Key Points:

- Spotlight: Growth of advertised pay picked up to 4.5% year-over-year in March, but continues to lag consumer price inflation.

- Job postings remain high but have stopped rising.

- Still no sign of a pickup in active or urgent job search despite rising cost of living.

Employment remains below pre-pandemic levels while job postings have plateaued

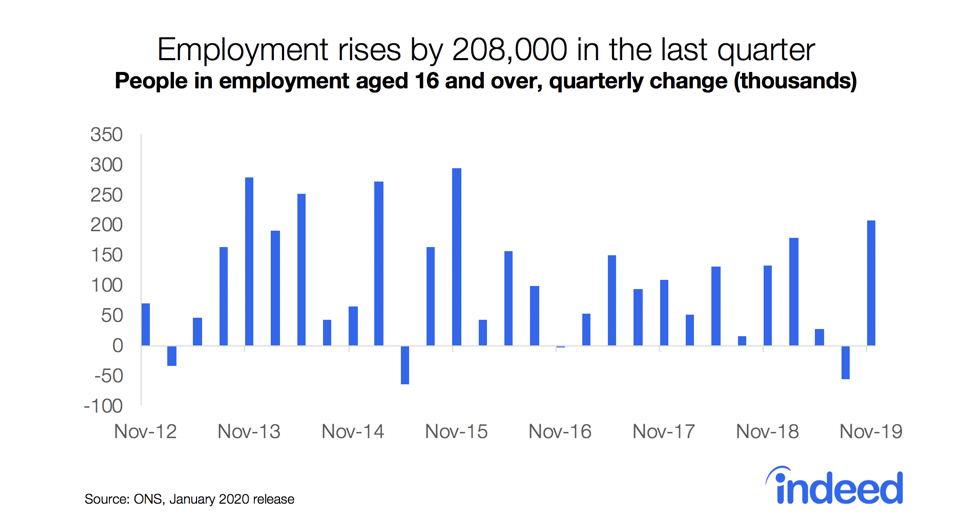

The UK labour market recovery has stalled recently. The latest Office for National Statistics (ONS) data show that the headline employment rate was unchanged at 60.6% in February, with the single-month figure dropping to a three-month low of 60.4%.

Meanwhile, UK job postings on Indeed remain high, but have plateaued. Postings were 46% above the 1 February 2020, pre-pandemic baseline, seasonally adjusted, as of 22 April 2022. That’s down slightly from a post-pandemic high of 50% in mid-February 2022, with little variation in the headline measure since then. Amid rising uncertainty over economic prospects and a severe squeeze on household incomes, employers appear to have eased off the gas. But amid widespread worker shortages, many employers still have substantial staffing gaps to fill.

Spotlight: Wage growth picking up, but lagging consumer price inflation

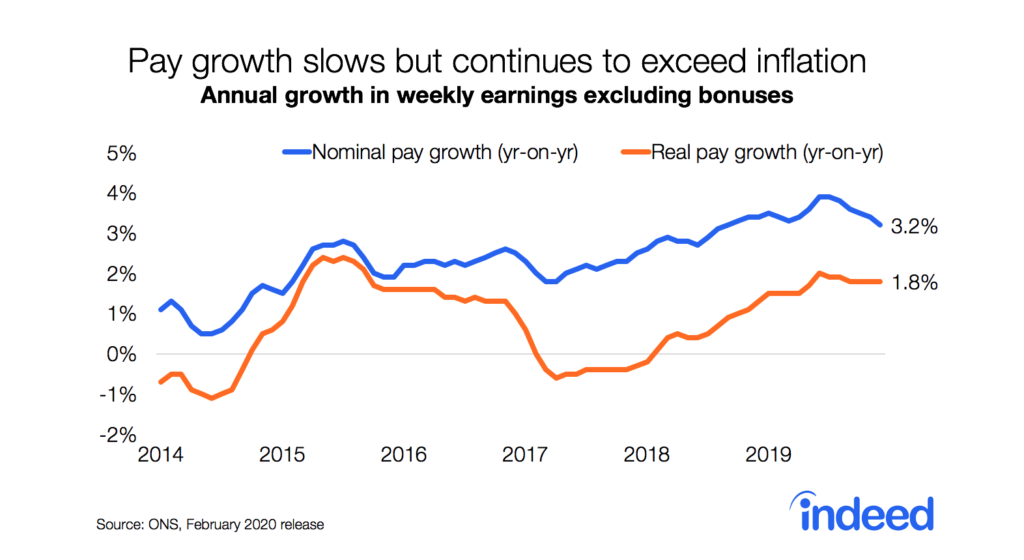

Obtaining a pay rise to offset rising living costs is likely to be top of mind for many workers. Advertised wages in job postings picked up in March, with the rate of growth quickening from 3.3% year-over-year to 4.5%.

ONS data showed that growth in average total pay was 5.4% y/y in the three months to February, boosted by strong bonuses. Growth in regular pay (excluding bonuses) was less marked at 4.0%. But pay continues to lag behind consumer price inflation (6.2% on the CPIH measure in March), which is set to spike even higher in the coming months.

The biggest pay increases continue to be centred on those occupations which have been experiencing the most acute worker shortages, including hospitality, construction and driving. Workers in those sectors have been able to take advantage of strong demand for their services to obtain higher pay. But other categories where conditions haven’t been as hot have seen only modest pay growth.

According to our March survey, looking for higher pay was the top reason people were searching for a new job. But other aspects of jobs are also valued by jobseekers, with career development, benefits, flexibility and the ability to work remotely also highlighted. Focusing on these aspects could help with attraction for employers who are struggling to hire.

Labour supply remains tight amid high inactivity

While labour demand remains elevated, labour supply is still tight. The unemployment rate dropped to 3.8% in February, matching its 2019 pre-Covid low. That’s despite total employment remaining half a million below its level on the eve of the pandemic. That gap is explained by a 490,000 rise in the number of economically-inactive working age people, with the impact among the over 50s being particularly striking. Meanwhile, ONS data show that long-term sickness is now the biggest reason for inactivity, having risen almost 230,000 since the start of the pandemic.

The latest ONS data show vacancies at a record 1.3 million, while the unemployment rate dropped to just 3.8% in February, matching its pre-pandemic low. That means there is just one unemployed person per vacancy, the lowest ratio in decades. So even if vacancies slow, the market is starting from a position of extreme tightness.

Our most recent Indeed Job Search survey showed that just 7% of respondents were urgently searching for a new job in March, with a further 16% not urgently searching. That’s the second-lowest total active job search share since the survey began in July 2021. Search urgency remains muted among both the employed and the jobless.

While we’re seeing little evidence of it happening yet, one factor that could start to draw people back from the sidelines is the squeeze on household incomes. Financial cushions that had been accumulated by some households through lockdowns will be eroded faster by high inflation, while those who had been getting by on a partner’s income could find it harder to do so.

Summary

The UK labour market continues to provide lots of opportunities for workers while presenting challenges to employers. However, the balance could start to change as economic conditions evolve. We will continue to monitor the above trends and track others as this happens.

We host the underlying job-postings chart data on Github as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post was published.

Methodology

All figures in this blog post are the percentage change in seasonally-adjusted job postings since 1 February, 2020, using a seven-day trailing average. 1 February, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. We adopted this methodology in January 2021.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.