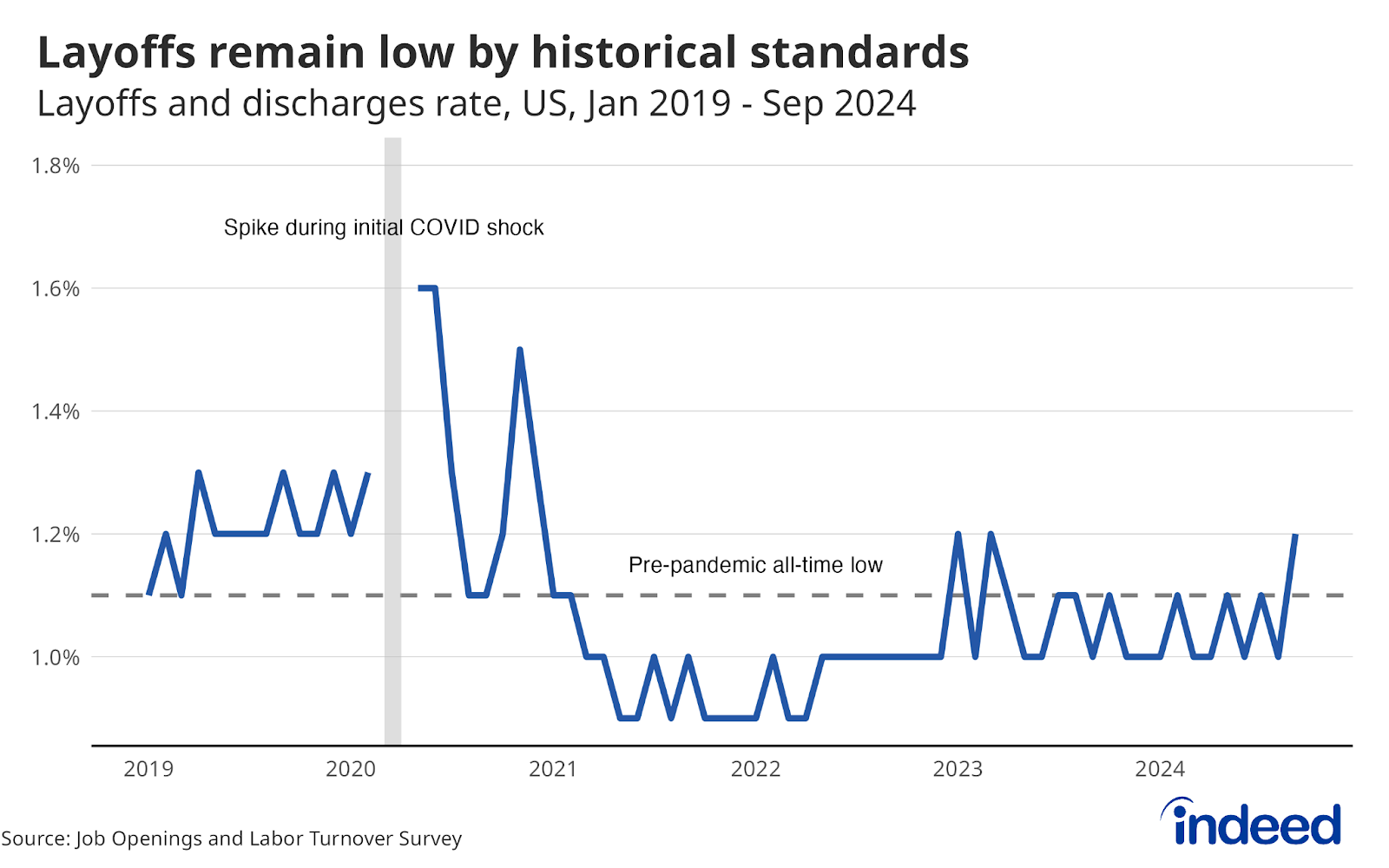

September’s JOLTS report gave mixed signals, painting a picture of a market that looks markedly weaker than previously thought, but one that also shows more signs of movement than it has for most of the year. The drop in job openings and the slight pickup in layoff activity (which remains low by historic standards) are concerning, especially after months of muted layoff activity. However, both are difficult to interpret alongside the uptick in the hires rate, which suggests a potential rise in employer confidence. Additionally, job openings data may have been impacted by Hurricane Helene.

Job openings fell much further than expected to 7.4 million, the lowest level since January 2021, and were down 5.3% from August, the sharpest decline since the spring. While the full effects of Hurricanes Helene and Milton won’t be known for months, some impacts are already appearing — job openings were measured on the last day of the month, and three-quarters of the drop in job openings in September came from states in the south. Prior months’ data was also heavily revised, with openings moving downward, layoffs moving up, and hiring improving. That mixed bag of data may represent more noise than signal, and warrants close monitoring in future months to gauge the impact of any subsequent revisions.

For those inclined to view the labor market glass as half full, the uptick in hiring brings the rate closer to pre-pandemic norms and suggests that hiring activity may be picking back up. But for those with a more pessimistic view, the report also offers plenty of stressors and represents a definitive turn down from the stabilization observed over the summer. Layoffs remain low, but the rise in September was a break from recent patterns and will be important to keep an eye on. Other economic indicators still broadly point to an economy and a labor market that remains on decent footing, but that footing may be slowly eroding beneath the market.