Is your city the next Silicon Valley? Many places would like to be, judging from the proliferation of Silicon thises-or-thats: Silicon Alley, Silicon Forest, Silicon Beach, Silicon Mountain and many others. But what is it that really sets Silicon Valley and other vibrant tech hubs apart? It turns out it’s not just the sheer amount of technology-related activity, but also the kind of activity—notably an unusual mix of technology jobs that skews toward high-paying and newly emerging tech occupations.¹

Tech jobs remain as concentrated in the same big eight US tech hubs as they have been for several years, despite the high cost of housing and labor in these metros. Furthermore, these big eight hubs are tightening their grip: Higher-salary technology occupations are becoming increasingly concentrated, while lower-salary technology jobs are dispersing slightly to the rest of the country. In this sense, the US technology jobs landscape is becoming more unequal—yet another example of how the country is becoming increasingly differentiated and polarized.

The big eight tech hubs are not replicas of each other—labor markets differ among them significantly. Indeed’s job postings in the first half of 2017 reveal that San Francisco and Seattle, more than any other US metros, share the Silicon Valley pattern of plentiful high-paying and newly emerging tech jobs—cutting-edge occupations like computer vision engineer and machine learning engineer. Seattle is the tech hub with the fastest growth rate in tech-job openings. Two additional hubs, Boston and Austin, have tech-job mixes similar to Silicon Valley’s, but, unlike Seattle, they are not gaining tech-job share. Rounding out the big eight, tech jobs in Washington, DC, Baltimore and Raleigh are more traditional and offer lower salaries, making these metros less like Silicon Valley than their fellow tech hubs.

Outside the big eight, three metros—Boulder, CO, San Diego, and Provo-Orem, UT—have tech occupation mixes that resemble Silicon Valley’s as well as growing shares of tech jobs. But, in these emerging tech metros, tech jobs have smaller footprints than in the eight big hubs. Despite that, they are among Silicon Valley’s closest cousins, offering opportunities for tech workers looking for a change of pace from the big hubs and for companies that want to locate in hot tech markets.

