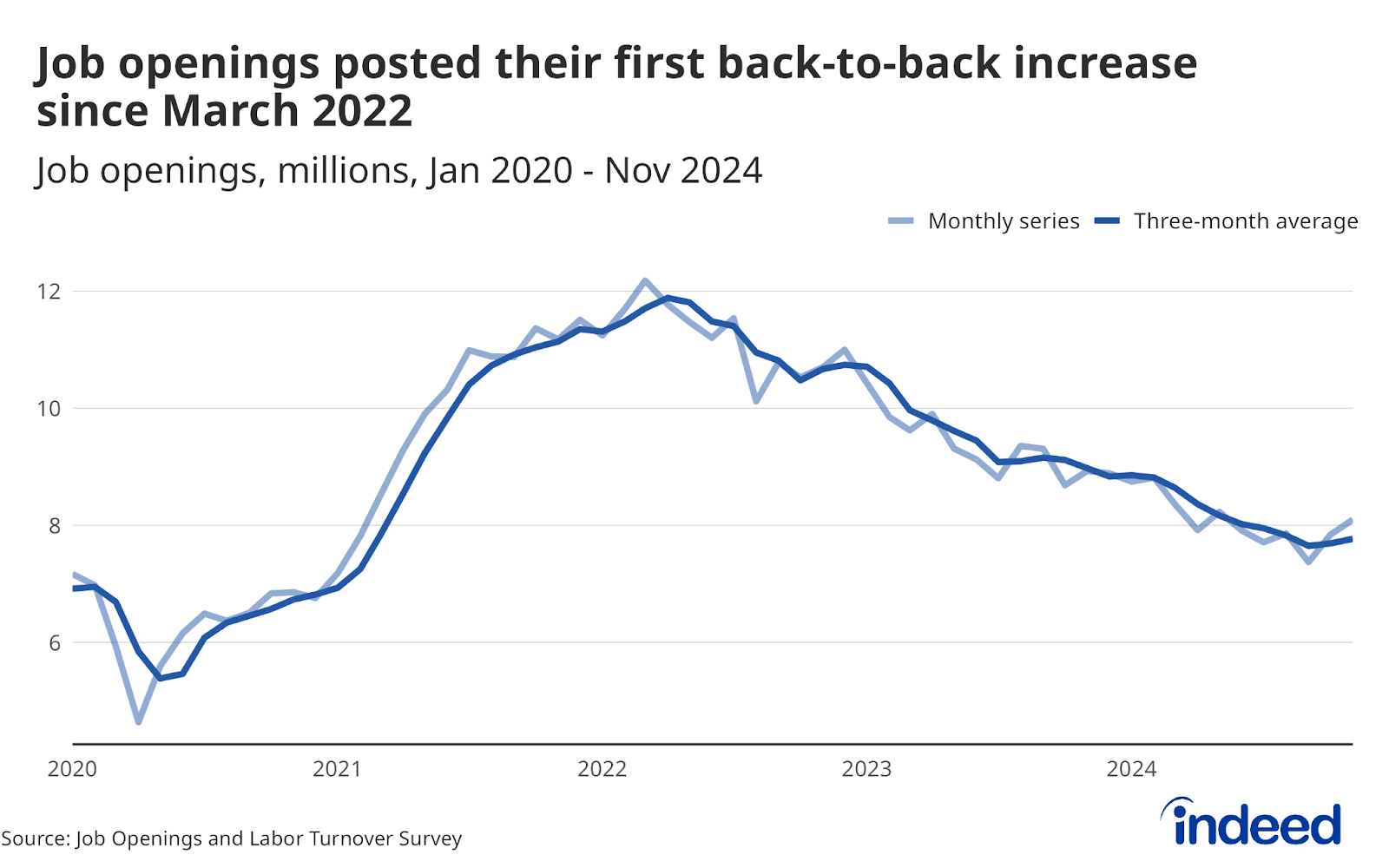

November’s JOLTS report shows all the signs of labor market stability we’d expect and want to see as the market comes in for a soft landing. Job openings have risen for two straight months, the first such streak since March 2022, and are now back above the 8 million threshold for the first time since May 2024. Hires and quits remain below pre-pandemic levels but show signs of stabilization, suggesting growing confidence amongst both employers and job seekers. Hundreds of thousands of new job openings were added in a handful of traditionally white-collar sectors, including professional & business services and finance & insurance. This bodes well for a broad-based stabilization in the market that is not just limited to the handful of sectors — notably government and healthcare — that drove the bulk of hiring in 2024.

Job openings rose to 8.1 million in November from an upwardly revised 7.8 million at the end of October — about 16% above their pre-pandemic level. While two months of data aren’t necessarily enough to signify a reversal in the deteriorating trends that marked much of 2024, the back-to-back increases in vacancies represent a promising step in the right direction. Looking ahead, more recent data from the Indeed Job Posting Index has shown continued stabilization through December, which points to a potential firming in employer demand.

A gradual rise in unemployment in 2024, paired with a pullback in employer demand, means that the ratio of openings to unemployed workers has fallen to 1.1 — below the 1.2 seen in February 2020. After several years of cooling, the return to the pre-pandemic ratio reflects a successful return to a largely sustainable balance between supply and demand. Last month’s spike in the quits rate looks a lot like a head fake after today’s report, as the rate dropped back to 1.9% — in line with 2015 levels (after excluding pandemic-impacted 2020 data).

Today’s report keeps the hopes of a soft landing alive but also raises concerns. Two major lynchpins of successfully getting the wheels on the ground, layoffs and the unemployment rate, remain encouragingly low. But hires and quits still remain near decade lows, which is concerning. The sideways movement in these two measures over the past few months is exactly what we would want to see before a potential turnaround. Updated projections from policymakers at the Federal Reserve suggest that recent stubborn inflation prints have delayed expectations for a soft landing, and the market won’t be entirely clear of potential turbulence until inflation is more firmly under control. However, ongoing stabilization in job openings and other key indicators is an encouraging sign that the labor market has enough gas left in the tank to stick the landing.