The UK labour market continues to gradually cool, and hiring conditions are likely to continue to gradually ease in 2024, as the labour market rebalancing proceeds.

Vacancies fell for a 17th consecutive period in the 3 months to November, and are now down 27% from their peak, though remain above pre-pandemic levels, according to official data. The unemployment rate was stable at a still fairly low 4.2%, while employment and inactivity were also unchanged (though these estimates continue to have only ‘experimental’ status).

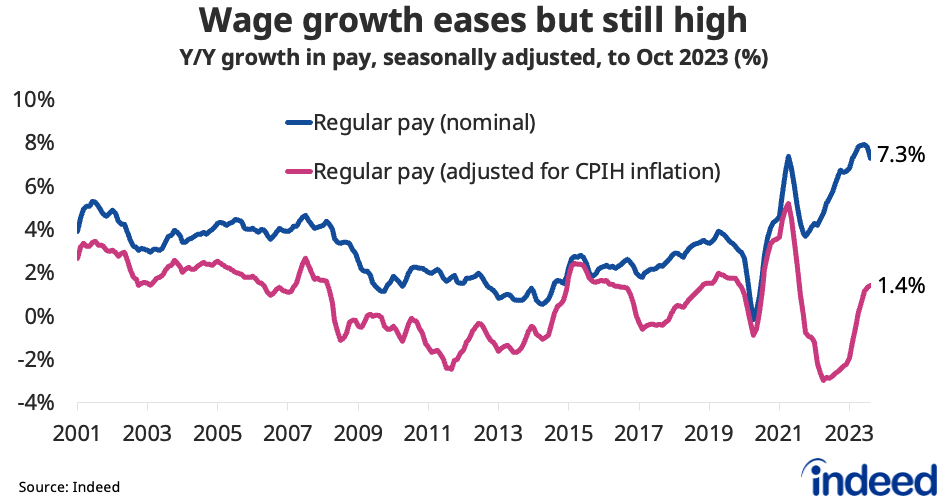

The latest figures showed regular pay growth easing but remaining very high at 7.3% year-on-year. Wage growth remains one of the key metrics for Bank of England rate-setters, and its persistence into 2024 will be key in helping determine the timing of any future monetary policy easing.

More timely evidence from the Indeed Wage Tracker shows wage growth for new hires cooling further in November, to 6.7% year-on-year, down from a peak of 7.4% in June. But pay pressures remain far stronger in the UK than in both the US (4.0%) and euro area (3.7%). These differences in the rate of pay growth are a key reason why the US Federal Reserve and the European Central Bank are both expected to cut interest rates sooner than the Bank of England, despite a relatively weaker UK growth outlook.