Key Points:

- Labour demand has slowed considerably, but labour supply remains somewhat tight.

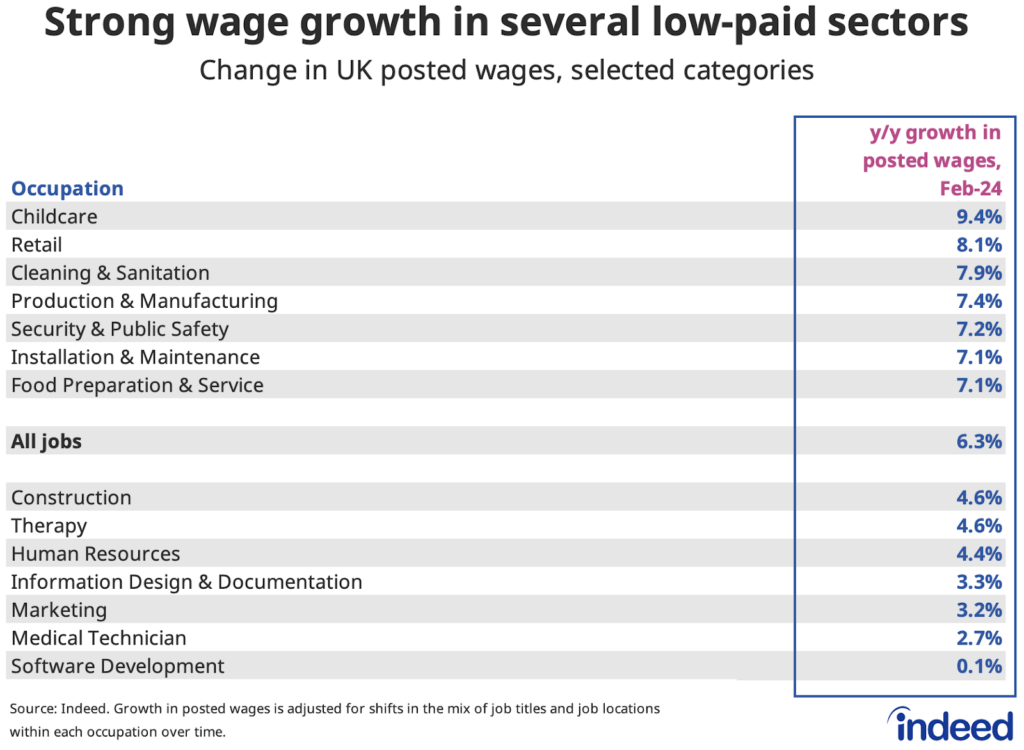

- That’s supporting still-robust wage growth, particularly in low-paid and in-person categories.

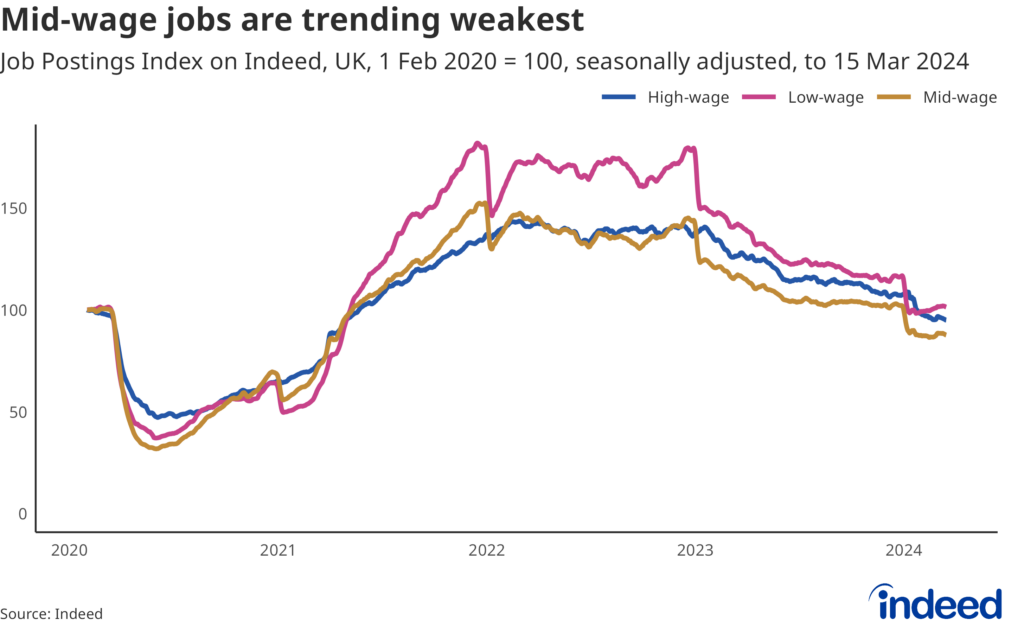

- Mid-wage job postings have seen the biggest decline from pre-pandemic levels.

