A second straight month of nothing to write home about. Canadian employment ticked down by 31,000 in July, and unlike June, was joined by a slip in hours worked. Job losses were once again led by wholesale and retail trade, and were also joined by dips in health care and education. Other areas were more mixed, with professional services as well as accommodation and food service relatively flat, and construction and manufacturing edging up.

Employment growth has clearly lost steam, though we shouldn’t read too much into the outright monthly decline — the margin of error for month-to-month change was 34,000. Rather than showing up in higher unemployment, the recent soft job numbers have shown up in declining labour force participation instead. Not what we’d expect from a wave of layoffs. At the same time, the pace of gains from earlier this year appear to have run out of gas — now the question is whether the car will stay in neutral.

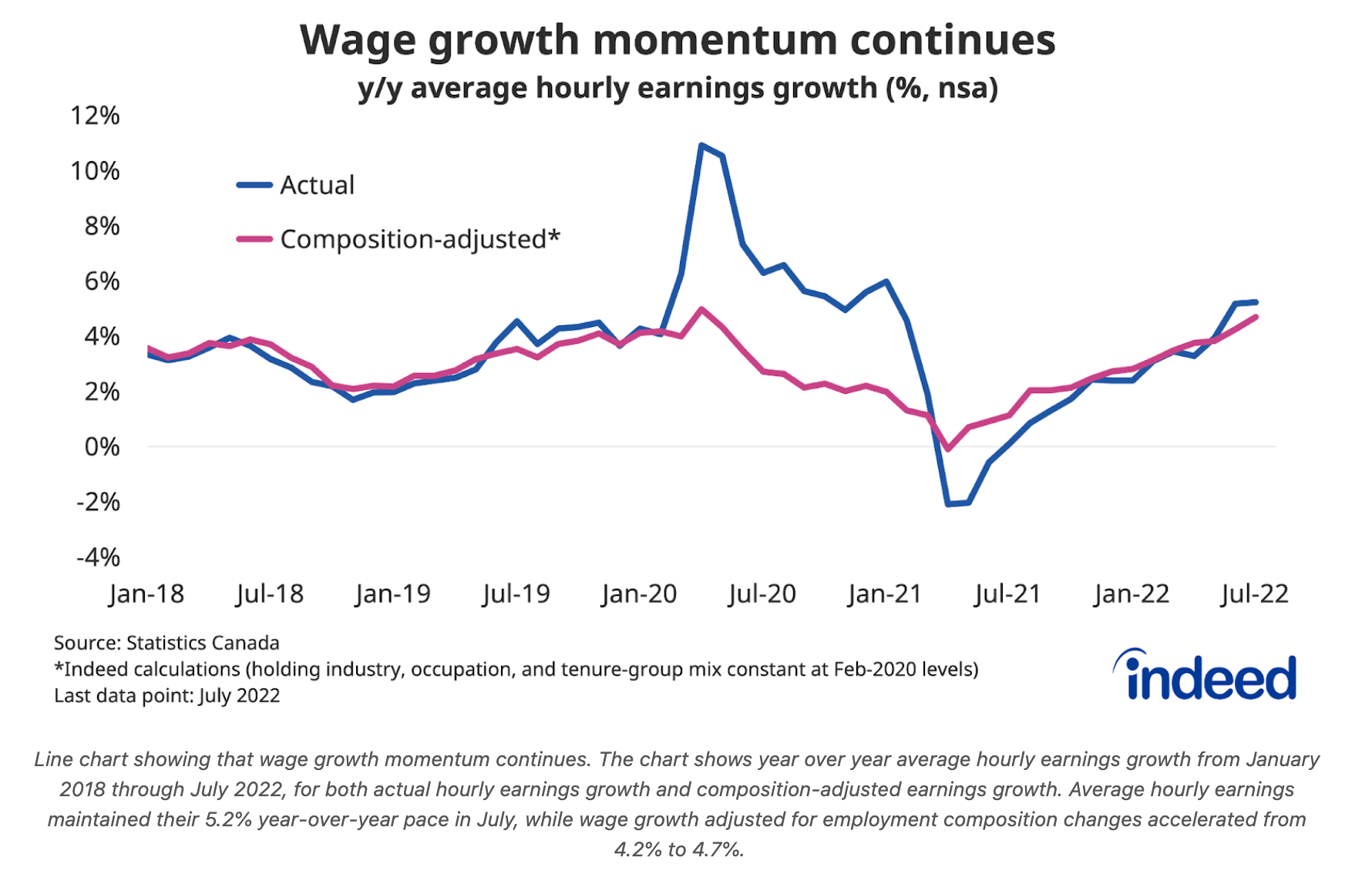

The other key trend this month was on the wage front. Average hourly earnings maintained their 5.2% year-over-year pace in July, a solid clip by normal standards, albeit unlikely matching the pace of inflation. Meanwhile wage growth adjusted for employment composition changes accelerated from 4.2% to 4.7%. While Canadian job postings on Indeed have slipped since May, they are still well above pre-pandemic levels, which along with the low unemployment rate signal that the job market remains tight. While this lays the groundwork for further pay gains, a more cloudy economic outlook complicates the picture for both employers and job seekers.