By most measures, times are pretty good for US job seekers. The economy is growing steadily and demand for workers has been strong, except in hurricane-distorted September. Major indicators signal a healthy job market: An average of 169,000 jobs per month have been added in 2017 and the unemployment rate, at 4.1%, is the lowest it’s been in 17 years. The number of unemployed people per job opening has dropped dramatically to 1.1.

But wage growth—which has been languid in recent years—is still below where many economists would like to see it. The Employment Cost Index—a measure of wages and salaries for workers in private industry—is up 2.6% year-over-year. However, average hourly earnings slumped in October to a gain of 2.4% from the year before, a slower growth rate than just before the Great Recession.

Wage gains may be lagging because the labor market still has patches of weakness: The prime age employment-to-population ratio—the share of 25-to-54 year olds with a job—stands at 78.8%, below the peak of 80.3% on the eve of the last recession. One reason wage growth may be underwhelming is that many economically marginalized workers are just now being pulled into the strengthening labor market. The unemployment rate of those with only a high school education has dropped to 4.3%, down a full percentage point since the start of the year. The rate for African-Americans has dropped to 7.5% from over 9% just two years ago.

The US Labor Department releases a more comprehensive measure of unemployment known as the U-6 rate, which hit a 10-year low of 7.9%. The U-6 rate includes workers classified as “marginally attached” to the labor force, meaning they want jobs but are too discouraged to look. The rate also takes in those who are working part-time for economic reasons, not because they choose to. The labor force participation rate, the percentage of the civilian, noninstitutionalized working-age population in the workforce, has flatlined around 63%, but that may reflect the aging of the workforce as Baby Boomers reach retirement age.

Anecdotally, it has gotten so hard for many employers to find workers that they’ve begun filling positions with people who might not have gotten a shot in the past—like ex-convicts. Although many people have yet to be pulled into the strengthening labor market, more who have long been out of work or too discouraged to look probably are now being tempted to jump in. Job search activity on Indeed reflects this tightening labor market.

Job seekers searching for full-time work

With tens of millions of unique visitors from the US each month, Indeed job search data provides a broad picture of the labor force. Many job seekers on our site look for positions like “computer programmer” or “manager.” But, in the past year, we’ve seen more use of search terms that suggest room for job growth as people who have not yet fully benefited from the expansion step up their job hunt. So what are the jobs that have seen the fastest growth in searches on Indeed? The answer is full-time jobs that are easy to get with regular hours and predictable pay.

