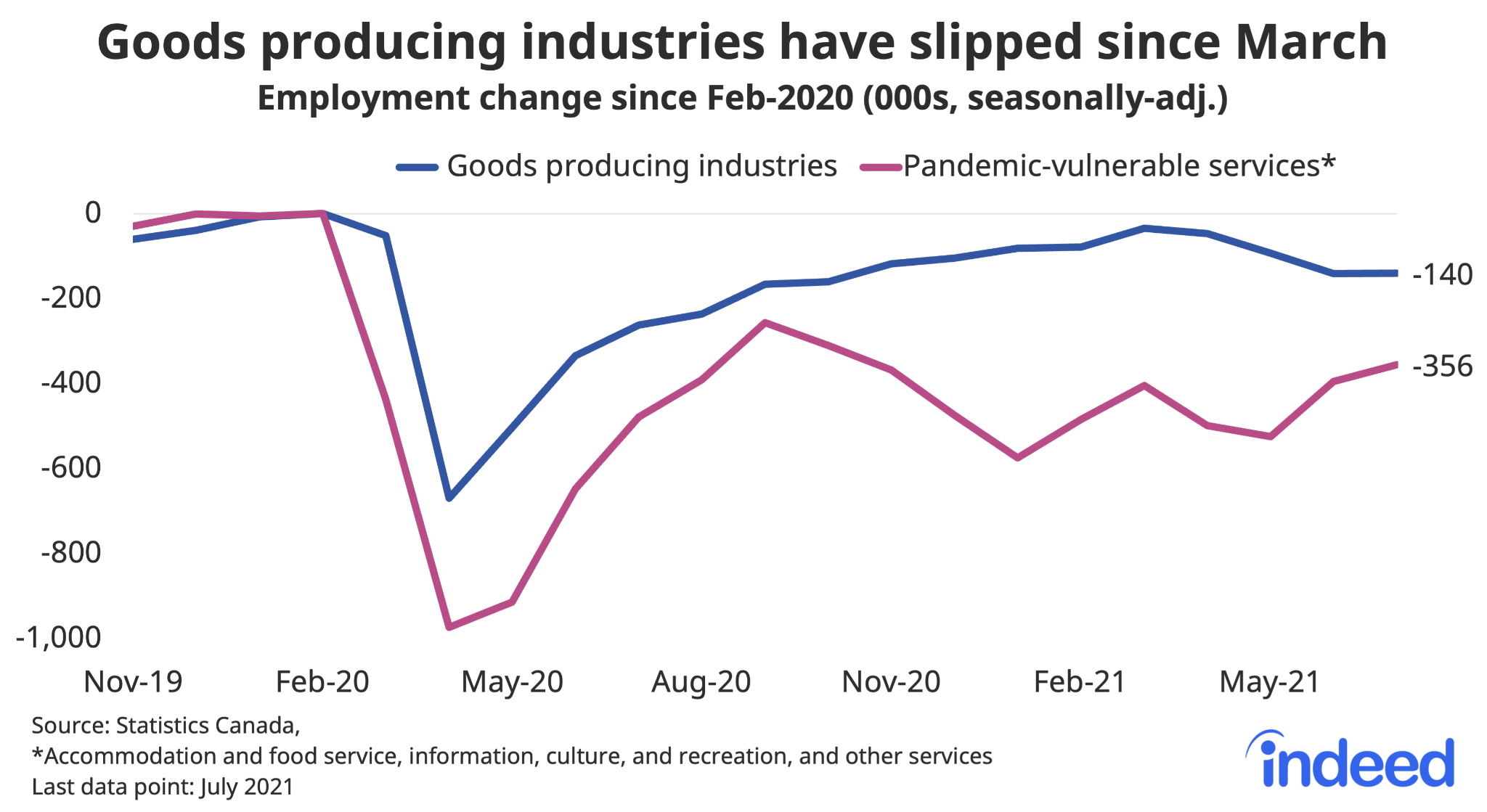

It’s been a wild few months for the Canadian labour market. Each of the past four Labour Force Surveys has broken a new record: March and April for job losses, and May and June for gains, though over half of the previous decline remains. These wild swings have been led by industries hit especially hard by the pandemic. Whether the July numbers maintain recent momentum will depend whether the tailwinds from economic reopening in these sectors persist.

Through June, three industries stand out with employment still particularly far in percentage terms from February levels:

- “Other” services (-16%), which cover a range of sub sectors like mechanics, but also hard-hit personal care services like hair salons and barber shops.

- Information, culture and recreation (-17%), which includes earlier shuttered businesses like gyms and casinos.

- Accommodation and food services, which has experienced by far the largest job losses (-33%).

These three sectors entered the crisis making up 15% of Canadian employment, but as of June accounted for 38% of net job losses since February.

Throughout the summer, the Canadian economy has been transitioning from the “reopening” phase of the recovery — during which the rebound from initial pandemic-induced closures has been swift — to what the Bank of Canada refers to as the “recuperation” phase — where further progress proceeds more slowly.

Which stage best describes the period between the June and July LFS weeks will substantially depend on developments in these hard-hit service sectors, and might vary by region. For instance, June employment in accommodation and food services was closer to February levels in Atlantic Canada, B.C., and Manitoba, then elsewhere. Meanwhile, patios hadn’t opened in large parts of Ontario until after the June reference week. Hopefully we’ll see more quick wins for the Canadian labour market in the upcoming job numbers, before hitting the point where sustaining improvement becomes a tougher slog.