Key Points:

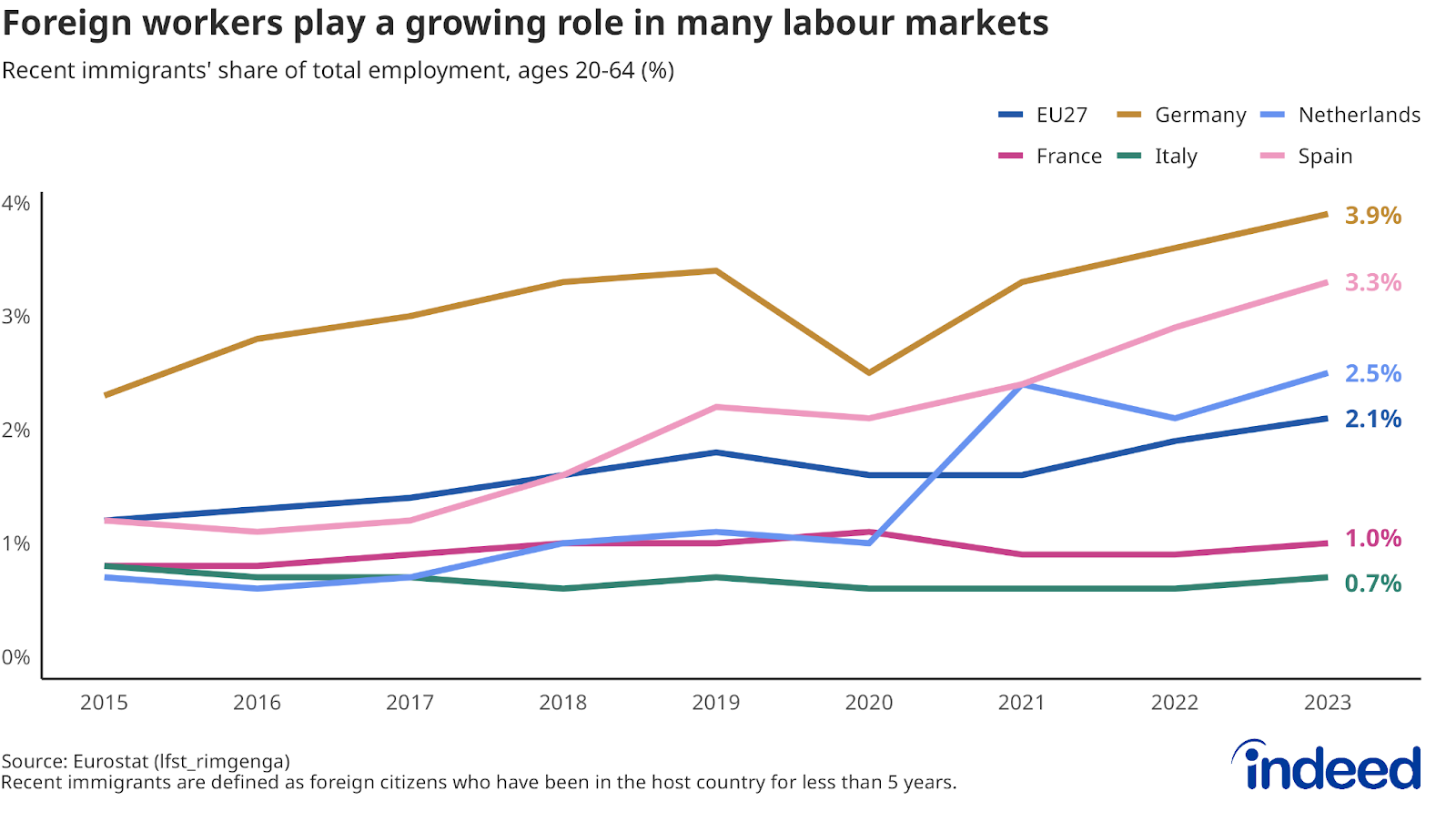

- The contribution of recent immigrants to employment has risen in the UK and most large European Union countries in the past 10 years.

- 4.9% of all clicks on UK job postings came from outside the UK in July, up from a pre-pandemic, pre-Brexit, 2019 average of 3.2%.