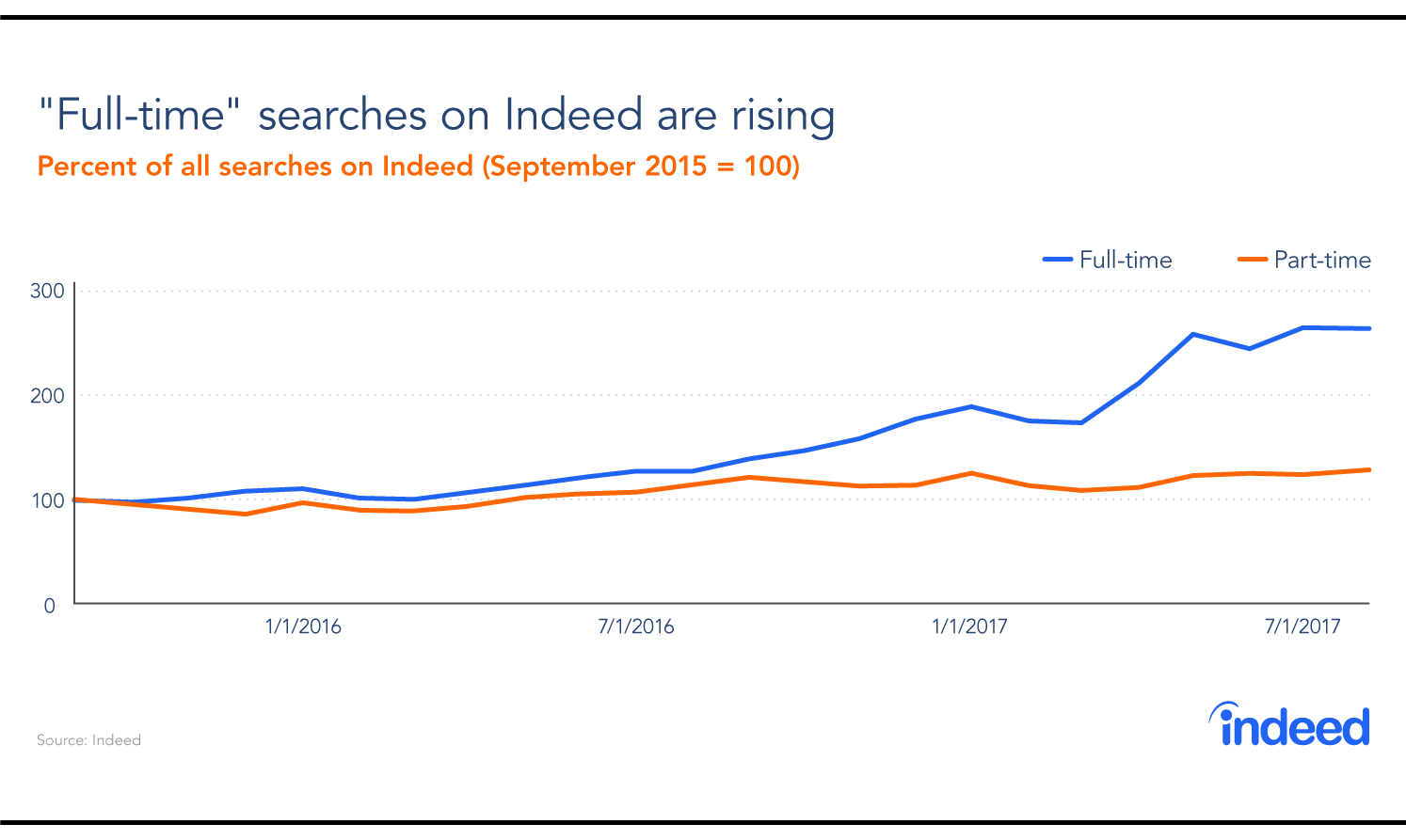

One of the fastest-growing searches we see is for full-time work. From January through August 2017, the term “full time” shot up 4.8 percentage points as a share of all searches on Indeed compared with the same period the year before. Searches for “full time” work have been trending upward over the past two years, while searches for “part time” work have risen only slightly. Perhaps these job seekers are part of the legion of more than 4.7 million who are working part-time but seeking more hours. Of course, not all workers want traditional full-time nine-to-five work. Indeed research has shown growing interest in flexible work arrangements.

Other terms among the fastest growing were “full time no experience” and “full time warehouse.” Presumably many of the people doing these searches were currently working part-time or not working at all. These terms suggest the job seekers were not picky, meaning they were not the kind of workers who had to be lured into the workforce with higher wages. Instead, greater use of these terms was consistent with an economic environment in which strong job growth was drawing in workers who had not yet found work.

Given the healthy state of the economy, other fast-growing search terms might have risen for similar reasons. These are terms that aren’t related to specific jobs or companies, but rather to job characteristics. Examples are “anything”, “hiring immediately,” “weekly pay,” “no background checks,” and “Monday through Friday.” In fact, the term “felony friendly” was among our 100 fastest-growing search terms. That seems to confirm anecdotal reports that those with criminal records are beginning to be hired as the labor market tightens.

The tepid 2.4% year-over-year rise in wages is consistent with Indeed job search data, which suggests there are still more economically marginalized workers to be drawn into the labor market. This pool of marginalized workers could be restraining wage growth.