The labour market continues to normalise, inflation is falling and the economy is moving in a direction that suggests the Bank of England may soon be able to begin cutting key interest rates that may spur more economic growth. But we’re not there yet, and policymakers will need to see further evidence that persistently high wage growth, in particular, won’t lead to a resurgence of inflation.

Spotlight: Mid-wage job postings are trending weakest

As the labour market has cooled, we have seen a broad-based retreat in UK job postings, which are now 7% below their immediate, pre-pandemic 1 February 2020 level. The decline in job postings overall appears to be largely driven by outsized declines in middle-wage jobs. Job postings for mid-wage jobs are 12% below their pre-pandemic baseline. High-wage job postings are down just 5% from the same period, while low-wage postings are 1% above the baseline.

Fields in this middle-wage tier include human resources, real estate, construction, insurance and IT support, which have been hit by slowdowns in the recruitment, financial, property and tech sectors. While certain high-wage categories like software development and banking & finance have also been affected by these trends, less cyclical occupations in the high-wage category including physicians & surgeons, medical technicians and education & instruction have held up better.

And even though low-wage postings are pacing best relative to pre-pandemic levels, they are still down substantially after peaking around 80% above pre-pandemic levels in late-2022 (a much higher peak than observed for mid- and low-wage postings). Despite this slowdown, many employers hiring for low-wage jobs continue to experience challenges in filling open roles and are having to raise pay to do so. Posted wage growth in categories like childcare, retail, cleaning and hospitality is currently running in the 7-9% range year-on-year. That’s ahead of a 9.8% increase in the National Living Wage due to come into effect on 1 April.

Labour Market Overview

The latest ONS figures paint a familiar picture of gradual softening in the labour market and easing pay pressures, but it remains an incremental process. Vacancies continued to fall from highs, down 43,000 in the three months to February, but remained above pre-pandemic levels at 908,000. Regular pay growth edged down from 6.2% to 6.1% year-on-year in the three months to January, but remains elevated.

The figures point to ongoing tightness on the labour supply side, with unemployment stable at a historically low rate of 3.9% and working-age inactivity at 21.8% (remaining well above its pre-pandemic rate of 20.5%). But the dubious veracity of the Labour Force Survey data makes it harder to accurately gauge underlying dynamics. The Bank of England are therefore cautious about second-guessing the likely persistence of pay pressures, signalling a desire to wait for more data before shifting towards interest rate cuts.

Wage growth is a key element of this, with the Bank remaining vigilant for signs of companies raising prices on consumers to offset the costs of chunky pay raises awarded to employees. Most indicators of pay growth are down from peaks, but still running well above Threadneedle Street’s comfort zone. Annual inflation fell by more than expected in February, to 3.4%, marking further progress towards the Bank’s 2% target, and is expected to drop further in the near-term on the back of lower energy prices and base effects. But rate setters are vigilant of the possibility that inflation could rebound if underlying conditions in the domestic economy have not cooled sufficiently to prevent firms from passing through higher wage costs into consumer prices.

The latest Indeed Wage Tracker data shows a gradual easing in posted wages for new hires. Annual wage growth cooled from 6.5% in January to 6.3% in February, but it remains high and is only down around one percentage point from last summer’s peak. Wage growth is still running hot in lower-paid and in-person sectors including hospitality, retail, cleaning and childcare.

Conclusion

The Bank of England held its key interest rate steady in March, as widely expected, while indicating that reductions to base rate are on the horizon. But there is still a way to go before they arrive; their timing remains dependent on the economic data. Policymakers need convincing that domestically generated price pressures are heading down and staying down. The labour market is a key element of this, particularly the presence of persistently strong wage growth.

From an employer perspective, though the overall labour market has cooled, the picture varies considerably by sector. Being mindful of these differences remains important for staying competitive.

Hiring Lab Data

Job postings data is available on our Data Portal. We also host the underlying job-postings chart data on Github as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post was published.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. Feb. 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner, except that the data are not adjusted to historical patterns.

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.