Key points:

- Employment growth was strong throughout 2018, particularly for full-time jobs. In fact, most occupational groups have increased their full-time staff.

- Falling property prices, particularly in Sydney and Melbourne, and an uncertain trade outlook pose key risks for the Australian labour market in 2019.

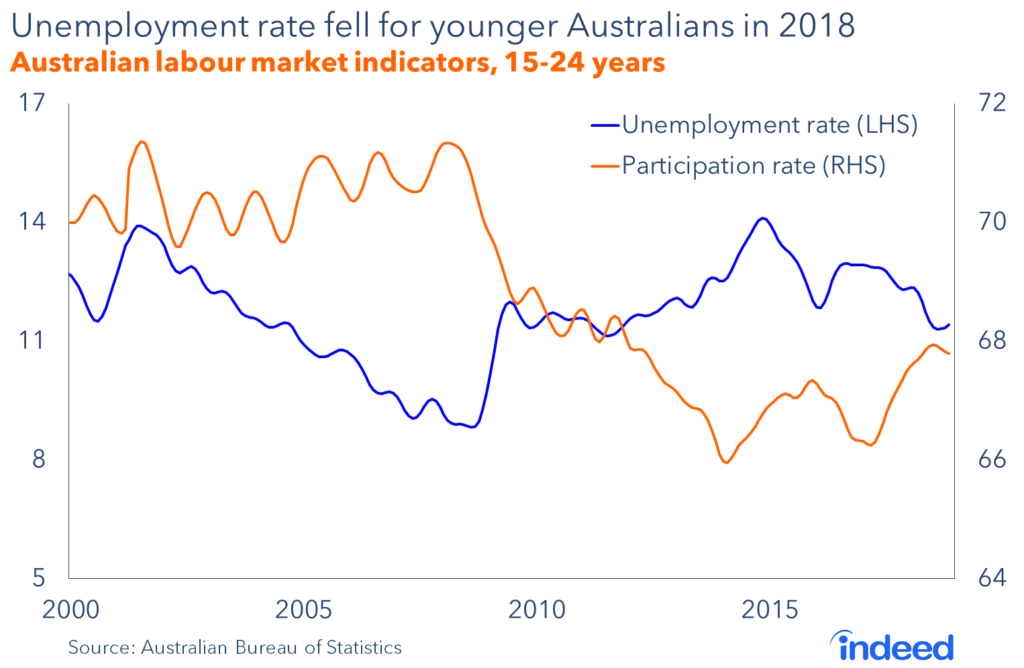

- For younger Australians, finding work has become less daunting. The unemployment rate among the 15-24 age group plunged to its lowest level in seven years. However, the struggles of the retail sector raise the question of whether this will continue in 2019

The Australian labour market took another step forward this year. Employment growth has been strong, particularly in full-time jobs, while unemployment continues to decline. Nevertheless, we are not out of the woods yet. The economy faces significant headwinds, including the largest property downturn in a generation, a challenging environment for retailers, and increasing concern over global trade, which will complicate matters in 2019.

Employment has increased by an average of 22,900 people per month in 2018. Certainly, that’s down from the 34,400 per month last year, but it’s a stellar result all the same. Over the past year, 285,700 people have joined the Australian workforce, helping push the unemployment rate to a seven-year low of 5.1%.

