Key Points

- Clicks on HGV driving jobs from overseas jumped 307% after the government announced temporary visas, driven mainly by jobseekers from outside the EU

- Demand for HGV drivers in the UK is high, with postings up 73% from their pre-pandemic level as of 24 September 2021 (48% seasonally adjusted)

- Annual salaries in postings for HGV drivers are up 19% this year as a result of hiring challenges – 14 times more than the 1.3% growth across all jobs, adjusted for composition. Meanwhile, mentions of signing bonuses in job adverts increased tenfold since late May

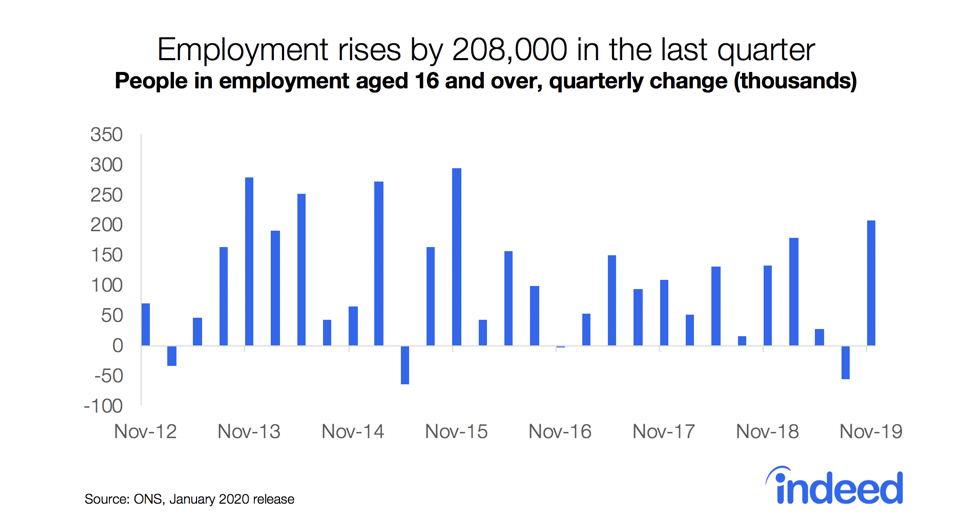

Panic buying of fuel amplified by driver shortages led the Government to announce temporary visas for HGV drivers and other workers. Indeed’s data on daily jobseeker activity shows clicks on UK driving jobs from foreign jobseekers surged following the announcement. The increase was larger for jobseekers outside the European Union. This suggests the visas could be filled with non-EU workers, as long as their qualifications are recognised.

Rise in clicks on HGV driving jobs from abroad

In the week to 28th September foreign jobseekers’ share of clicks on HGV driver job postings in the UK jumped 307% from 2.5% to 10.2%, a quadrupling from the usual interest level. The surge was driven mainly by jobseekers from outside the EU, whose share of clicks increased 627% from 0.9% to 6.5%. It appears to have been prompted by the visa announcement because clicks on non-driving jobs stayed flat.

The largest increases were from India, UAE, South Africa, Poland and Nigeria, followed by Saudi Arabia, Italy and Ireland. Most HGV drivers in non-EU countries will not have the right to work in the EU and may find the offer of UK visas attractive if their qualifications are accepted.

Last year we saw a similar surge in job searches from Hong Kong, followed by a rise in visa applications, when the Government created a special entry route for some Hong Kong residents.

The rise in clicks from EU jobseekers (albeit smaller and waning) may come as a surprise to many. The media reported widely on the negative views some European drivers hold about working conditions in the UK. Moreover, demand for HGV drivers is high all over Europe. This means that qualified EU drivers have many opportunities in their home countries or elsewhere within the EU without needing to apply for a British visa. Among Europe’s five largest economies, as of 24 September postings for HGV drivers were 45% above their pre-pandemic level in France, 67% in Germany, 95% in Spain and 105% in Italy, compared with 73% in the UK. The smaller rise in Poland (15%) and lower wages may explain the rise in interest from Polish jobseekers.

