At the end of November, Opec announced a deal between oil producing nations to help curb global oil production. While this is welcome news that could help support an industry which has been struggling since oil prices collapsed in mid-2014, some skepticism remains about the viability of the agreement.

Although where oil prices will be next week or next month is—as always—up for speculation, it appears that for now they hit bottom in early 2016. Since then they have recorded modest gains and, perhaps most importantly, have remained stable in recent months.

Earlier this year we reported how the oil price drop impacted the US labor market and also how job seekers responded to such an unexpected change. In light of this improvement we decided to look for a corresponding reaction from oil producers, in the form of increased oil-related job postings on Indeed, and also for any sign of increased interest in these jobs from our job seekers.

What follows is an analysis of oil-related job postings and searches, both for the US overall and the five states in which the oil industry carries the largest impact on the local labor market.

Oil Job Postings

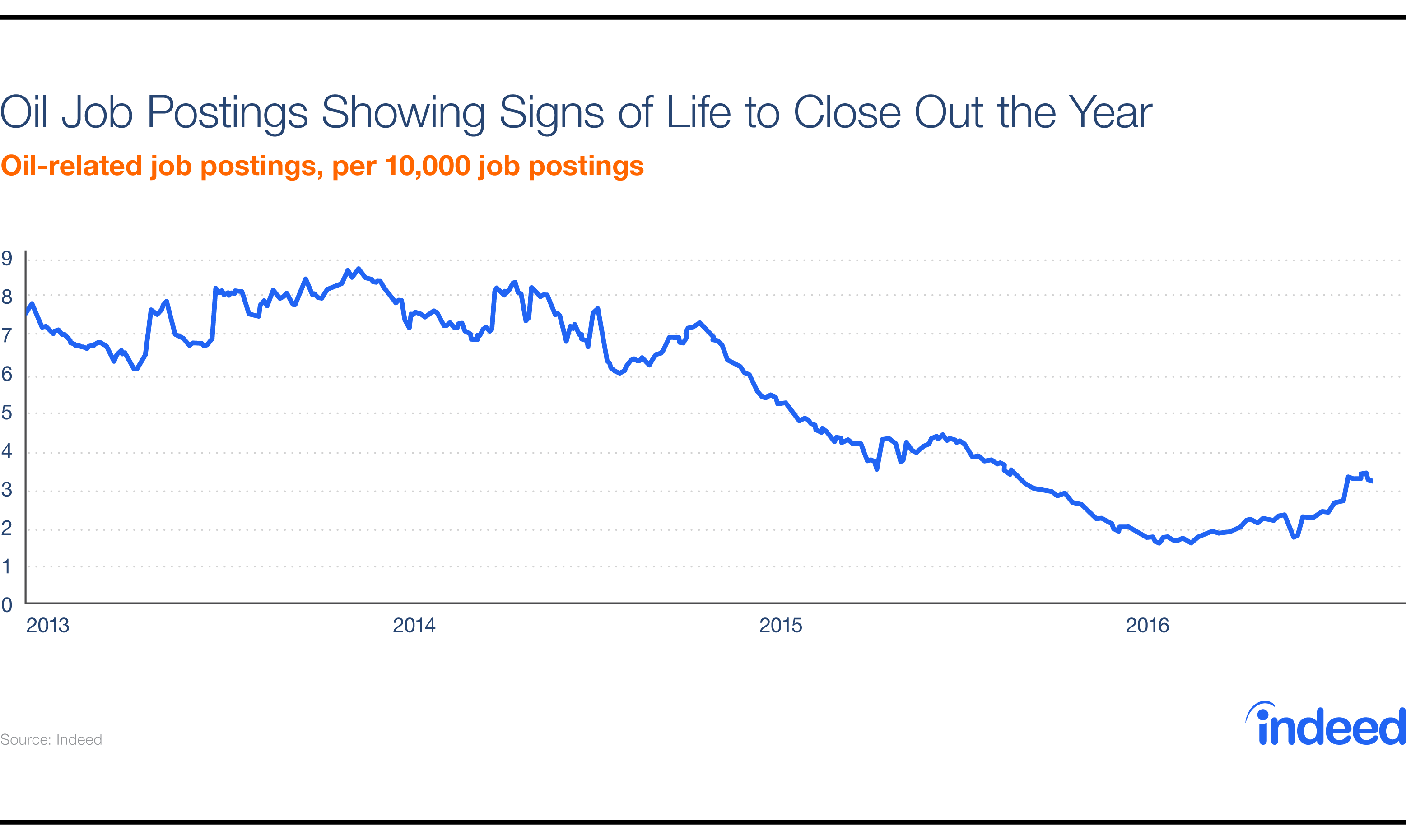

While there has only been modest improvement in prices, Indeed job postings data show some signs of new life in the oil labor market.

As the chart shows, oil producers were already tightening the reins in early 2014, before prices plunged mid-year. Job losses continued nearly unabated until early 2016 when oil-related postings briefly stabilized. Since hitting that bottom, oil-related jobs as a share of all postings have notched small but significant growth, climbing by 52.1%.

It would be a stretch to classify this as an enormous improvement, and the uptick is likely not yet sustained enough to designate it a rebound. However, it is encouraging to see oil producers willing to invest in hiring once again after such a long layoff.