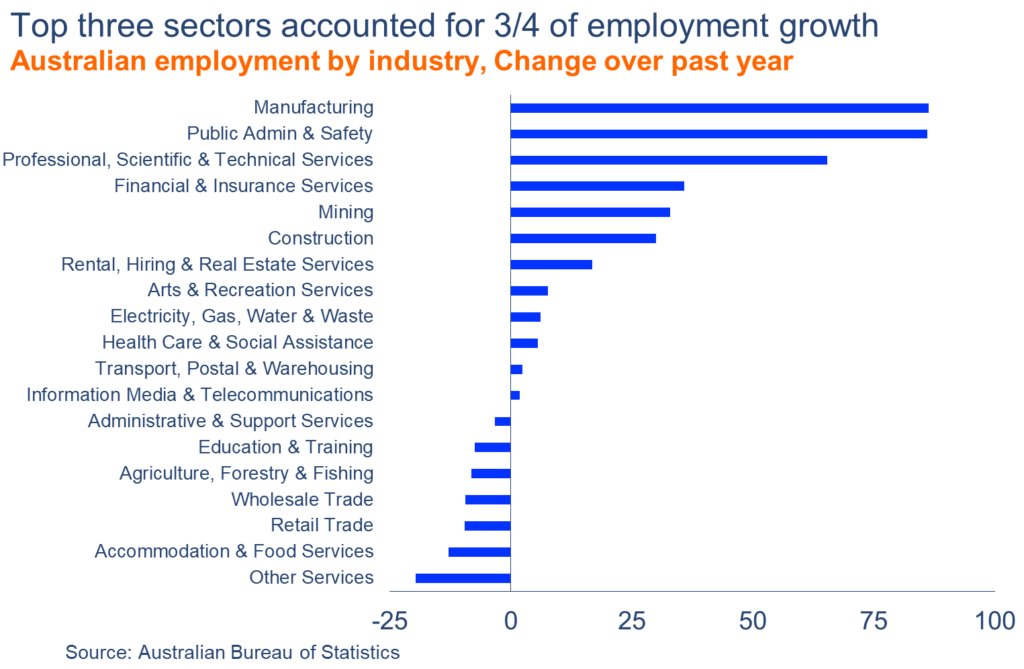

However, job growth has also been relatively narrow. Three industries account for three-quarters of employment gains over the past year. Although those industries may prosper in 2019, some of Australia’s other well-performing industries face stiff challenges. Chief among them are finance and construction, which must contend with a widespread decline in property prices.

A number of emerging trends will shape the Australian labour market in 2019. Although the market is heading in the right direction, its path is fraught with potential hazards. Global and domestic uncertainty have increased in recent months, and that is sure to affect the Australian labour market in the coming year.

Still, two key trends should bring a smile to the faces of job seekers across the country. Strong growth in full-time employment and a stronger labour market for younger Australians have been notable this year. These trends need to continue for the Australian economy to improve further.

The key trends that will shape Australia’s labour market in 2019

While the Australian labour market is likely to build on the past two years and continue its gradual improvement, a number of developments could strengthen or undermine the outlook.

A property downturn is already well under way, potentially hitting key sectors such as construction, real estate, finance, and retail. At the same time, uncertainty about global trade, particularly the risk of a trade war, could have a negative impact on the mining sector that could spill over to the broader economy.

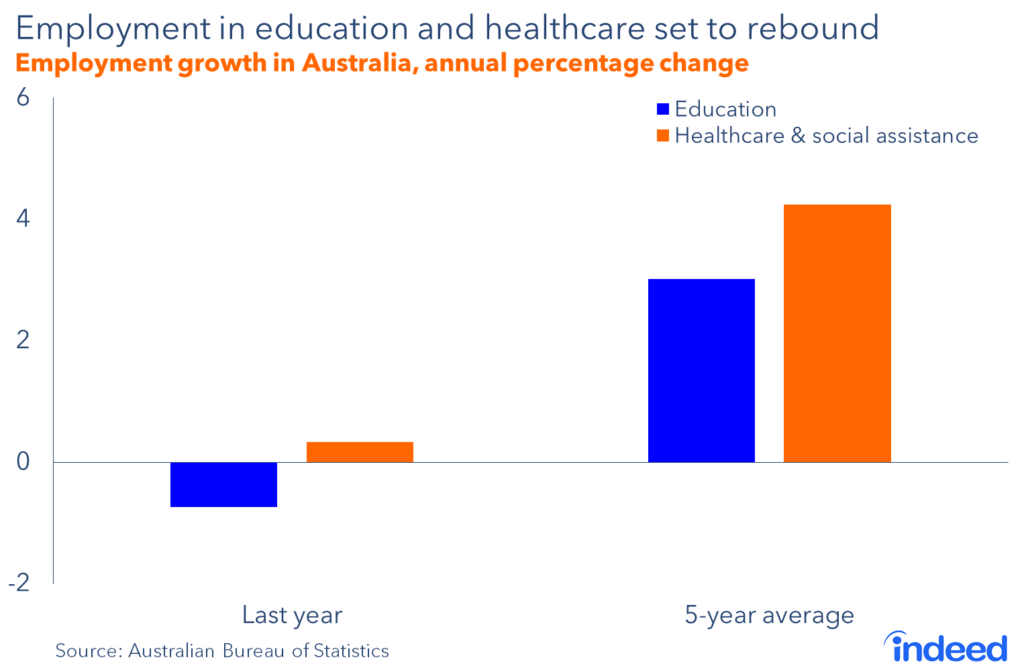

It’s not all bad news though. Two of Australia’s biggest industries, healthcare and education, are poised to rebound, boosted by an ageing population and exports of education services. Meanwhile, wage growth should improve, even if most households will be disappointed by the size of the gains.