Budding interest in marijuana jobs reflects emerging industry

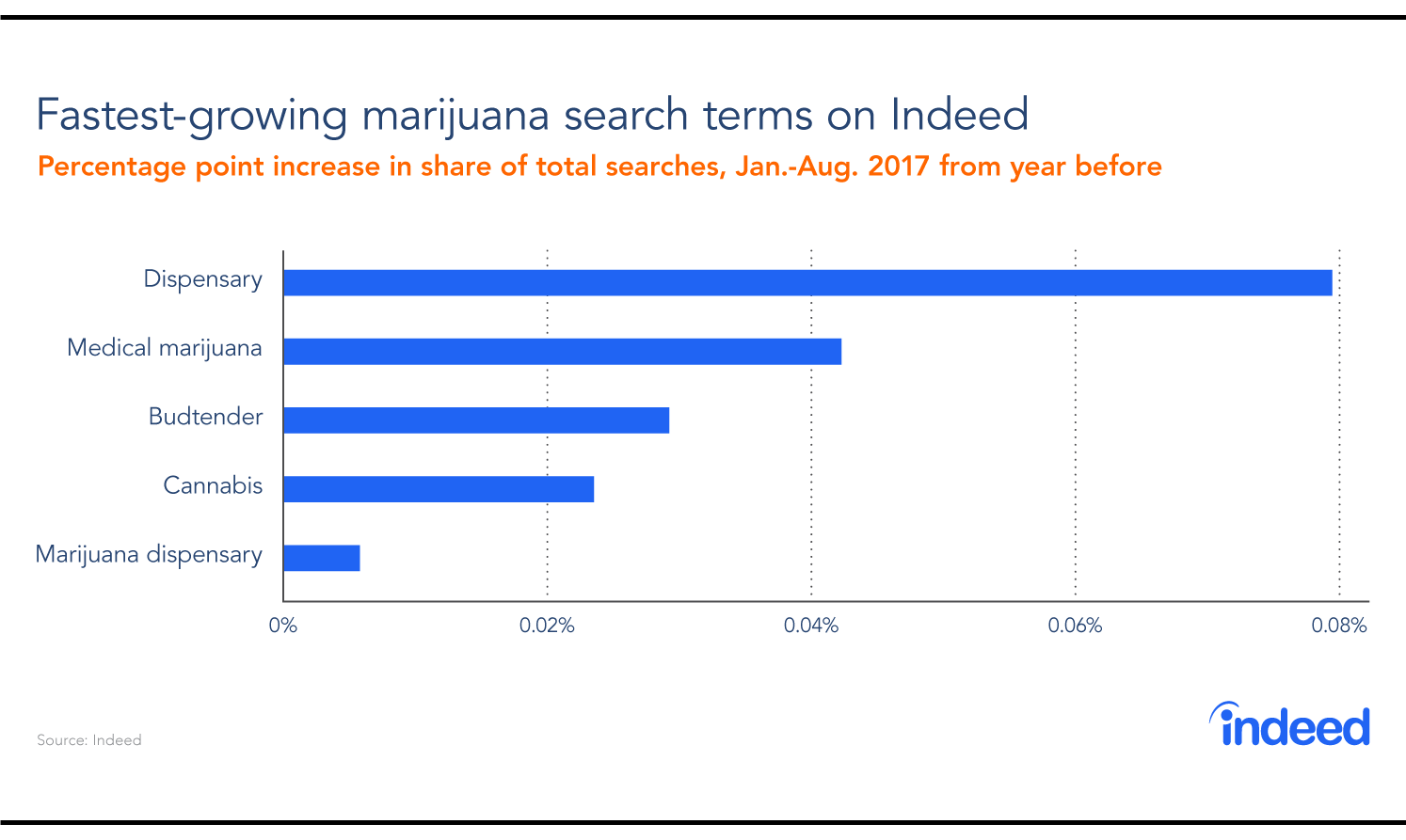

This may not be an economic trend per se, but it’s a sign of the times: There has been a surge of interest for jobs in the, dare we say, budding legal marijuana industry. Five of the top 100 fastest-growing search terms are related to this burgeoning business, including: “dispensary,” “medical marijuana,” “budtender,” “cannabis,” and simply “marijuana.”

This makes sense, given that four states—including California and Massachusetts—approved referendums in November 2016 to legalize recreational marijuana. That brought the total to eight states that have legalized recreational marijuana and 21 other states that have allowed medical marijuana of some sort. Soon about one in five Americans will be able to purchase marijuana in brick-and-mortar stores. Not surprisingly, this growing industry is attracting job seekers.

Healthy labor market may not yet be hitting its full potential

Indeed job search trends portray a labor market that is clearly tightening, as evidenced by the rise of searches for “full time” work. The fact that millions of discouraged or underemployed job seekers are jumping in helps explain the puzzle of a tightening labor market and anemic wage growth. The labor market, while healthy, may not yet be running on all cylinders.