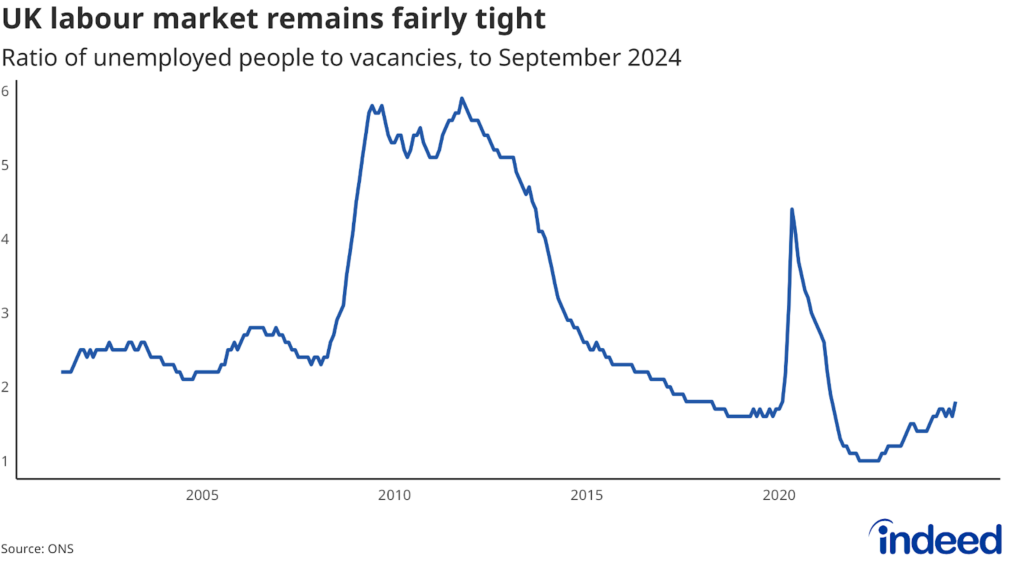

The Office for National Statistics (ONS) figures showed familiar trends in December, marked by further cooling in the labour market alongside stubbornly strong wage growth. Vacancies declined further in December, while there was a second consecutive monthly fall in payrolled employment. The unemployment rate ticked up to 4.4%, though this measure continues to be plagued by data quality issues.

Wage growth remains the key labour market metric for the Bank of England. The latest figures showed average regular earnings rising 5.6% year-on-year in the three months to November, up from 5.2% in the period to October. Though good for workers seeing real-terms pay growth of 2.5% year-on-year, wage growth remains well above levels consistent with keeping inflation sustainably at the Bank of England’s 2% target. A soft labour market and lower headline inflation will likely weigh on wage growth this year. However, its current stickiness makes the Bank unlikely to deviate from its gradual approach to interest rate cuts any time soon, even though cuts could stimulate an economy that stalled in late 2024.

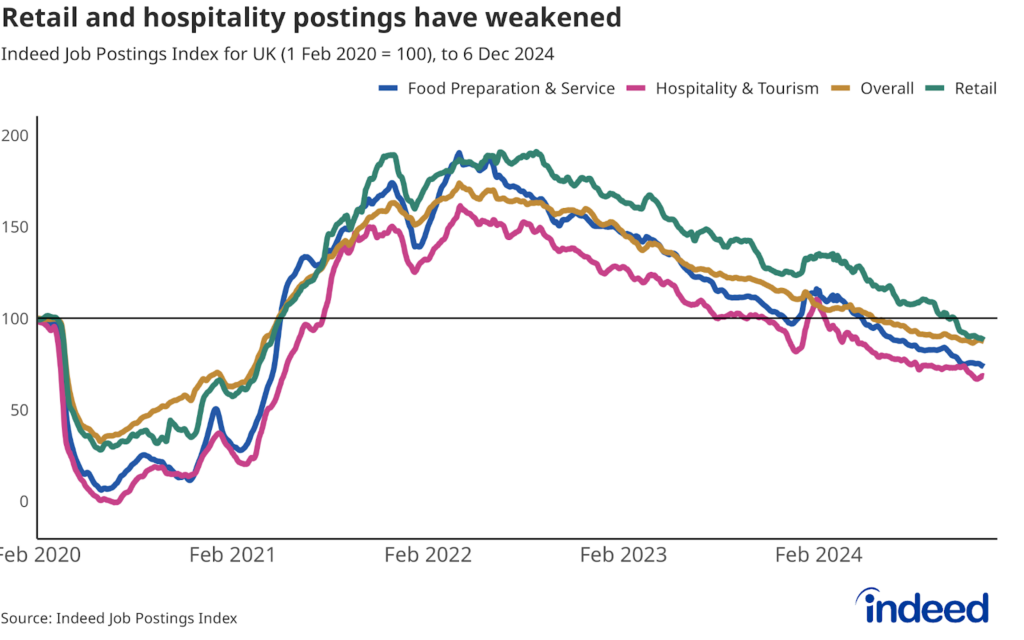

The spectre of stagflation lingers, with businesses still to absorb April’s increase in labour costs as a result of the Budget, which is likely to drive some combination of price increases and cost reduction measures. Even if warnings of layoffs don’t come to pass, hiring faces stiff headwinds (with Indeed’s UK Job Postings Index almost 15% below its pre-pandemic level in early January), while some firms may be looking to reduce permanent headcount through attrition. With the Chancellor under pressure to boost confidence and lay out pro-growth reforms, businesses will likely remain cautious for now.