1. Property prices are falling

Australia’s faith in the property market was shaken during 2018. Falling prices in Sydney and Melbourne, along with weakness across most other capital cities, have left home owners and investors feeling gloomy. The fallout from the Royal Commission looking into misconduct in banking and financial services, along with softer investor demand and subdued wage growth, point toward further falls in the year ahead.

Sydney home prices are down 8.1% over the past year, while Melbourne prices have fallen 5.8%, according to CoreLogic. The pace of decline has picked up in recent months.

Employment in construction, real estate services, and finance will be directly affected. But declining wealth may also create difficulties for Australia’s struggling retail sector. Residential construction has already started to contract, according to the Australian Industry Group, although a lack of opportunity in the residential sector may be offset by more commercial opportunities.

Real estate employment may begin to decline as sales and commissions dry up, while lower borrowing activity and tighter regulation could hamper employment in the financial sector.

Retailers already face intense competition from the likes of Amazon, squeezing margins and profitability. Soft wage growth for most households isn’t doing the sector any favours. For that reason, a drop in household wealth is the last thing retailers need now. Retail sector employment has fallen over the past year and, if the number of high-profile bankruptcies is any guide, more pain may be on the way.

The outlook for housing is greatly uncertain, in particular how deeply prices will fall. Thus, the impact of the property downturn will be a key focus for policymakers in 2019. The OECD has already flagged this as a major risk for the Australian economy.2. China, trade, and the mining sector.

2. China, trade, and the mining sector

The mining sector accounts for less than 2% of Australian employment, but it is often integral to Australia’s economic success and it has a particularly strong influence on wages. The key question is how will Chinese demand for iron ore and coal evolve? The direct employment implications may be minor, but the impact on Australia’s trade balance could be profound.

At play here is the global trade environment. Protectionism is increasingly in vogue, particularly in the United States. Some analysts believe a global trade war could undermine Australia’s mining sector. If this occurs, it would spell nothing but trouble for Australian employment and wages.

Already we have seen stiff falls in iron ore prices. Of course, these markets can be volatile. But if lower prices persist, it will probably weigh on corporate earnings growth, ultimately flowing through to employment and wages.

3. Healthcare and education are set to bounce back

On the brighter side, healthcare and social assistance, Australia’s largest employment sector, is poised to bounce back in 2019. Rising demand for health and aged care services, primarily due to an ageing and fast-growing population, will create a range of opportunities in healthcare and related occupations in 2019. A key challenge will be managing skill shortages, particularly among nurses.

Education, which ranks fifth in size among Australian employment sectors, is also likely to improve in 2019. Strong population growth and exports of education services should create lots of opportunities for teachers and support staff. Rising employment in healthcare and education will help offset any weakness in such areas as construction, retail, and finance.