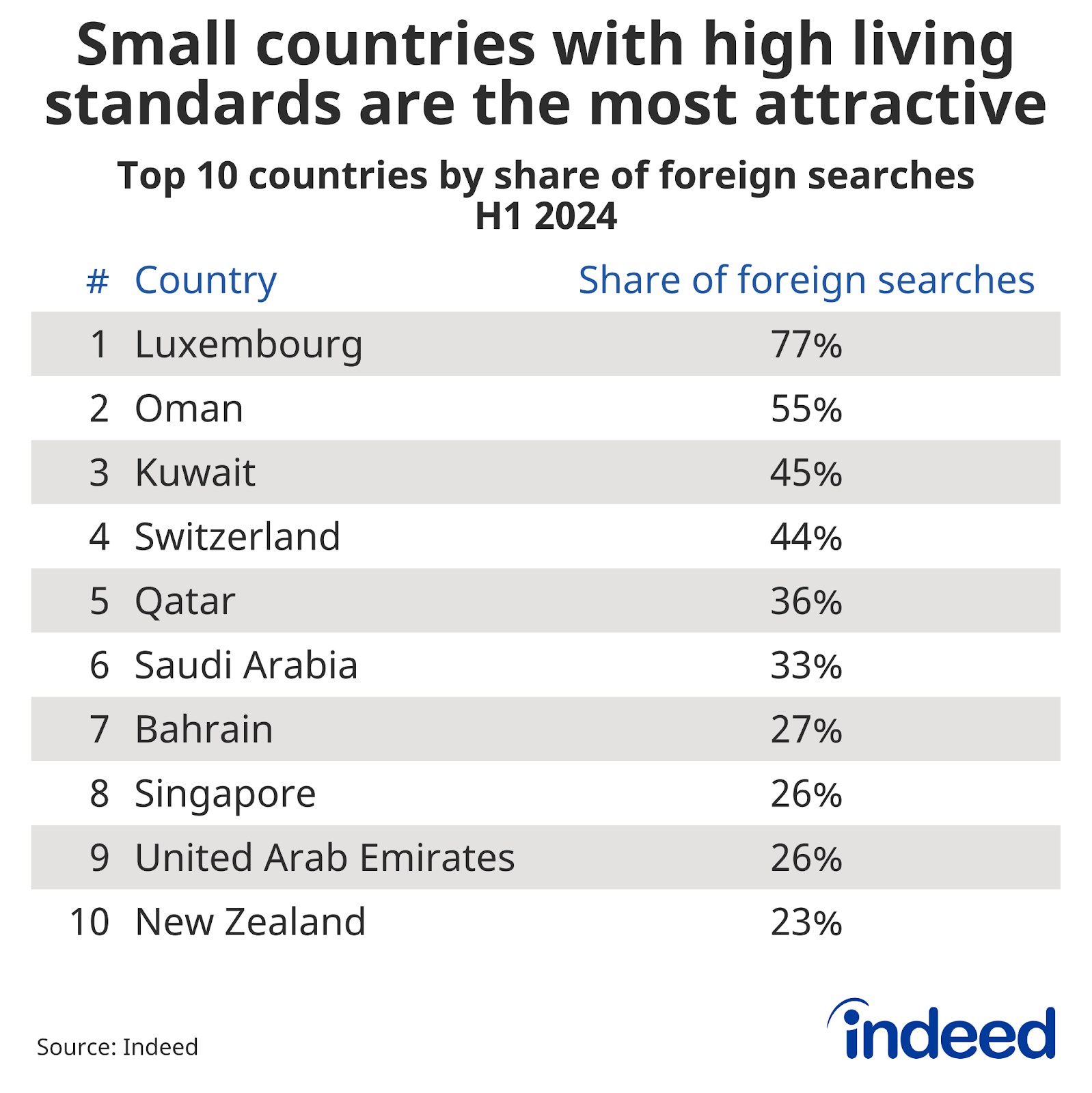

- Countries with relatively small, open economies and high standards of living (including Luxembourg, Oman, Kuwait, Switzerland, Qatar, Bahrain, Singapore, United Arab Emirates) have the highest share of searches from abroad globally. More than three-quarters (77%) of all clicks on job postings in Luxembourg came from abroad in July, the highest among all countries analyzed.