Ups and downs in the eight big tech hubs

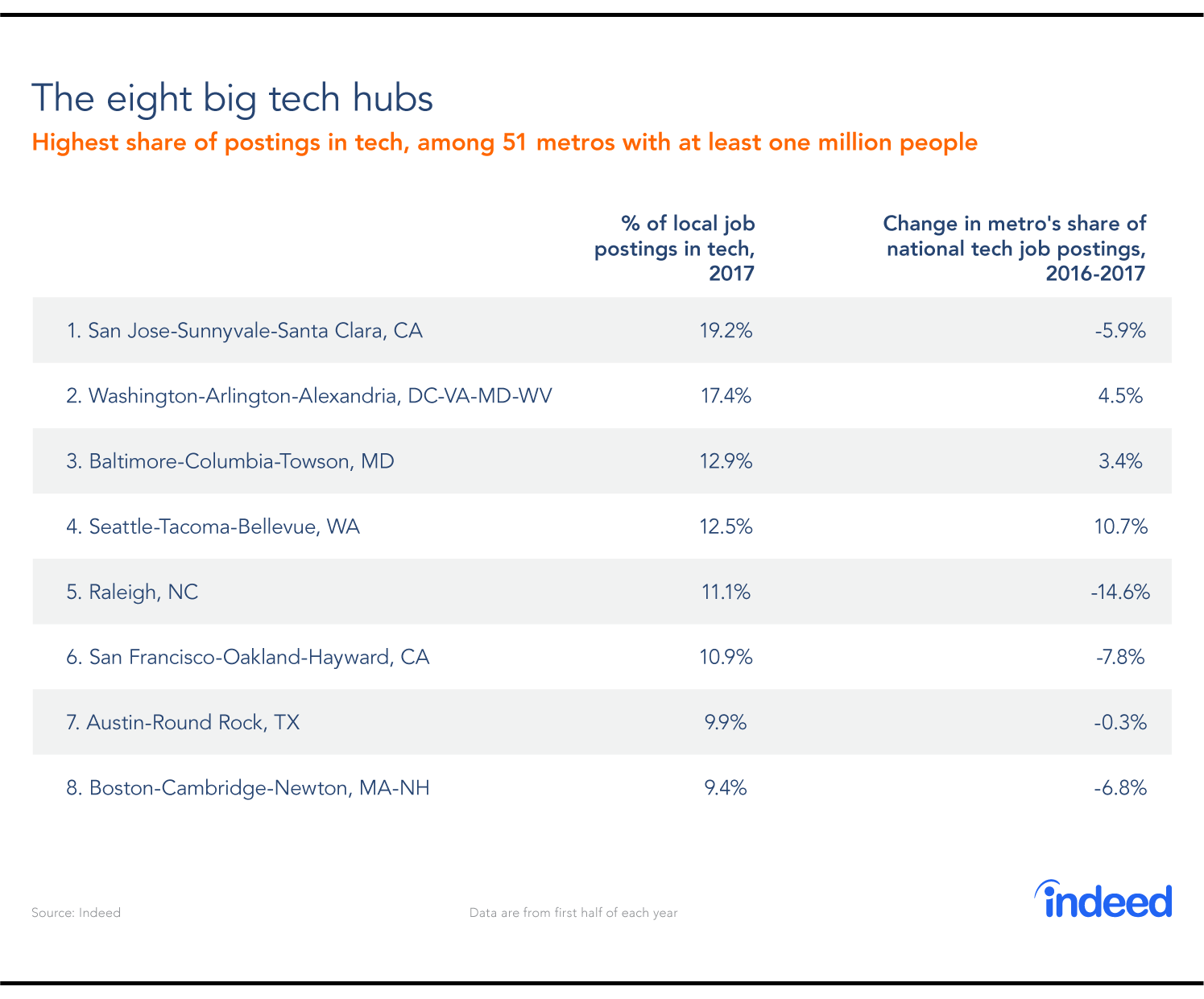

Let’s start with the basics—where the tech jobs are. In the first half of 2017, among the 51 largest metros in the US—those with at least 1 million people—technology job postings accounted for a higher share of all postings in San Jose than in any other metro.² The Washington, DC, and Baltimore metros come next. The rest of the top eight are places with strong reputations as technology centers: Seattle, Raleigh, San Francisco, Austin, and Boston.³ Together, 27% of technology job postings nationally were in these eight tech centers.4

The share of US tech-job openings in these eight hubs has been consistent for years, rising slightly from 26.5% in 2013 to 27.6% in 2016 and 27.4% in 2017. In other words, there hasn’t been a broad shift of technology jobs away from these hubs toward the rest of the country. Furthermore, the metros in the top eight have been almost unchanged over the past five years.

But, among this set of eight, some are on the rise, while others are losing share. Both Bay Area metros—San Jose and San Francisco—had smaller shares of US tech-job openings in the first half of 2017 than in the first half of 2016. It’s no coincidence they have the highest cost of living among the tech hubs. Seattle is gaining share in tech-job openings the most, followed by Washington and Baltimore. Still, the shifts in tech jobs among these eight hubs are bigger than any broader shift away from them to other parts of the US.

Some metros outside these tech hubs are claiming a rising share of tech-job postings. Between 2016 and 2017, this share increased notably in Colorado Springs, Albany, NY, and Dayton, OH, for instance. All the same, having more tech jobs doesn’t make a place the next Silicon Valley. It matters critically what kind of jobs these are, as we’ll see next.

