Key points:

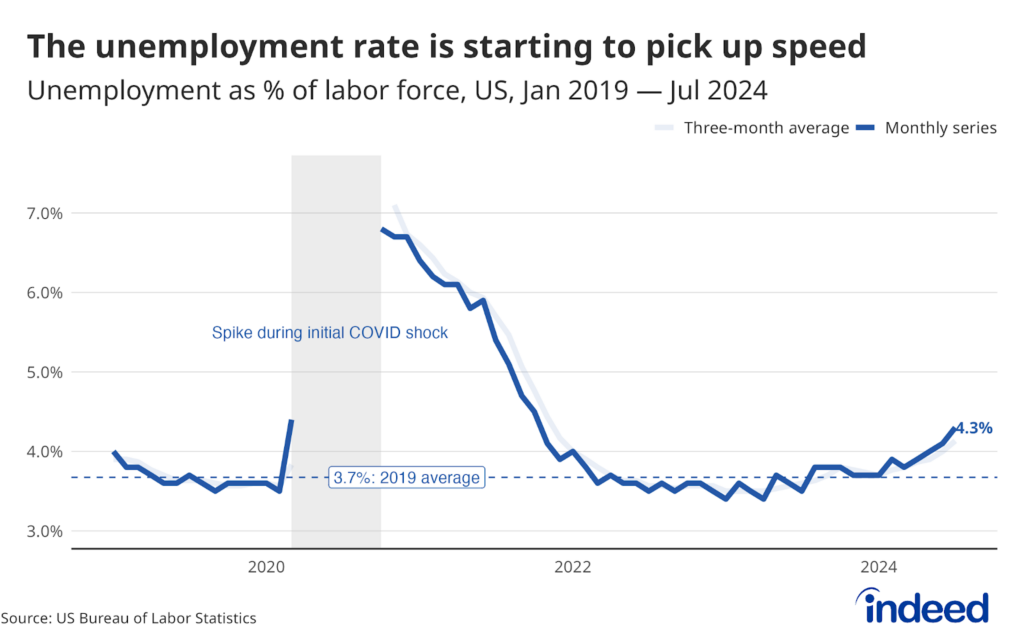

- The unemployment rate ticked down to 4.2%, as the dramatic rise in July reverted due to a drop in temporary layoffs.

