Key Points

- The unemployment rate ticked down to 4.1%, a welcome contrast to the year-long increasing trend.

- Payroll jobs increased by 254,000 in September, while July and August were revised upward, bringing the three-month average gain to 186,000.

- Despite a healthy gain this month, the labor market’s ongoing rebalancing toward a soft landing remains fragile.

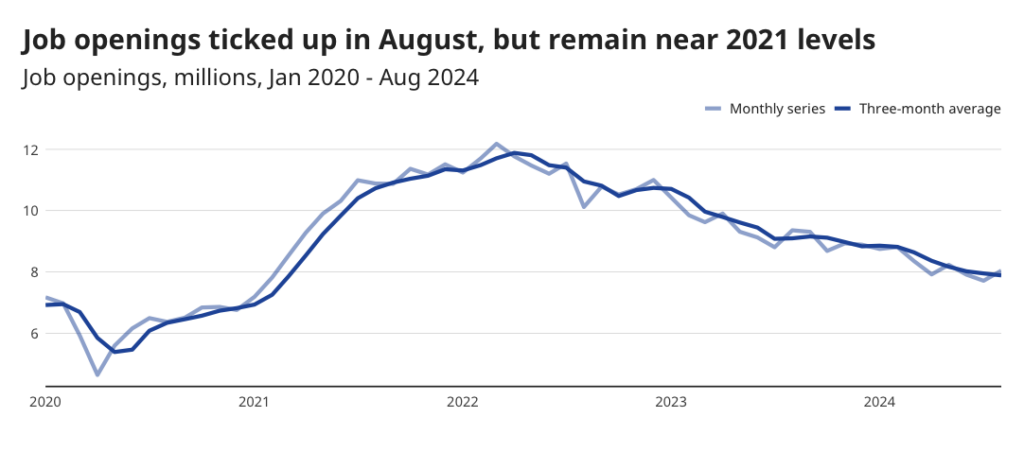

The September jobs report shows that even after a year-plus of slowing, the labor market remains in good shape, delivering broad job gains and meaningful wage increases while maintaining a sustainable balance between employer demand and worker supply. After substantial upward revisions to July and August data, payroll gains over the last three months now stand at 186,000 — well below the 251,000 pace of last year, but above the 166,000 clip recorded in 2019. The unemployment rate fell, which is always a welcome sign, though labor force participation moved sideways and fewer people took the risk of leaving their jobs. The labor market isn’t on the brink of collapse and still has the potential to deliver surprises, however, its ability to sustain momentum without further support from the Federal Reserve is not guaranteed.

Payroll jobs grew by 254,000 in September. Gains were revised upward by 72,000 jobs for July and August, alleviating some fears after an initially weak July report. Growth was primarily concentrated in healthcare and social assistance, and leisure and hospitality, which accounted for nearly 60% of the gains. The diffusion index, which measures the share of industries that added jobs, came in at 57.6 in September, indicating that more than half of the sectors added jobs in September.

