Key points

- Job openings declined to 8.5 million at the end of March as the demand for workers continued to cool.

- Hiring slowed down slightly, but the simultaneous reduction in quitting suggests a relatively benign reduction in churn.

- The cooldown in the US labor market over the past two years has been exceptional, with job openings falling dramatically but unemployment barely rising.

March’s JOLTS data was relatively benign and a continuation of ongoing trends. Openings continued to fall gradually and hiring declined, but so did quits — likely a reflection of reduced churn rather than a more worrisome dropoff in hiring. And layoffs remain low. This continued moderation is largely positive for the market and the economy overall, and is mostly sustainable for the time being. But now, some two years after the peak in job openings and the sustained slowdown that followed, the next phase of the cooldown is coming into sharper focus — and how it unfolds will depend a lot on how demand for workers evolves over the next few months.

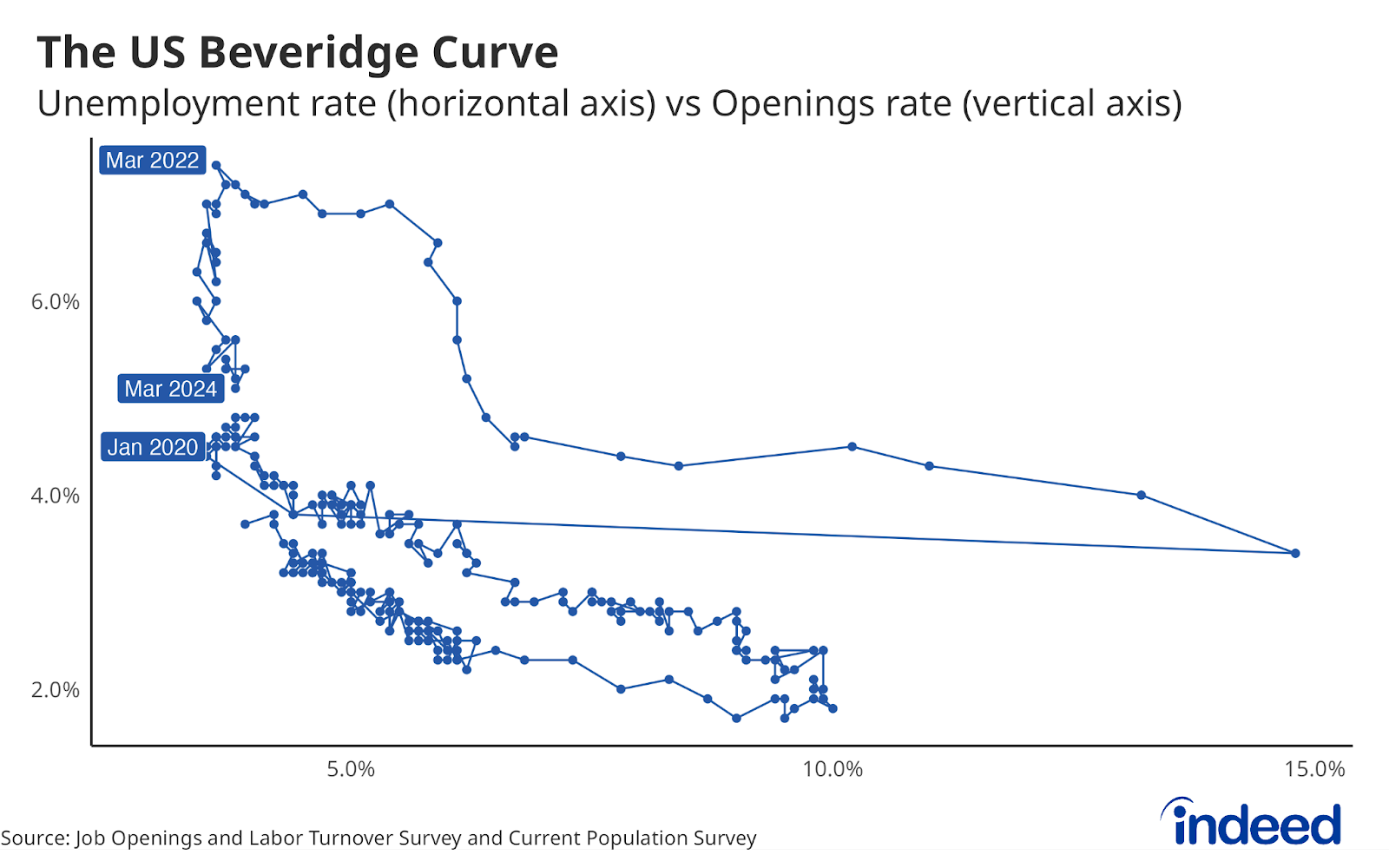

March 2024 marks the second anniversary of the peak in job openings. Over the past two years, openings have fallen by 30% and the openings rate has dropped by 2.3 percentage points. The unemployment rate, on the other hand, has only risen 0.2 percentage points. It’s rare to be on the steep part of the Beveridge Curve — the relationship between job openings and unemployment — for this long. In 2022, many people expected a reduction in openings this large would have boosted unemployment much more. In post-war US economic history, such a sharp decline in openings without a corresponding spike in unemployment is unprecedented, singular, and exceptional.

But it’s not clear how much longer this miraculous trend can continue. If job openings continue to decline for much longer, the hiring of unemployed workers will eventually retreat enough to drive unemployment up. For hiring to remain robust enough to keep the labor market strong, the gradual decline in openings will have to level off at some point. As the Federal Reserve contemplates how long to keep interest rates elevated, they need to weigh how long the demand for workers can decline before joblessness rises.