The UK labour market continues to slow but continued high wage growth underlines concerns over inflation persistence.

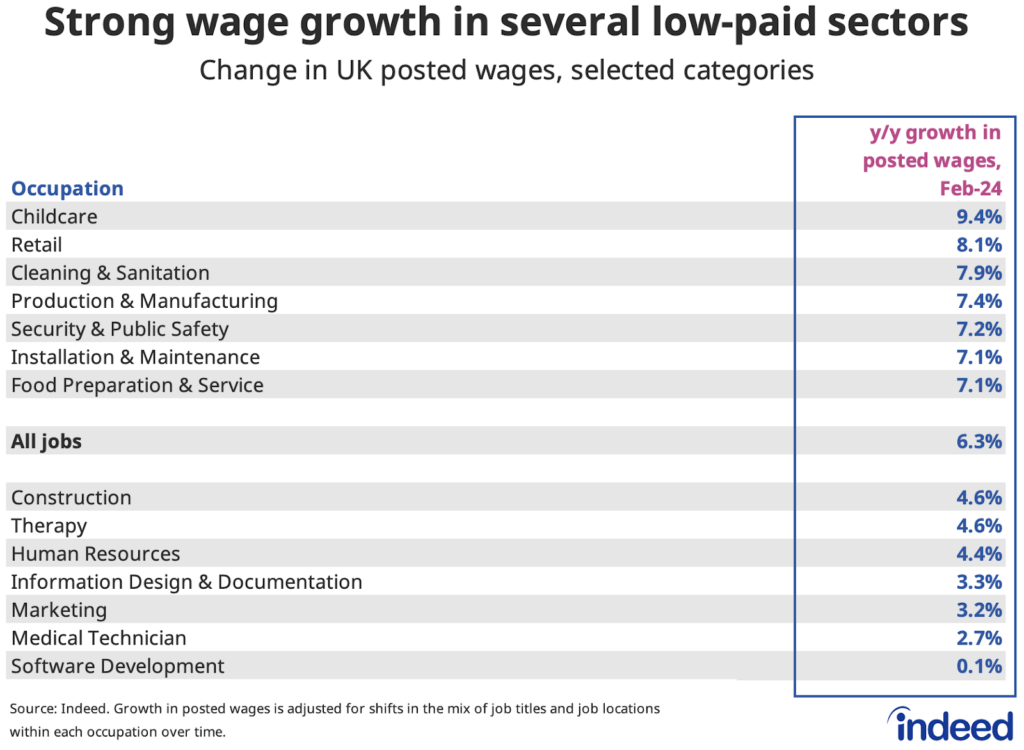

Today’s ONS figures point to a drop in employment, rising unemployment and worsening inactivity in the three months to February. Data quality issues mean these figures are volatile, but the underlying trend is a weakening job market. On the other hand, wage growth remains robust, with annual growth in regular pay easing less than expected to 6.0%. That’s good news for workers who are seeing their wages rise faster than consumer prices but presents a headache for the Bank of England as it deliberates on possible interest rate cuts over the coming months.

The mixed signals of a weakening labour market but still strongly rising wages mean policymakers are likely to want to wait for more evidence that conditions are falling into place for a sustained downshift in pay pressures before being comfortable initiating rate cuts.

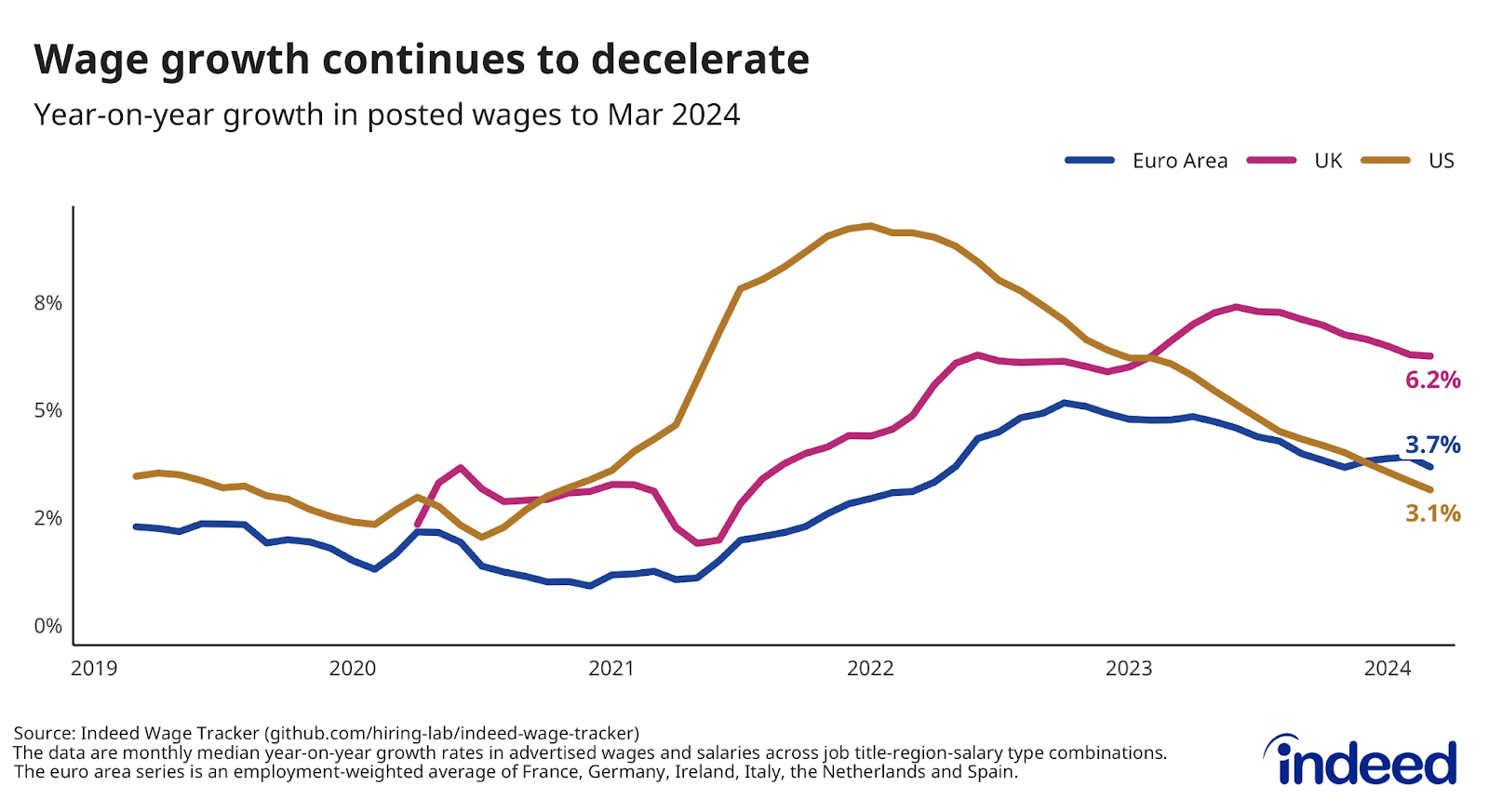

Indeed data on posted wages shows a similar picture, having eased in recent months but still running hot at an annual 6.2% rate in March. The UK continues to see much stronger posted wage growth than the euro area (3.7%) and double that in the US (3.1%). With expectations of near-term rate cuts from the Federal Reserve having recently dimmed amid signs of stubborn US inflation, the persistence of UK wage growth may give their counterparts at the Bank of England similar pause for thought.