The November job numbers threw a few curveballs. Employment growth came in surprisingly hot, keeping up with rapid population growth for just the second time in 2024. However, the details weren’t as strong. Private sector job growth was soft, with nearly all the net gains coming from the public sector, while total hours worked edged down.

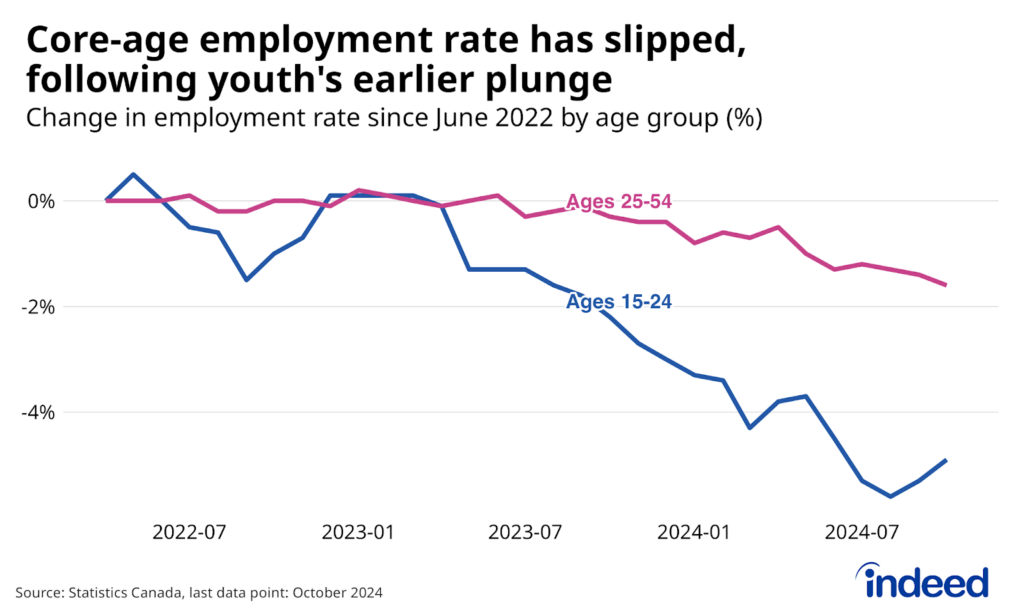

Most eye-catching though was a jump in the unemployment rate, to 6.8% from 6.5% in October. This change occurred despite a steady headline employment rate, but it wasn’t necessarily a sign of new weakness. Rather, the rise of the unemployment rate over the past year had understated how much the job market had deteriorated, as it occurred alongside declines in the labour force participation rate. Participation rebounded somewhat in November, and with more people on the job hunt — one of the requirements to be considered unemployed — the official jobless rate moved higher. As a result, the rise in unemployment doesn’t just reflect a drop in conditions in November itself, but rather highlights the steady weakening of the labour market in 2024 more generally.

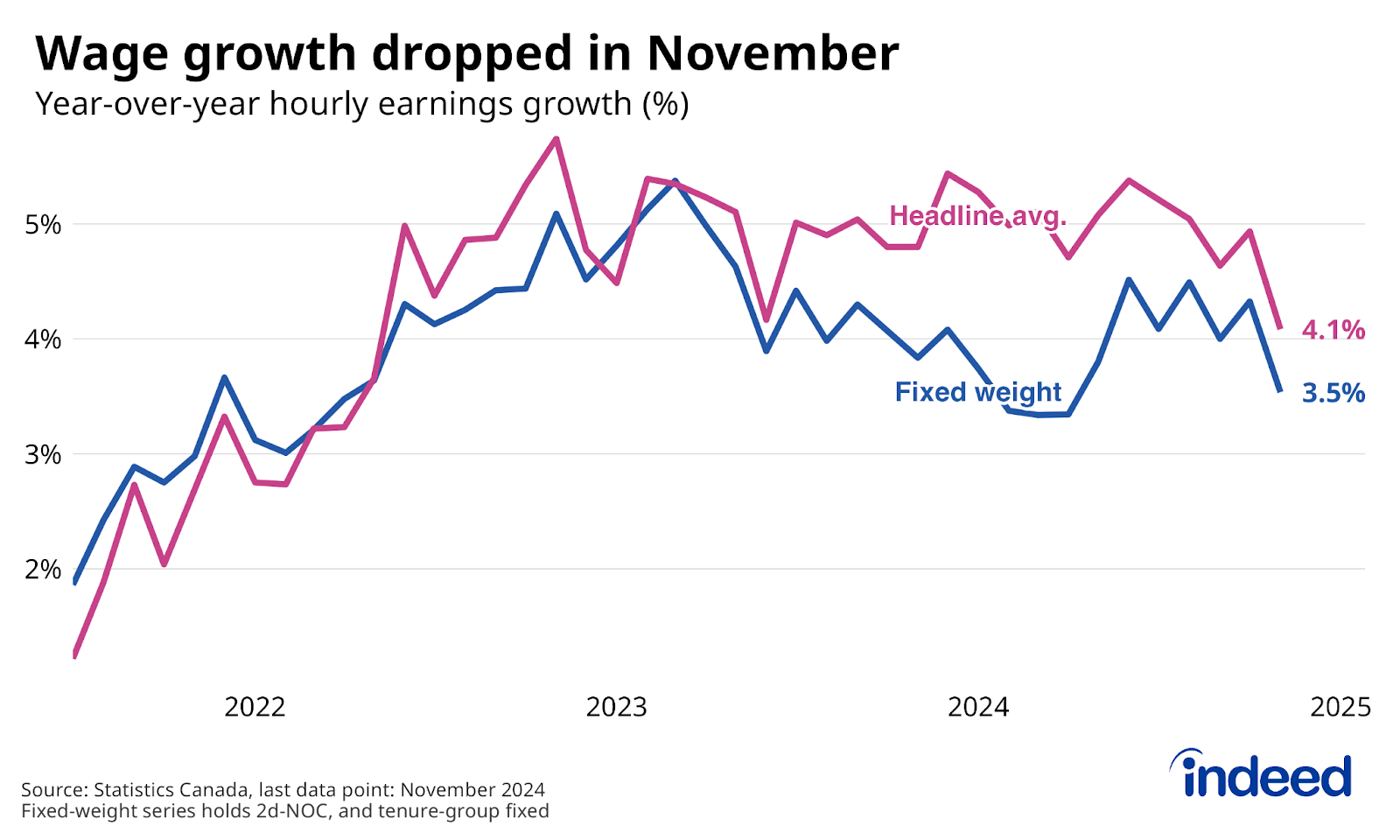

Wage growth also showed some shifts in November. Hourly earnings grew 4.1% over the past year, a notable step down from the near 5% pace prevailing recently. Wage growth hasn’t been this slow since May 2022, and it was striking how persistent elevated pay gains remained even as the labour market, and inflation, cooled. This could be a sign that one of the last remnants of the hot post-pandemic labour market is starting to fade, as a divergence between wage growth and the broader economy can only last for so long.