Today’s labour market figures from the Office for National Statistics (ONS) were in line with expectations, leaving prospects for an August Bank of England interest rate cut in the balance. The two key concerns for the Monetary Policy Committee (MPC) remain high services inflation and wage growth.

The labour market has continued to soften in recent months, with vacancies gradually declining and unemployment edging up (though still low at 4.4%). Still, growth in average earnings remains high at 5.7% year-on-year. That’s good for workers who are seeing their real wages rise 2.5% year-on-year, but its persistence could limit the monetary easing the Bank can deliver in the near future.

Elsewhere, Indeed data point to upside risks for wage growth. The Indeed Wage Tracker shows posted wage growth picking up to a nine-month high of 7.0% year-on-year in June. That’s more than double the rate seen in the US and nearly double that of the euro area.

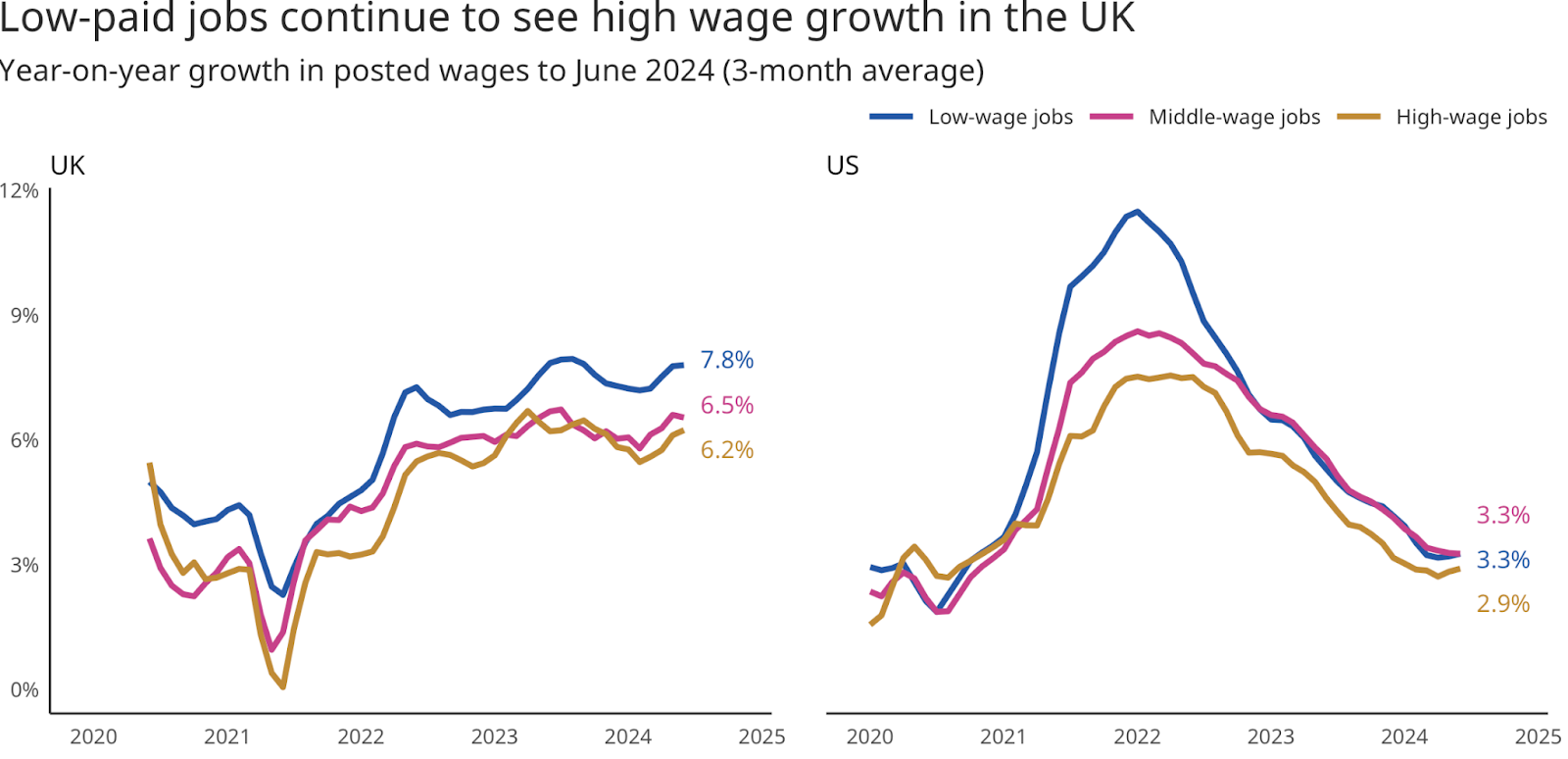

Posted wage growth in lower-paid categories is particularly strong, reflecting the recent large minimum wage increase and continuing tightness in hiring conditions. Posted wage growth for the lowest-paid third of occupations is running at 7.8% annually, though it has also ticked up for mid- and high-wage jobs.