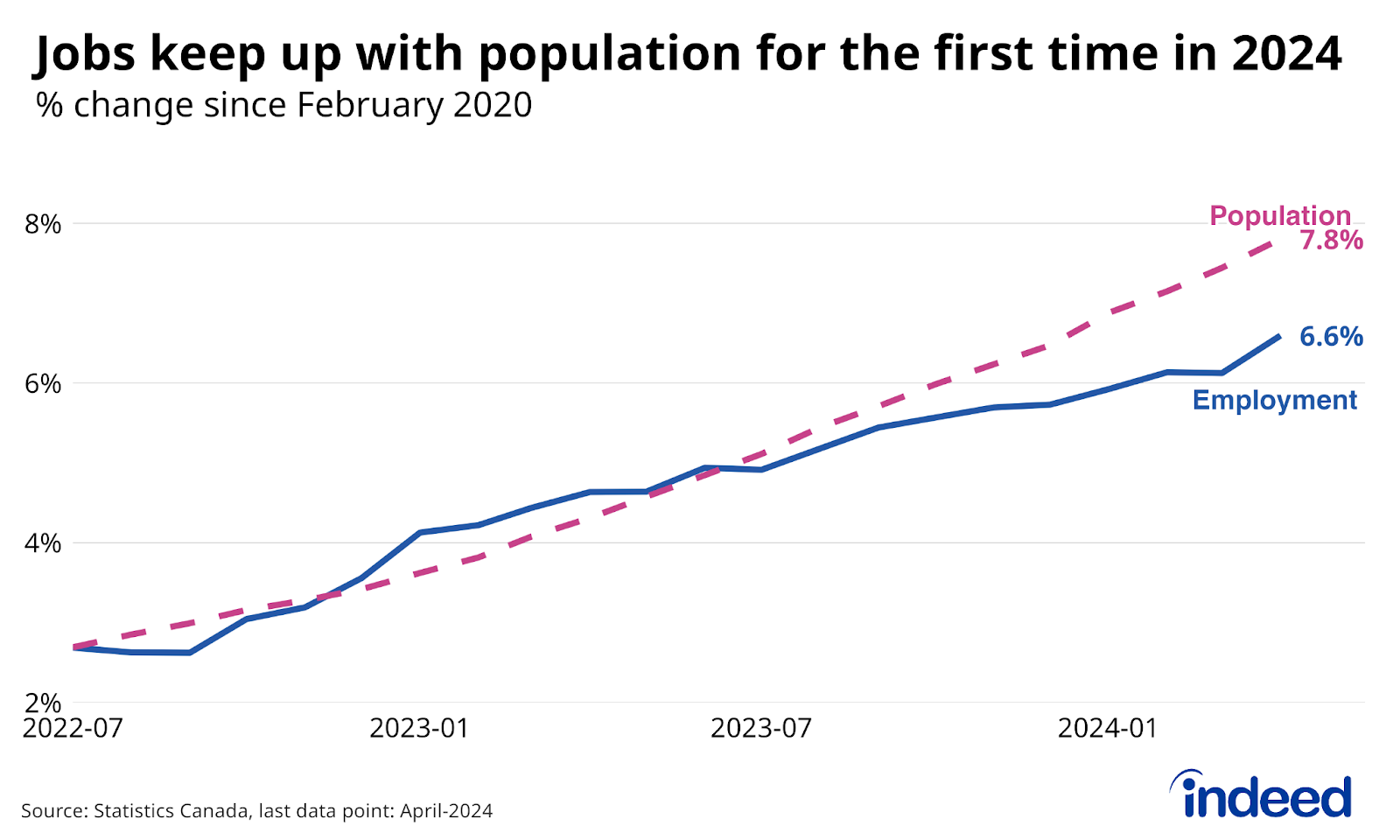

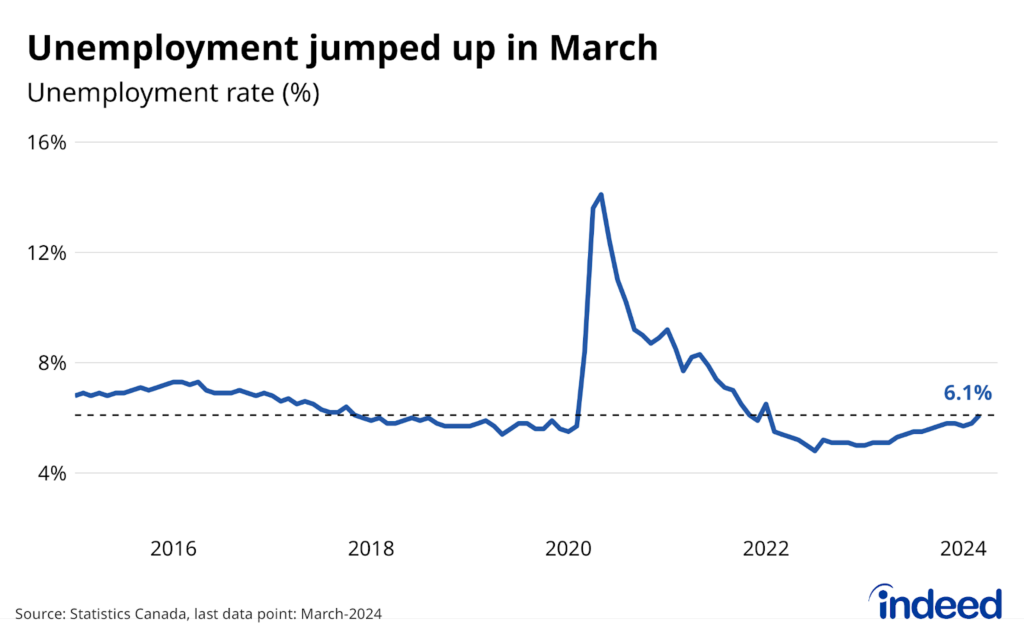

The start of spring brought some needed relief to the Canadian labour market. After a rough March LFS, which saw the unemployment rate rise above 6%, job growth in April made up for the earlier weakness. Hours worked also advanced nicely. The 90,000 increase was less impressive after factoring in rapid population growth — job gains had to hit 69,000 just to keep pace — and conditions have still clearly weakened over the past year. But the rise did soothe some concern that the job market had hit a negative turning point. This is consistent with recent job posting trends on Indeed, which have stabilized this year after sliding throughout 2023.

Looking at the details, the stronger-than-expected job numbers provided a bit of reprieve for the youth, whose employment rate clawed back some of the losses experienced in March. Nonetheless, the share of Canadians under 25 with a job is still well below where it stood a year ago, in contrast to the core-age (25-54) employment rate, which has eased modestly.

Headline wage growth slipped in April to its lowest year-over-year rate since last June, though remained at a brisk 4.7%. Nonetheless, this pace has been a bit of an outlier compared to other pay metrics. So far this year we haven’t seen much indication that the lingering elevated rate of pay gains in the LFS has prevented inflation from easing. Financial market reaction to the LFS was zeroed-in on the bounce back in job growth, with the Canadian dollar jumping on the news, amidst new doubts surfacing on whether the Bank of Canada will start cutting rates in June. However, given the typical monthly volatility of the LFS, the upcoming April CPI numbers will likely be more instructive of the Bank’s next move.