Key Points:

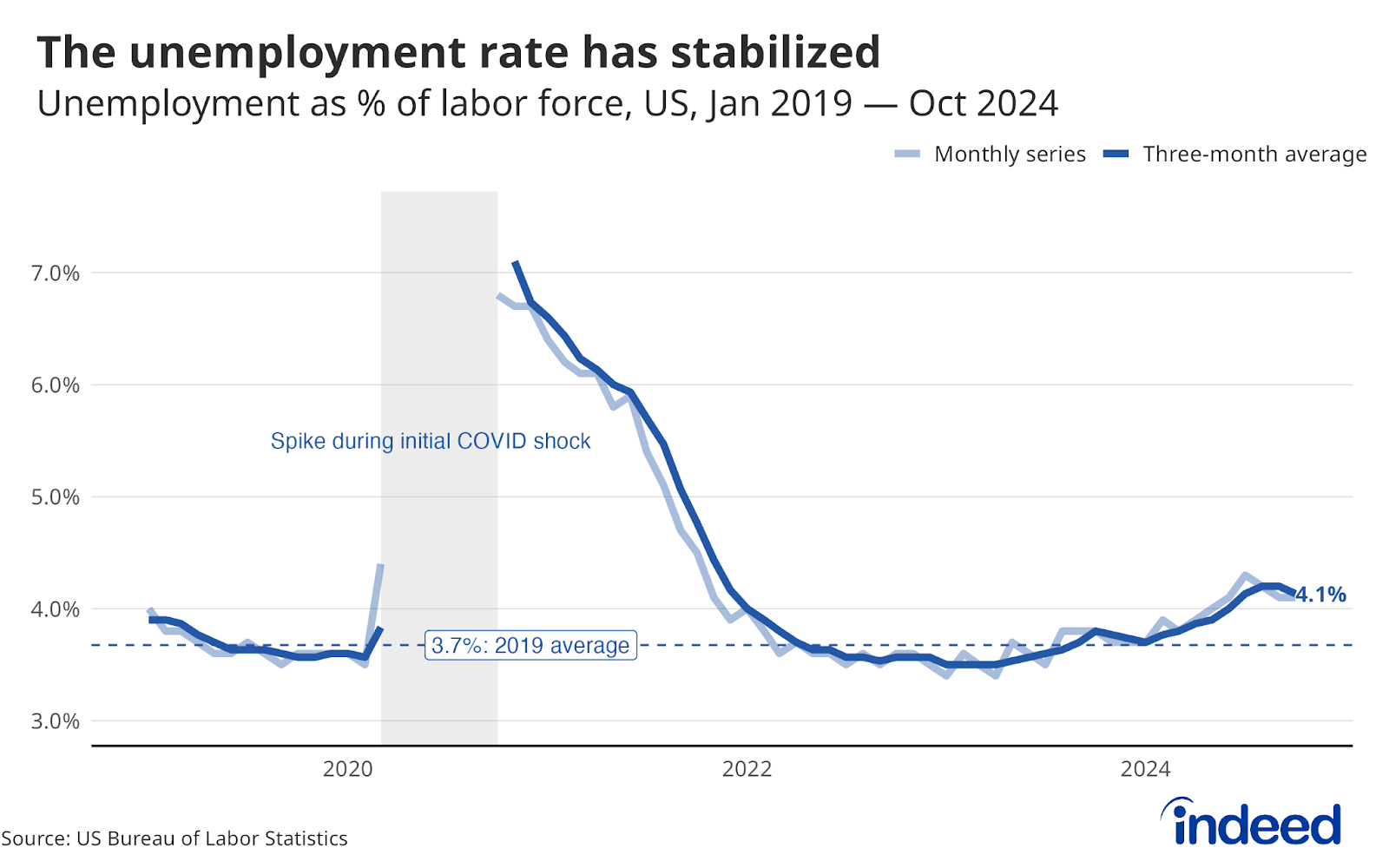

- The unemployment rate remained unchanged at 4.1% in October.