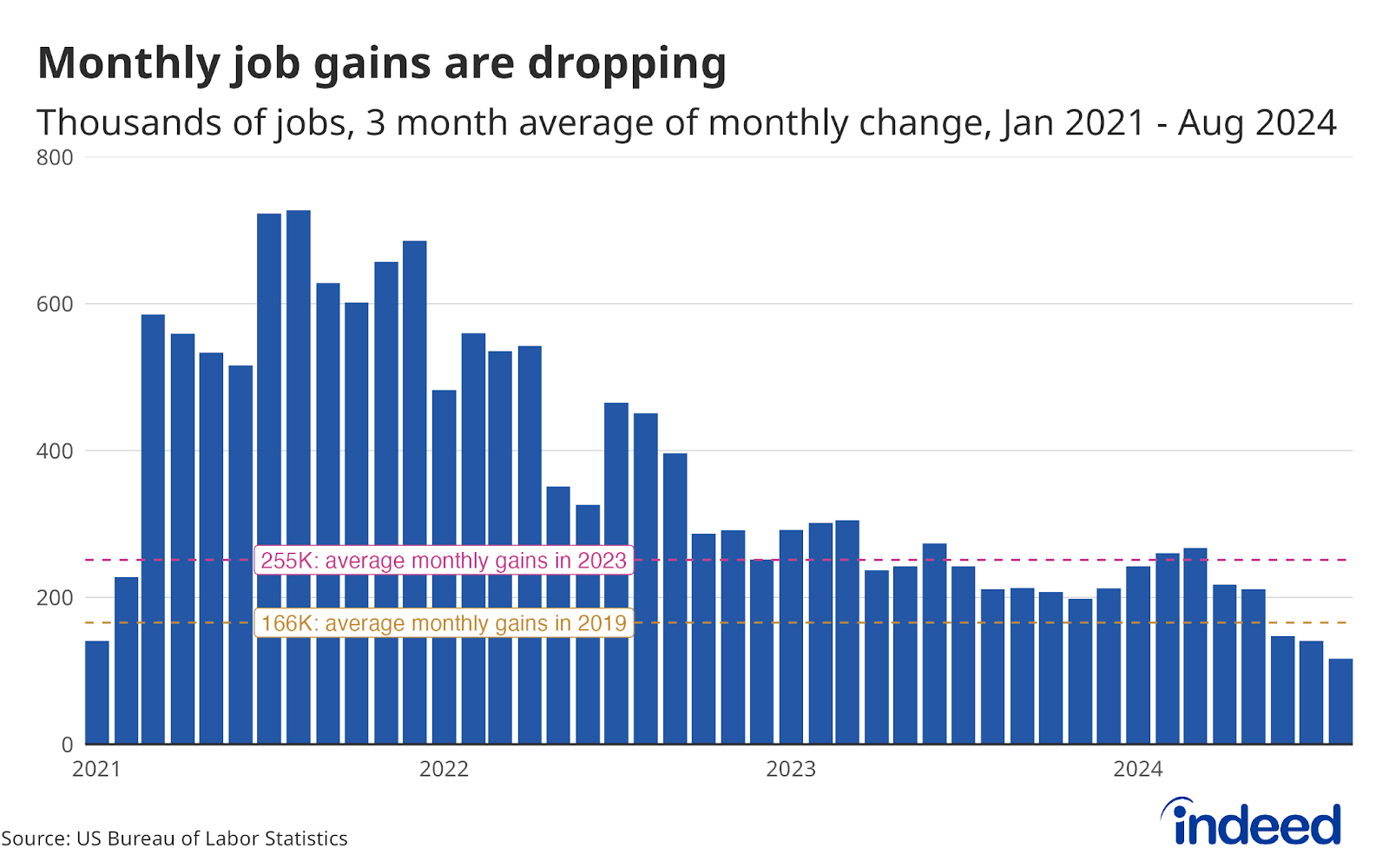

- Payroll jobs grew by 142,000 in August, but the three-month average dropped to 116,000 as June and July’s gains were revised down.

- The labor market isn’t deteriorating as quickly as last month’s report indicated, but it does continue to cool off. Hopefully, policymakers can step in and provide some relief.

The good news from the August jobs report is that the labor market isn’t weakening as quickly as July’s shaky report would have you believe. The bad news is that the labor market’s strength keeps fading. Large downward revisions to data from earlier in the summer put the three-month average of job gains at 116,000 per month, lower than the pace needed to simply tread water and below 2019’s average clip. The unemployment rate may have ticked down, but the market’s overall momentum suggests joblessness is more likely to keep rising than to fall. A lifeline from the Federal Reserve in the form of an interest rate cut is likely imminent, but there are questions if it’s coming too late or if it will be strong enough to pull the market back.

The unemployment ticked down to 4.2%, as temporary layoff unemployment dropped after spiking in July. A dip in unemployment is something to celebrate, but don’t get overly excited about this decline. The pullback from last month’s spike likely signals that the unemployment rate is back on its former trajectory — a slow, but steady increase. Rising unemployment continues to be driven by more people entering the labor force having a harder time quickly finding a job. That’s a good sign the labor market isn’t on the cusp of imminent collapse, but it does mean its strength is steadily eroding.

Payrolls continue to slow down. Over the past three months, job growth has slowed to an average of 116,000. That speed is not fast enough to keep up with current labor force growth and is below 2019’s average pace of 166,000 job gains. The trend has become more concerning after revisions to July and June’s data, bringing down growth in those two months by 86,000. Employers continue to add jobs, but the current pace is approaching stall speeds.

This labor market expansion is still salvageable, and its future depends in large part on policymakers’ actions. The Federal Reserve is set to cut interest rates later this month. What’s not clear is the scale and speed of the cutting. Help seems like it’s on the way, but we’ll have to see if it will be enough and if it will come in time.