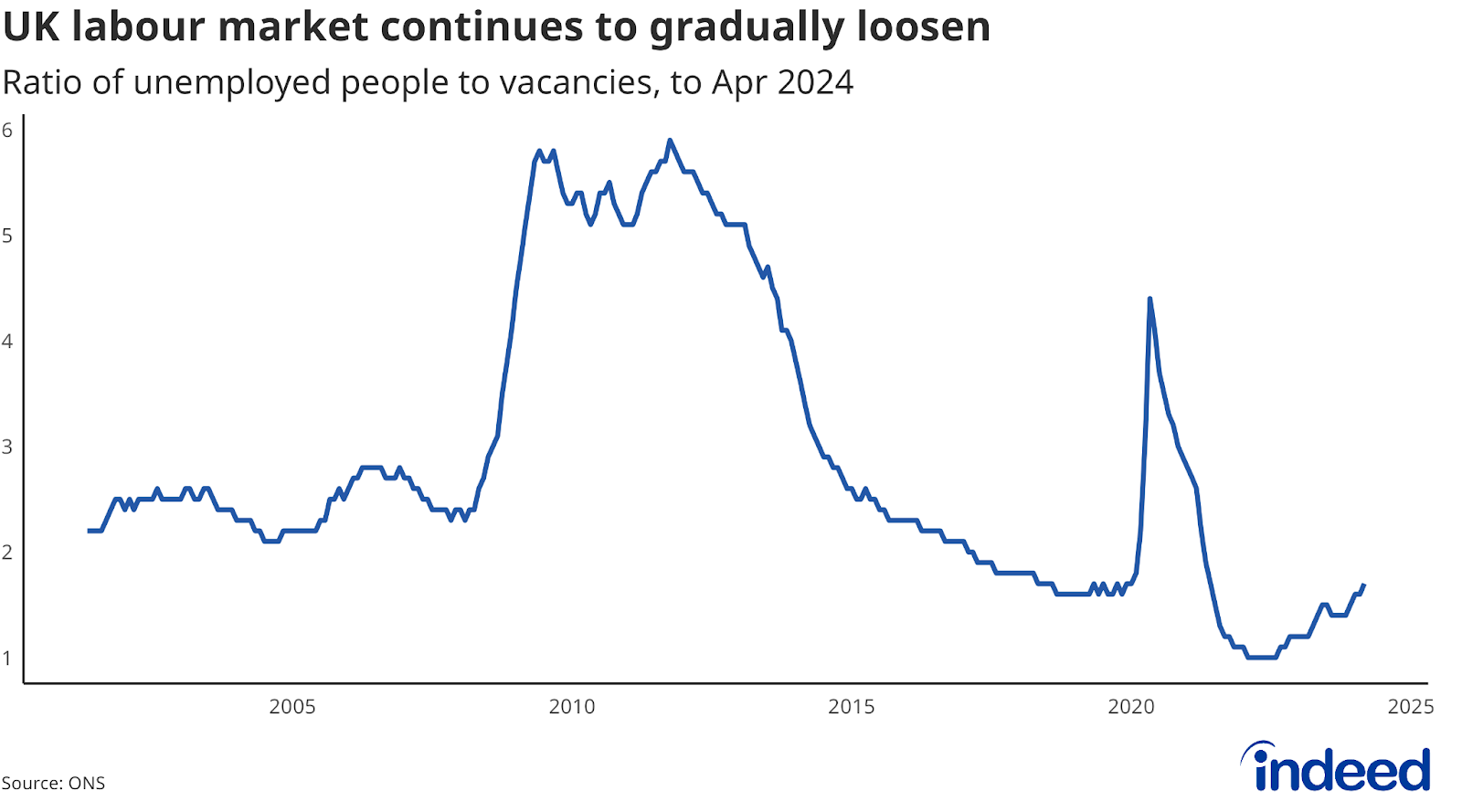

In the run-up to the 4 July general election, all eyes will be on the strength of the UK’s labour market. The latest figures show a now-familiar combination of further cooling in the labour market and stubbornly strong wage growth. Meanwhile, a further increase in inactivity underlines the challenge facing the next government in bringing more workers into the labour force.

The data are likely to reinforce divisions in the Monetary Policy Committee (MPC) as it weighs the timing of interest rate cuts. The MPC will take some comfort from the fact that regular pay growth didn’t tick higher, with the single-month figure actually dipping in April after the large minimum wage uplift at the start of that month.

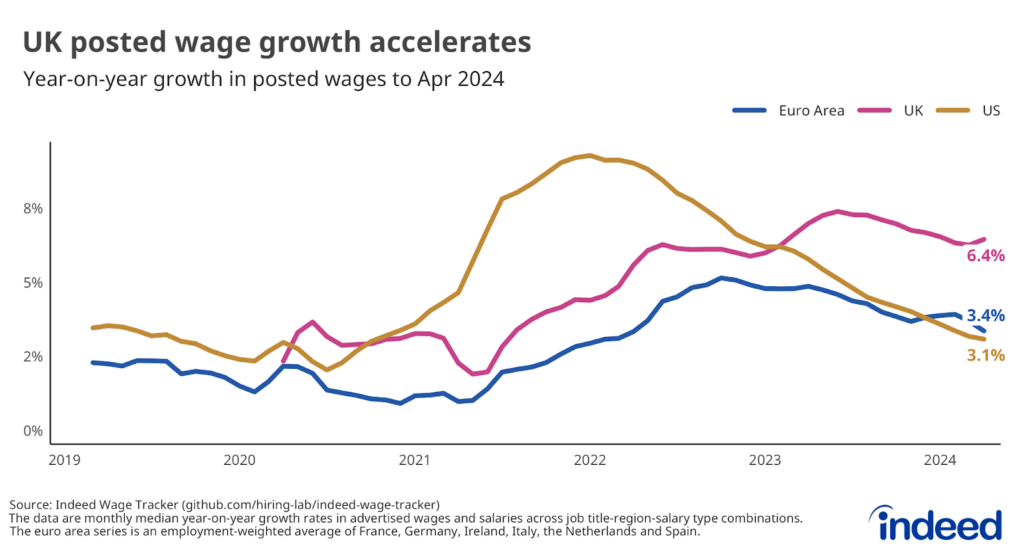

But more timely data from Indeed show an uptick in posted wage growth for new hires, suggesting pay pressures aren’t yet dissipating. Annual growth in the Indeed Wage Tracker rose to a four-month high of 6.5% year-on-year in May. Lower-paid categories, including childcare, cleaning, retail & hospitality, continue to see notably strong posted wage growth amid tight occupation-specific hiring conditions.

If wage growth (alongside service-sector inflation) continues to prove sticky, that could delay the timing of any interest rate reductions.