Key points:

- In mid-May, Canadian summer job postings were down 17% from a year earlier but were still 55% above their level at the same point in 2019.

- Internship opportunities have been more impacted by falling hiring appetite in white collar fields like tech, finance, and marketing. In mid-May, postings for internships were 19% lower than at the same point in 2022, and up a relatively modest 18% from their pre-pandemic level.

- Youth employment was still strong through April but is vulnerable to cooler employer hiring appetite going forward. Opportunities have remained plentiful for those searching for traditional seasonal roles like camp counselor, but conditions could be more challenging for recent grads looking for entry-level positions in higher-paying sectors.

- The slip in summer job postings could make for somewhat easier hiring conditions for seasonal employers this year, but the ongoing tight Canadian labour market will still cause difficulties for businesses under a time crunch to find workers for the summer.

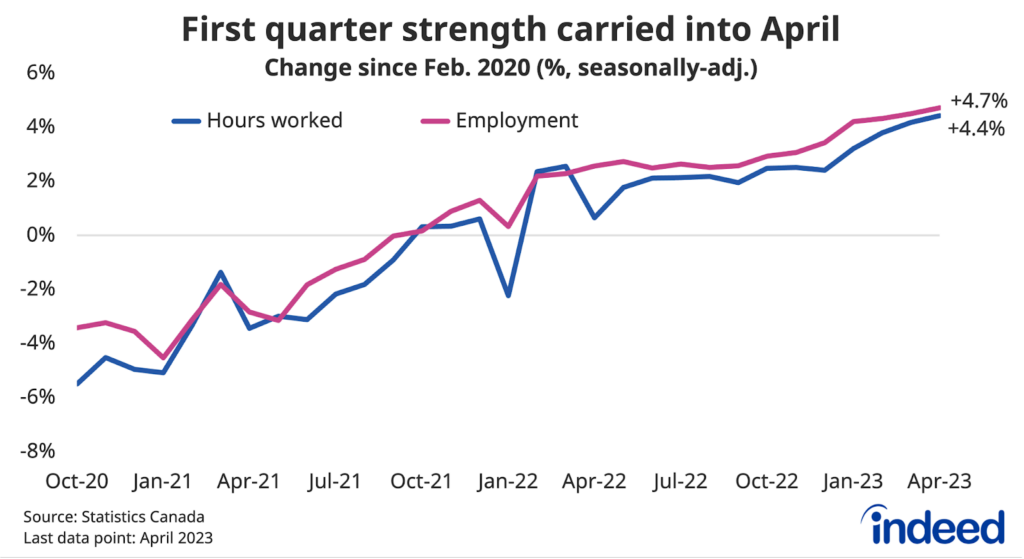

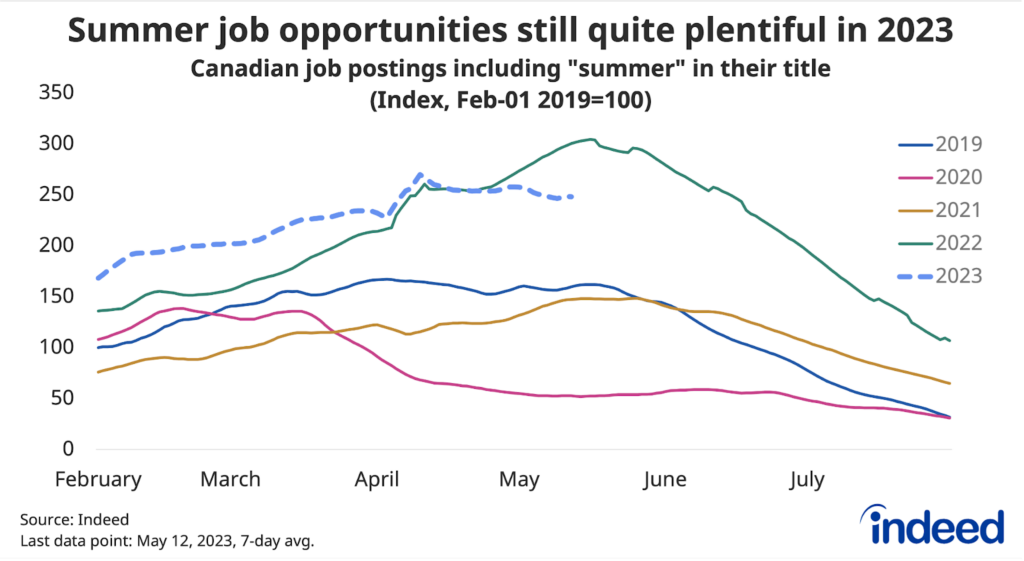

Canadian employers were fast out of the gate in 2023 when it came to looking for seasonal summer workers. Through the first quarter, the level of job postings on Indeed including the term “summer” in the job title was quite strong, well outpacing hiring intentions in early 2022. However, the pick-up in seasonal demand since the start of spring hasn’t been as dramatic as last year. As of May 12, summer job postings were down 17% from the same point in 2022, but were still elevated, up 55% compared to the same point in 2019.