The tech jobs that set tech hubs apart

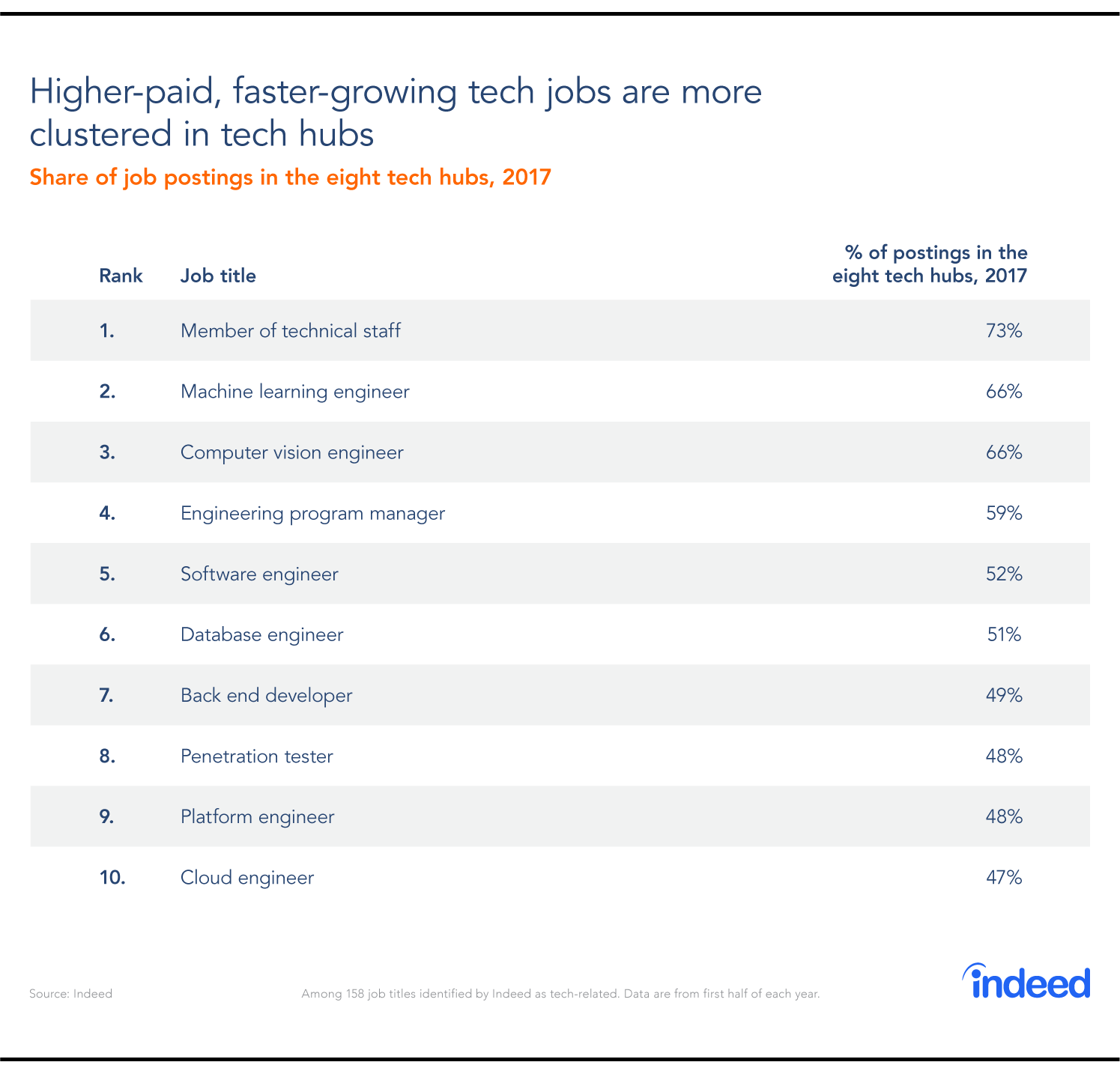

As noted, 27% of US tech-job postings in the first half of 2017 were located in the eight main tech hubs. But some tech-related occupations are even more concentrated in tech hubs, and these include higher-salary and faster-growing occupations. In fact, tech hubs not only have a larger share of higher-salary tech jobs than of other tech jobs, but these well-paying tech jobs are increasingly concentrated in these top metros.

To see this, we analyzed job posting locations on Indeed’s site for 158 tech-related job titles. For six job titles, more than half of job postings nationally are in the eight tech hubs: member of technical staff (often a research position); machine learning engineer; computer vision engineer; engineering program manager; software engineer; and database engineer.5

What do tech jobs highly concentrated in hub metros have in common? Two things. First, they are faster-growing or emerging occupations. Many of the job titles that have become far more common today than two years ago are highly concentrated in tech hubs, including machine-learning engineer, computer-vision engineer, cloud engineer, data scientist and full-stack developer.

