Key Points:

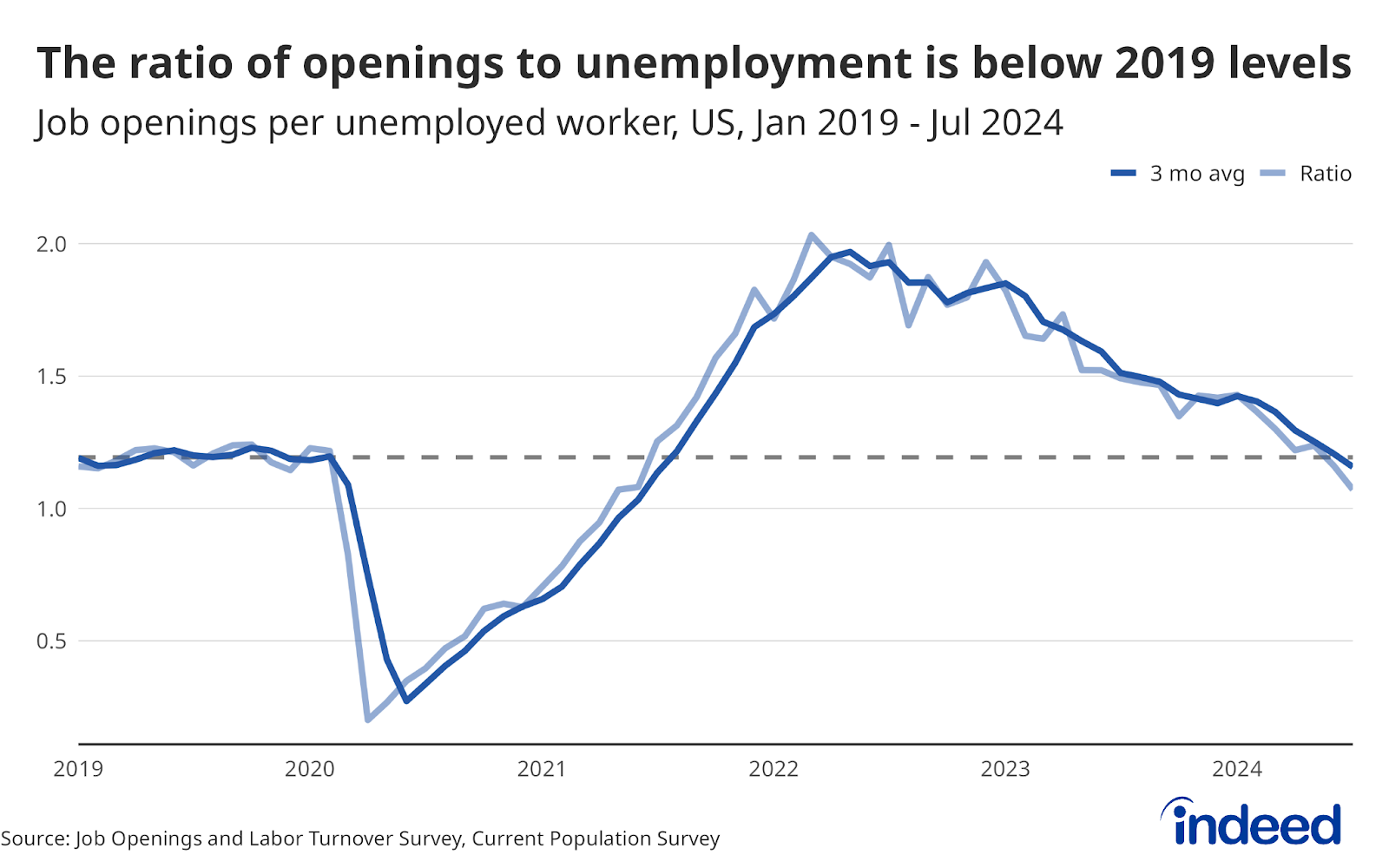

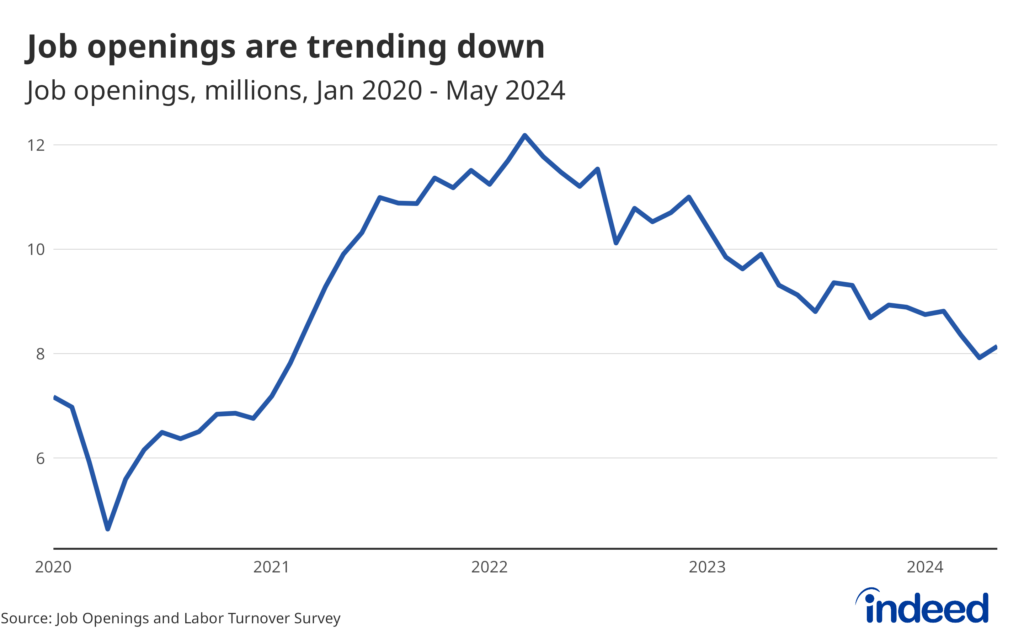

- Job openings fell in July to 7.7 million, with the ratio of job openings to unemployed workers falling below its 2019 average.

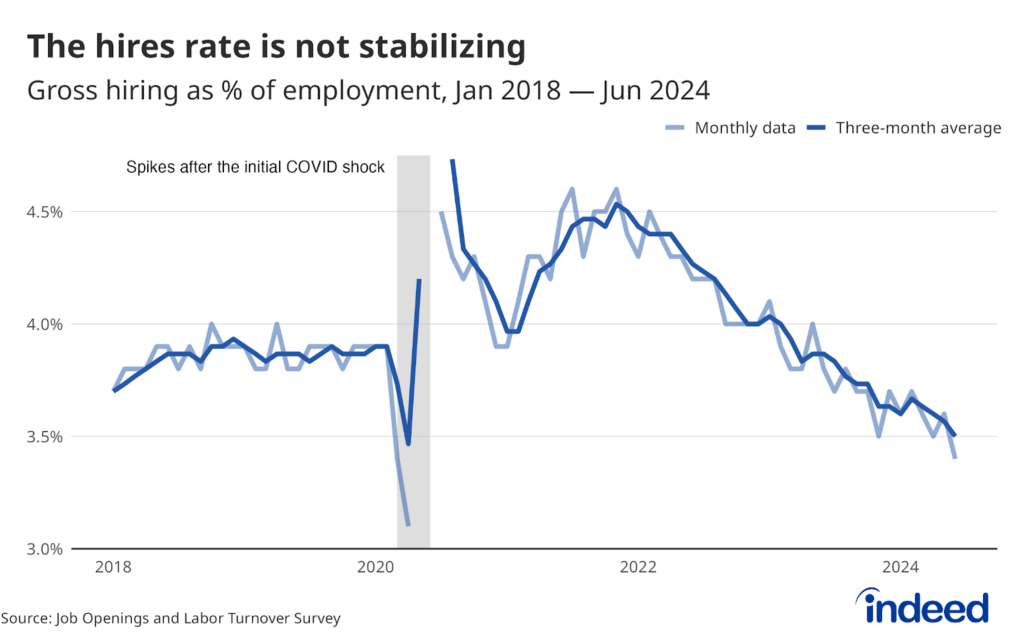

- Hiring and quitting ticked up in July, but those increases are likely bounce-backs from low readings in June. Both series are still trending downward.

- Fortunately, layoffs remain low. But unemployment is likely to keep drifting higher if hiring remains depressed.

The labor market is no longer cooling down to its pre-pandemic temperature… it’s dropped below it. At this point, nobody — and certainly not policymakers at the Federal Reserve — should want the labor market to get any cooler. The hires rate ticked back up after a weak June report, though it’s still drifting slowly downward. Fortunately, layoffs remain low by historic standards. Overall, this report represents the exact kind of unwelcome news from the labor market that Federal Reserve Chair Jerome Powell recently warned of. The labor market is past moderation and trending toward deterioration. The Federal Reserve has indicated that it has shifted some attention away from inflation and toward the health of the labor market, which is good, but it needs to take action soon.

Job openings not only fell more than expected in July but are now back at levels we haven’t seen since early 2021. Openings are still up 7% from their January 2020 levels, but the dip below the 8 million mark should be a cause for concern. And the ratio of job openings to unemployed workers is now below its 2019 average. We’ve hit the spot where cooling in the labor market can’t just come from fewer job openings, unemployment will likely continue to rise as well. However, the JOLTS data can be quite noisy, and the fact that almost 80% of the decline in openings came from Health Care and Social Assistance suggests July’s drop might be overstated.

Hires and quits both rose over the month, but those moves are mostly bounce-backs from particularly weak June readings. Over the longer-term, these measures have both been below pre-pandemic levels for some time, and are continuing to trend down. The July hires rate of 3.5% is similar to the level from more than a decade ago, when the labor market was still recovering from the Great Recession. The low level of layoffs may calm some concerns, but unemployment will possibly continue to drift upward if hiring remains so low.

With the Fed on the verge of cutting interest rates, the questions moving forward are by how much and how quickly. If we continue to get labor market data like today’s report, then the pace of cutting is likely to be quick. Hopefully, the labor market can level off and a more deliberate pace of cuts can be undertaken. However, the underlying trends in the data suggest that might not be the reality.