This downshift in seasonal hiring appetite has coincided with a somewhat larger decline in economy-wide job postings. Total Canadian job postings were down 21% year-over-year as of May 12. Meanwhile, the level of postings was still elevated, but also closer to its 2019 level than summer-specific postings, up a comparatively moderate 30% from four years earlier.

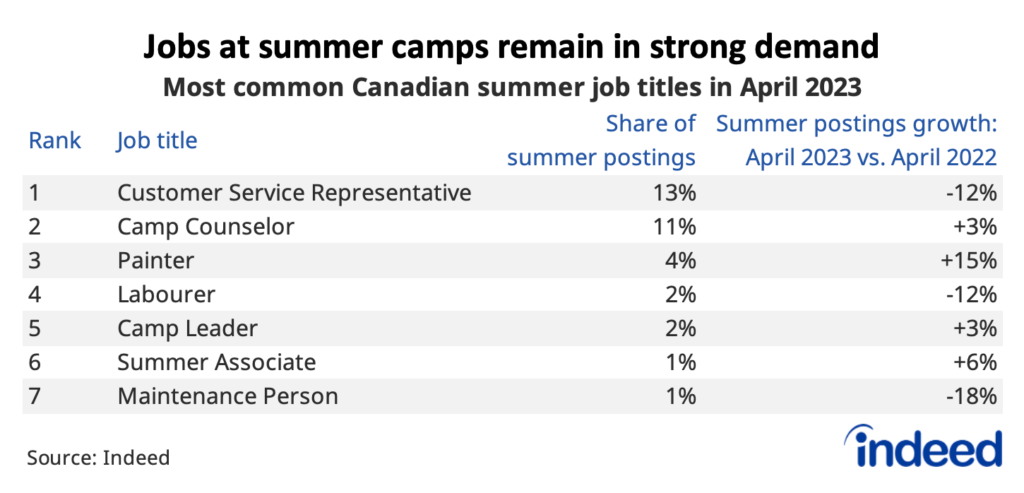

One potential reason for the relatively strong showing for summer postings could be that, given their temporary nature, immediate need for seasonal staff may be a larger driver of recruiting activity than longer-term economic certainty. This appears to be especially true in various roles related to community service, including camp counselors, the second-most common summer job title on Indeed. In April, postings for both camp counselor and camp leader were each up slightly from a year earlier, while postings for summer customer service representative and labourer, for example, were each down more than 10% over the same period.

Internship opportunities have slipped

Another likely reason traditional summer job postings have held up relatively well is that some sectors where hiring appetite has dropped most, including tech and marketing, do relatively little traditional summer recruitment. Instead, weaker demand in these fields has shown up in a different segment of the temporary labour market popular among youth: Internships.

