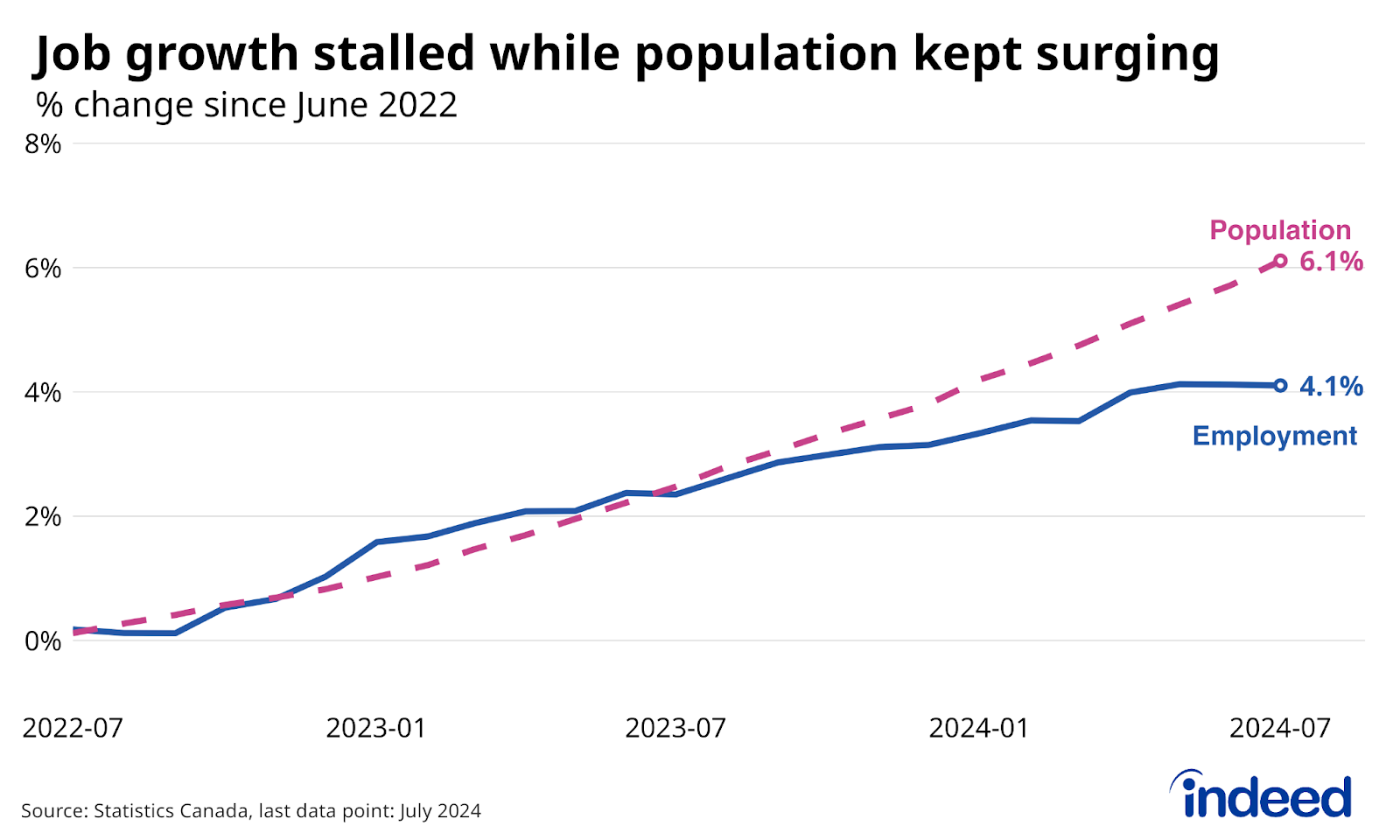

The hits to the labour market kept coming in July. Employment was flat, once again underwhelming in the face of rapid population growth. The unemployment rate held steady, in contrast to recent months, as weakness showing up in a lower labour force participation rate instead. Private sector jobs fell, led by a decline in wholesale and retail trade, offset by a bounce in the public sector. One brighter spot was a solid gain in total hours worked, likely helped by a rise in full-time employment, hopefully a sign that broader economic momentum is holding up better than the flat headline job numbers suggest.

The youth employment rate tumbled further in July, in keeping with recent trends. The rapid pace of population growth among those age 15-to-24 has far outpaced employer hiring appetite. However, older workers aged 55-to-64, who had been relatively insulated from the broader market weakening over the past year, also experienced a notable drop in employment rates in July. At the same time, while the direction in trends has been generally similar across demographics, comparisons to previous levels highlight how the labour market is sharply divided: youth employment rates are well below their 2017 to 2019 average, while both core-age (25-54) and 55-to-64 year old employment rates are still above.

Despite downbeat conditions, for those in stable employment, paychecks continued to grow briskly. Hourly pay is up 5.2% from a year earlier, somewhat disconnected from the weaker hiring situation. The LFS has been a bit of a high outlier across wage metrics, but relatively solid pay gains has shown up in the payroll data too. This is good news for the majority of Canadians who have a job, though elevated wage growth compared to the more downbeat macroeconomic situation could weigh on how much employers are looking to hire going forward. Meanwhile, wage growth appears to have shifted to the backseat in the Bank of Canada’s calculus, as the solid pace hasn’t precluded further cooling in the broader inflation rate.