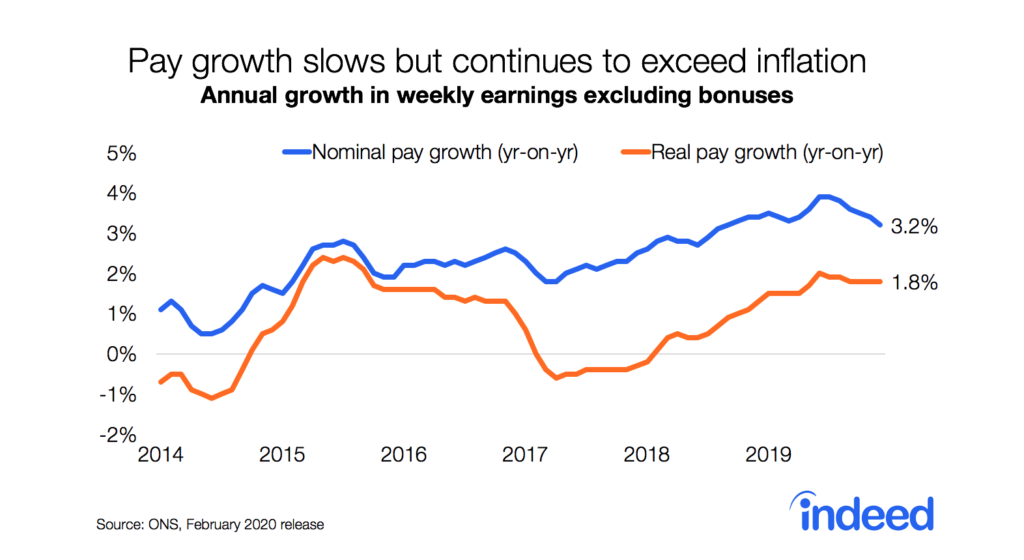

Driver pay has surged

Pay is one factor that is probably attracting some foreign jobseekers to driving jobs in Britain, despite challenging working conditions and visa-related paperwork. Between January and September 2021 the median hourly wage for HGV drivers in job postings on Indeed in the UK increased 15% from £13.05 to £15.00, while the median annual salary advertised in postings increased 19% from £30,000 to £35,600. Some HGV driver jobs offer even higher pay and a growing proportion offer signing bonuses.

Average increases for HGV drivers are 14 times larger than what we observe in the wider jobs market. Adjusted for compositional changes, pay in all job postings has risen just 1.3% over the same period.

HGV driver pay is higher in the UK than in Southern and Eastern Europe

HGV driver pay in the UK is higher than in Southern and Eastern Europe or in countries on the EU’s periphery. But employers hoping to recruit drivers from within the EU face tough competition from Western European countries, where both demand for new drivers and advertised salaries are relatively high.

We compared the salaries advertised in job postings for drivers on Indeed in the UK and the EU’s six largest economies from 1 January to 24 September 2021. Some postings specify an hourly wage, while others list a monthly or annual salary, so we looked at each frequency separately. Due to small sample sizes in some countries, we looked at all driving jobs.

The median advertised hourly rate for drivers was £12.10 (€14.05) in the UK, higher than in the Netherlands, Germany, France and Spain (there’s little hourly wage data available in job postings in Italy or Poland).

However, when we look at job postings that specify monthly salaries – which is more common on the Continent than in the UK – the median was £2,000 (€2,321) in the UK, higher than in France (€1,925), Spain (€1,600), Italy (€1,500) and Poland (€970), but lower than in the Netherlands (€2,400) or Germany (€2,500), Finally, when we look at job postings that list annual salaries, the median is £28,750 in the UK (€33,365), comparable with Germany (€32,500) and higher than France (€22,500) or Spain (€17,925) There’s little annual salary data for the Netherlands, Italy or Poland.

There are several things to keep in mind when analysing these data. First, the figures are for all driver job postings, not specifically for HGV drivers, who are usually paid more than van or delivery drivers. Second, in some countries, like Germany, postings are much less likely to include explicit information on salary than in the UK, so data for those countries may be less representative. Third, the composition of driving jobs that contain salary information might vary across countries. For instance, data in some countries might be less skewed towards highly paid HGV driver roles than in others. These factors can impact comparisons.

However, a quick check using data from the Structure of Earnings Survey published by Eurostat confirms UK pay levels are attractive relative to Southern and Eastern Europe, though not as much compared to many Western and Northern European countries. Latest available figures for the transportation and storage sector in 2018 showed mean gross annual earnings were €39,863 in the UK, slightly higher than in France (€37,375) and Germany (€36,213), but lower than in Denmark (€66,683), the Netherlands (€46,015) or Ireland (€44,987). While these figures are sector-wide and do not take into account the latest UK increases, they do suggest the UK faces tough competition from high-income European countries for EU-based drivers.

But drivers who don’t have the right to work in the EU may find the UK’s offer attractive. The same Eurostat data show average annual earnings in the transportation and storage sector were just €9,836 in Turkey, €7,498 in Serbia and €5,106 in Albania. While drivers from these non-EU countries will certainly consider the UK’s high cost of living, tough working conditions and the temporary nature of the visas, high British salaries and joining bonuses are likely to be a magnet for many, as long as their qualifications are accepted.

The 5,000 temporary visas will not be a silver bullet for the driver shortage, as some estimates put the UK’s needs at 100,000 additional workers. Better schedules, more training and even higher pay may be needed to attract more people to a career as an HGV driver.

Methodology

We calculated the shares of clicks on job postings from the EU and countries outside the EU, based on the IP location of the jobseeker. We include Switzerland and countries in the European Economic Area in the EU figures.

Wage and salary data are extracted from job postings. When a range is mentioned, we use the midpoint of the range. We excluded wages expressed as “up to” or “from” a certain amount since it was not possible to identify the full range in those cases. Pay growth for all job postings is adjusted for shifts in the composition of job titles and locations, consistent with our recent analysis.

All job posting growth figures in this blog post are the percentage change in job postings since 1 February, 2020, using a seven-day trailing average. 1 February, 2020, is our pre-pandemic baseline. For the seasonally adjusted figure at the beginning of the post, we seasonally adjusted the posting series based on historical patterns in 2017, 2018, and 2019.

Information on job posting trends and wages/salaries advertised in job postings is based on publicly available information on the Indeed website in the UK and any other countries named in the post, is limited to the UK and those countries, is not a projection of future events, and includes both paid and unpaid job solicitations.