4. Wage growth will improve, but still disappoint

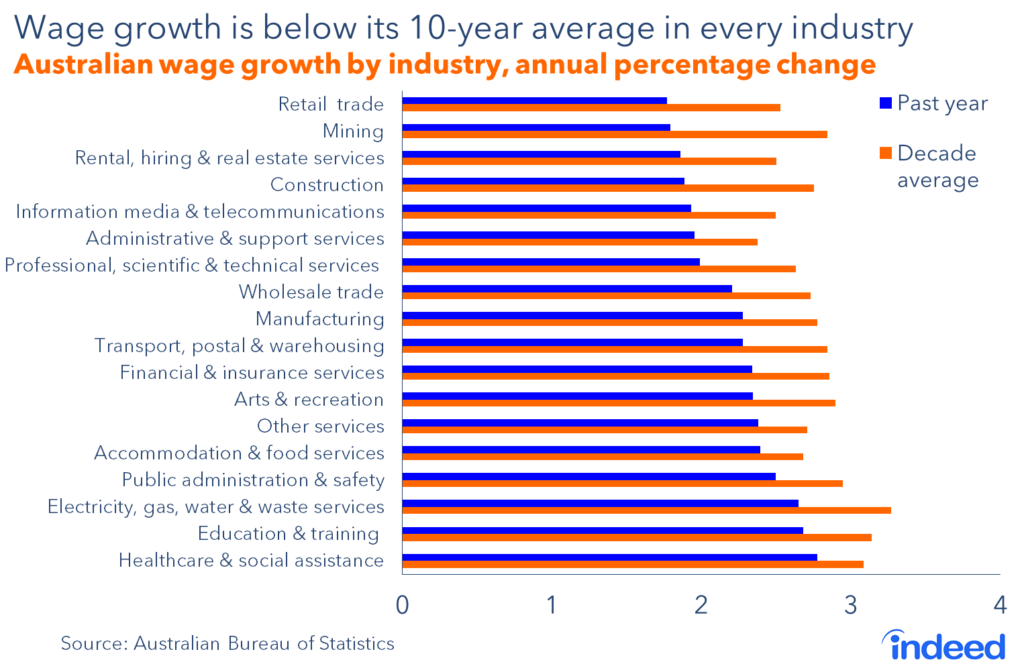

Wage growth in Australia remains below its decade average in every state and industry. Growth has been highest in healthcare and education, two sectors that are less subject to market forces, and lowest in retail and mining. But, from a wage standpoint, no industry is genuinely strong. There are just varying shades of disappointment, which has been the case in Australia for a long time.

Wage growth will probably improve a little throughout 2019, which isn’t to say that the gains will be large or provide much relief to Australian households. Nevertheless, the recent improvement in unemployment measures, particularly in broader indicators such as the underutilisation rate, point toward modest improvement in wage growth.

In practice this means that annual wage growth may reach 2.5% from the current level of 2.3% — awful by historical standards. Unfortunately for Australian households, for at least another couple of years, wage growth is likely to remain well below the 3-4% level once considered normal.

Australia’s full-time resurgence

Full-time employment has accounted for two-thirds of employment growth in 2018, compared with three-quarters last year. That represents an impressive turnaround after years during which the economy mainly created part-time, often insecure, jobs. From 2009 to 2016, full-time opportunities accounted for just 44% of employment growth. In 2016, they actually declined.

Improved business conditions, including stronger earnings growth and profitability, have underpinned this improvement. The creation of full-time, high-quality roles reflects a stronger economy and greater competition for workers.

Some occupations have fared better than others. Leading the charge is the business, human resources, and marketing category. Full-time employment among these occupations surged 51,000 over the past two years. Just behind were specialist manager jobs, and design, engineering, science, and transport positions.

These occupation groups cover lots of ground and have different skill sets. Yet they share one thing in common — they are high-skilled occupations.

Nevertheless, it would be incorrect to characterise the surge in full-time employment as purely a high-skilled phenomenon. There has also been strong full-time growth among sales support workers, carers and aids, and food trades workers.

At the other end of the spectrum, full-time opportunities for office managers, clerical and office support workers, and even chief executives have declined. Around one-quarter of occupations have seen a decline in full-time employment over the past two years.

Continued full-time gains are essential if the Australian labour market is to take the next step on its path to recovery. Full-time employment growth is needed to bring down the rate of labour market underutilisation which, at 13.4%, remains far too high.

Young people are finding jobs

Also welcome is the improvement this year in the job picture for Australians aged 15-24. For much of the past decade, younger workers have suffered a lack of opportunities. The ones that did emerge were typically casual or insecure. That has been changing throughout 2018, although progress still needs to be made.

The unemployment rate among Australians aged 15-24 fell 0.9 percentage points this year to 11.4%. That’s the lowest level jobless rate for younger workers in over seven years. Workforce participation of this group has also improved despite a fall in employment in retail and hospitality, which have typically employed younger workers in large numbers.

The year has been marked by strong demand for university graduates who completed their courses in 2018, following increased opportunity for students who graduated in 2017.

Assessment

Strong full-time employment gains and greater opportunities for younger workers are key to driving unemployment lower. These developments played a pivotal role in the labour market improvements achieved in 2018. Momentum may slow next year due to falling property prices and trade uncertainty. Nevertheless, we anticipate that the unemployment rate will gradually improve, creating greater competition for workers and hopefully providing relief for households in the form of higher wages.