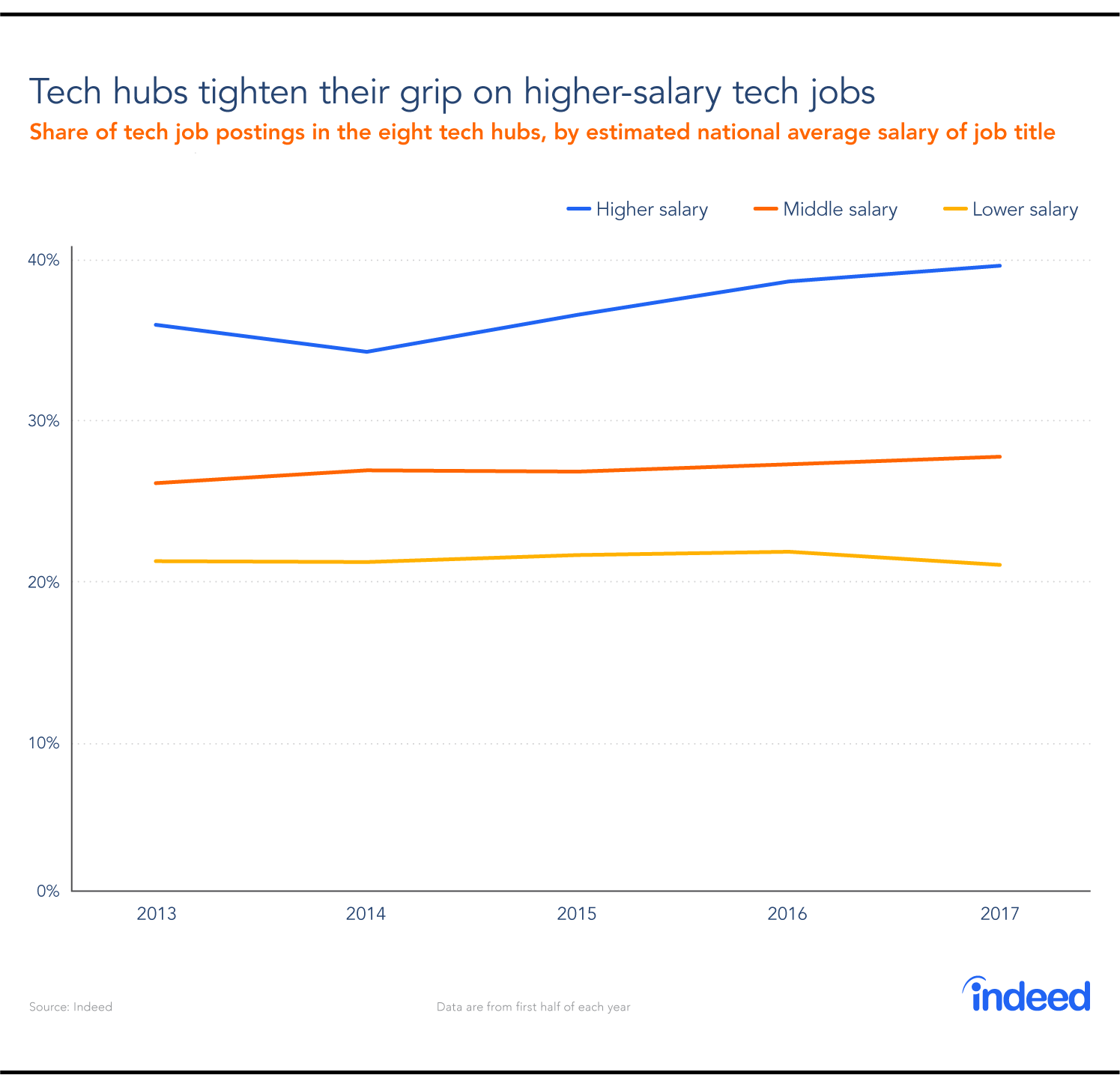

Second, they pay more. We divided the 158 tech-job titles into three categories based on their estimated national average salaries on Indeed: higher-salary jobs ($100,000 or more), middle-salary jobs ($75,000-$100,000) and lower-salary jobs ($75,000 or less). In the first half of 2017, the eight tech hubs had 39% of the higher-salary tech jobs, 27% of the middle-salary jobs and 21% of the lower-salary jobs.

Therein lies a key point about the dynamics of tech hubs: Although the overall share of tech jobs in hub metros has been essentially flat from 2013 to 2017, higher-salary tech jobs have become more concentrated in top-tier tech centers over the past year, while lower-salary tech jobs have dispersed a bit. In other words, tech hubs are keeping their grip where it really counts—on higher-salary tech jobs. Only lower-salary jobs are dispersing. In this way, the tech-jobs landscape is similar to the patterns in incomes, politics, and housing—becoming more polarized as places become increasingly different from each other.

The tech-job mix not only shows that tech hubs are different from the rest of the US. It also reveals how the eight tech hubs differ from each other and helps show where the places in the US most like Silicon Valley can be found.