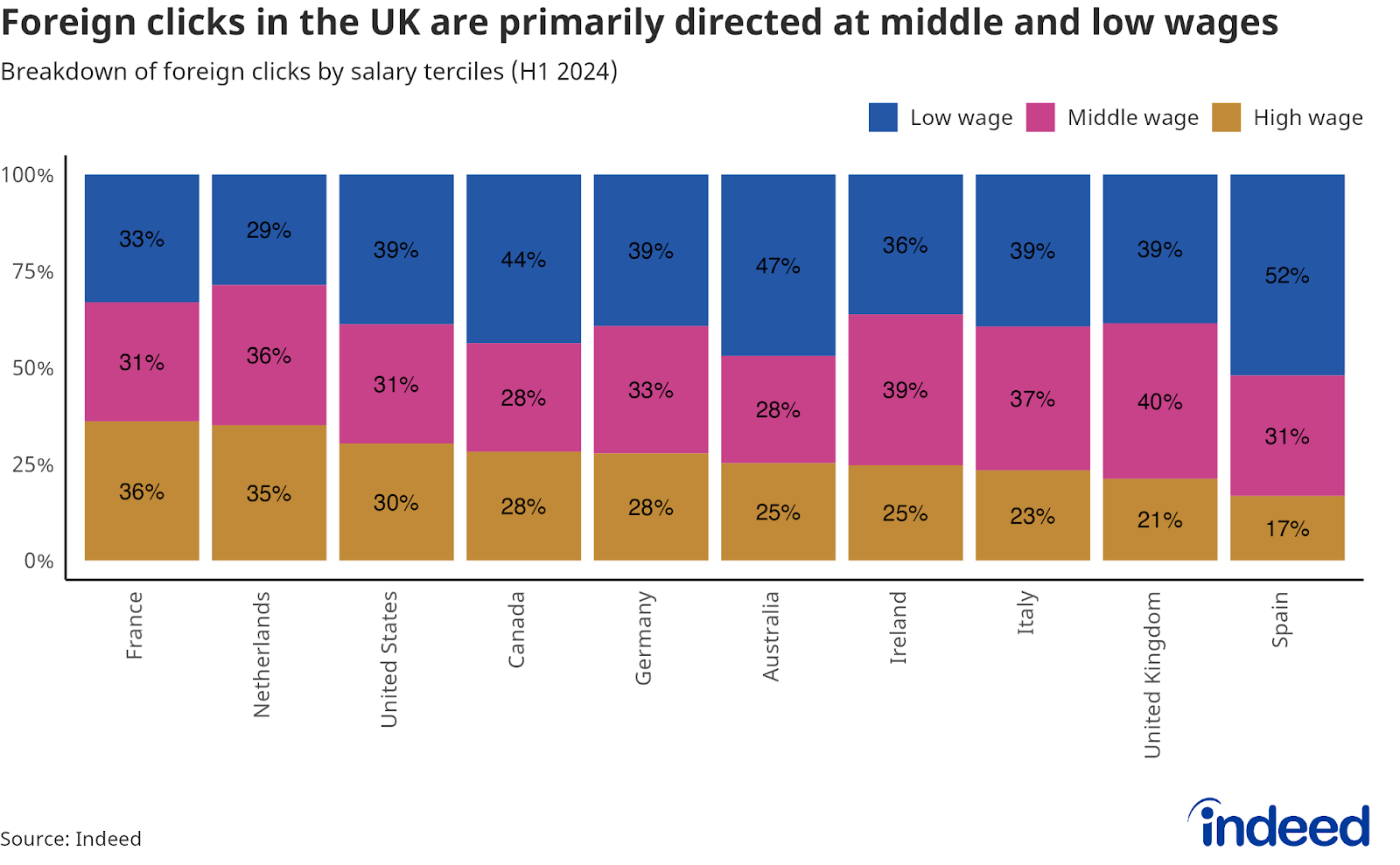

- Among major Western economies, France and the Netherlands attract the most clicks from workers interested in higher-paying roles. More than a third of foreign clicks on job postings in France and the Netherlands (36% and 35%, respectively) were directed towards job postings in high-wage occupations in the first half of 2024, compared to just 21% in the UK and 17% in Spain.

