The summer heat didn’t stem the Canadian labour market’s steady cooldown. In a familiar pattern, lackluster job gains in August (+22,000) were easily swamped by rapid population growth (+96,000), an ongoing sign of deteriorating conditions. The wrinkle this month was that the labour force participation rate ticked up, and as a result, the unemployment rate rose 0.2 percentage points to 6.6%, the highest outside of the pandemic since the first half of 2017. Details underneath the headline number were also weak, as the net increase came from part-time jobs, while total hours worked slipped during the month.

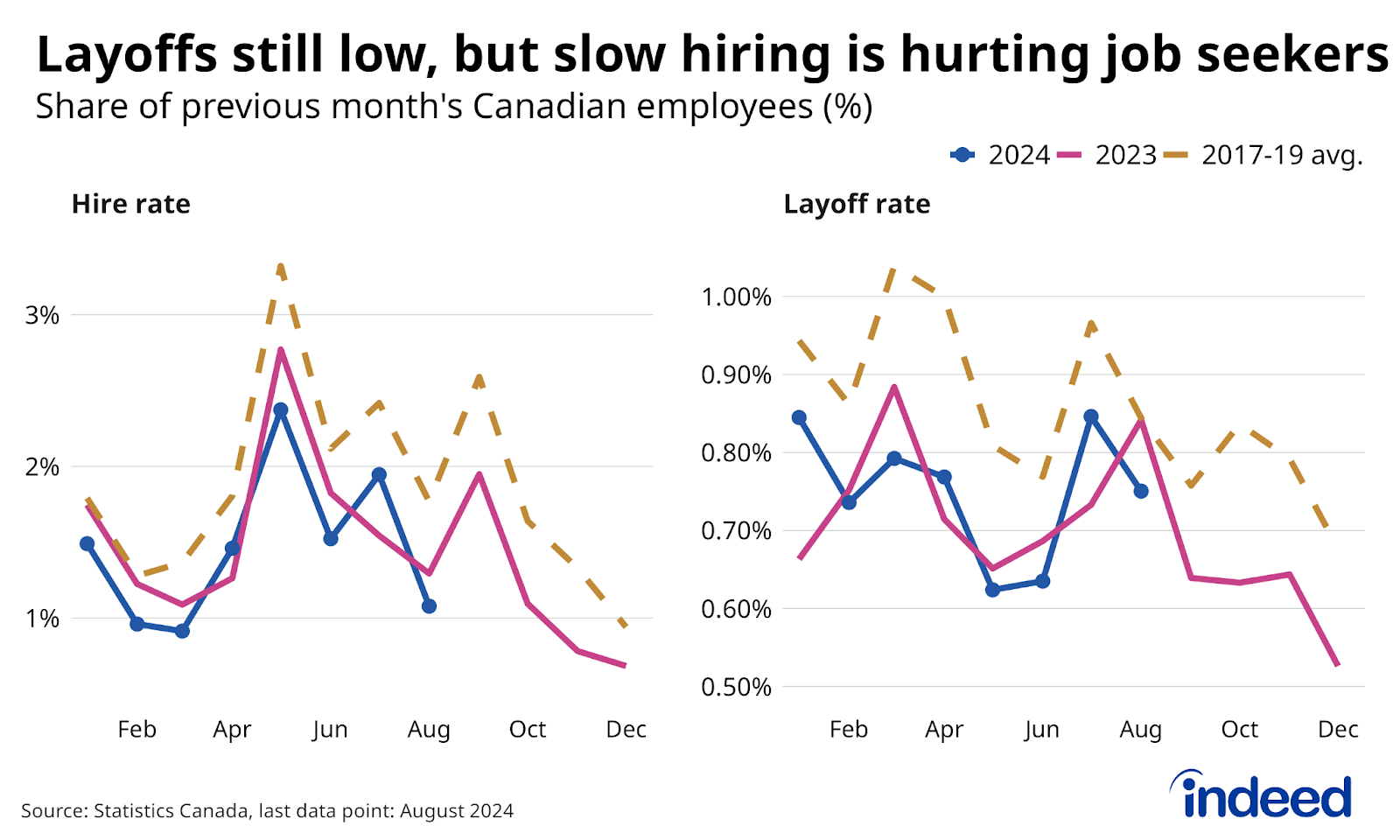

Weak hiring continues to drive the downbeat numbers. The Canadian hiring rate remained low in August, as it has all year. However, the tough market for job seekers hasn’t particularly impacted job security, as layoff rates also held low. The dichotomy between the two has meant the impacts of the labour market downturn have been particularly sharp on groups more on the margins of employment, while those in stable jobs are faring better. Among the consequences was a particularly challenging summer job market for returning students.

Wage growth held strong in the August job numbers, once again seemingly disconnected from the broader labour market softening. While the year-over-year pace of hourly earnings growth ticked down, it remained at a still-elevated 5.0% rate. Wage growth among youth was similar to the headline average, particularly striking given their jump in unemployment. Focus on paychecks has taken a back seat in recent months, not only because of the weaker headline job numbers, but also because strong wage gains haven’t precluded inflation from easing, nor the Bank of Canada from cutting rates.