Silicon Valley’s closest cousins

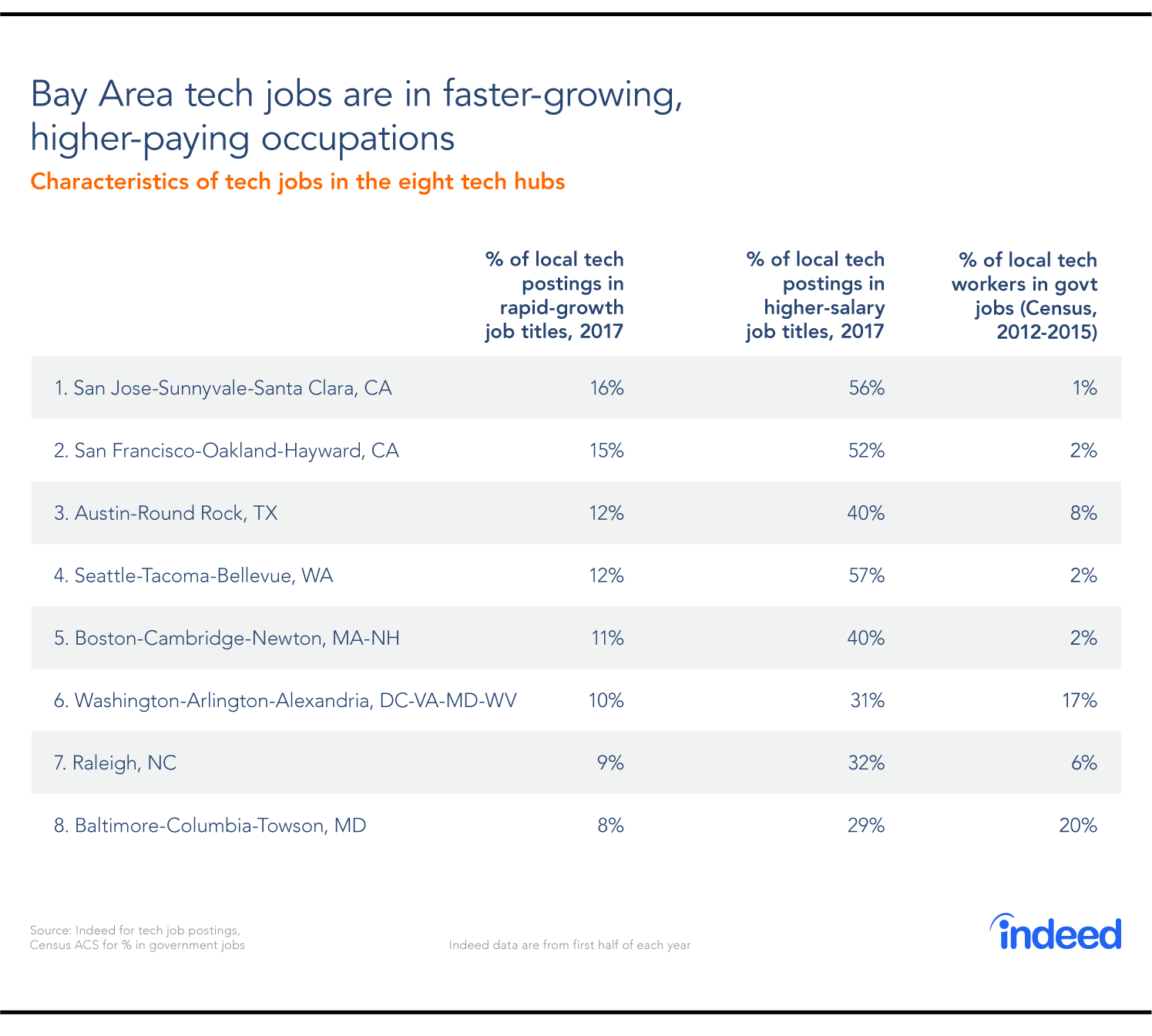

On most measures of technology activity, Silicon Valley stands out. Stanford University and a favorable business culture helped establish its dominance. In addition, Silicon Valley and San Francisco have been the center of venture capital investment in recent decades, accounting for more than 40% of the national total in the past few years. The mix of tech jobs today in Silicon Valley also stands apart from those in most other tech hubs based on the two measures identified above that distinguish tech hubs from other technology clusters.

