September marks the tenth anniversary of the Lehman Brothers bankruptcy, a key moment in the greatest financial crisis of our times. Unsurprisingly, the financial crisis affected employment in the financial industry, defined here as the finance and insurance subindustry. The financial industry only recovered to its 2007 employment level at the end of 2016 and, as a share of employment, is still not back to its 2007 level.

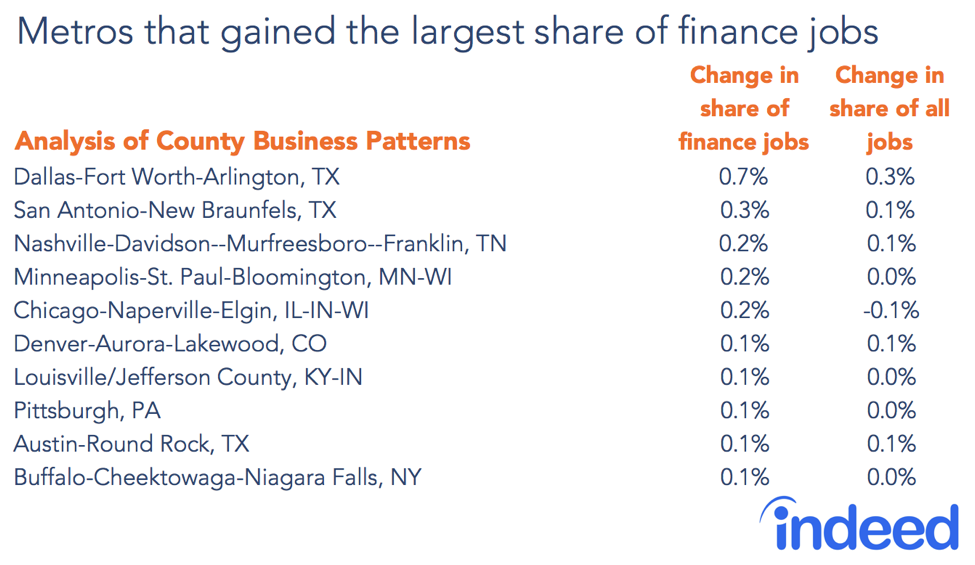

Crises often lead industries to change work patterns and where they locate jobs. Census data show how industry employment has evolved over the past ten years. It has largely remained the same. The cities that had the most finance jobs in 2007 remain dominant. But, around the edges, some changes have taken place. Metros on the coasts have lost finance jobs, while metros in the middle of the country have gained.