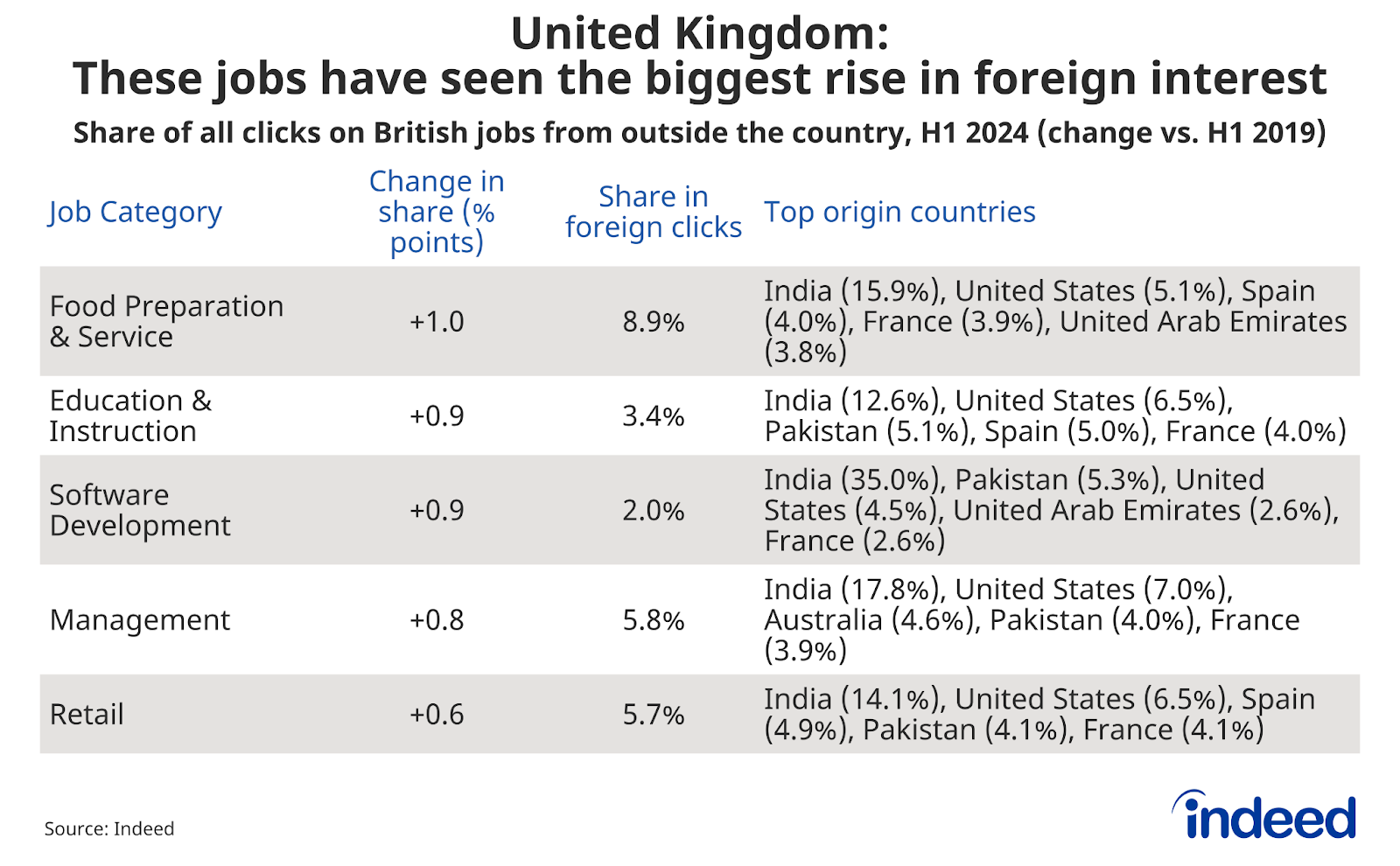

- Compared with the first half of 2019, clicks on UK jobs from abroad have increased the most in the food preparation & service, education & instruction, software development, management and retail sectors. Candidates for those roles originate mainly from India, Pakistan, Spain, France and the United States.

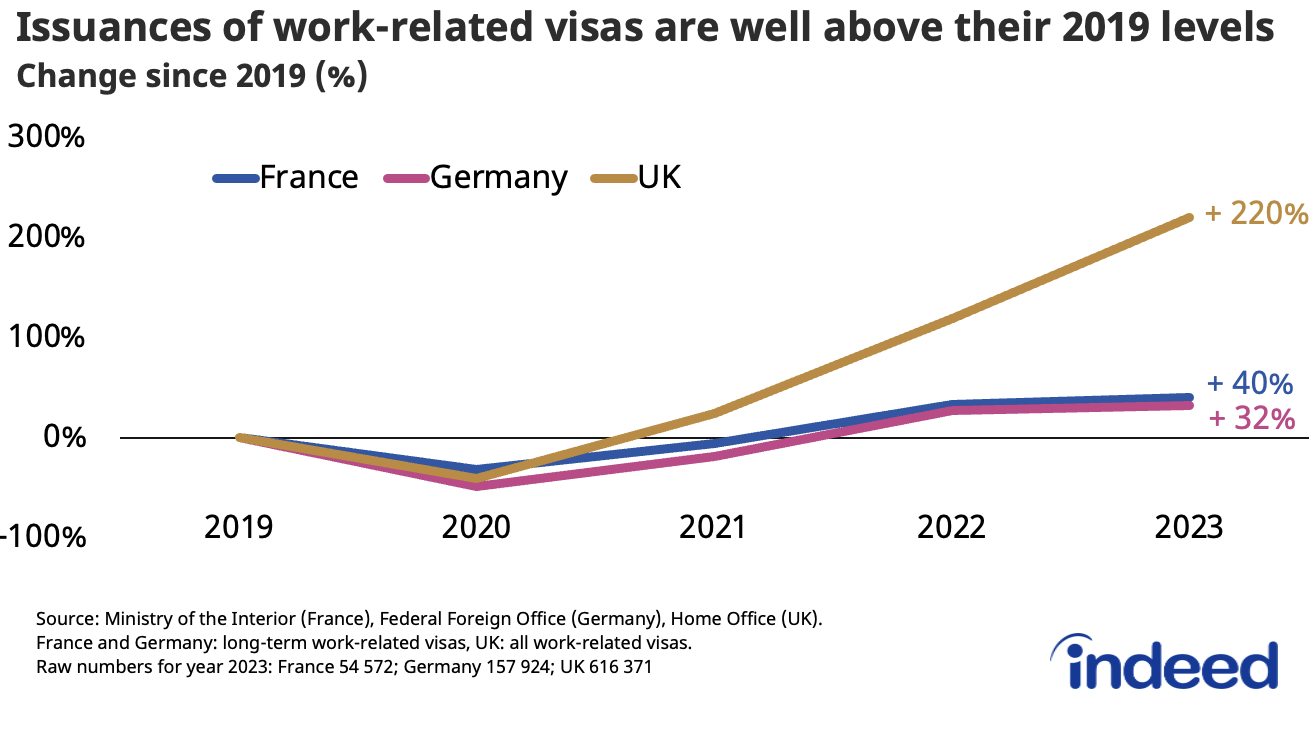

Work-related immigration has become a major issue in Europe and many other nations torn between the need to fill labour shortages and the societal challenges linked to integrating new arrivals. Amid heightened competition with other Western nations for skilled labour, the largest countries in Europe — France, Germany and the UK — have increased their issuance of work visas. Even so, job postings in smaller, often wealthier nations with high standards of living (including Switzerland and some Persian Gulf countries) continue to attract outsized interest from jobseekers.