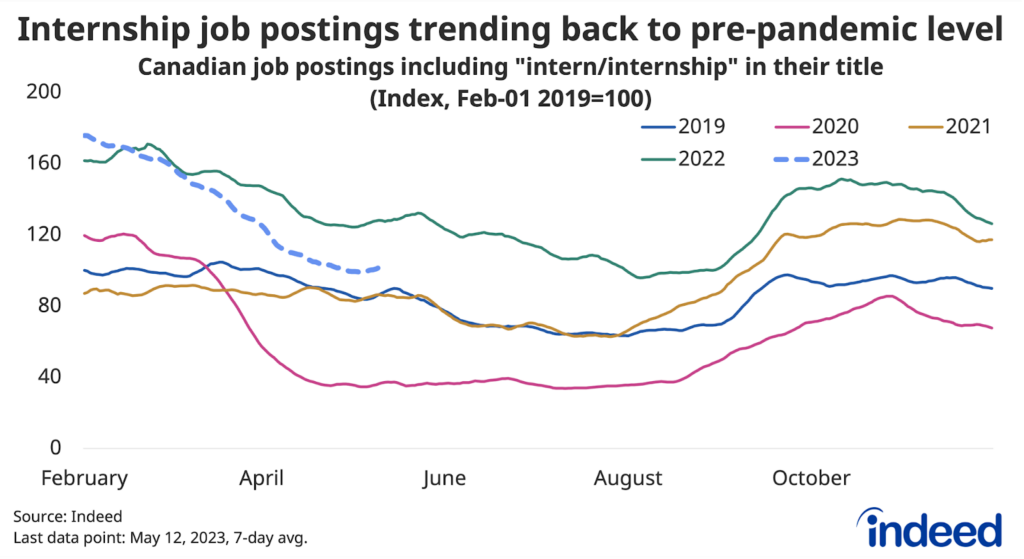

Job postings with “internship” in the title follow a different recruitment cycle than summer job postings, with activity typically highest in the fall and winter months before easing in the spring. But after a strong start to 2023, internship postings have dropped more sharply than their typical trend, and as of May 12, were down 19% from a year earlier. Unlike summer postings, job ads for internships are no longer particularly elevated compared to pre-pandemic levels, up a relatively modest 18% in mid-May compared to the same point in 2019.

Line chart titled “Internship job postings trending back to pre-pandemic level” showing the level of Canadian job postings including “intern/internship” in their job title, all indexed to February 2019 for each year separately between February and December for 2019 through 2022, and February through May 12 for 2023. Internship postings are down from last year, more closely resembling their pre-pandemic level.

