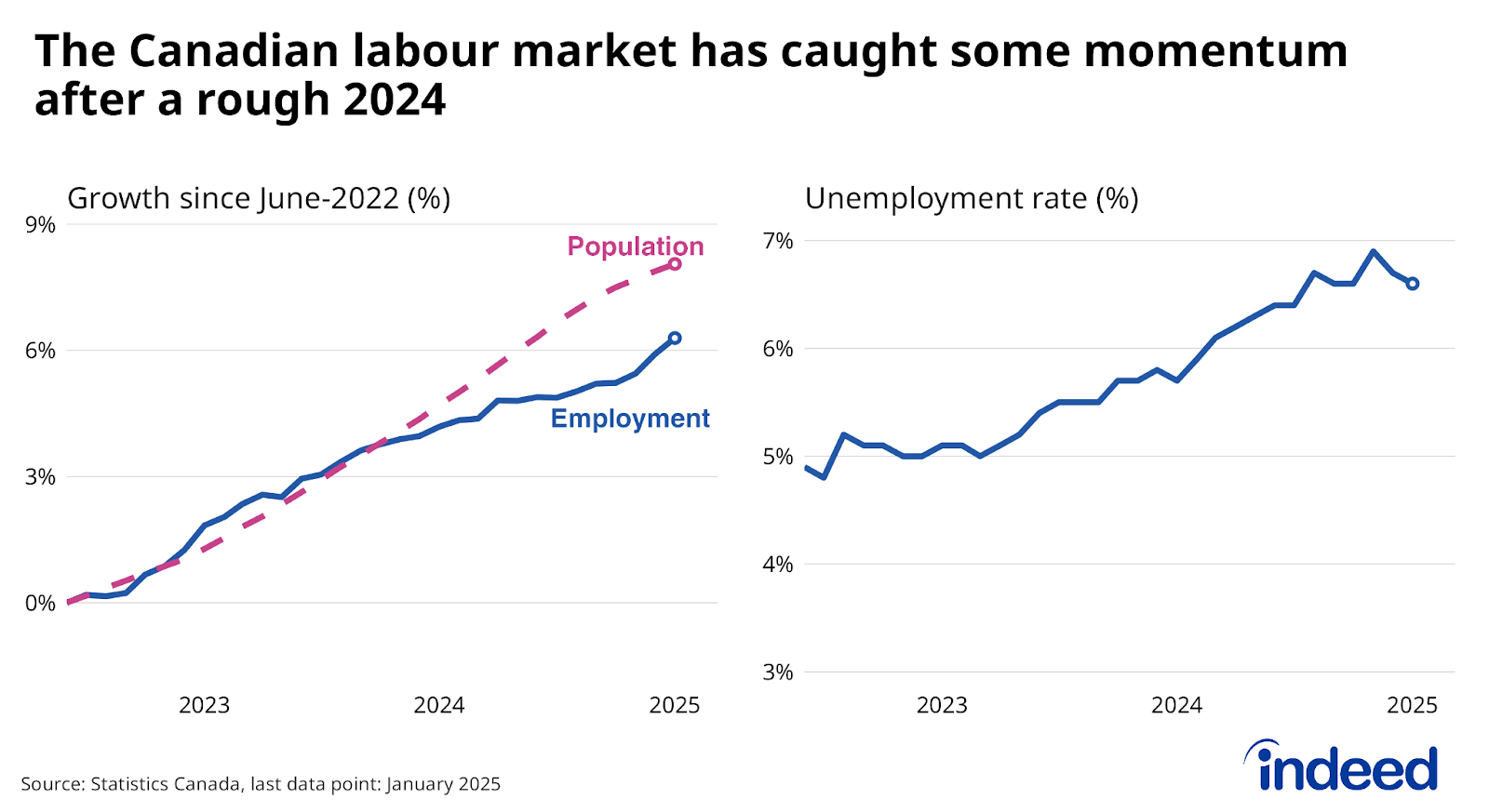

The labour market shrugged off the uncertainty swirling around the economy, kicking off 2025 with strong job growth for a second straight month. Like in December, employment gains outpaced population growth, translating into another dip in the unemployment rate, which went back to 6.6% after hitting 6.9% last November. The labour market has a ways to go before we start declaring it strong again, but the swing in momentum is still quite welcome, given the negative trends facing job seekers over most of 2024.

The details of the report were also generally positive. Hours worked rose even faster than employment in January, while job gains came from a mix of private-sector industries and an uptick in self-employment. Given the spike in tariff-related uncertainty, manufacturing was a surprising contributor to growth. That said, job postings on Indeed showed little sign of weaker hiring appetite in January, including in trade-exposed sectors. Still, the unresolved situation could prove a drag going forward.

In contrast to solid job growth, hourly wage growth continued to cool. Year-over-year wage growth slipped for a third consecutive month to 3.5%, its slowest pace since early-2022. With the tight post-pandemic labour market behind us and inflation back to normal, the drivers of nominal wage growth in recent years have faded. Advertised pay in job postings has grown even slower lately, averaging 2.8% in Q4, suggesting the trend will continue. This could ease pressure on employers’ payroll budgets, but also highlights how stronger economic growth is needed going forward to help Canadian workers get ahead.