An ageing population and persistent labour shortages in a number of critical sectors across several large, developed nations are powerful drivers of immigration. Data on job searches and clicks from Indeed can shed light on how the global competition for workers is evolving.

Work-related immigration continues to rise in the UK and EU

The proportion of immigrants in the employed population has increased significantly in Europe over the past decade. This trend is noticeable in Germany, for example, where immigration policies have facilitated the integration of foreign workers in key sectors including construction, personal services and hospitality.

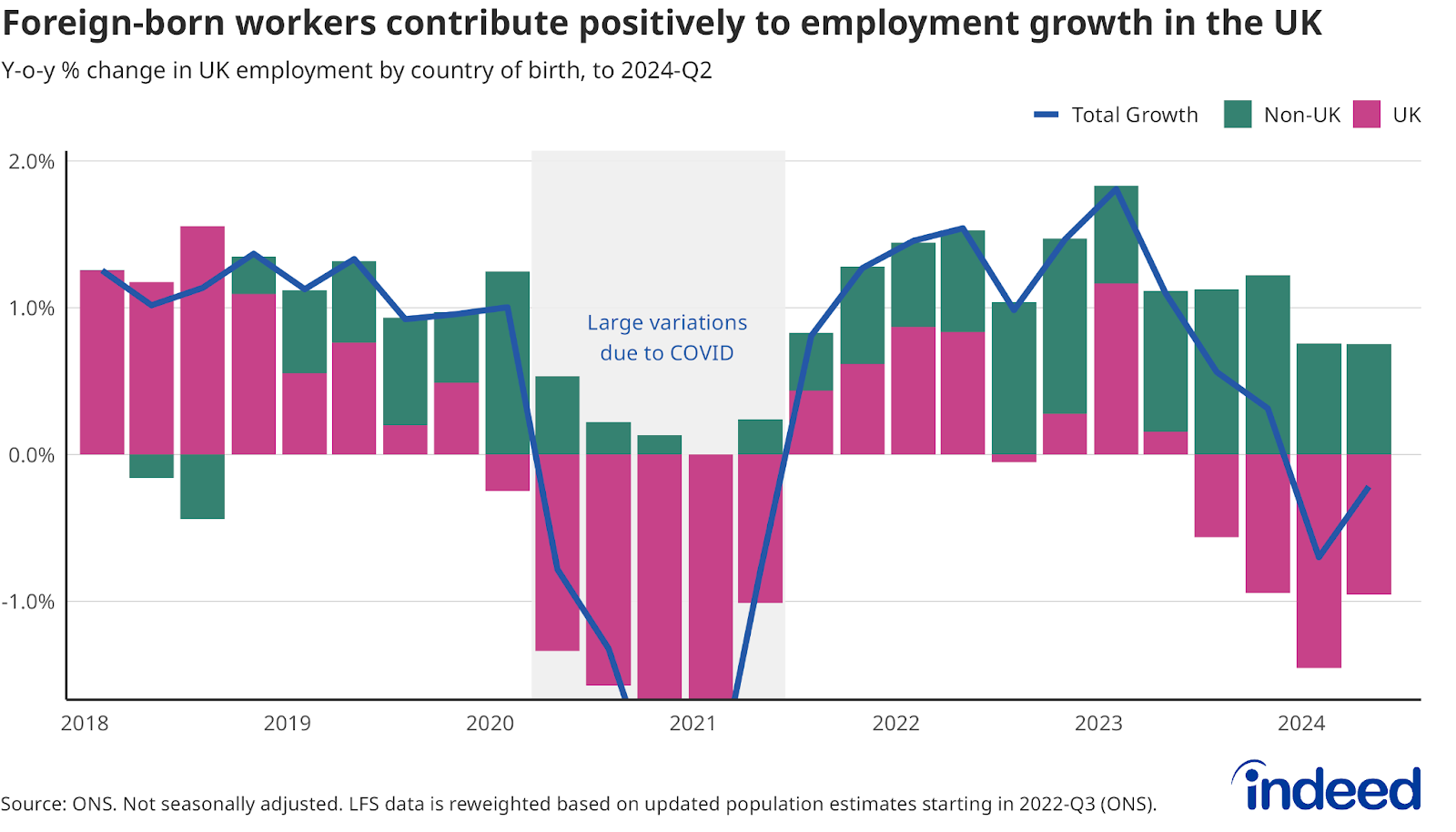

The UK labour market continues to be marked by high levels of inactivity and relies heavily on immigrant workers, particularly in the IT and communications, transport and storage, and hospitality sectors. The main source of new foreign workers has shifted away from EU countries and towards non-EU countries after post-Brexit employment rules complicated the process for many European workers. While methodological changes to UK Labour Force Survey data make interpreting trends over time somewhat complicated, the latest available data shows that the estimated number of foreign-born workers employed in the UK grew 1.0% in the last four quarters, while the number of UK-born workers fell 0.3%.