Youth employment entering summer in strong shape

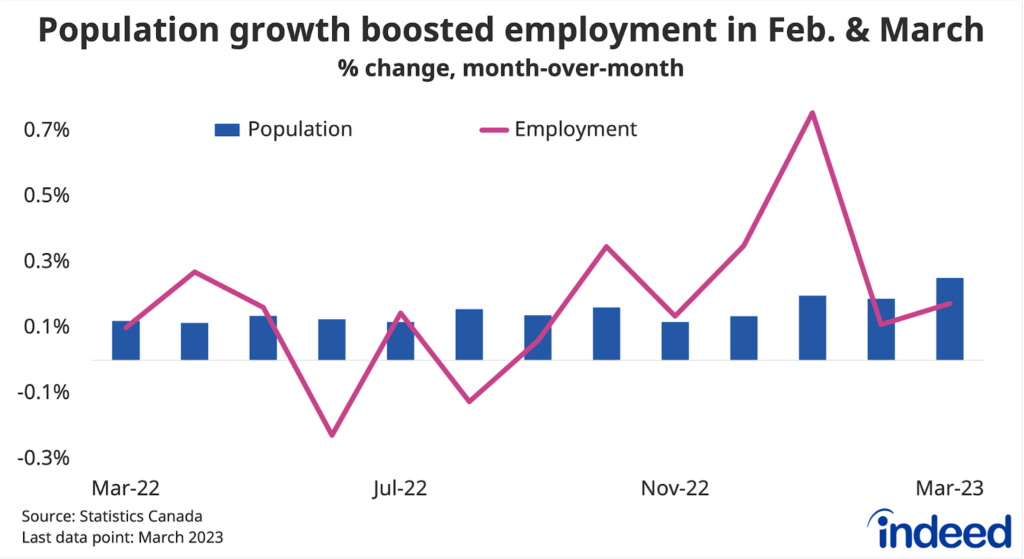

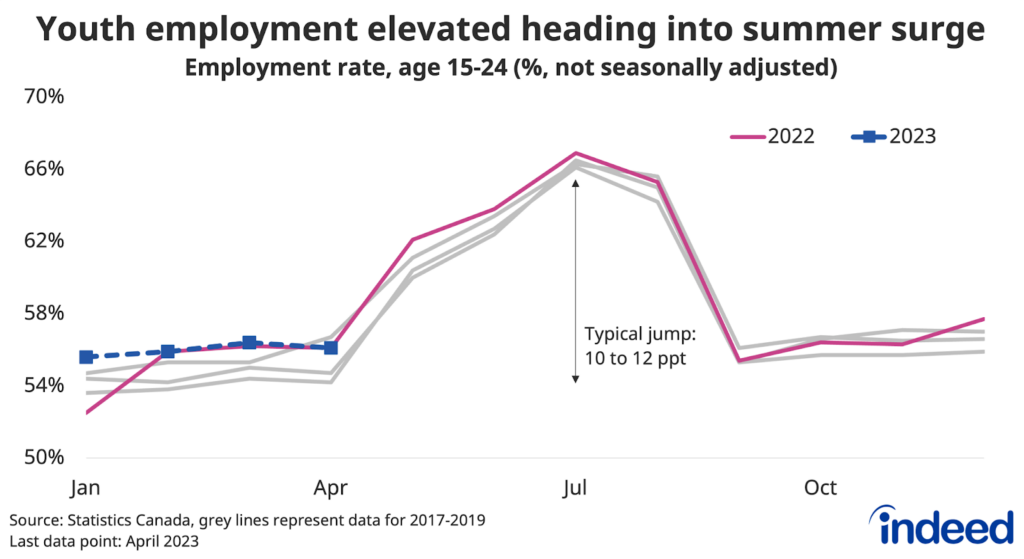

Canadian youth employment rates are highly seasonal. In a typical year, the share of 15- to 24-year-olds with a job generally jumps 10-12 percentage points between April and July. Youth employment has also historically been quite cyclical, responding sharply to downturns in the economy.

The 2023 summer hiring season represents an interesting intersection of these two patterns. Youth employment has fared well in 2023, similar to the broader labour market. The employment rate of 15- to 24-year-olds in April 2023 was on par with its 2022 level and was above where it stood in 2017 and 2018.

At the same time, the recent overall decline in job postings could disproportionately impact younger job seekers, depending on the types of jobs they’re interested in. On one hand, despite being somewhat cooler than a year ago, traditional summer hiring appetite is still quite solid, suggesting another strong year for seasonal employment, especially among teens. Conversely, the drop in internship opportunities, and postings in a range of white collar fields more broadly, could mean a tougher market for some university students and recent grads.

On the employer side, the modest easing in summer job postings and cooldown in labour demand more broadly is likely to make the hiring environment somewhat easier, at least compared to a particularly challenging 2022. Reports of labour shortages have declined, even though the unemployment rate remains low, as some employers are no longer recruiting, while those still active are likely facing softer competition to attract job seekers. Even so, the Canadian labour market remains tight for now, and businesses under a time crunch to find workers before summer gets into full swing will still likely face some difficulties.

Methodology

We track summer hiring appetite by tallying Canadian job postings on Indeed that include the term “summer” or “été” in the job title, excluding postings with job titles that also include “intern” or “internship”. We track internship postings separately tallying the presence of the latter two terms in job titles. This method doesn’t capture the full extent of seasonal demand but provides a gauge of recent trends and how season postings compare to the prior year.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.