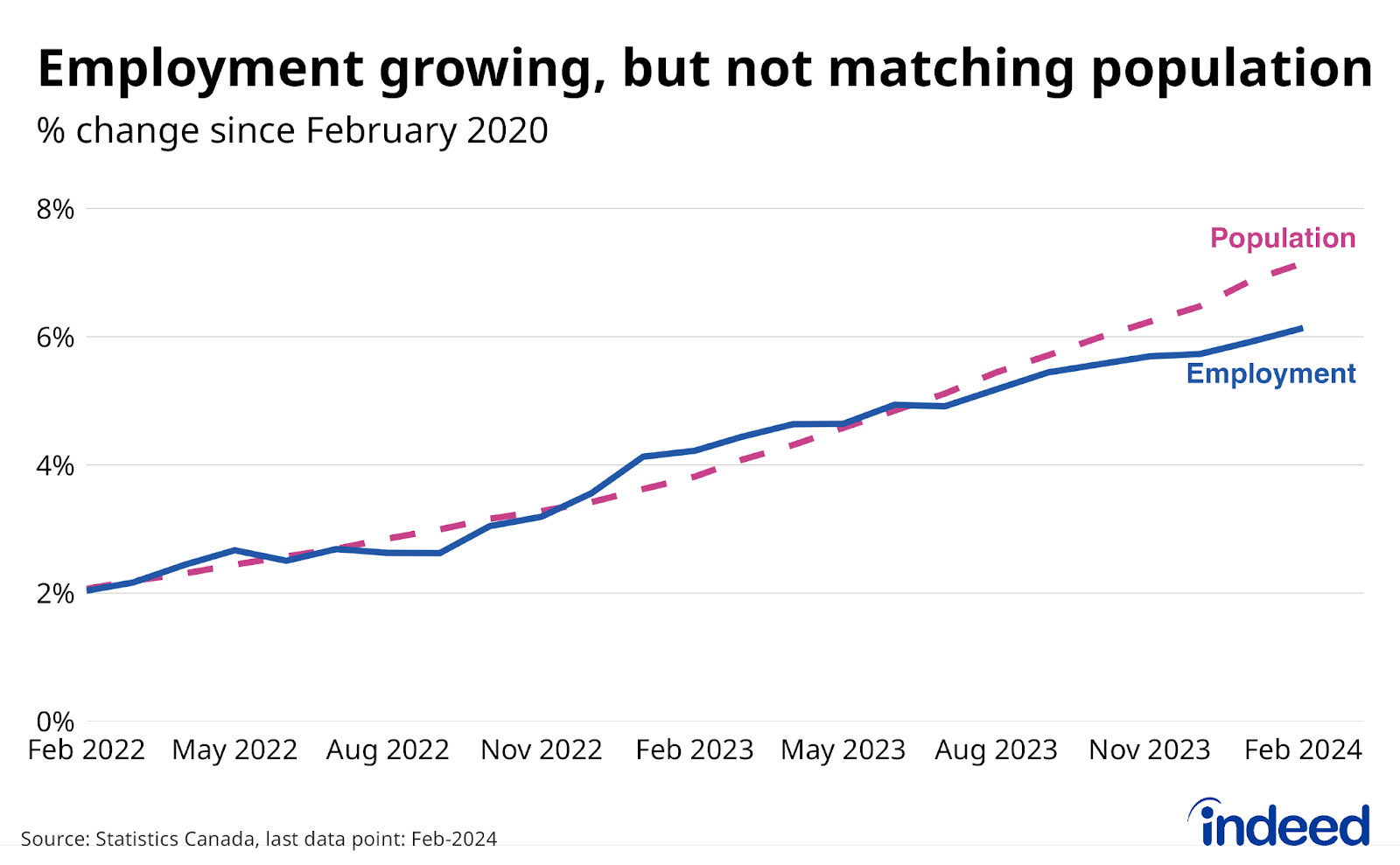

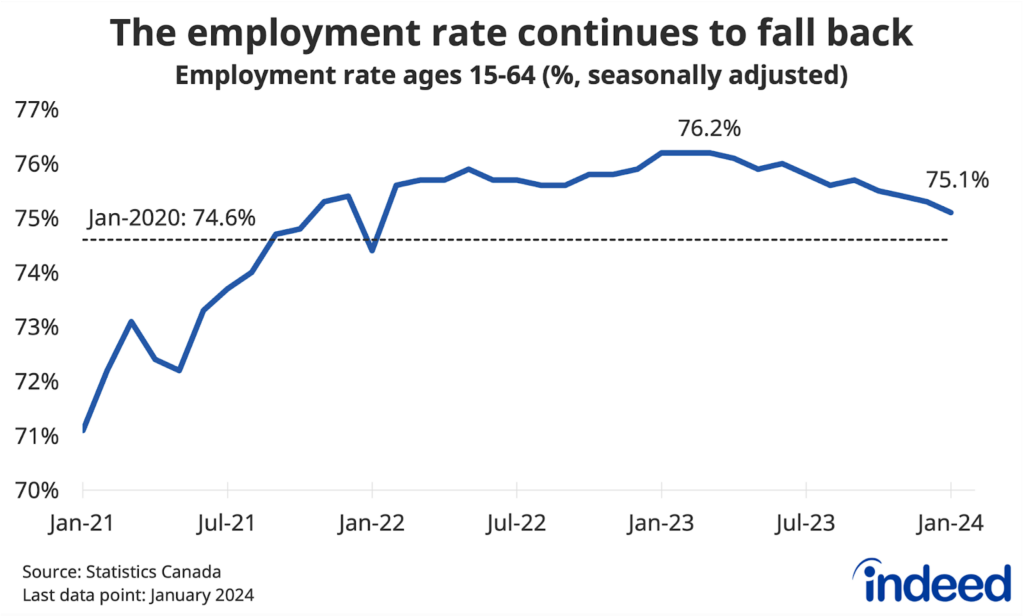

The Canadian job numbers remained remarkably consistent in February. Employment posted gains that historically would’ve been considered quite solid, but in the context of Canada’s soaring population, weren’t enough to keep the unemployment rate from ticking up. Nonetheless, the 5.8% jobless rate still suggests the labour market continues to hold on amid the current period of economic uncertainty. Hours worked didn’t quite match the gain in employment, but also moved higher.

Unfortunately, one trend that continued in February was a further slip in the youth employment rate; its seventh consecutive decline. The combination of cooler employer hiring appetite and soaring population growth from abroad has created a difficult situation for young entrants to the labour market. As a result, the share of 15 to 24-year-olds working was down 3.5 percentage points from a year earlier, compared to a more modest 0.7 point decline about 25 to 54-year-olds. One implication of the weaker youth job market is that fewer Canadians under 25 report having ever worked.

On the wage front, year-over-year hourly earnings growth ticked down, but to a still strong 5.0% pace. Other pay indicators, including advertised wages and salaries on Indeed job postings have eased recently, a potential sign that the solid wage gains in the LFS could also fade as the year progresses. Whether slower pay growth hits Canadian pocketbooks will in turn depend on whether inflation can maintain its downward path.