Regional Postings

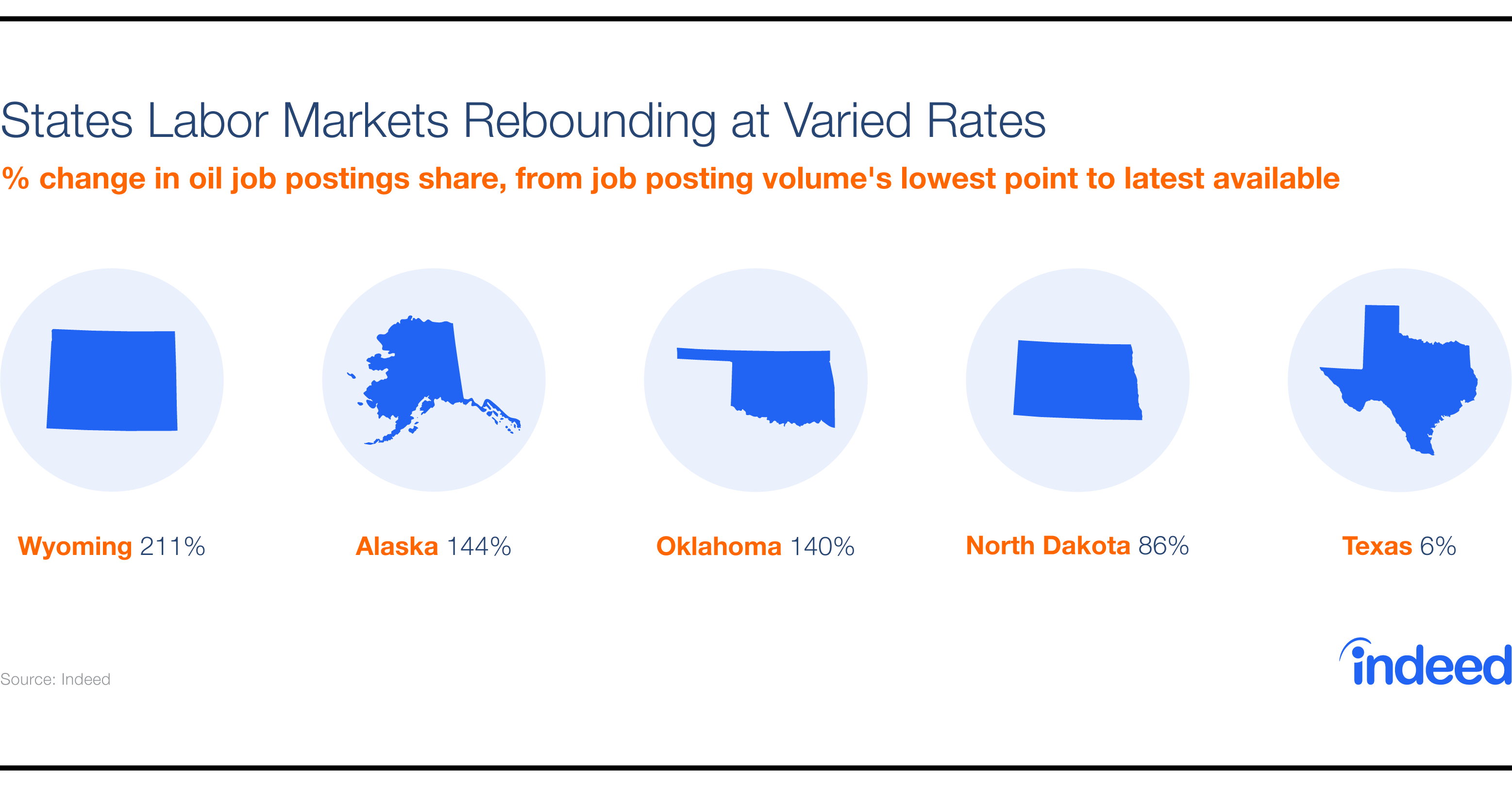

We examined job postings activity in the five states in which oil-related jobs have the largest impact on the local labor market, according to Bureau of Labor Statistics (BLS) data, and found that while the number of available openings declined by a similar amount across 2014 and 2015, the subsequent rebound has not graced each market evenly.

The table above shows just how far the relative job posting volume in each state declined from the day prices started their plunge in mid-2014, to the day search volume hit their eventual bottom sometime in early 2016. Labor markets in these states suffered a decline of a similar magnitude, with each state’s relative job posting volume dropping about 80-85%.

However, the recent rebound in job postings has not occurred evenly across states.

The relative volume of oil-related job postings in Wyoming, Alaska and Oklahoma have all bounced back significantly, more than doubling the level reached at their lowest point. That of North Dakota has bounced back as well, although not to the significant degree of the top three states.

Meanwhile, job postings in Texas have remained remarkably flat. However, developments in west Texas could bode well for the state’s oil producers, as the US Geological Survey’s recent estimate that the Permian basin of west Texas may contain the largest ever accumulated deposit of US oil carries the upside risk that it could keep them quite busy in the near future.