The first is the share of tech jobs in faster-growing or emerging occupations. These account for 16% of tech-job postings in Silicon Valley, followed closely by 15% in San Francisco. Compared with Silicon Valley, tech jobs in metro Baltimore are only half as likely to be in faster-growing or emerging occupations.

Second is pay: 56% of Silicon Valley’s tech postings are in higher-salary occupations. Seattle is slightly ahead, at 57%, and San Francisco close, at 52%. No other tech hub is above 40%. Thus, Silicon Valley, San Francisco and Seattle skew most toward the tech-jobs mix that sets tech hubs apart in the first place.

It’s worth noting that tech hubs with the highest proportion of tech jobs in government tend to have postings that skew less toward higher-salary and faster-growing tech occupations. Thus, in metro Washington and Baltimore, which rank near the bottom among tech hubs in the share of local tech jobs that are faster-growing or higher-salary, nearly a fifth of local tech jobs are in government, according to the US Census, much higher than in other tech hubs. By contrast, in Silicon Valley, San Francisco, Seattle, and Boston, just 1–2% of tech workers are employed by government. Austin and Raleigh are state capitals and have higher shares of government tech jobs. Boston too is a state capital, but it’s a larger metro in a smaller state and its economy isn’t as heavily shaped by state government.

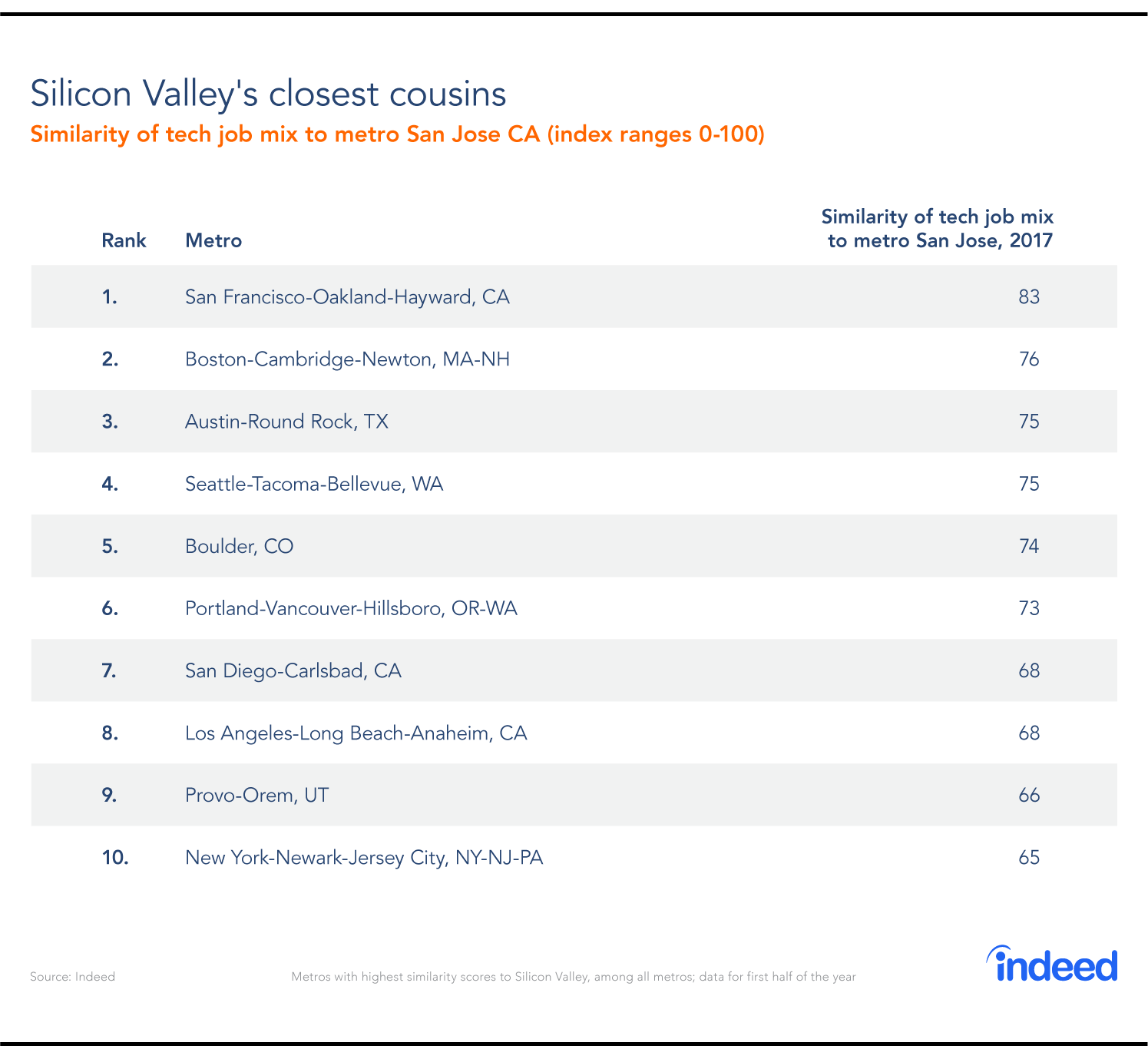

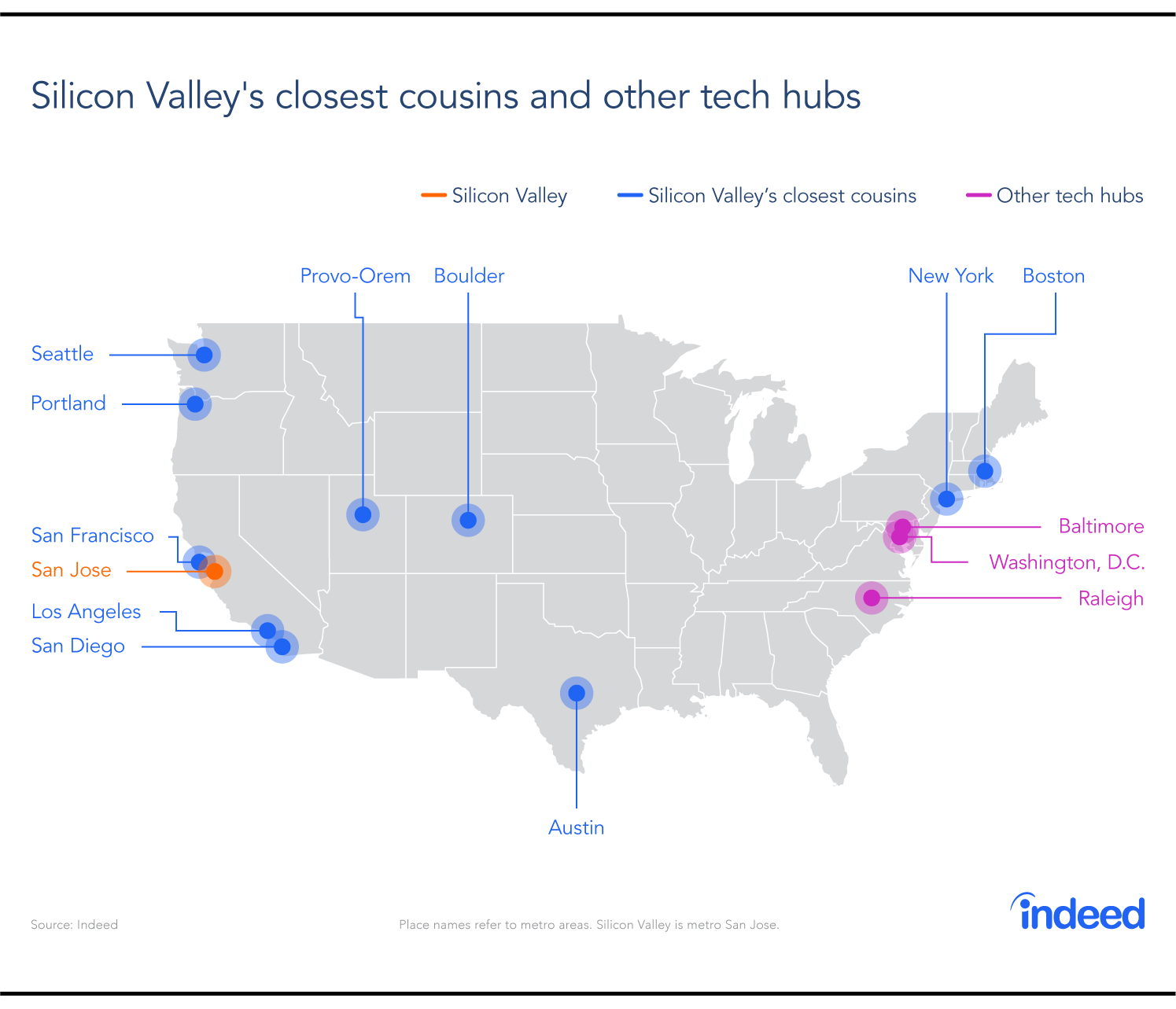

Are there Silicon Valley-like tech clusters beyond the eight tech hubs? Looking at every metro’s mix of job postings across all 158 technology job titles shows which ones are most similar to Silicon Valley.6 The top four metros with tech-job posting mixes most like Silicon Valley’s are big eight stalwarts. San Francisco tops the list with a similarity score of 83 out of 100. Silicon Valley and San Francisco aren’t just geographic neighbors—in terms of tech jobs, San Francisco is as close as it comes to a Silicon Valley sibling. Boston, Austin and Seattle come next with Silicon Valley similarity scores of 75 or 76.

