Key Points:

- UK job postings slipped further in recent weeks and are currently 11% below pre-pandemic levels.

- Hiring demand remains particularly subdued in sectors that typically offer more work-from-home opportunities..

- Gradually easing wage growth may pave the way for further interest rate cuts by the Bank of England.

Our Labour Market Updates examine important trends using Indeed and other labour market data. Our recently introduced European Labour Market Overview chartbook provides a more comprehensive view of the European labour market. Other data, including the Indeed Wage Tracker, are regularly updated and can be accessed on our data portal.

The UK labour market continued to cool into October, with job postings slipping further in recent weeks. Some employers may be weighing the likely impact of the Labour government’s Budget next week, alongside the implications of a sweeping employment rights bill, before committing to big hiring decisions. A closely-watched survey of private sector businesses signalled that growth momentum slipped to an 11-month low in October amidst both domestic and international uncertainty. The potential for further interest rate cuts from the Bank of England could help support hiring demand in coming months.

Hiring demand remains soft

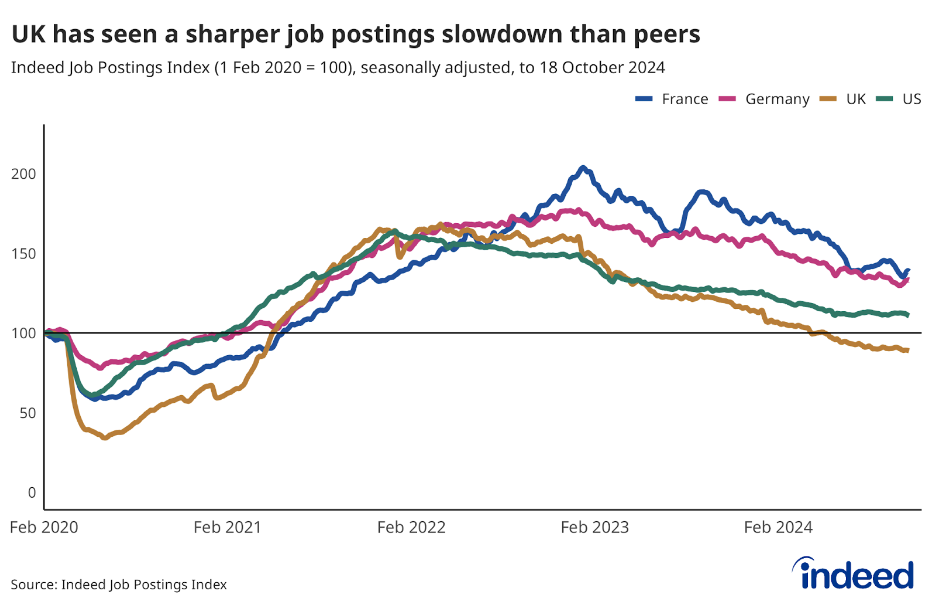

UK job postings have softened in recent weeks, and as of 18 October were more than11% below their 1 February 2020, pre-pandemic baseline. And over the past year alone, postings have declined some 26%, a steeper annual drop than in peer economies including Australia, Canada, France, Germany, Italy and the US. The UK is one of only two of those countries (along with Canada) where the level of postings is currently below the pre-pandemic baseline. Anecdotally, a wait-and-see attitude to hiring has been reported ahead of the Labour government’s Budget in late-October, which is expected to include business tax rises.