Oil Job Searches

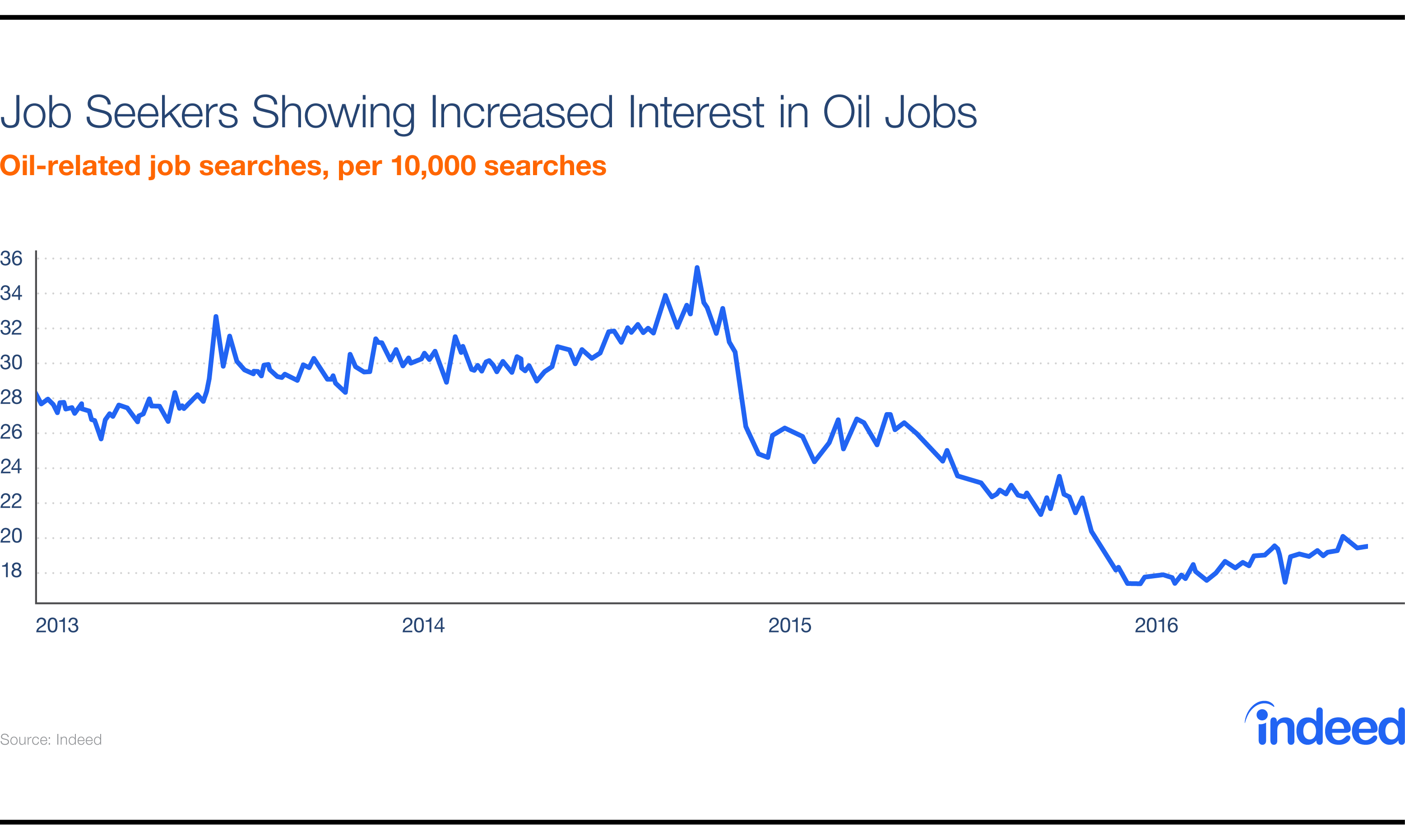

Job seekers are typically aware of broad changes in the labor market and respond in kind, and this case is no different. However, as we showed in previous research, job seekers were a little slower than oil producers to respond to rapid changes in the oil markets. Although prices collapsed in mid-2014, at which point oil producers immediately began posting far fewer jobs, job searches actually climbed throughout most of 2014. This is likely due to the higher number of job seekers recently displaced from oil jobs continuing to search in the industry. Searches for oil-related jobs didn’t decline until late in the year, and fell in fits and spurts through early 2016.

However, as the chart above shows, since the spring of 2016 job searches using oil-related terms on Indeed have slowly edged higher. This could suggest that idle oil workers or those that may have found work in other fields after the price collapse have seen encouraging signs in the oil labor market and are seeking to return to the industry.

