Editor’s Note: This article is part of a series examining how US federal workers are responding to ongoing efforts to shrink the size of the federal government. Find out more about where potentially impacted federal workers are located here, and read about government employees’ demographics and skills here.

Key Points:

- Applications from workers at federal agencies under DOGE review surged by 50% in February.

- Remote work is popular among federal workers actively looking at jobs, with 3.2% of job searches including the phrases “remote,” “work from home,” and/or “remote work from home.”

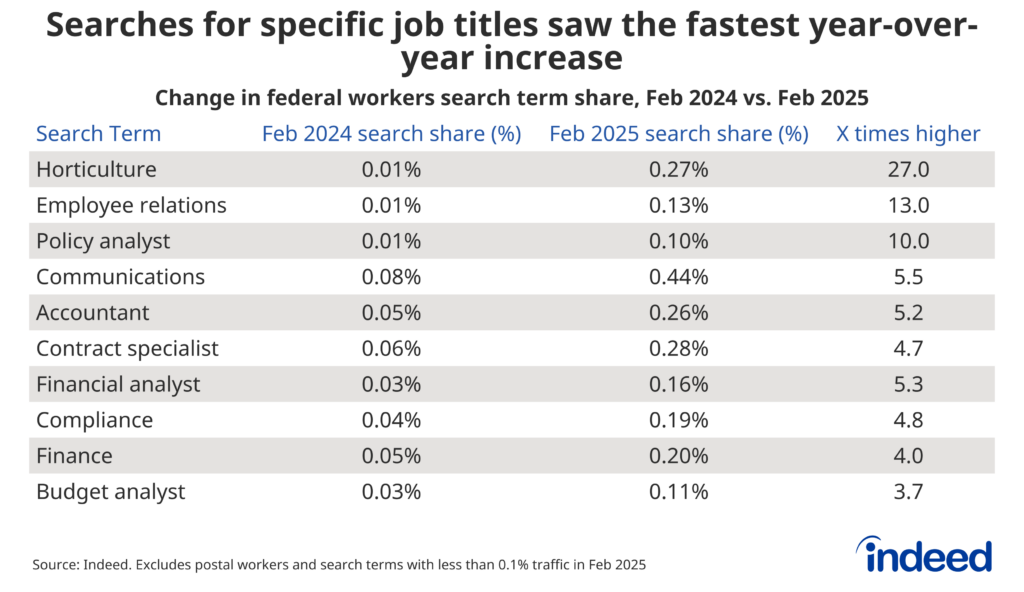

- The shares of searches for horticulture and employee relations roles are more than 10 times above where they were last year, likely coming from impacted workers in diversity, equity & inclusion (DEI) roles, and workers coming from the US Department of Agriculture (USDA) workers.

