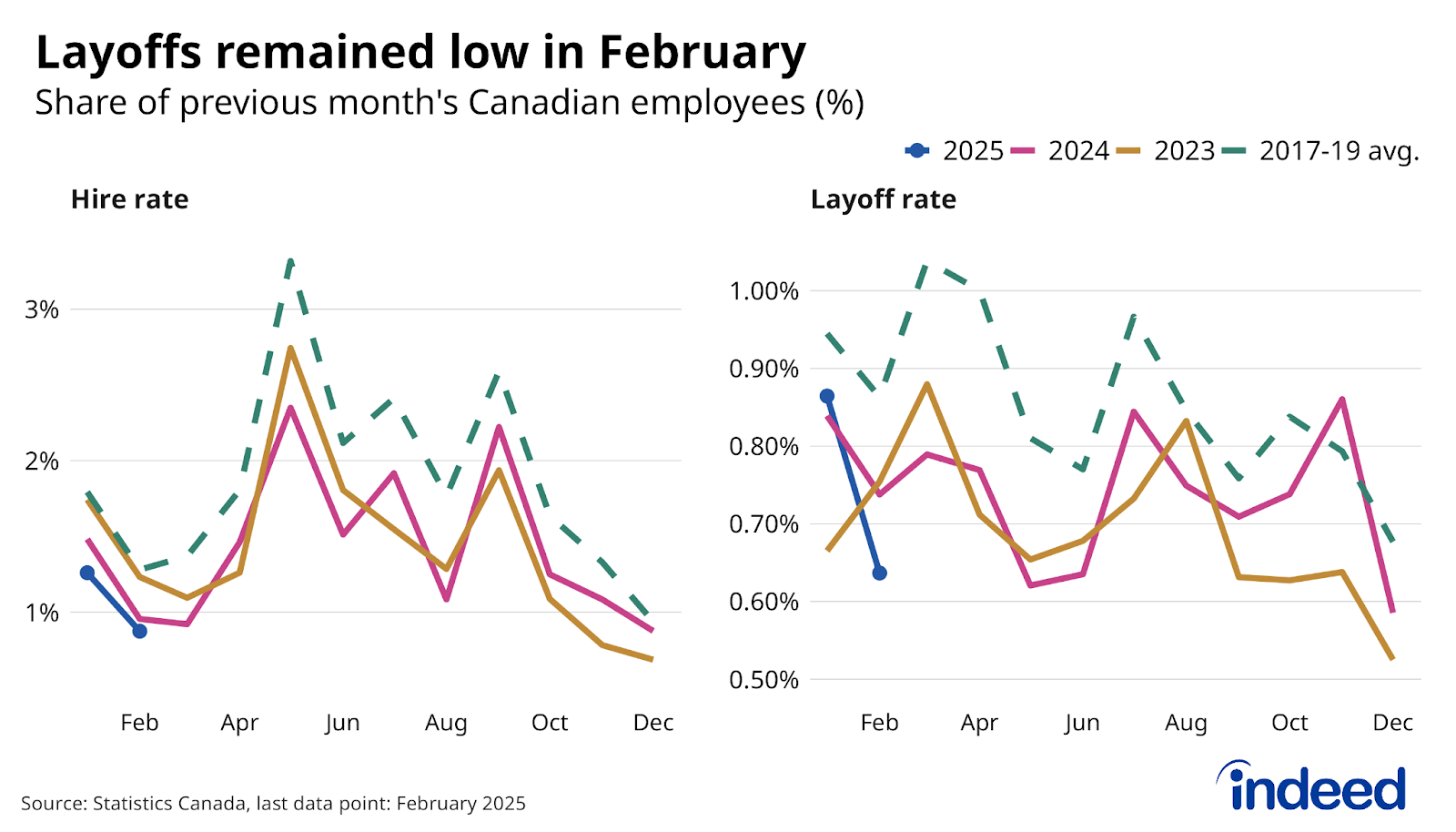

The labour market’s mini hot streak cooled in February, though it’s unlikely the prospective trade war directly caused the pause in job growth. Employment in the highly exposed manufacturing industry ticked down slightly, in line with most other sectors, while overall layoffs remained low, helping to keep the unemployment rate steady at 6.6%. For now, we’re still in the world of typical Labour Force Survey (LFS) monthly volatility. We’ll have to wait another month to see if the new era facing the Canadian economy is becoming evident in the job numbers.

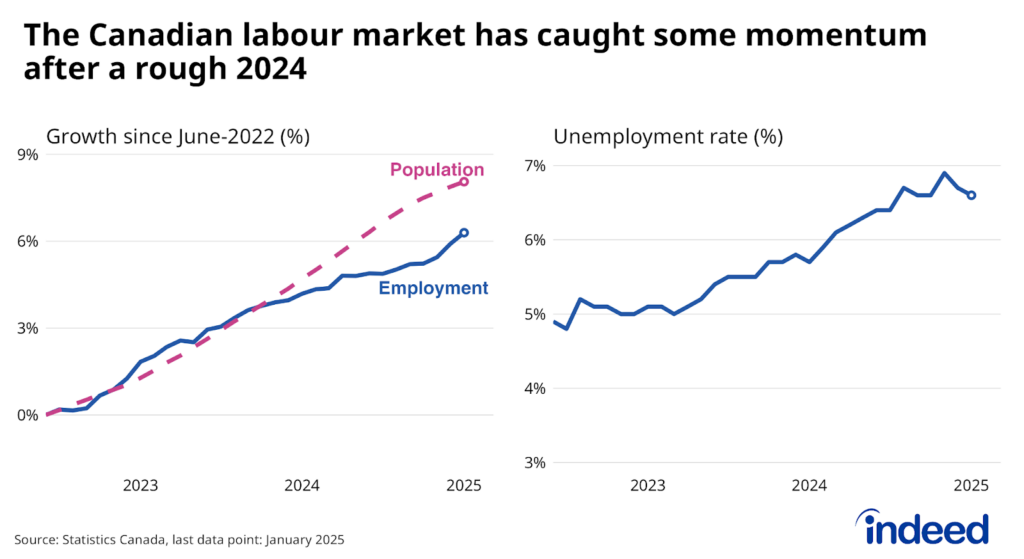

February’s employment growth slowdown also showcased another trend that’s fallen out of the spotlight recently: The pace of population growth is slowing. According to the LFS figures, the number of adults in Canada rose by 47 thousand in the month, far below last summer’s pace of over 100 thousand. Given that changes in LFS tend to lag other population data sources, it’s possible the actual change in employment may have been flatter than recorded in recent months, consistent with softer payroll recently reported in the Survey of Employment, Payrolls and Hours.

Meanwhile, wage growth bucked recent trends. Growth in average hourly earnings eased for three consecutive months heading into February, but perked up again, from 3.5% to 3.8% year-over-year. This trend isn’t a problem as long as inflation holds steady, but it’s vulnerable to the trade shock going forward, particularly if shocks in exposed sectors start impacting demand throughout the economy. Total Canadian job postings ticked down in February (-2.6%), not a dramatic shift, but were led by a 7.2% drop in postings for manufacturing and production occupations, a sign of the concerning outlook for the sector.