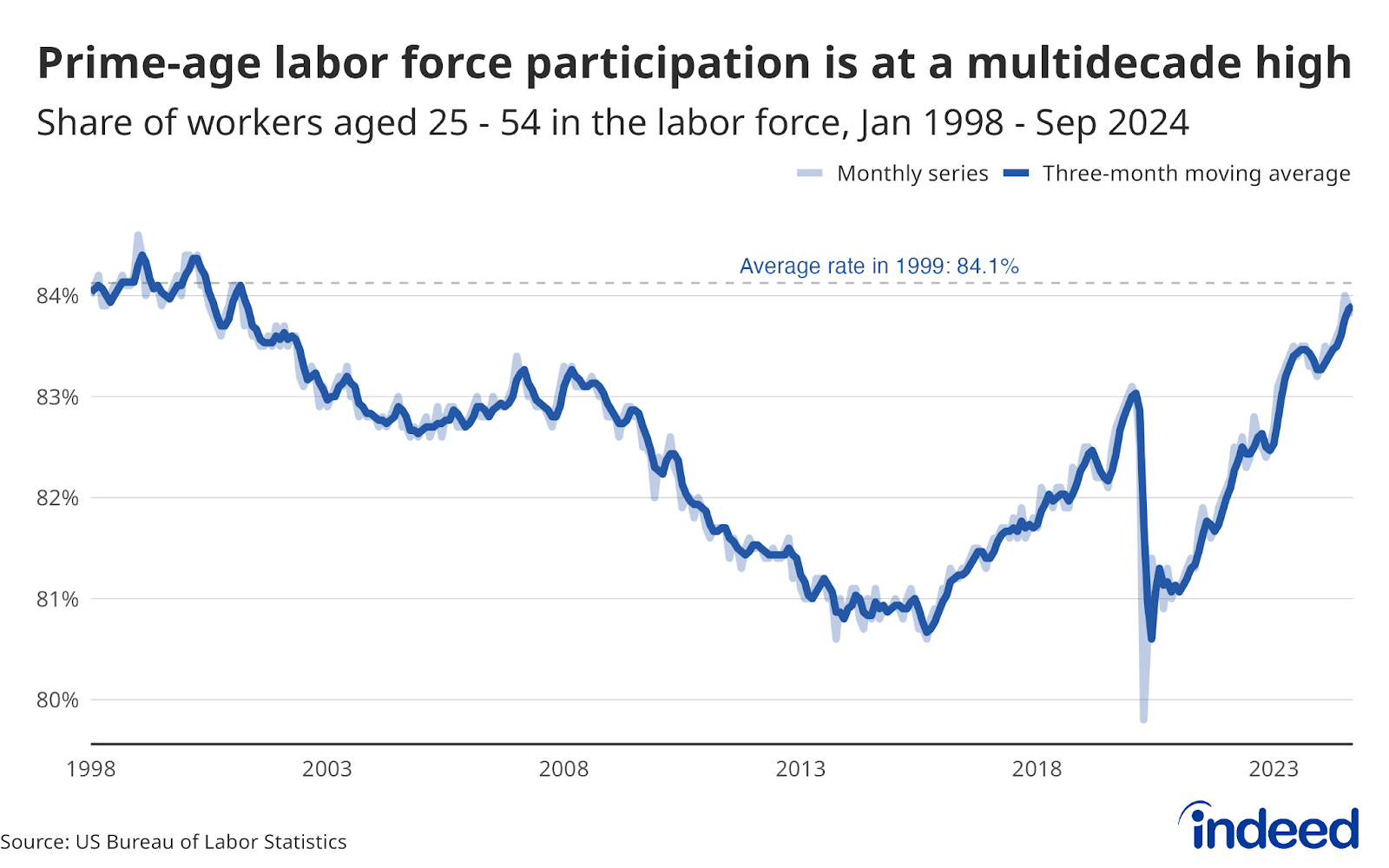

After a slight drop last month, the unemployment rate ticked down again, bucking a year-long trend of steadily increasing joblessness. The rate of people working or looking for work remains high, with prime-age labor force participation measuring 83.8% — a near multidecade high. So far, the labor market has been able to absorb this strong supply of workers, but any further cooling in job growth would be worrisome.

The stability reflected in this report may not extend into next month, highlighting the month-month volatility this data often presents. The full impacts of Hurricane Helene on job markets in the southeast will be reflected in future reports. And while a large-scale strike by port workers appears to have been (at least temporarily) halted, ongoing strikes and furloughs at Boeing, and/or any other unexpected surprises, may yet dent future labor reports. The labor market’s ongoing rebalancing toward a soft landing remains fragile. Policymakers at the Federal Reserve will likely see this report as both validation for the recent interest rate cuts that have already been announced and motivation for more potential cuts going forward, though maybe at a slower pace than expected.