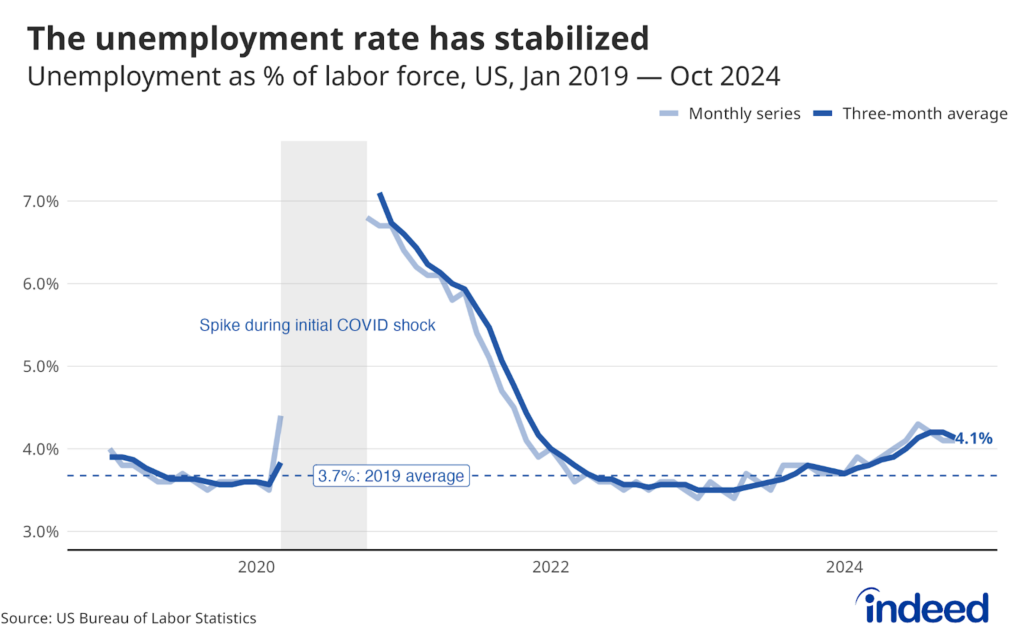

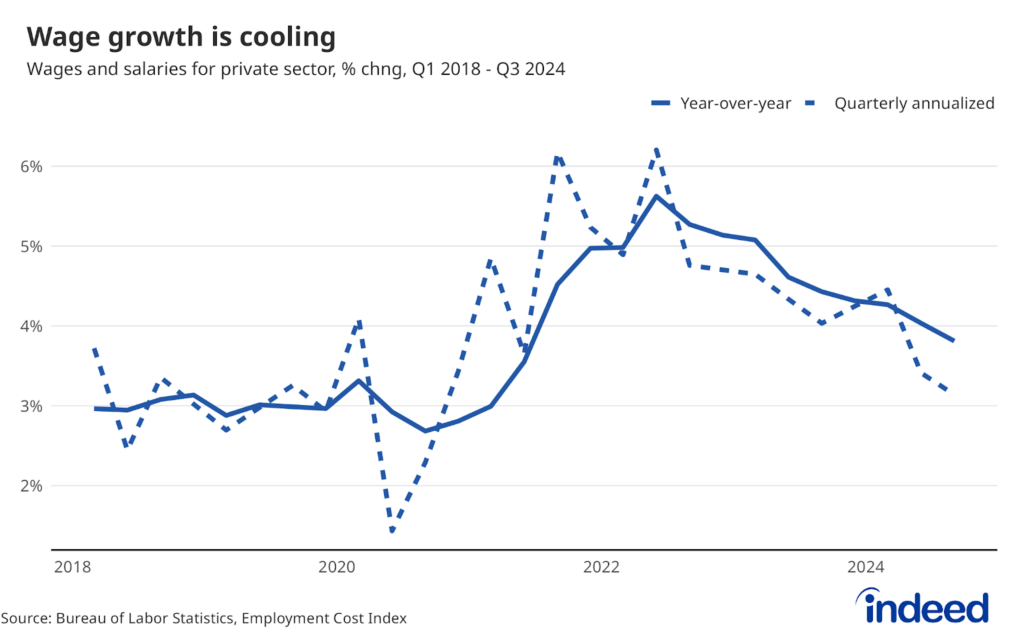

The Federal Reserve’s decision to cut the Federal Funds Rates by a quarter-point reflects a continued shift in focus toward labor market stability even as inflation remains top of mind and somewhat higher than desired. The labor market is generally in good shape, and — critically — “not a source of significant inflationary pressure,” according to Fed Chair Jerome Powell. But recent government data shows that job openings have continued to decline and are approaching concerning territory where further slides could translate into increasing unemployment. Unemployment is low and layoffs are subdued, but hiring remains sluggish overall. This cut is a step toward relieving pressure on businesses facing higher interest costs, which could, in turn, lead to more hiring if business leaders feel more confident in their finances. With inflation near, but not yet at, the Fed’s 2% target, this modest rate cut represents a careful approach that keeps an eye on both sides of the Fed’s dual mandate: price stability and full employment.

November 2024 FOMC Reaction: A Careful Approach

The Federal Open Markets Committee voted unanimously to lower the target range for the federal funds rate by 1/4 percentage point, to a range of 4.5% to 4.75% percent.

November 7, 2024