After that we find metros outside the big eight. Boulder, CO, and Portland, OR, are in fifth and sixth places respectively with similarity scores of 74 and 73. Boulder and Portland don’t count as tech hubs because tech accounts for a smaller share of local job postings than in the eight hubs. Nevertheless, their tech postings are quite similar to Silicon Valley’s. These metros should be considered cousins of Silicon Valley, not because of the amount of tech-job postings they have, but rather because of the kind.

In contrast, the remaining three big eight tech hubs are less like Silicon Valley. Raleigh is 11th on the similarity list at 64, just behind New York. Baltimore and Washington are even less similar, with scores of 59 and 57 respectively. Although tech jobs account for a relatively high share of employment in Baltimore and Washington—which is what makes them tech hubs in the first place—their tech-job landscapes are different from those of Silicon Valley, San Francisco and Seattle. Tech-job postings in those markets tend to be in slower-growing and lower-salary occupations, and are more likely to be in government.

So which metro is the next Silicon Valley? The answer is none, at least for the foreseeable future. Silicon Valley still stands apart. The San Jose area remains the metro with the highest share of local job postings in tech, and its tech mix ranks first for fast-growing jobs and second for higher-salary jobs. San Francisco is close, with the most similar mix of tech jobs to Silicon Valley’s. Yet, despite their continued dominance, both Bay Area metros are seeing their share of tech jobs fall. Seattle is the tech hub that has both a rising share of tech jobs over the past year and a job mix that is most similar to Silicon Valley’s. Outside the eight tech hubs, Boulder, CO, San Diego and Provo-Orem, UT, are also gaining share and have tech-job mixes that look like Silicon Valley’s. For tech workers looking for alternatives to the Bay Area—places where the pace is a bit slower and the homes a bit cheaper—Seattle, Boulder, San Diego, and Provo are where their specialized skills are increasingly in demand.

