Key Points:

- Australian job vacancies fell 3.5% in the June quarter, the seventh consecutive quarterly decline, and were down 17.3% over the year.

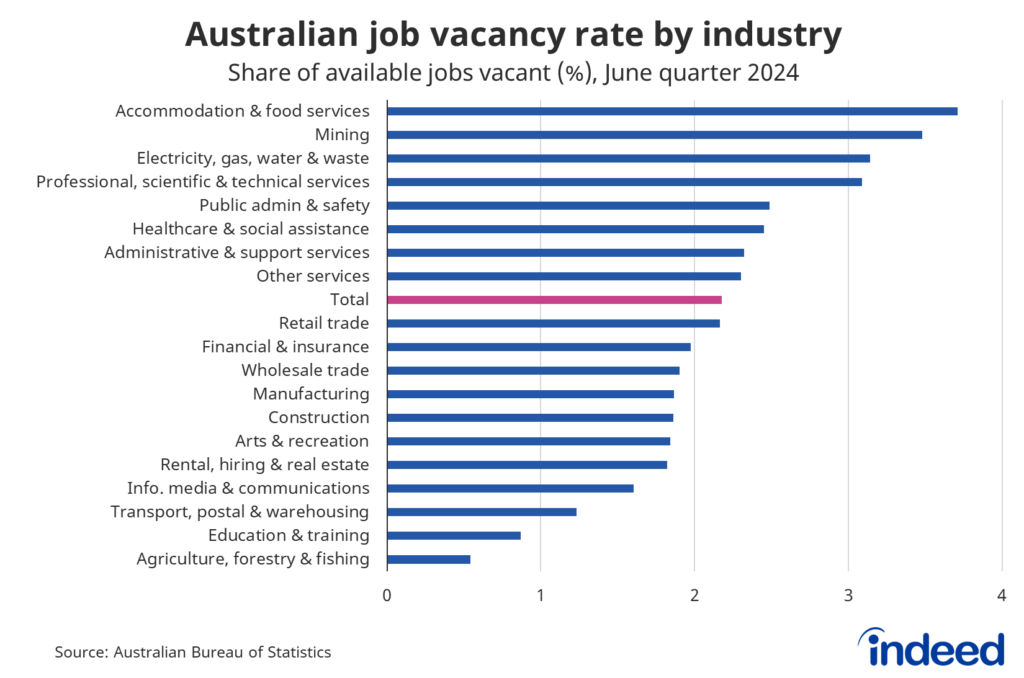

- Australia’s job vacancy rate eased to 2.2% in the June quarter, ranging from 3.7% for accommodation & food services to 0.5% in agriculture.

- The number of Australians working multiple jobs declined 1.2%, to 961,400.

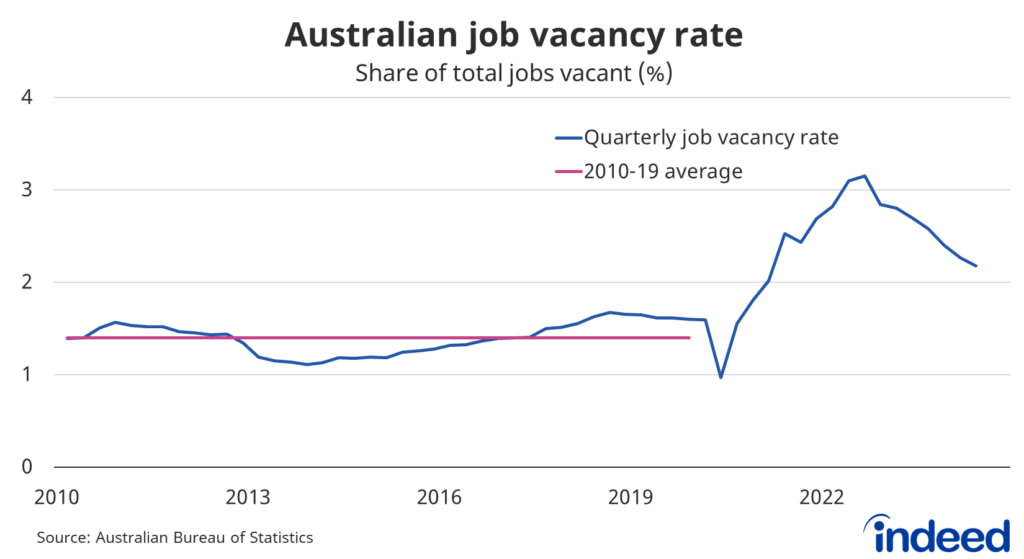

Australia’s job vacancy rate eased to 2.2% in the June quarter, still well above the 1.4% average rate from 2010 to 2019. Competition for talent has eased considerably but by no means has it returned to normal. Skill and talent shortages remain quite common and many businesses continue to find recruitment challenging. This is still a job market that is quite favourable to jobseekers.

Australia’s job vacancy rate fell in 13 of 19 industry categories, but some prominent industries bucked the national trend. Restaurants continue to struggle to find staff, with the vacancy rate for accommodation & food services spiking to 3.7% (from 3.0% last quarter). It also jumped considerably for professional services (from 2.7% to 3.1%). The vacancy rate continues to ease in key sectors such as healthcare & social assistance and education & training.

The job vacancy rate remains above the 2010 to 2019 average in all but two industries. Only financial & insurance services and administrative & support services have a vacancy rate that appears relatively low by historical standards.

Multiple job holders decline

In the June quarter, roughly 6.5% of all people with a job — some 961,400 people — had multiple jobs, down from 6.7% in the previous quarter. The decline was driven by the education, public administration and retail sectors.

Multiple job holders are most common in administrative & support services (9.5% of workers), ahead of agriculture, forestry & fishing (8.9%) and arts & recreation (8.4%). Some industries lend themselves more readily to people working multiple jobs. It’s quite common for people to have multiple seasonal jobs on farms, for example, and labour hire workers might provide some administrative services across multiple businesses.

Cost-of-living pressures continue to make things difficult for Australian households, creating a need for extra work among many workers struggling to manage mortgages, rent, electricity and/or food costs. People will continue to seek more hours — either in an existing job or via an additional job — to deal with these cost pressures. Consequently, despite the decline in the June quarter, the share of workers with multiple jobs may trend higher over the next year or two.

Assessment and implications

The latest job vacancy figures clearly show that while the job market continues to slow, it also remains remarkably resilient given the overall economic environment. Strong job creation suggests that employment growth should remain solid in the near term, supporting the overall economy.

However, labour market conditions typically lag shifts in economic activity. The Australian economy overall is struggling, and that presents a considerable risk to the labour market outlook.