Foreign worker interest in UK and European jobs has risen in recent years

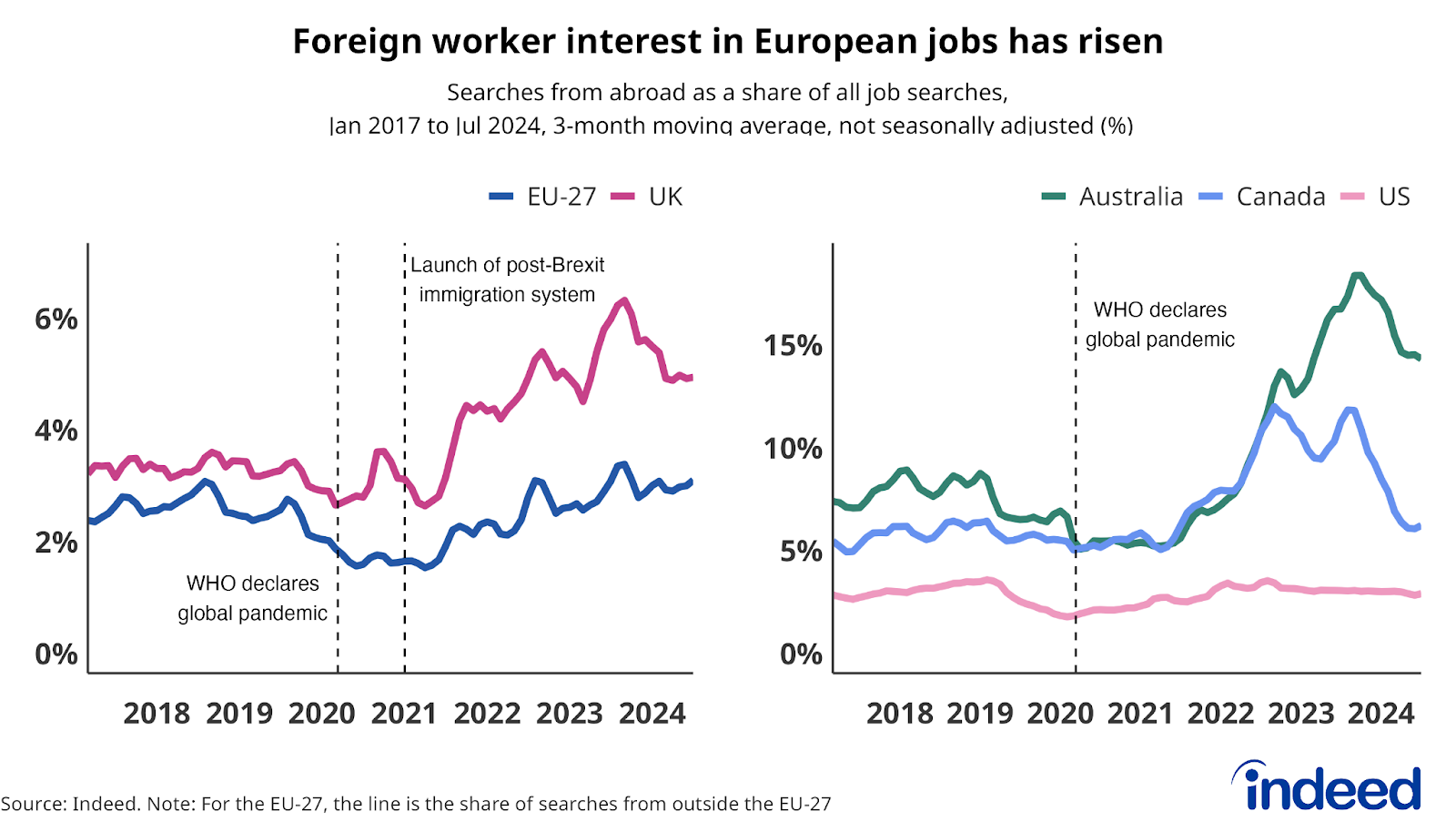

As of July 2024, the share of searches by foreign jobseekers for positions based in the European Union was double its recent, April 2021 low, rising from 1.5% to 3.1% in slightly more than three years. Foreign jobseekers have shown even greater interest in UK roles, where the share of foreign job searches rose from 2.6% at its pandemic low point in April 2021 to 4.9% in July (an 87% increase).

Other large, Western, English-speaking countries — including Australia and Canada — also attract large shares of foreign jobseekers, though the share of foreign searches has dropped significantly from recent peaks in those two countries. More than 14% of job searches for positions in Australia came from outside the country in July, a figure that had never exceeded 10% between 2017 and 2020. In Canada, the share fell to 6.2% in July, after peaking at 12% in September 2022. But the post-pandemic rebound in the share of searches from abroad has been weaker in the United States, perhaps driven by stricter immigration policies. Some 2.9% of searches on US jobs originated abroad in July, up from 1.8% in February 2020 but well below the peak of 3.6% reached in February 2019.