Notes

-

Throughout this post, Silicon Valley refers to San Jose metropolitan area, which includes the counties of Santa Clara and San Benito. The San Francisco metropolitan area includes Oakland and comprises the counties of San Francisco, San Mateo, Marin, Alameda and Contra Costa. The Bay Area refers to the seven counties that constitute the San Jose and San Francisco metros.

-

Tech jobs were defined as the Standard Occupational Classification categories of “computer occupations” (SOC 15-1000), along with “computer and information systems managers” (SOC 11-3020) and “computer hardware engineers” (SOC 17-2060).

-

The eight tech hubs we identified based on Indeed job postings are also the top eight large metros for tech-employment share according to the American Community Survey, combining data from 2012 to 2015, though in somewhat different order.

-

In contrast, 13% of all US job postings—across all occupations—were in the eight tech hubs.

-

In contrast, other tech-related occupations are only slightly more concentrated in tech hubs than jobs overall are. Just 17% of quality assurance analyst jobs, 18% of technical support jobs and 19% of desktop support technician jobs are in tech hubs, not much higher than the 13% of all job postings that are in tech hubs.

-

This index measures how similar a pair of metros is in their mix of tech-job postings across 158 titles. Two metros with the identical mix of tech-job postings would have a score of 100; two metros with tech-job postings in entirely different job-titles (all of Nerdville’s postings are for data scientists; all of Geektown’s postings are for IT security specialists) would have a score of 0. The measure is equal to the sum across job titles of the absolute value of the difference in each job-title’s share of local postings; divided by two, subtracted from one, and multiplied by 100.