may often be bundled together in order to attract the widest pool of candidates possible in a still-competitive market for talent. In fact, as of May 2024 30% of postings advertised all three of these benefits.

But while a majority (55%) of non-unionized, private-industry workers have access to employer-provided life insurance, overt mentions of life insurance appeared in just 18% of postings. Disability insurance follows a similar trend, appearing in just 13% of postings despite the fact that BLS data shows 41% of employees have access to short-term disability benefits and 35% to long-term. And according to the BLS, as of 2021 43% of private-sector employees had access to a flexible spending account (FSA) — a tax-advantaged account that can help cover certain medical and other costs — but only 8% of job postings advertised FSAs as a benefit in May. This disparity could be because job seekers assume FSAs are included as part of broader medical insurance coverage packages and/or because this benefit isn’t seen as an attractive enough selling point for employers to include it in their limited advertising space.

Of course, a job posting can mention more than one medical/insurance benefit. While the chart represents the share of postings that mention at least one benefit, it’s likely at least some postings will include more than one — hence why the individual shares in the table below will add up to more than the total 45% share of postings in which any single medical/insurance-related benefit may appear.

Advertised benefits by sector

For much of the past four-plus years, medical and insurance benefits were more commonly offered in postings for middle-wage jobs, with the share of postings among higher-wage jobs that offered these benefits lagging somewhat behind. But the gap between high- and middle-wage sectors that advertise medical and insurance benefits is closing. The share of high-wage sectors advertising these benefits rose from 26% in January 2020 to 46% in May 2024, compared to a rise from 30% to 45% over the same period for middle-wage jobs. The share of postings in low-wage roles advertising these benefits also grew over this period, from 26% to 44%, showing that the overall gap between wage tiers isn’t too significant.

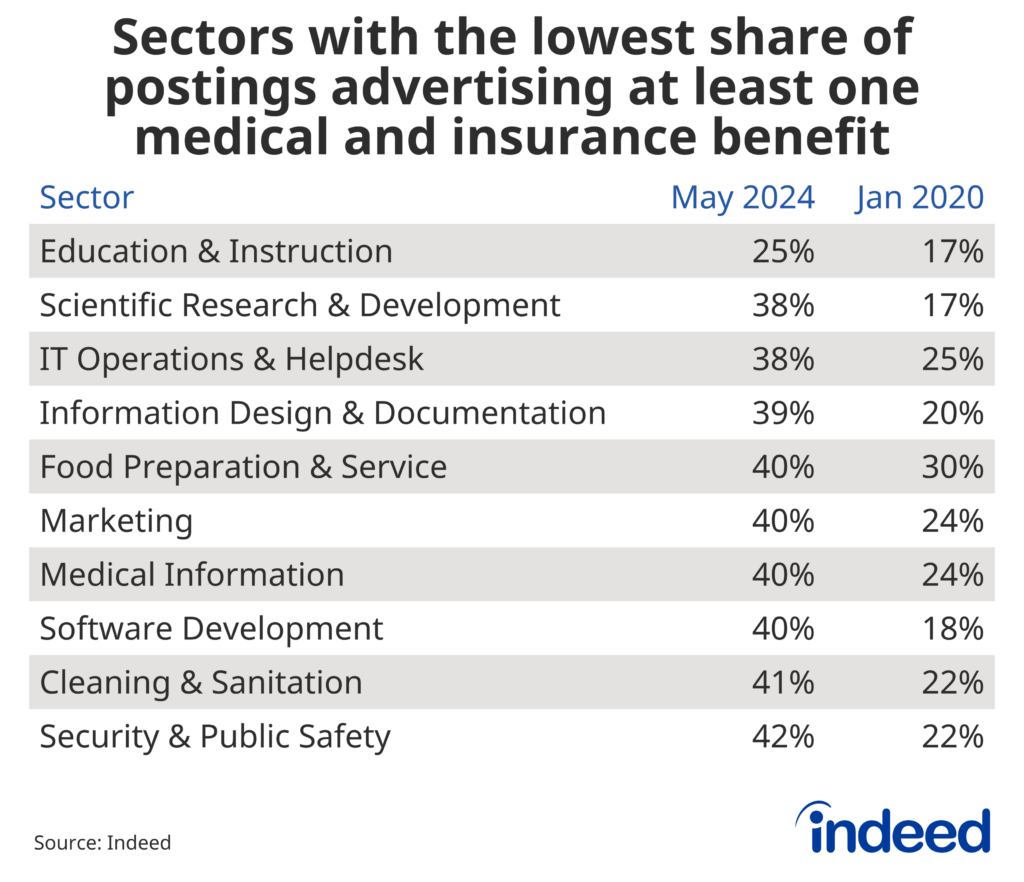

The majority of the sectors with the largest share of postings advertising a medical and insurance benefit are also sectors that tend to highly advertise the presence of other benefits, too. Importantly, the overall level of postings in all ten of the sectors that have the highest share of postings mentioning a medical/insurance benefit are also all well-above their pre-pandemic baselines, meaning employers might be prioritizing adding benefits to job postings in order to attract applicants.

The sectors with the lowest share of postings advertising medical/insurance benefits are sectors where benefits may be expected by job seekers, including traditional office jobs such as marketing, science, and tech. These sectors may also have a higher share of part-time postings, including Food Prep & Service, Cleaning & Sanitation, and Security & Public Safety.

Conclusion

Health insurance is the most widely advertised benefit, but is also a mandatory offering for most full-time employees, making it an expected benefit in many sectors. But in cases where health insurance is offered for part-time positions, advertising that alone could make a posting stand out in a crowd. And even if a position requires health insurance to be offered, including less-common but related perks like FSAs or prescription drug insurance could bolster any job posting. Still, among all job postings, advertisements for medical and insurance benefits have been rising well after federal requirements were in place, particularly following the pandemic. It could very well be that as labor market tightness forces employers to compete for employees, even advertising already-existing benefits can be useful in attracting talent and making a job posting more appealing.

Methodology

We track benefits by tallying US job postings on Indeed that mention at least one benefit in the job posting as of May 2024. Data is not adjusted for seasonality. Overall benefit calculation is limited to one benefit per job posting, while the share of postings by benefit type is limited to one job posting per benefit type. As such, aggregations by benefit type can exceed the share of overall postings for that benefit, as a job posting can include more than one benefit type.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of the performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.