In France, Germany, and the UK, changing immigration policies and increased issuance of work visas also reflect the growing importance of immigrants in the workforce. The UK issued more than three times as many work permits in 2023 than in 2019, and France 40% more. In France, programmes including “Passeport Talent,” which facilitates the arrival of skilled workers in high-demand sectors, have simplified work visa procedures. In Germany, the adoption of the Skilled Workers Immigration Act (“Fachkräfteeinwanderungsgesetz“) significantly relaxed recruitment criteria for non-EU foreign workers and strengthened the rights and protections of these workers once in the country. In the UK, Brexit profoundly changed the landscape of work visas. The introduction of a new points-based system, inspired by the Australian model, has made the process more selective and increased the obligations on employers wishing to recruit foreign workers, including EU citizens. This system places greater emphasis on specific skills and salaries, leading to an increase in visa applications in sectors with urgent labour needs, including healthcare and technology. These developments signal a commitment to balancing economic needs with migration control and to adapting regulatory frameworks to attract the talent necessary for national economic development.

Small, wealthy countries attract the highest share of searches from abroad

Yet, these countries do not attract the highest shares of foreign jobseekers. A host of smaller nations, largely characterized by a relatively high standard of living, attract a much larger proportion of foreign jobseekers. Luxembourg stands out among these destinations, boosted by strong multilingualism, a focus on opportunities in the financial sector and a significant number of cross-border workers owing to its central location nestled among larger economic neighbours and a significant number of cross-border workers. In July, more than three-quarters (77%) of all searches for jobs in Luxembourg originated from abroad. Switzerland benefits from similar conditions, and also ranks highly, with 44% of all job searches originating from abroad in July. A host of Persian Gulf states, including Oman, Kuwait, Qatar, Saudi Arabia and Bahrain, helped round out the list of top foreign jobseeker destinations in July. While major Western countries remain popular destinations for foreign workers, a combination of economic, social, and policy factors unique to these smaller nations also make them competitive in the international labour market.

Which jobs are foreign jobseekers clicking on?

Analyzing the distribution of clicks from abroad on job postings of varying salary levels can also signal the skill level of foreign workers attracted to each country, assuming average wages paid by a job can be considered a proxy for the skill level required to do that job.

Among major Western economies, France and the Netherlands attract the most clicks from workers interested in higher-paying roles. More than a third (36% and 35%, respectively) of foreign clicks on job postings in France and the Netherlands were directed towards job postings in high-wage occupations in the first half of 2024 (occupations in the upper third, or third tercile, of the salary distribution). This was followed by the United States (30%) and Canada (28%). The UK and Spain ranked last, with just 21% and 17% of foreign clicks going to jobs in the third-income tercile. In Spain, more than half of foreign clicks in the first half of 2024 were on the lowest-paid jobs in the first tercile, compared to 39% in the UK. The relatively low proportion of clicks on postings in high-wage occupations in the UK contrasts with the stated aim of the current immigration policy to focus on attracting high-skilled (and presumably higher-paid) foreign workers.

The UK’s relatively limited ability to attract jobseekers interested in the highest-paid roles can be illustrated by looking at the job categories with the most significant growth in foreign clicks. Food preparation and service jobs — which are typically lower-paying — accounted for almost 9% of foreign clicks in the first half of 2024, up one percentage point from the same period in 2019. Clicks from India represented almost 16% of foreign clicks in this job category. In other categories with growth exceeding 0.5 points (education & instruction, software development, management and retail), clicks from India were also relatively plentiful, representing 35% of the H1 2024 total in software development.