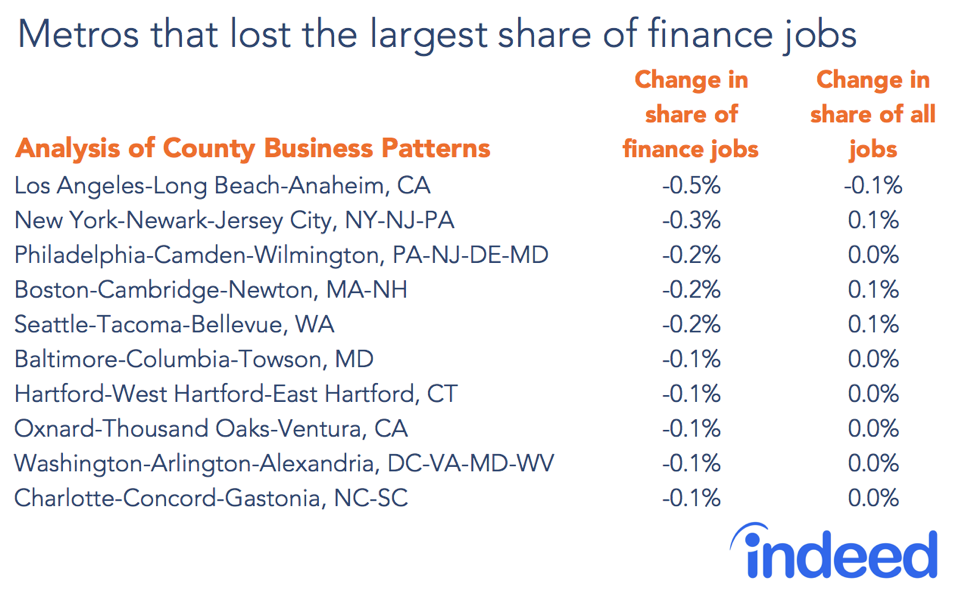

New York is still far and away the biggest hub for finance, with 10% of finance jobs nationally located in the metro area. But New York has lost some of its dominance over the past decade. While its prominence is unlikely to be challenged anytime soon, other localities are luring finance jobs to new places.

Metros that gained the largest share of finance jobs tend to be cities in the middle of the country. Generally, these metros gained more finance jobs than they did jobs overall during this period. Chicago and Austin are interesting standouts. Chicago, while losing jobs overall, gained positions in finance. Austin, while a top gainer of finance jobs, got a similar percentage to its change in overall share of jobs, suggesting that this gain is really about its growth as an employment center.

Many of the metros that lost the largest share of financial jobs are coastal cities. They are also cities conventionally thought of as hubs for finance or, more broadly, white-collar jobs: New York, Boston, Charlotte. For none of these metros is the loss in share of finance jobs about losing jobs overall. For instance, the New York metro area actually has more of the overall share of jobs than it did in 2007. Los Angeles in particular had a big hit to finance jobs, causing it to cede its second place financial hub ranking to Chicago.

The housing crisis continues to affect the finance industry

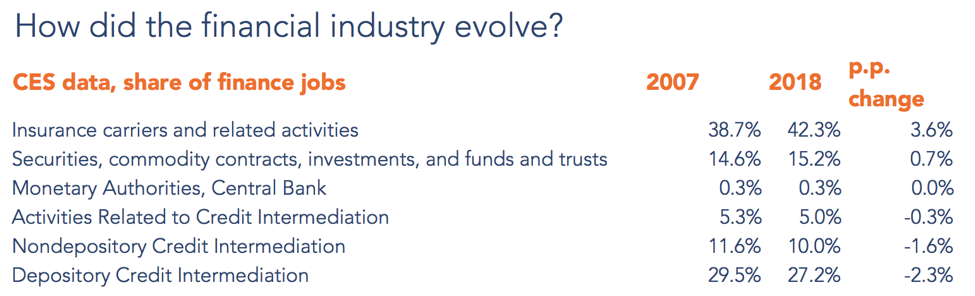

Looking at the industrial breakdown, insurance carriers and related activities have become more important to the financial industry, while credit intermediation types of activities — which often involve mortgages — have become less important. The fact that financial industry jobs that can be more involved in mortgages represent a smaller share of the financial industry today, and in fact are still below their 2007 employment level, shows how the overhang of the housing crisis continues to affect sectors of the economy. But, overall, these changes haven’t greatly changed the composition of finance industry jobs. Insurance jobs are still the biggest sector, followed by depository credit intermediation.

Financial industry has changed around the edges

Overall, the financial industry in many ways looks similar to 2007 — New York is still the biggest finance hub and insurance carriers are the biggest subindustry. But, on the edges, we’ve seen changes. Metros like Dallas are gaining ground in the finance industry, while New York is losing ground. Insurance carriers are becoming even more important, while credit intermediation is becoming less important. As the finance industry leaves the financial crisis behind, it will be interesting to see whether it moves further towards the middle of the country and insurance activities, and away from the coasts and credit intermediation.

Methodology

Analysis was performed using the County Business Patterns on NAICS 52. For the city shifts, analysis was also done removing the insurance industry and central banking and just on NAICS 522, 523 and 525. It did not change the results. City rankings for change of national share done by NAICS 52 were correlated 99% with city rankings for change of national share done by NAICS 522, 523, and 525. Because County Business Patterns data only go to 2016, that was the latest year used.