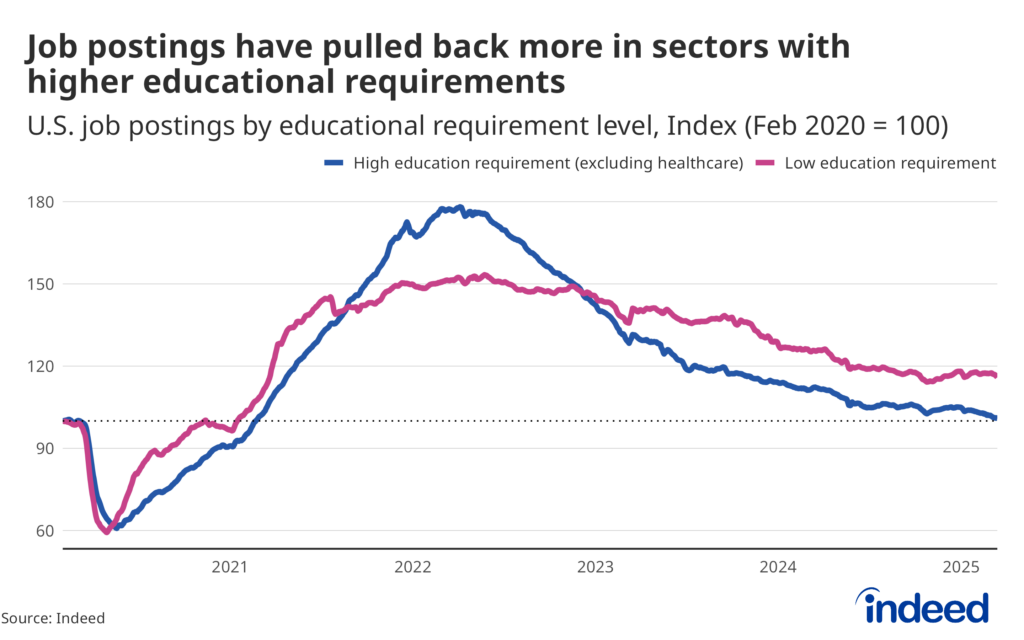

- Federal workers and contractors are highly educated and are looking for work at a time when there are likely fewer opportunities that match their education and experience.

Job applications from federal workers have surged since the start of the year, especially from workers in those agencies first to come under review by the Department of Government Efficiency (DOGE) as part of a broader Trump Administration effort to shrink the size of the federal government. The surge in applications from this generally well-educated and highly specialized segment of the workforce comes as growth in job openings remains muted overall, particularly for the kinds of knowledge worker roles likely to be sought by displaced federal workers.

The precise number of displaced and/or soon-to-be-displaced federal workers remains unknown as plans shift and regulatory and legal challenges to some changes continue to unfold. But early signals offer some clue as to the size of the potential influx of new workers into a so-far largely stable, but also gradually weakening, national job market. The February jobs report showed a decline of 10,000 federal government jobs last month, with larger numbers expected in the March report. Additionally, an analysis of Indeed’s job seeker profile and website data shows a surge in job search activity and applications well above recent norms coming from workers in agencies considered for cuts.

Early spike in federal worker applications is very likely DOGE-driven

Over the past few years, the job search behavior of federal workers (excluding workers at the US postal service) has roughly followed the up-and-down trends of the broader labor market. The number of federal workers starting an application on Indeed peaked in mid-2022 before declining consistently and then stabilizing near the end of 2024 — a similar pattern to overall US job postings on Indeed, which peaked in 2022, subsequently declined, and have since largely stabilized.

That stability in federal worker applications appears to have abruptly ended once the calendar turned to January and the new administration took office and began making rapid changes to the status quo. But despite a noticeable spike in applications this year from federal workers overall, total applications from that group remain roughly 12% below where they were in 2022 at the height of the market. The spike is far more pronounced, however, amongst those workers specifically at federal agencies first to come under review by DOGE. While application trends for workers from these agencies — including the US Agency for International Development (USAID), the Consumer Financial Protection Bureau (CFPB), the US Department of Agriculture (USDA), and the Federal Aviation Administration (FAA), among others — are similar to the overall pattern, the rise in job search and application activities for these workers has been much steeper since the inauguration. Applications coming from workers at these agencies spiked by more than 50% in a single month, ending February at 75% above their 2022 levels. While it is fairly common to see a slight uptick in this activity amongst federal workers after most presidential inaugurations, the recent surge in job search activity is unprecedented. Corresponding rises of this magnitude did not occur after the 2016 or 2020 presidential elections.

Federal workers are seeking specialized work they can do from home

For many job seekers, their pathway to starting a job application often begins at the Indeed search bar. The range of phrases that a job seeker enters can vary widely, but there are common patterns that often emerge. Flexible work arrangements were highly sought after among those job seekers employed by the federal government for at least part of February, with terms including “remote,” “remote work from home,” and “work from home” accounting for a combined 3.2% of queries. Searches for “part-time” and “hiring immediately” were also common, each representing 1.5% of total searches. These patterns suggest that job seekers with federal government experience are seeking flexible and work-from-home opportunities.