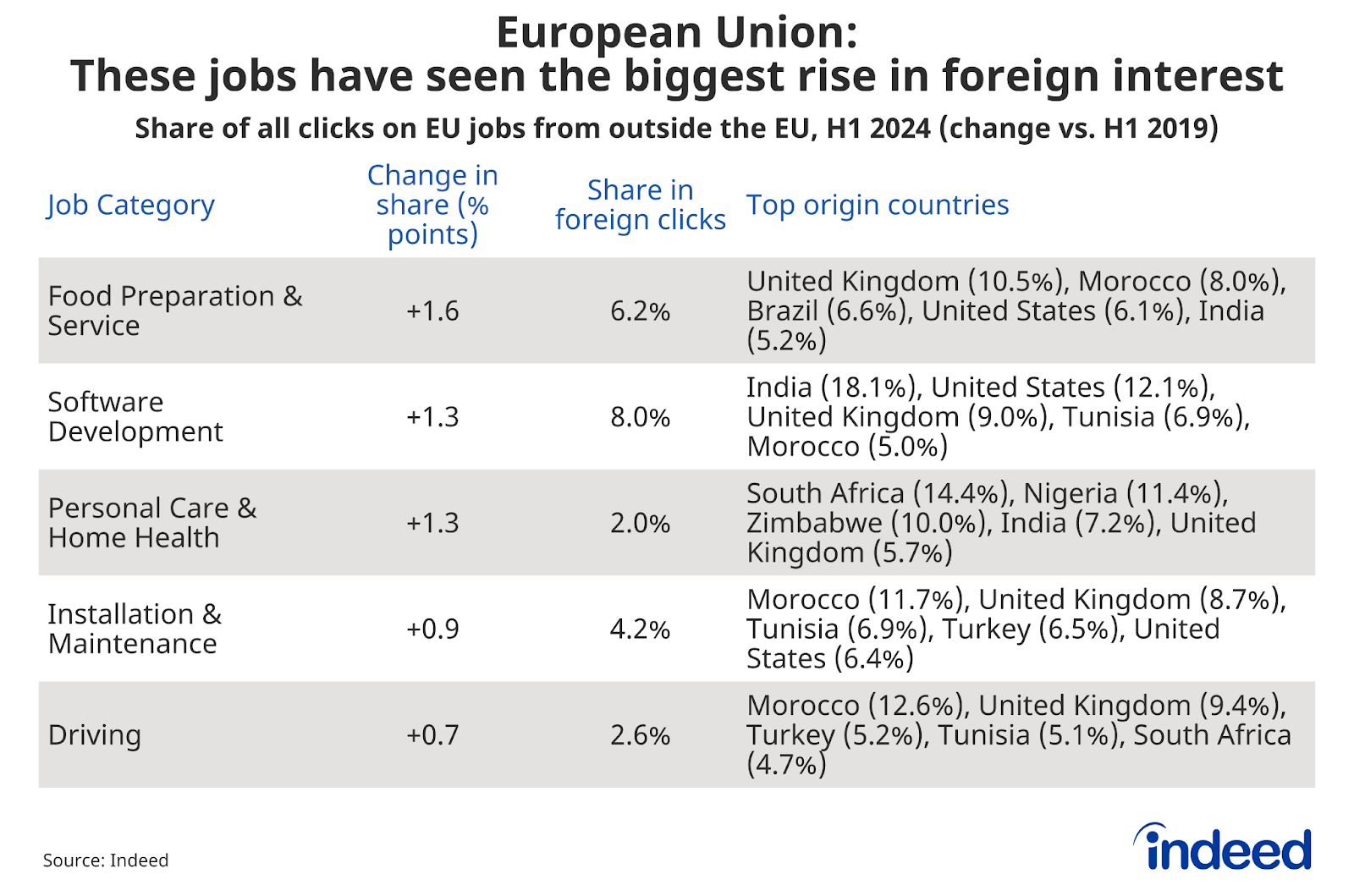

In the European Union, software development alone accounted for 8.0% of clicks from abroad in the first half of 2024, up 1.3 percentage points since the first half of 2019. Indian, American and British jobseekers together represented almost 40% of the foreign clicks on these EU jobs. However, food preparation and service is the job category that has seen the most significant increase in non-EU clicks since early 2019 (+1.6 points over the past half-decade, representing 6.2% of total foreign clicks in H1 2024), with British candidates accounting for the largest share of the total (10.5%). The share of searches going to jobs in personal and home healthcare gained 1.3 points, installation and maintenance was up by 0.9 points, and driving rose by 0.7 points over the same time.

Workers are generally more likely to migrate to countries and regions where there is a significant presence of their diaspora, or when there is linguistic or geographical proximity. Similarly, in our clicks data, Commonwealth countries such as India, Pakistan, or Nigeria represent a significant proportion of foreign clicks in the United Kingdom, just like Maghreb countries in France. The same goes for Spanish-speaking countries like Colombia and Argentina in Spain, or to a lesser extent, Turkey in Germany. Economic theory, through gravity models, suggests that distance, language, and culture are strong determinants of migration. Empirical data from job searches on Indeed confirms this pattern.

Conclusion

Major European economies have a lot to gain by remaining competitive in a global context of increased mobility among highly skilled professionals. Businesses and states alike must offer not only competitive salaries, but also attractive living conditions, high-performing healthcare and education systems, and political and economic stability to attract these individuals. Immigration policies must align with these efforts. By investing in modern infrastructure and strengthening their legislative frameworks to welcome foreign workers, the UK and Europe can not only attract but also retain the skills necessary for economic growth and innovation.

Methodology

This analysis focuses on countries where Indeed has a website, where searches or clicks are recorded, and on the countries of the user’s IP location. This is relevant for defining domestic and cross-border searches and clicks. A domestic search is conducted by a user whose IP location is in the same country as the Indeed website where they conducted the search. A cross-border search is conducted by a user located in a different country than the Indeed website used to perform the search. A click is the user’s action of clicking on a job listing in the search results, which opens the full job description. We interpret this as a demonstration of interest in a specifically listed position. As with searches, click data is anonymized and cannot be linked to users. Intra-EU searches or clicks are not considered cross-border.