- Payroll jobs increased by only 12,000, though hurricane disruptions and ongoing strikes largely impacted that headline number.

- Other economic data still indicate that the labor market is relatively solid, but we are at a point where we don’t want to see many more reports like this.

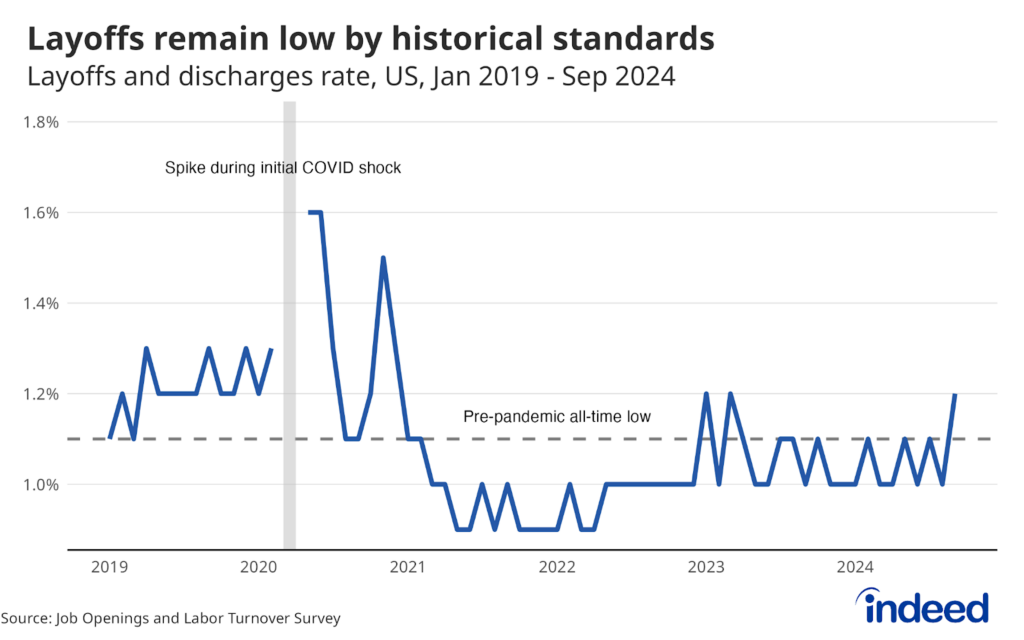

At first glance, October’s jobs report paints a picture of growing fragility in the US labor market. But under the surface is a muddy report roiled by climate and labor disruptions. In addition to the potentially tens of thousands of jobs impacted by Hurricanes Helene and Milton, strike activity impacted another estimated 44,000 jobs in October. While the impacts of these events are real and should not be ignored, they are likely temporary and not a signal of a collapsing job market. Other economic data shows that the labor market remains relatively solid despite steady cooling in recent years.

Payroll jobs grew by 12,000 in October, while previous months were revised down by a collective 112,000 jobs. Due to previous months’ revisions and weather impacts, the three-month moving average of job gains now stands at 104,000. The healthcare, social assistance, and government sectors continued to record strong job gains despite hurricane disruptions, generating more than 90,000 jobs combined.

After a slight drop last month, the unemployment rate stayed at 4.1% in October and has been stable for a few months after gradually climbing in the first half of the year. The share of workers between the ages of 25 and 54 with a job, also called the prime-age employment-to-population (EPOP) ratio, fell slightly in October but remains above pre-pandemic levels. Stable unemployment paired with still-elevated EPOP suggests that the labor supply remains healthy and that the labor market is still drawing people in.

Despite the weak headline number, today’s report shouldn’t raise alarm bells for job seekers, workers, or policymakers — especially if the hurricane and strike impacts prove temporary. If future reports are similarly weak, with limited job gains and persistent downward revisions to prior data, there will be a real cause for concern. But for now, a soft landing is still on the table, though it will require stronger job gains and steady unemployment in the coming months. For policymakers, this report is not likely to shift plans too much, but we can probably expect to see more interest rate cuts and support for the labor market on the horizon.