- The UK’s gross domestic product (GDP) contracted by 0.3% in the three months to December, following a 0.1% decline between July and September, according to official data.

- The Office for National Statistics (ONS) said the economy grew 0.1% across 2023 compared with 2022. The Bank of England forecasts output will pick up slightly in 2024, but only to 0.25% growth.

News that the UK economy slipped into recession in the second half of last year will raise the volume on talk of when the Bank of England will start cutting interest rates. But as ever, the GDP figures are of secondary importance in this respect, as rate setters remain focused on services inflation and wage growth to guide them. Concerns over stubbornly high wage growth in particular are the main obstacle to rate cuts, with the MPC stressing the need for more evidence that wage growth is falling towards levels consistent with inflation remaining sustainably at target.

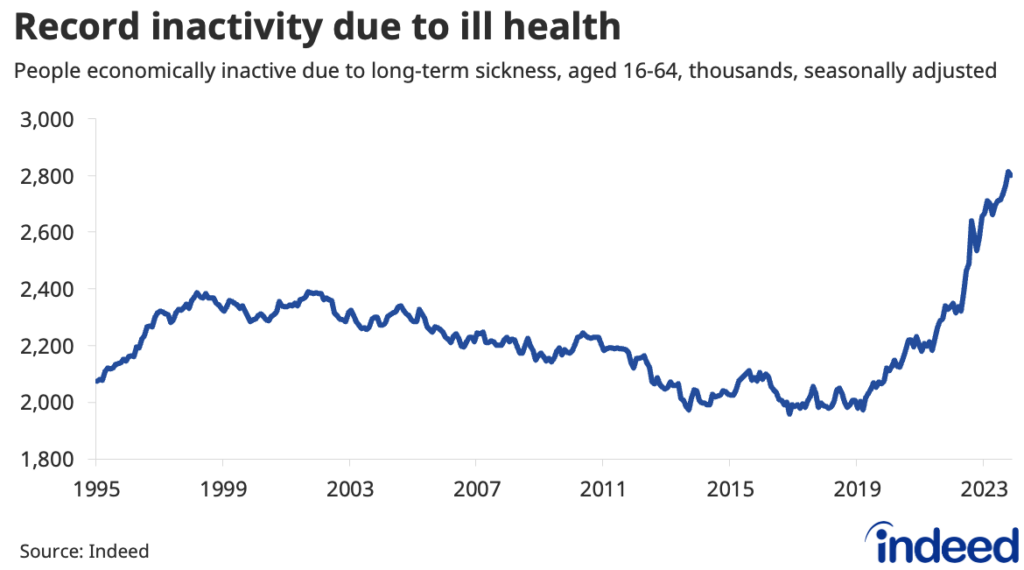

The latest wage growth figure from the ONS was higher than expected, while data from the Indeed Wage Tracker shows that annual growth in advertised pay for new hires was running at 6.4% in January. Though down from last year’s peak above 7%, UK wage growth as measured by Indeed is still well above equivalent measures for the euro area (3.9%) and US (3.6%). With labour supply constraints appearing more of an issue in the UK than elsewhere, stubborn pay pressures are a key reason why the Bank of England may need to maintain high rates longer than the ECB and Fed.