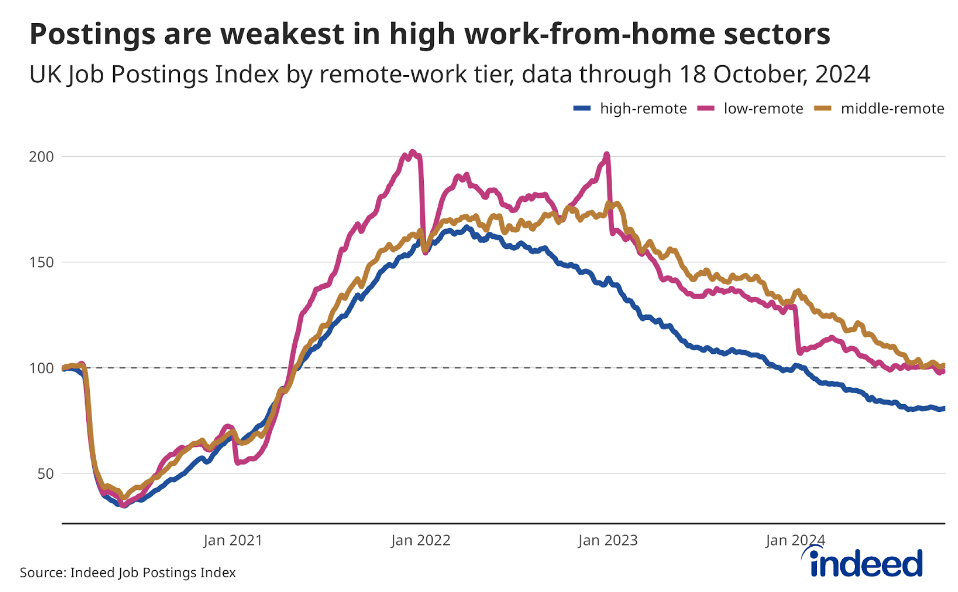

Job postings in high work-from-home sectors continue to lag in-person categories

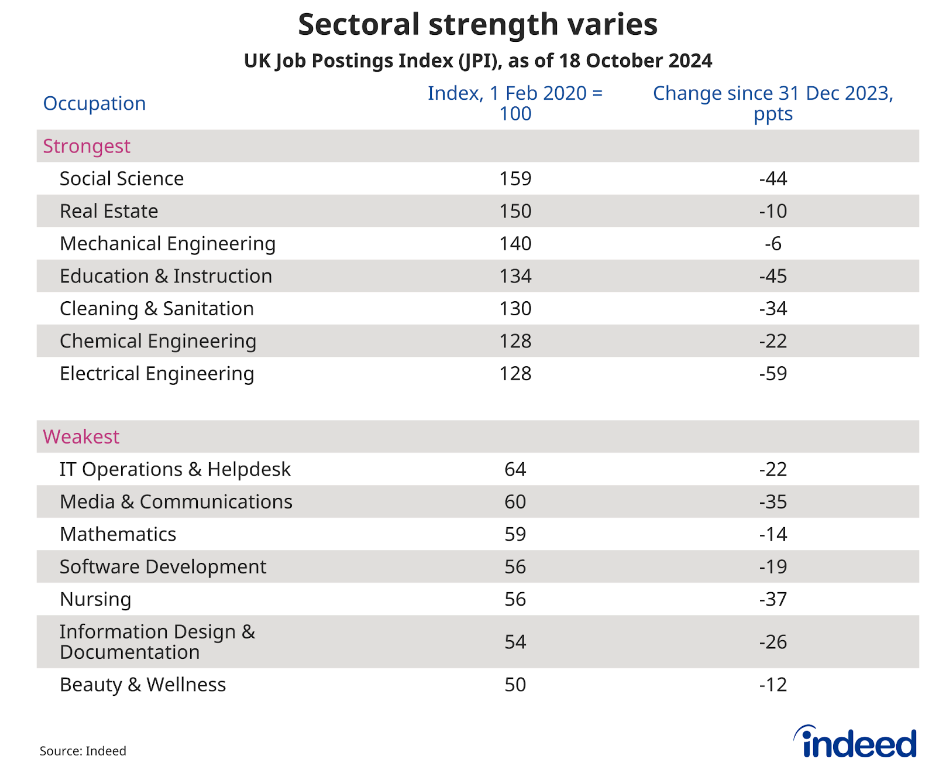

Job postings have declined across almost all occupational categories in 2024, though some remain comfortably above their pre-pandemic baseline (including social science, real estate, education, cleaning and several engineering categories). By contrast, job postings are well below the baseline in tech categories, beauty & wellness, nursing, media & communications and mathematics.

When split into high, medium and low-remote work tiers, the job postings trend is considerably weaker for those occupations that tend to offer the most remote-work opportunities, including tech, finance, and marketing (19% below the pre-pandemic baseline). Low-remote occupations, including retail, driving & construction, are just 2% below the baseline. Medium-remote occupations, including jobs in the customer service, administrative assistance & real estate sectors, are actually 1% above the baseline.

Wage growth continues to gradually ease, but inactivity remains a challenge

The latest Office for National Statistics (ONS) figures showed a familiar pattern of a cooling UK labour market. At 841,000, vacancies continued to fall and are well down from highs, while gradually easing wage growth is expected to help pave the way for further Bank of England interest rate cuts over coming months. That said, growth of posted wages for new hires remains stubbornly high, particularly in lower-paid categories.

Inactivity remains a key challenge, with more than 700,000 working-age people outside the labour force now compared to pre-pandemic. Policies to get more of these inactive people into the workforce are a focus for the new Labour government. The labour market remains somewhat tight at 1.6 unemployed people per vacancy, a similar level to where it was pre-Covid.

Conclusion

The UK labour market appears to be in something of a holding pattern, with caution appearing to be the order of the day for many employers amid uncertainties. That seems to also be reflected in a sluggish start to peak hiring season.

On the positive side, the Bank of England has suggested that interest rate cuts could be “a bit more aggressive” over coming months should inflation pressures continue to weaken. That could help support growth and hiring, a point acknowledged in the latest forecast from the International Monetary Fund, which upgraded the UK’s outlook.

Hiring Lab Data

Job postings data is available on our Data Portal. We also host the underlying job-postings chart data on Github as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post is published.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. Feb. 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner, except that the data are not adjusted to historical patterns. Note that we have recently restated the historical JPI data for the UK, due to the removal of a faulty job feed.

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.