It might be tempting to attribute job seekers’ desire for remote work to the Trump administration’s push to get workers back in the office. But searches from federal workers for those terms were more popular a year ago, accounting for about 3.9% of such searches in February 2024. Similarly, many of the other popular terms this year were also present in the most frequently used searches last year as well, suggesting that their enduring popularity is likely not (yet) attributable to any specific change in policy. However, there has been a notable uptick over the past year in federal workers searching for specific job titles on Indeed. Searches for “horticulture” grew the fastest, and were 27 times higher in February 2025 than in February 2024. Searches for other specialized job titles common to federal employment, including “policy analyst” and “contract specialist,” also grew markedly compared to last year.

The range of jobs highlighted on the list of fastest-growing searches points to the diverse and specialized nature of federal work. It also hints at what roles are already being impacted by DOGE’s cost-cutting efforts. ”Horticulture” at the top of the list is likely a reflection of displaced USDA workers seeking specialized roles. Searches for “employee relations” may represent a segment of the federal workforce whose jobs were or are focused on the kind of diversity, equity & inclusion programs the Administration has sought to eliminate. Beyond those specific examples, the list also includes many specialized policy, contract, and/or compliance roles common to federal employment.

How will an influx of displaced federal workers impact the labor market?

The labor market has gradually cooled across the board in recent years, but employer demand for knowledge workers (measured as those jobs that require higher educational attainment) has fallen much quicker. At the end of February, job postings on Indeed in those occupational sectors with historically high formal education requirements were 2% above pre-pandemic levels, compared to 17% above in sectors that typically ask for less education. Indeed profile data shows that almost 70% of federal workers active on Indeed in February had at least a bachelor’s degree. In other words, federal workers are highly educated and are looking for work at a time when there are likely fewer opportunities that match their education and experience.

In addition to fewer opportunities, federal workers are also facing a labor market with muted hiring activity. The hires rate, a ratio of how many people were hired as a percent of employment each month, currently sits at 3.4% and has hovered at or near decade lows since May 2024. The combination of all these factors points to potential job search challenges and friction for these specialized workers.

An opportunity or a challenge?

While this analysis focused on workers directly employed by the federal government, cost-cutting efforts have also turned to federal contractors. Research suggests there are twice as many federal contractors as people employed directly by the government. Many of those contractors perform similar tasks to their government employee peers, which suggests that they are also likely to be highly educated, and may soon be joining an increasingly crowded pool of displaced federal workers looking for their next opportunity. Absorbing displaced federal workers and contractors may prove to be a challenge for a job market that is frozen by uncertainty, especially in knowledge-work sectors where employer demand remains low.

A dynamic, growing economy — especially one facing a looming shortage of skilled workers in various fields ranging from healthcare to engineering — will likely be able to absorb those workers in due time with limited disruption. Employers with longstanding and/or difficult-to-fill vacancies, not to mention understaffed state and/or local government agencies that may perform similar functions as their federal counterparts, may yet welcome this influx of candidates. Ultimately, the overall job market’s ability to absorb cuts will depend largely on the types of jobs workers are looking for and a rebound in employer hiring and confidence.

Methodology

On data privacy: To protect workers’ personal information, all datasets are stripped of identifying information, including names and addresses. Results are only reported in an aggregated format. Analysis and data review are also performed to ensure that data points cannot be tied back to individuals.

For this analysis, we utilized Indeed’s pool of hundreds of millions of job seeker profiles to identify active job seekers who listed the federal government as their current or (newly) former employer. We then grouped them by their highest listed education level, skills, job titles, and current/former department or agency. United States Postal Service workers were excluded to allow for comparisons with Office of Personnel Management and Bureau of Labor Statistics data.

Application data is based on the number of workers who started an application on Indeed, regardless of whether they saw the process through. Search data is based on phrases used by job seekers with an Indeed profile only. Time series data are seasonally adjusted to provide a clearer look at the trends. US searches on Indeed included queries on both the desktop and mobile versions of Indeed.

Data on seasonally adjusted Indeed job postings are an index of the number of job postings on a given day, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. Data for several dates in 2021 and 2022 are missing and were interpolated.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.