Regional Searches

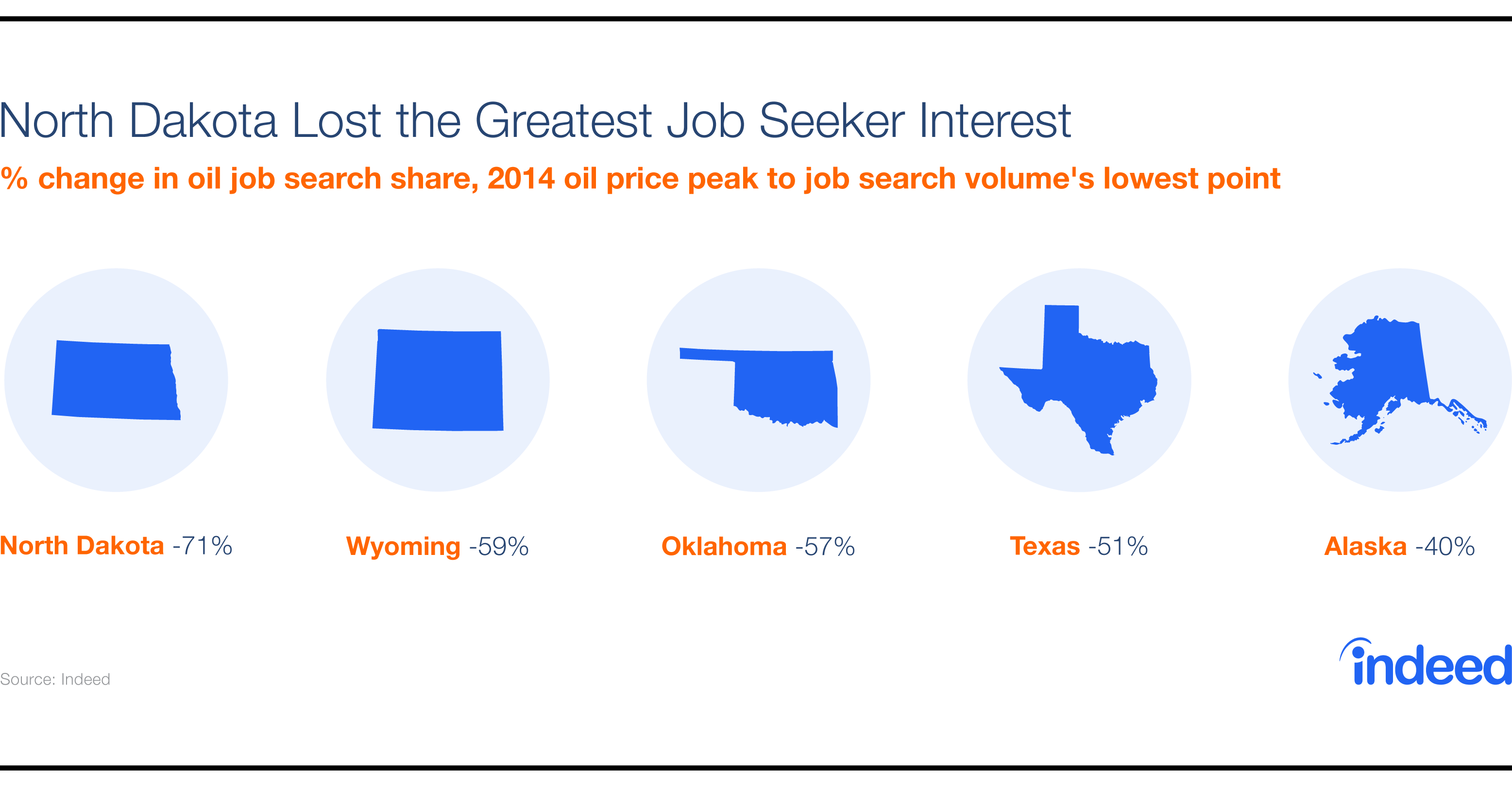

Again focusing in on US states where the oil industry is most crucial, the table below shows just how much searches for oil-related jobs fell as a result of the oil price collapse. Similar to the US trend, searches for oil jobs in these states hit bottom in the first half of 2016, and have since notched steady increases of varying degrees.

Interest in North Dakota took the biggest hit, with the oil job search share falling to about 30% of previous levels. Search levels in Wyoming, Oklahoma and Texas took less of a hit, notching declines in the 50-60% range. Job seekers looking for oil-related work in the far northwest were the most resilient, as job searches in Alaska fell by just under 40%.

The chart below shows just how much search volumes have bounced back in each state.

Of our five oil dependent states, job seeker interest for oil-related jobs experienced the greatest resurgence in Wyoming and North Dakota. Notably, there is a wide gap between the rebound in Texas and the other four states, which all recorded upticks significantly higher than that of the southern oil producer.

It is of note that searches have rebounded the most in Wyoming and the least in Texas. These are the same states which registered the greatest and weakest rebound in oil jobs, respectively. That job seeker activity is matching that of postings is further evidence that job seekers are responsive to changes in the labor market and searching for jobs in segments that have new opportunities.

As the rest of the labor market strengthened considerably over the past two years, oil and gas extraction employment remained a weak spot in the US economy. As we head into 2017 oil prices and further developments in international oil markets bear watching, as the impact these factors carry for both the US and local labor markets is evident in the data.